🦝RISK Blog

Post #17 | 2025-08-27

-----BEGIN PGP SIGNED MESSAGE-----

Hash: SHA512

RISK and Quroe have discussed some things related to the FOLDED Manifold game.

-----BEGIN PGP SIGNATURE-----

iHUEARYKAB0WIQT2AvthnKdxNUZNbdoXpILQAa6kiwUCaK9XMwAKCRAXpILQAa6k

i6cjAQDlftnwemC7TEBMNSITigMxDiaC/xf/sxsqWBiMz5ZmaAD7Bb0xelh0YG2U

4fxnRzR9sbGdDj0mk0y5ax/aJhdRSAM=

=UOrK

-----END PGP SIGNATURE-----

Download RISK's public key:

https://risk.markets/public-key/RISK%20CORPORATION_0x01AEA48B_public.asc

View RISK's public key (scroll to bottom):

https://manifold.markets/news/risk

Post #16 | 2025-06-16

Another new app on the website- Arbitrage App! Read the post.

Post #16 | 2025-06-16

New app on the website- Limit Order App + Volatility Bettor! Read the post here.

Post #15 | 2025-06-13

RISK Announces 10-for-1 Stock Split + Share Price Increase

We are thrilled to announce an upcoming 10-for-1 stock split for RISK shares, a strategic move designed to enhance liquidity and accessibility for both our current and future investors. This decision comes as a direct response to the increasing demand and limited supply of RISK shares, reflecting the strong growth and confidence in our ecosystem. The stock split will occur sometime between now and 2025-06-15.

What This Means for RISK:

Currently, our total share volume stands at 100,000 shares. The planned 10-for-1 stock split will increase this to a new total of 1,000,000 shares. This significant increase in available shares will allow more participants to join the RISK community and share in our success.

No Dilution for Current Investors:

We want to assure our valued existing investors that this stock split will result in no dilution of their investment. For every share you currently own, you will receive 10 times more shares. This means your proportional ownership of RISK will remain precisely the same.

New Share Valuation:

Following the stock split, all shares, including those newly issued, will be valued and sold at 0.25 mana per share. This adjusted price per share will make RISK more accessible to a broader range of investors while accurately reflecting our strong market position.

Example: Your Investment at a Glance (Pre & Post-Split)

To illustrate the impact, let's look at an example for an investor who currently holds 11,000 shares:

Pre-Split

Original Shares: 11,000

Original Investment: M25,000

Post-Split

New Shares: 110,000 (10x increase)

New Price Per Share: M0.25/Share

Total Investment Value: M27,500

As shown, while your share count increases, your total investment value reflects the new pricing and the benefits of our growth.

We are incredibly excited about this next step for RISK and believe it will contribute significantly to our continued expansion and the overall health of our market. We will notify all investors with further details and the exact date when the stock split will occur.

Stay tuned for more updates as we continue to build and grow the RISK ecosystem!

Post #14 | 2025-06-11

Manifest was lovely. Meeting so many of you was the highlight of my year. RISK also received over M15,000 in VC funding. Thank you to our investors and our clients. 💙💜

Post #13 | 2025-05-30

We are (I am) attending Manifest. We'll have some vouchers for the award ceremony, probably have a Night Market, and we are helping with @Quroe's Manifold Game Show (yet to be named).

See you there!

Post #12 2025-05-29

So many updates! We lowered our rates, integrated CSP (cross site scripting protection) on our website, administrator authentication, refactored the credit score files to be more readable and maintainable, and invited @IanPhilips as a collaborator on the project. We are very close to open sourcing!

Post #11 2025-05-22

BOOM! Another major update! We introduce: Credit History. Visit https://risk.markets/chart/crowlsyong (or whatever your username is) and view your chart and create a first data point. Datapoints are created whenever you visit the site, but no more than once per 24 hours.

Post #10 2025-05-21

MAJOR UPDATE! Version 2.0 of the credit score algorithm! Here's the overview:

The 🦝RISK credit score is calculated using a weighted combination of six factors: your current balance, managrams, profit, account age, transaction quantity, and league rank. Each component plays a specific role:

Balance reflects how much you have.

Managrams how much you have received vs how much you have been given.

Profit tracks how well you've done financially over time.

Age adds credibility based on how long you’ve been around.

Transaction quantity reflects how much you engage with the Manifold.

League Rank gives credit for your relative performance compared to peers.

These values are combined using specific weights to produce your credit score. The formula is proprietary and central to our model, so we don’t open source the exact algorithm.

