📖RIPE Research In Prediction Markets

🦝RISK | 📖RIPE | ⛑️POOR | ⚖️LAWS

📖RIPE is a manifold non-profit we created to lead the way in researching the prediction economy. We aim to take advantage of the API in order to gather and organize data to make it useful to not only ourselves, but also the community at large.

Our blog has moved. It lives here now: https://manifold.markets/news/risk-blog

Research idea

🦝 RISK Loan Packages (RLPs) and 🦝RISK Package Insurance (RPIs)

At 🦝RISK, we’re proud to expand the future of peer-to-peer lending with two powerful new offerings: 🦝RISK Loan Packages (RLPs) and 🦝RISK Package Insurance (RPIs).

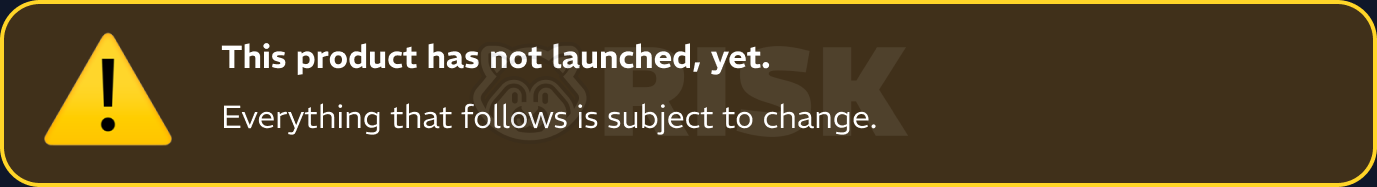

🦝RISK Loan Packages (RLPs)

🦝RISK will now bundle individual insured loans into investment packages. These bundles will be independently rated from AAA (safest) to BBB (riskiest), helping you select investments that match your risk appetite — all while knowing the loans are already backed by 🦝RISK insurance.

AAA Packages: Loans to low-risk borrowers; highly stable and modest returns.

AA and A Packages: A blended portfolio of low- and standard-risk borrowers.

BBB Packages: Higher proportions of high-risk borrowers; higher potential returns but more volatility.

