Resolves YES if @Tumbles is even slightly late to pay back any mana loan that they intentionally accepted. Any extensions must have been agreed upon in advance.

@Tumbles may choose to resolve this market NO if they don't owe any mana to other users. Once they do so, they will be prohibited from taking on any new loans for three months.

I will use this description as a ledger of what I owe and when I owe it. I will update it as appropriate. All amounts listed include any fees or interest associated with the loan. Dates listed are the final day during which payment is not late (PST -8:00).

(short term loans not listed, nor included in running totals)

June 8th 2025 - Ṁ20,000 @RomanHauksson

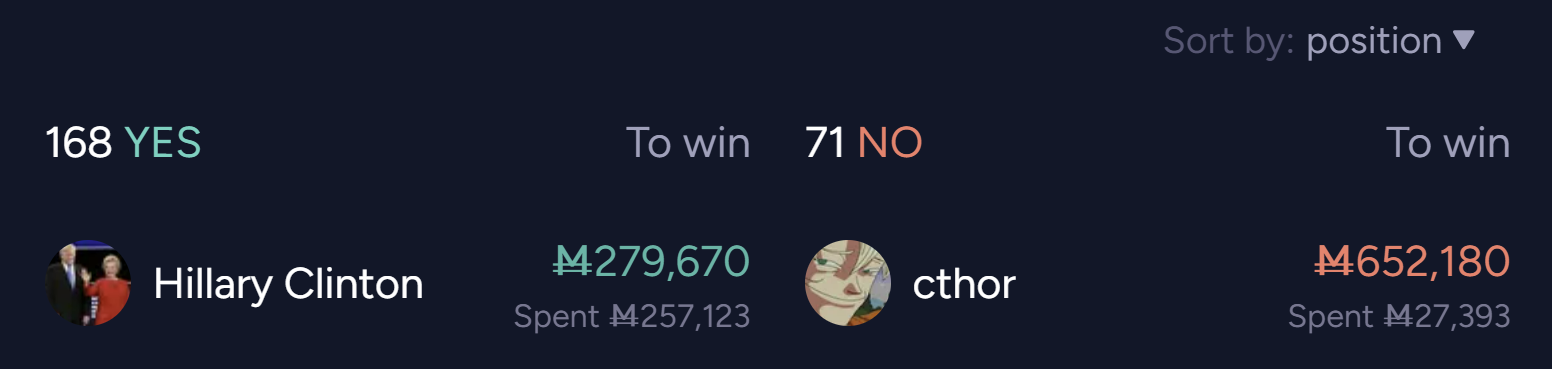

June 8th 2025 - Ṁ169,000 @cthor

June 8th 2025 - Ṁ2,000 @copiumarc

June 8th 2025 - Ṁ4,000 @Bayesian

June 8th 2025 - Ṁ30,000 @TheWabiSabi

June 8th 2025 - Ṁ80,000 @Gen

June 8th 2025 - Ṁ6,000 @Vortex

June 8th 2025 - Ṁ2,000 @jcb

June 8th 2025 - Ṁ84,138 @Quillist

June 8th 2025 - Ṁ4,000 @A

June 8th 2025 - Ṁ3,392 @mana

June 8th 2025 - Ṁ4,000 @JeffreyDeLucca

June 9th 2025 - Ṁ20,000 @TheSchwa

June 9th 2025 - Ṁ10,000 @Mh

June 9th 2025 - Ṁ20,000 @sophiawisdom

June 9th 2025 - Ṁ10,000 @copiumarc

June 9th 2025 - Ṁ2,000 @BlackCrusade

June 9th 2025 - Ṁ2,000 @root

June 9th 2025 - Ṁ10,000 @bence

June 9th 2025 - Ṁ2,000 @draaglom

June 10th 2025 - Ṁ2,002 @crowlsyong

June 11th 2025 - Ṁ10,000 @kopecs

June 11th 2025 - Ṁ20,000 @copiumarc

June 11th 2025 - Ṁ10,000 @TheWabiSabi

June 11th 2025 - Ṁ2,690 @CryptoNeoLiberalist

June 12th 2025 - Ṁ2,000 @ONEMILLION

June 15th 2025 - Ṁ100,000 @Tripping

July 31st 2025 - Ṁ33,000 @TheWabiSabi

July 31st 2025 - Ṁ56,800 @AndrewG

August 2nd 2025 - Ṁ16,500 @ScipioFabius

August 7th 2025 - Ṁ24,000 @CryptoNeoLiberalist

August 31st 2025 - Ṁ79,000 @Joshua

October 31st 2025 Ṁ70,000 @SemioticRivalry

October 31st 2025 - Ṁ56,000 @Vortex

October 31st 2025 - Ṁ70,000 @DrDerek

Jan 7th 2026 - Ṁ269,000 @AmmonLam