The old system used to be this:

The 🦝RISK credit score mostly looks at three things: how much you have, how well you've done, and how long you've been around. It mixes those together in a careful way. If you're doing better, been around longer, and have more, you get a higher score. there's a tiny extra boost if you're one of the top users in your league. This is core to our business model, which is why we have not to opensource it the algorithm.

Post #9 | 2025-05-09

The update significantly reduces the weight of user balance, increases the weight of user profits, and decreases the weight of transaction history (sorry amit). Early testing shows that users like Bayesian, SemioticRivalry, Gabrielle, Joshua still have very good scores, user's like Robincvgr and myself are kind of midrange, and users like amit.... are very low (again, sorry amit).

Unfortunately, is still possible to increase ones credit score by taking more loans thereby increasing balance, but this is the best I could do to combat this vulnerability in a span of under an hour. A better solution is needed and if anyone has any ideas, feel free to get in touch with me here or on discord.

Post #8 | 2025-05-02

We now own https://risk.markets! Yay! You can still visit https://risk.deno.dev.

Have a nice day!

Post #7 | 2025-04-26 - More changes!

Our research branch is in the lab right now. They are testing much lower fees.

Coverage fee

C₂₅ – 25% of loan covered = 1.02x fee

C₅₀ – 50% of loan covered = 1.05x fee

C₇₅ – 75% of loan covered = 1.11x fee

C₁₀₀ – 100% of loan covered = 1.21x fee

And adding:

Duration fee

<1 month = 1.02x fee

1–2 months = 1.06x fee

3–5 months = 1.1x fee

6–11 months = 1.25x fee

12–23 months = 1.35x fee

24–47 months = 1.6x fee

48months+ = 1.8x fee

This helps give better deals to shorter term loans, and should make sure high credit score users don't get shafted with high fees. Having a high credit score should always result in low fees, so we will report back if these numbers work.

Post #6 2025-04-29

Bots. Lessons from v1

In an experimental attempt to piggyback off the smartest money on Manifold, I built a bot designed to follow the top 20 traders (by profit) as well as Kbot. The core idea was simple: whenever one of these “whales” placed a meaningful bet, the bot would echo that bet—at a scaled-down level, using the square root of the amount placed. The aim was to benefit from their superior signal without copying them so aggressively as to become predictable or distort the market. It didn't work very well.

How It Worked

The architecture centered around a persistent WebSocket connection to Manifold’s global firehose of bets. The bot filtered this stream for large bets from high-performing users and responded with proportional bets of its own. It had logic to detect sells vs buys, ignored micro-bets, and even attempted to mimic the whale’s side (YES or NO) and answerId (for multi-choice).

But as expected, first drafts are rarely right. Here's what went wrong:

v1 Pitfalls and Pain Points

1. Limit Order Blindness

The bot could only see filled bets, not limit orders. This made it fundamentally reactive. Often, whales would place limit YES at 55%, only for it to be filled seconds or minutes later when sentiment changed. By the time the bot reacted, the probability had shifted, and the bot would follow into a worse trade—sometimes the exact one the whale was exiting. This lack of foresight made the bot prone to entering traps instead of mimicking conviction.

2. Firehose Disconnects

Despite handling WebSocket events gracefully, the bot would occasionally lose connection to the bet stream. Worse, in v1, it didn’t always reconnect. This meant periods of silence where the bot missed major movements entirely. Fixing this involved re-architecting the socket connection to auto-retry with exponential backoff.

3. Head-Fake Exploits

Sharp traders quickly noticed the bot’s behavior. Since it blindly followed whale-sized bets, some users would place and cancel or reverse large trades to bait it. Without deeper logic to detect intent or volume spoofing, the bot bought into more than a few head-fakes, losing small but cumulatively costly amounts.

4. Incorrect Sell Logic

The bot was designed to mirror sells by whales—but if a whale bought 100 mana of YES, the bot would buy √100 = 10 mana. Later, when the whale sold their 100 mana, the bot would attempt to sell 100 mana too, which it didn’t own. Most of these sell attempts failed silently. This mismatch wasn't patched until later, when sell volume was tracked relative to the bot’s own prior positions.

5. Naïve Selling Criteria

Finally, the bot had no ability to check its own position or cost basis. It wouldn’t ask, “Is this a good time to exit?” Instead, it would only sell when a whale sold. This follower logic sometimes caused it to exit at a loss—even when it had a chance to take profit earlier. Without memory of its own trades or cost averages, it lacked true strategy.