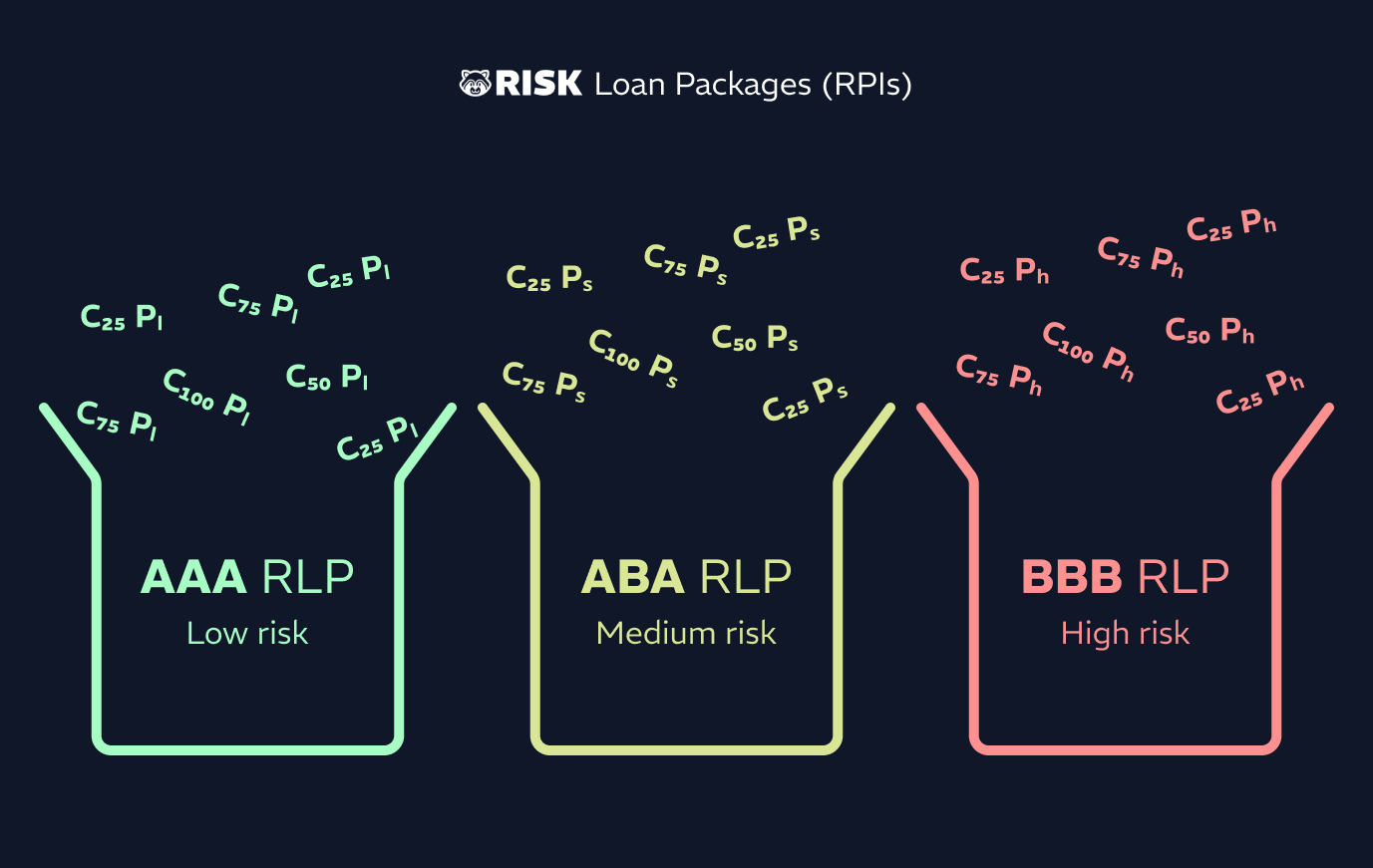

🦝RISK Package Insurance (RPIs)

Beyond loan-level protection, you can now insure entire packages, and even sets of packages.

If multiple borrowers in a package default, 🦝RISK Package Insurance ensures you recover your insured share based on the selected coverage.

