Out of date. Please refer to this post for most recent updates: https://manifold.markets/post/new-financial-system

Platform interest

We're happy to result the platform will now pay interest at the rate of 5% per year automatically on all market positions at market resolution.

E.g. if you bet 100 mana on YES at 50% and the market resolves YES one year later, you will receive a payout of 205 mana (200 mana in winnings plus 5 mana in interest).

Interest payments will apply immediately to all markets on the platform, i.e. you will be paid interest retroactively for markets resolving today.

Only positions on markets will earn interest; mana balances will not.

Loan rates

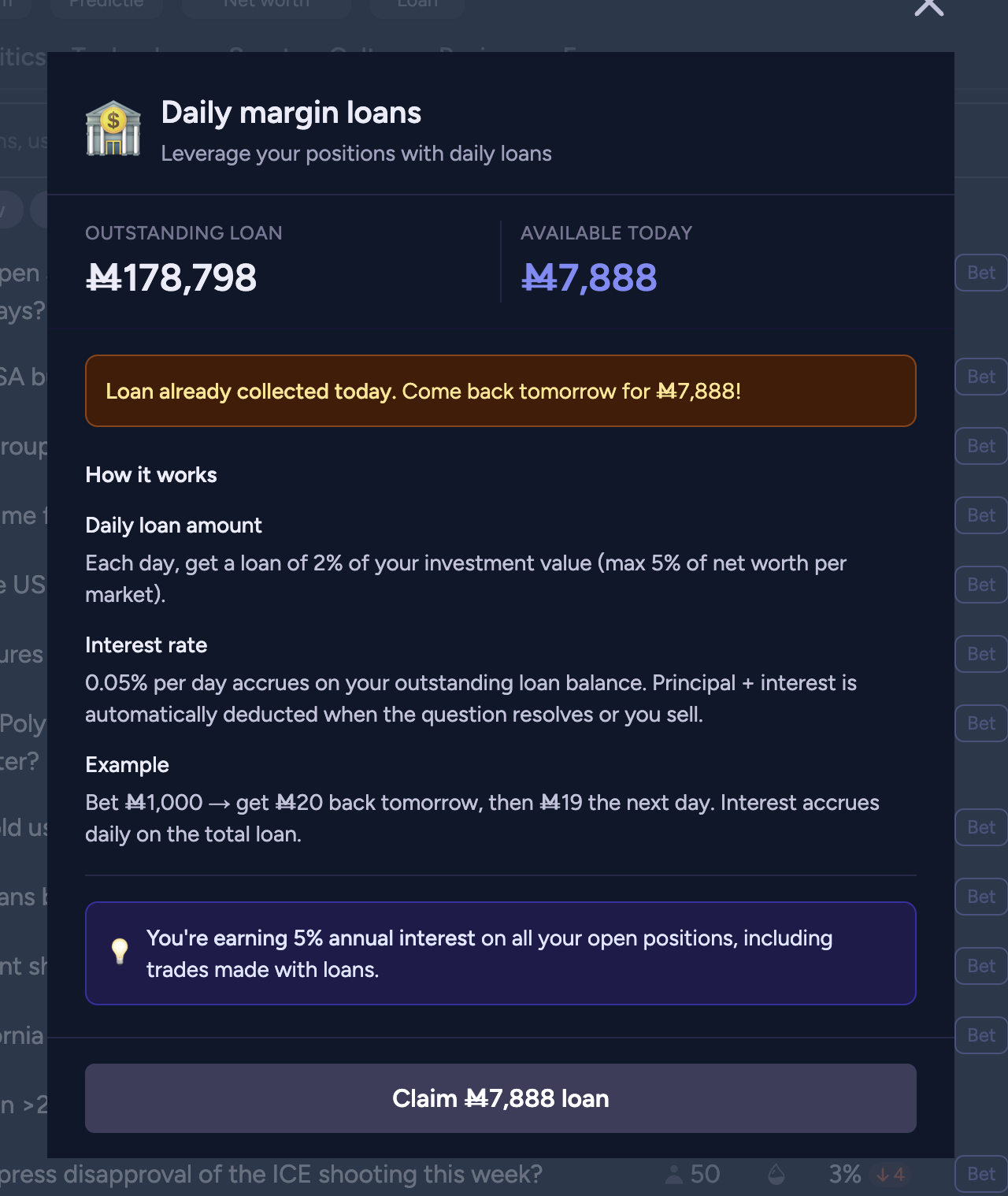

Positions on markets made with daily margin loans will also earn interest. To compensate for this, we are introducing a small fee on loans.

Loan balances will now accrue a fee of 0.03% per day, automatically included in loan repayment when selling shares or during market resolution.

The max cumulative loan you can receive on any single market has been raised (back) to 5% of your net worth.

These changes should increase the accuracy of longer timeframe markets, as well as encourage users to invest more of their idle mana balances. Happy trading!

Update: Previous interest-free loans have been fully grandfathered in and will not accrue any fees going forward.

0.05% is 18.25% APR. Doesn't that mean in year long markets you would literally lose money on a loan made to do the best if you bet on yes and the odds were 90%? Even if you won? I am very confused or this totally breaks long markets. If I make a 90% bet, I win 10% but lose 18.25% on the loan. I get 5% interest, so I net lose 3.25% for winning?