Post #5 | 2025-04-29

Introducing the 🦝RISK Recovery Insurance Service Kiosk Bot: A Bold New Strategy for Diversification and Profit Sharing

In the evolving world of prediction markets, where data and intuition converge, it's critical for innovative companies to stay ahead of the curve. Enter 🦝RISK Recovery Insurance Service Kiosk (🦝RISK), our insurance arm that now proudly integrates cutting-edge technology through its nonprofit research division 📖RIPE Research In Prediction Markets (📖RIPE).

Our latest development is a bot, built and fine-tuned by 📖RIPE, designed to track and place strategic bets alongside the top 20 users on the Manifold Markets platform. It’s not just about riding the coattails of the brightest minds in the game—it’s about systematically diversifying risk and ensuring a strong, sustainable profit flow for 🦝RISK, with direct benefits flowing back to our investors.

How It Works

The bot taps into Manifold’s vibrant ecosystem, where users make predictions and place bets on a variety of outcomes. By targeting the 20 most successful and influential users (the “top users”) on the platform, our bot automatically mirrors their betting strategies. Not stopping there, it also follows other bots that operate within this space—tracking, learning, and betting alongside them.

But we don’t just follow the pack. The bot’s strategy is programmed to assess each bet, adjust amounts, and optimize for risk while maintaining a competitive edge. If a bet seems too risky, the bot adjusts, applying strategies based on sophisticated predictions—essentially ensuring that 🦝RISK gets in on the action, no matter what.

Why This Matters

By automating our participation in the prediction market, 📖RIPE is not only generating value but also diversifying the capital strategy for 🦝RISK Recovery Insurance Service Kiosk. This diversification helps safeguard against volatility in other investment sectors, spreading the financial risk and securing long-term growth.

Here’s where the real value lies: Earnings generated by the bot are funneled back into our company, and most importantly, they contribute to our dividend pool for investors. Here's the breakdown:

40% of the bot's earnings will go directly into the dividend fund.

Let’s say our bot generates 10,000 mana in profit. That means 4,000 mana will be allocated to dividends.

If you’re an investor with a 10% stake in 🦝RISK, you’ll receive 400 mana as part of your dividend payout for the quarter.

But it doesn’t stop there. Investors will also receive dividends from the company’s core insurance operations, allowing them to maximize their return. So, if you're holding onto that 400 mana from the bot, you might also see additional mana from the fees collected through 🦝RISK’s insurance services.

That’s a pretty sweet deal, right? You could make that 400 mana plus some more, creating a diversified income stream—and have a stake in an innovative company. It’s a win-win.

Long-Term Vision

The overarching goal of this strategy is to provide stability and growth for 🦝RISK and our investors. The bot's continued operation ensures that 🦝RISK isn’t reliant on any single market or asset class. Instead, we’re spreading our bets across the prediction markets and evolving as an adaptive, intelligent player.

Think of it this way: we’re not just playing the game; we’re rewriting the rules.

By using this technology and strategy, we’re laying the groundwork for a future in which 🦝RISK becomes synonymous with innovative, AI-driven financial strategies that benefit everyone involved—from our investors to our users.

Post #4 | 2025-04-23

Fee Calc., Credit Score Changes

We modified our Credit Score System algorithms- they should be more accurate now.