April 20th 2026 - Ṁ69,696 @GazDownright

April 20th 2026 - Ṁ7,478 @Robincvgr

April 20th 2026 - Ṁ6,000 @TheWabiSabi

April 20th 2026 - Ṁ6,414 @crowlsyong

April 20th 2026 - Ṁ14,070 @cthor

April 20th 2026 - Ṁ15,000 @copiumarc

April 20th 2026 - Ṁ6,000 @zsig

April 20th 2026 - Ṁ44,000 @StopPunting

April 20th 2026 - Ṁ5,200 @ahalekelly

April 20th 2026 - Ṁ10,176 @mana

April 20th 2026 - Ṁ10,140 @NivlacM

April 20th 2026 - Ṁ6,000 @GastonKessler

April 20th 2026 - Ṁ6,000 @A

April 20th 2026 - Ṁ60,000 @Simon74fe

April 30th 2026 - Ṁ151,500 @SanghyeonSeo

May 7th 2026 - Ṁ15,001 @ManaTotal: 1,738,197

Debts paid off, cleared, and/or forgiven:

after Manifest 2025 (after this market resolved): Ṁ159,102

after 2025 Canadian Election and before Manifest 2025: Ṁ141,349

after Biden dropped out and before 2025 Canadian Election: Ṁ981,800

before Biden dropped out: Ṁ711,679

Check out the Tumbles Financial Complex! 💸

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ104,002 | |

| 2 | Ṁ98,340 | |

| 3 | Ṁ97,987 | |

| 4 | Ṁ64,894 | |

| 5 | Ṁ52,912 |

People are also trading

@TonyPepperoni forgave my 30k debt

@EBurk forgave 69k in debt, and gifted me an additional 35k!

So I have some mana to do some loan repayments. But who should I pay first? Going by whichever loans I'm most late on would be reasonable, but this is post-bankruptcy-Tumbles, we're going to get wacky with it. I'm going to do repayments in chunks of 10k at a time, using unorthodox methods to choose who it goes to each time.

The next recipient will be chosen by whoever is crowned the Rock Paper Scissors Mastermind

🪨📄✂️

/Tumbles/who-will-be-crowned-the-rock-paper

🪨📄✂️

They can choose any creditor to be repaid, including themselves. If I owe the chosen user 10k or less, I will pay off all of my debts to them. If I owe the chosen user more than 10k, I will pay off 10k of my debt to them.

After that I will come up with some other way of deciding where the next 10k goes.

Good luck!