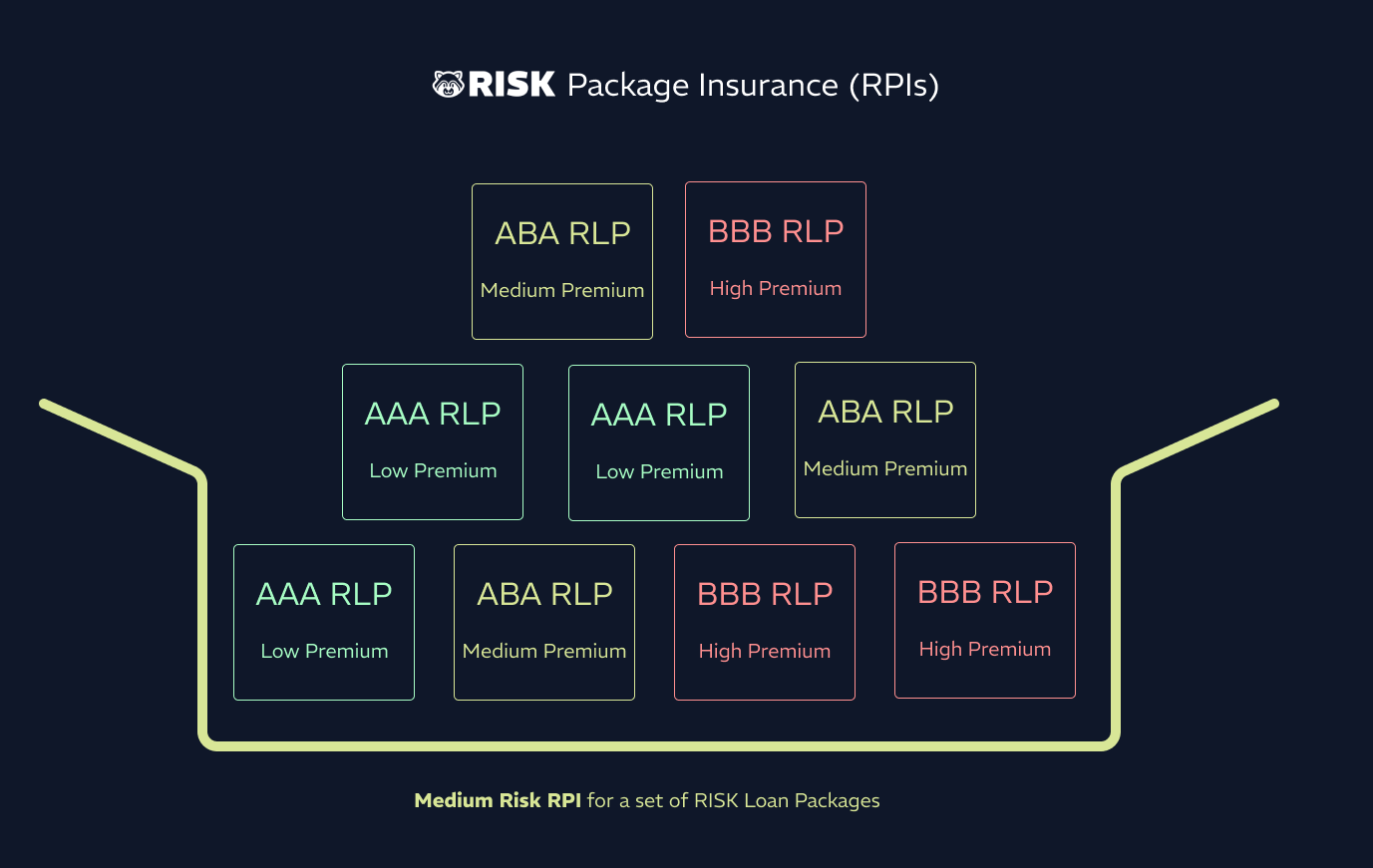

and then this is probably not a wise idea:

How It Works: Examples for Manifold Users

Let's walk through realistic scenarios:

Example 1: Buying a AAA RLP

You invest: 10,000 mana in a AAA RLP

Expected gross return (before insurance): ~5%

10,000 mana × 1.05 = 10,500 manaYou buy RPI at 1% cost:

10,000 mana × 0.01 = 100 mana insurance costFinal return (if loans repay as expected):

(10,500 - 100) = 10,400 manaIf defaults occur, insurance can soften or erase the impact.

Example 2: Buying a BBB RLP

You invest: 10,000 mana in a BBB RLP

Expected gross return (higher yield): ~12%

10,000 mana × 1.12 = 11,200 manaYou purchase RPI at 4% cost:

10,000 mana × 0.04 = 400 mana insurance costFinal return (if loans repay as expected):

(11,200 - 400) = 10,800 manaIf defaults are higher than expected, insurance helps recover losses up to coverage limits.

We’re excited to offer smarter, more flexible ways to grow your mana while managing your exposure. We are even considering building products on Manifold which correlate to fake money versions of health, life, car, business, and home owners insurance! We may also dabble in debt refinancing, but that's for the future to determine. We are also looking into providing services on manifold for Mergers & Acquisitions. We just might design a layer 2 solution for our products to integrate seamlessly into manifold. We also plan to use the API for various services and products. We may also use AI to automate tasks and finally: we hope to have a roadmap up soon. If you are a service provider on manifold and investors want to acquire your business, us to us first.

Stay tuned for more updates and happy investing.