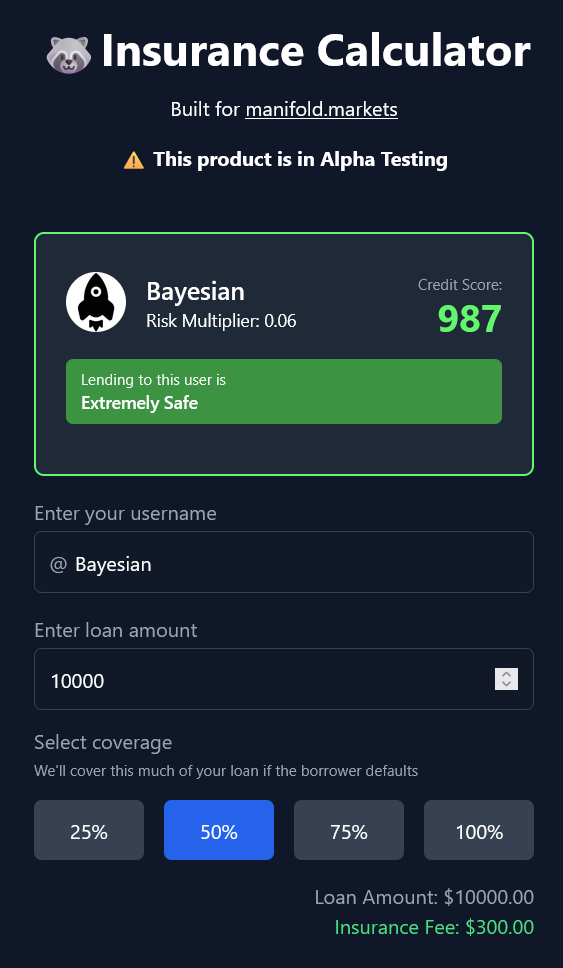

Our Insurance Fee calculator is almost ready for primetime (see screenshot below). Researchers are a little worried though. The API (which is used to generate 🦝RISK Credit Scores) is also in Alpha, and may change/break at anytime. Since this is the backbone of our business, we are seeking to diversify our strategy for generating good, accurate credit scores. If this research interests you, contact @crowlsyong to assist (working for 📖RIPE has benefits such as a quarterly dividend payout!).

Post #3 | 2025-04-23

Investment Oppurtunities

RIPE is investigating the utility of dividends as an investment option. Each quarter 🦝RISK would pay a percentage of the fees earned as a dividend. The larger the investment, the higher the percent in dividends. This opportunity is only available for investments of 20k-100k Mana.

If you're that investor, contact @crowlsyong today!

Post #2 | 2025-04-25

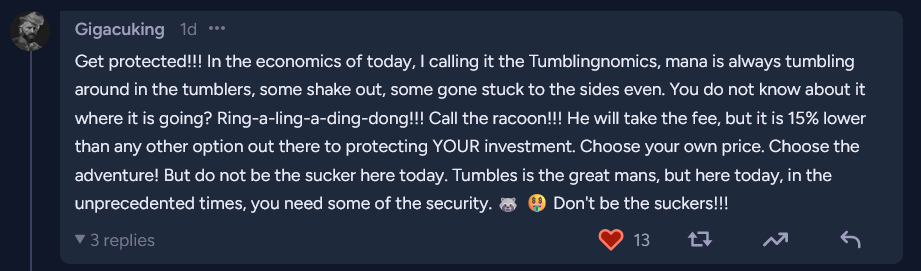

This has got to be one of the best comments I've come across in my time here. Our first customer,

@CryptoNeoLiberalist posted the comment on Tumbles market: /Tumbles/will-tumbles-ever-be-late-to-pay-ba

Bless you, Gigacuking. Bless you.

Post #1 | 2025-04-21

Determining Risk

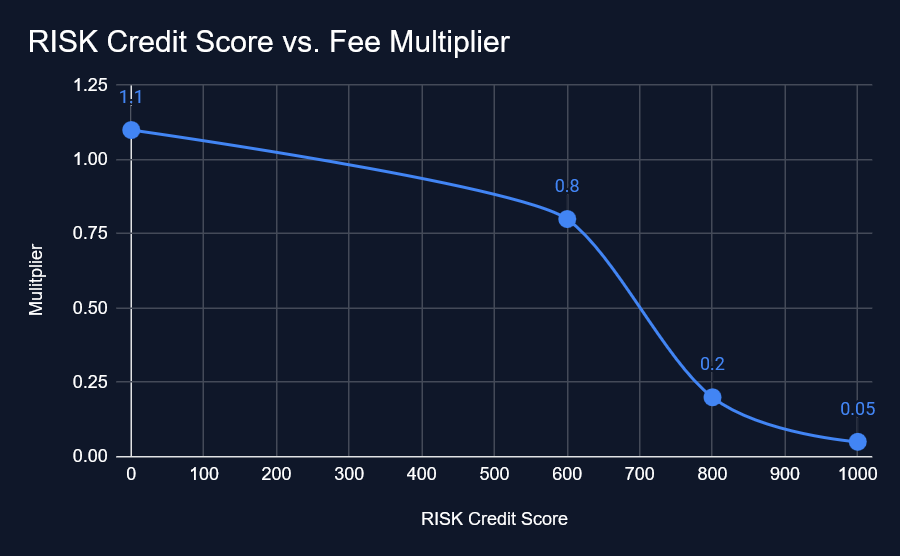

[OUTDATED AND INACCURATE] Learn how we calculate risk. See chart below.