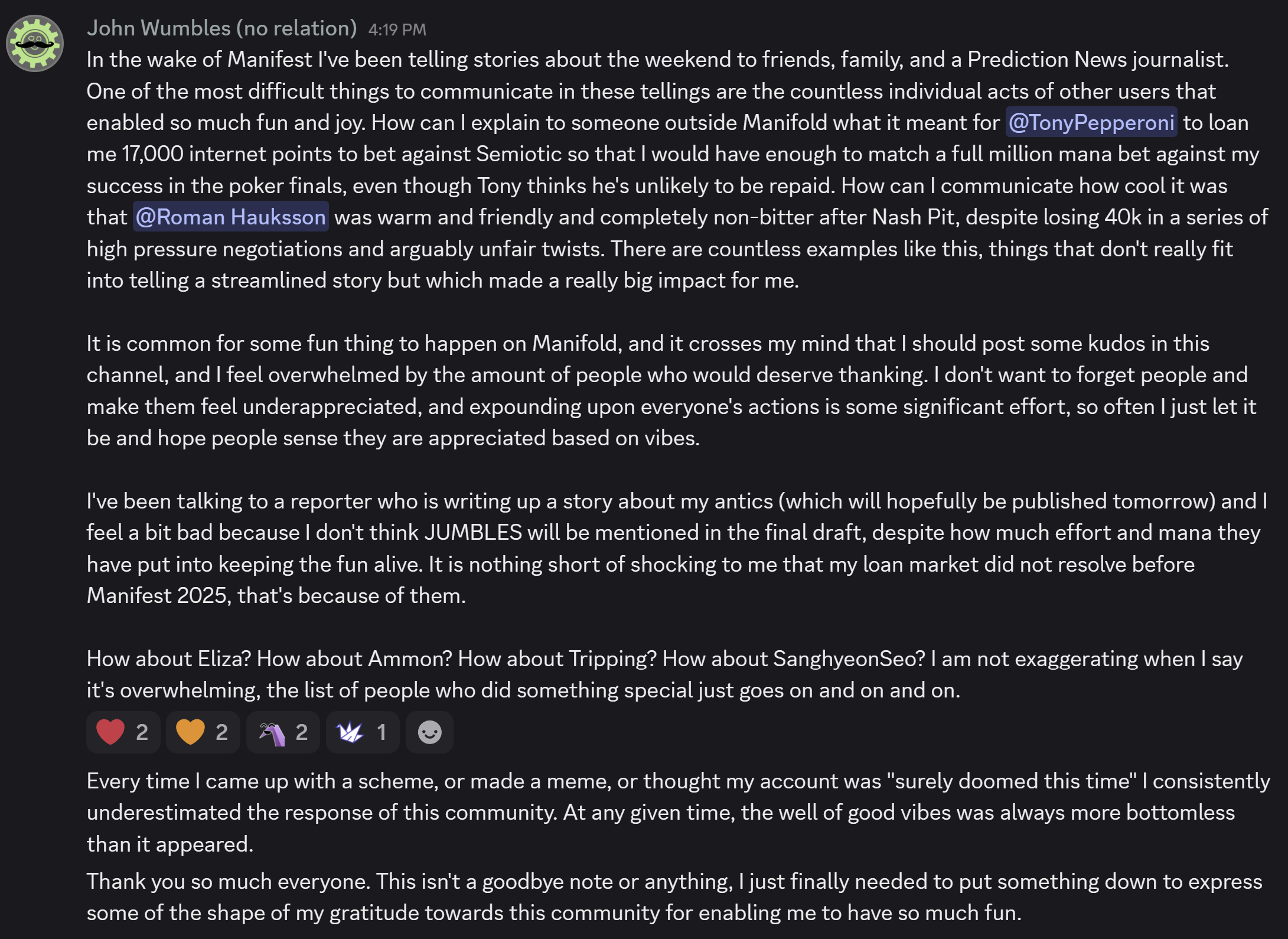

An open letter to the Manifold community

https://discord.com/channels/915138780216823849/987142274989297694/1382861922482917388

I've sold my NO shares to @cthor, who has been making big plays in the background along with a shadowy cabal of debt manipulators. I've seen some of their plans... I know not if they be borne of genius or madness

As for myself, I must admit I find myself daunted by the state of my account. Even if I use an alt to avoid my negative balance, it's very unlikely I'm going to find a way to cough up Ṁ1,852,199. Perhaps I'll buy a lottery ticket tomorrow

Apologies to everyone who find themselves left holding the bag. I tried! Y'know, it's possible I may have been an unexceptional future predictor all along 🤔 the possibility of spectacular failure has always been a part of what made all of this fun, and unfortunately spectacular failure has come to pass.

I will continue honoring my debts to whatever extent is possible. I will put any mana I can get my hands on into paying my creditors.

Thank you to everyone who participated up until now! You enabled this to be a pretty cool thing for me for a long time now, hopefully the feeling is mutual for many of you. I think we got pretty damn close to glory, considering how consistently wrong I've been for like two years now.

I'm not necessarily going anywhere! I just predict my habits on the site will be impacted by the fact my account is now a six million mana crater.

Love you all 🧡 🧡 🧡

Orangey sends his regards

@AndrewG It just might be a little late getting to you. And, uh, there might be a few hoops involved now in the repayment process

@TonyPepperoni forgave my 30k debt

@EBurk forgave 69k in debt, and gifted me an additional 35k!

So I have some mana to do some loan repayments. But who should I pay first? Going by whichever loans I'm most late on would be reasonable, but this is post-bankruptcy-Tumbles, we're going to get wacky with it. I'm going to do repayments in chunks of 10k at a time, using unorthodox methods to choose who it goes to each time.

The next recipient will be chosen by whoever is crowned the Rock Paper Scissors Mastermind

🪨📄✂️

/Tumbles/who-will-be-crowned-the-rock-paper

🪨📄✂️

They can choose any creditor to be repaid, including themselves. If I owe the chosen user 10k or less, I will pay off all of my debts to them. If I owe the chosen user more than 10k, I will pay off 10k of my debt to them.

After that I will come up with some other way of deciding where the next 10k goes.

Good luck!

@Tumbles why not invest it all on Yes for daylight saving time changing back to standard time in November?

@Eliza It would be hard to justify holding onto the mana for such meager returns rather than pay what I owe now, since it's past the agreed upon due date. Of course, it's also hard to justify this new circus I've described, but that's still my answer lol

@traders If anybody wants to forgive a loan, please comment here and we will give you a 25% discount on 🏦BANK Interest rates. We are also offering a 5% buyout, after which we will forgive most loans (some will be paid in full so we can use that money to forgive more loans and so that I don't make a huge loss).

@100Anonymous willing to forgive all my loans (79.000 mana), if 2 other people will do the same! Who joins? @Orangey

It's kinda crazy that the profit from @SemioticRivalry's million mana bet against me winning poker doesn't even break into his top 15 most profitable markets (/BrendanFinan/who-will-win-poker-at-manifest-2024-QNyAgctZAR)

A Prediction News article about the Tumbles Financial Complex 😃

https://predictionnews.com/news/how-one-manifold-trader-spiraled-into-6-million-debt-cautionary-tale/

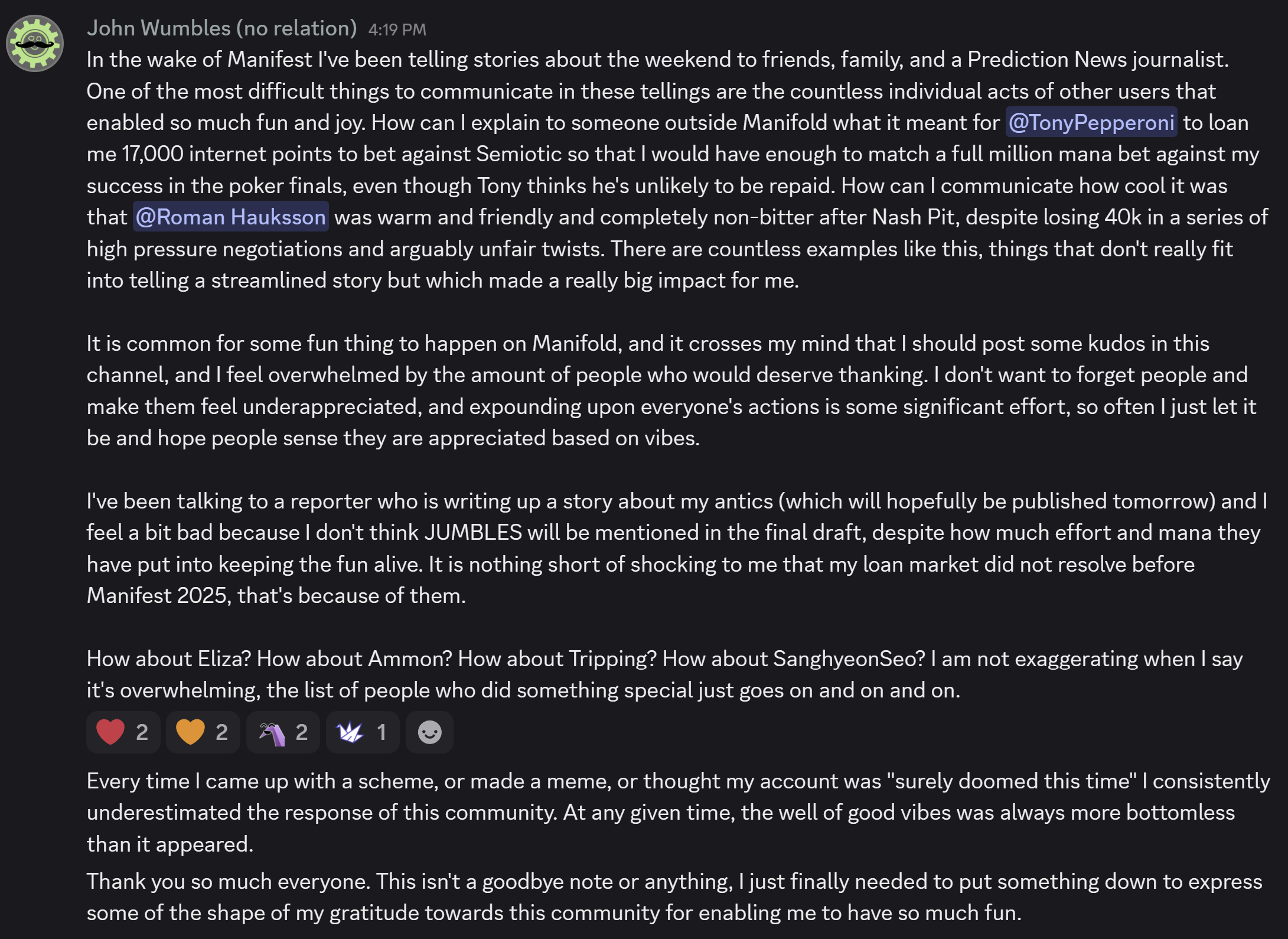

An open letter to the Manifold community

https://discord.com/channels/915138780216823849/987142274989297694/1382861922482917388