@HillaryClinton yes, I thought this of the AI movie market, no sense better no there at the moment with loaned money

@HillaryClinton yes like why is 0.05% the right interest on loans? A factor of 4 seems a bit punchy vs interest earned... i would've said a factor of 1.5 to 2 would suffice to make loans quite costly? Ie even 0.025% is probably on the higher end?

@4fa so I'm not crazy? This completely kills long term markets. I thought the entire purpose of the loan system was to allow long term markets.

@HillaryClinton Much worse than you say, because it doesn't depend on the market percentage, but on the difference between the market percentage and the “real” percentage. Even a 50% option may not be worth betting on if you have to take out a loan to take advantage of it, if you believe that the probability of it actually happening is only 55%.

To give a concrete example, imagine a prediction market on the roll of a die, one year from now. You can buy each number at 15%. You have the mathematical certainty of an average gain of 11%. In addition, you also have 5% annual interest, so it exceeds 16%. It seems like a market. It seems like a very advantageous market, but it's still too little compared to the 18.25% it would cost you to take out a loan (then yes, of course, nothing prevents you from taking out a loan and paying it back after a week because you have liquidity again thanks to another market, but it's an additional complication to add when betting on long-term markets).

@Emanuele1000 Ah, in all this, I would point out that if one user has an “average gain” of 20% per year, another user must lose that 20% per year, the sum is zero. There must be irrationality in prediction markets, but in this case it must be a major irrationality in long-term markets, if two users both believe that betting on the opposite side will allow them to have a gain greater than 20%

To give a concrete example, for a market that closes in 2030, which is now priced at 50%, in order to apply for a loan, one user must believe that the real percentage is below, approximately, 15%, and the other that it is above, approximately, 85%.

The loan only makes sense if you want to bet on short-term markets.

@HillaryClinton the entire original purpose, yeah, but I think it's actually not there great possible way to do that (but does help and could be a good piece of the answer!). But it also has other positive impacts, so analyzing it only from the perspective of its original goals seems mistaken. See my recent forum posts for more thoughts on that.

@SG is the interest for new loans still ~ 20%/year? BTW, another issue with hight interest - before, I always requested loans daily even if I had a bit of cash, eventually using those loans up within a few days. But now I am hesitant to request loans when I do not have an immediate need for more liquidity... If you are going to keep the loan fee (even if it becomes smaller), then you may need to consider: 1) being able to ask for a loan < max; 2) having the ability to request a bit more, if it's not maxed every day (e.g. 3% daily max, 10% weekly max, or some such).

And is the interest still only at resolution? So there is now a disincentive to participate in a mispriced market, if I already have a position in the opposite direction, and the older the pre-existing position is, the bigger the disincentive?

@SG 👍 Appreciate you taking the feedback seriously (just wish you took time to collect it before implementing things :) ).

@SG Doesn't make this update any less bad. You're rewarding whales with huge amounts of free mana proportional to net worth, not meaningfully incentivizing real trading but rather parking cash balances in risk-free markets, and making it seriously costly to access any daily liquidity for smaller/newer traders. It doesn't even encourage betting on long term markets because the interest is the same whether you bet on one 1-year market or twelve 1-month markets.

Interest makes sense on real money markets because you have to compensate people for the opportunity cost of keeping their money on the platform. Mana doesn't have any opportunity cost. Interest doesn't make sense here, it doesn't achieve its ostensible purposes, and it has all kinds of unintended negative consequences.

Sure it sort of "sounds right" that adding interest will incentivize trading and improve the accuracy of long term markets, but so far there's been very little argument made that it works that way in practice, and lots against it. @Ziddletwix in particular has been doing a great job in this thread of laying out very well reasoned arguments for why all of this is a bad idea.

@xjp I think the interest actually fixes the long term markets, provided the interest matches interest-free rate. It is different mechanism than loans that also fix long term markets somewhat. (Especially if they are capped per market, that was very good change, I think.)

I think the main disadvantage of this update is the fee on loans that will greatly deminish how much users with small mana reserves can trade. I think this will definitely have some impact on user engagement. Even for whales, now the strategy will be "park your balance on safe market and do trivial 1M trades to collect daily bonus". The loans gave you some mana daily (for the non-whales) so there was always something to do. I predict this will change if the fees persist at this rate. Also, for whales, the (capped) loans were great incentive to search for markets that are not capped on loans for you. Now, the strategy will simply be "avoid loans & park your money on a safe market".

I think the interest actually fixes the long term markets, provided the interest matches interest-free rate.

I don't think so, because as I said the interest is the same whether you bet on one 1-year market or twelve 1-month markets. The problem with betting on long term markets is the opportunity cost of not betting on short term markets with higher cumulative expected value. Now we've increased both sides of the equation by 5% yearly, which doesn't actually change anything.

Interest does improve the accuracy of long term markets on real money prediction market sites, because in that case you aren't only competing with short term markets but also with the return from e.g. a high interest savings account, so you need to pay interest to even out the equation. But that doesn't apply here, where mana doesn't have an opportunity cost external to Manifold.

@xjp yup https://manifold.markets/Eliza/recommend-market-structures-that-in?tab=comments#8l5weg5hb2f

If shares held were to pay interest, there would need to be some extra mechanism to specifically prioritize long term holdings rather than short term ones.

I suggested a few mechanisms there but none seem particularly good. Maybe a simpler one would be "interest increases the longer the share has been held for, starting at e.g. 1% and increasing linearly to 10% after 1 year" but it's possible there are issues with that too.

This change overall is surprising since loans already sufficiently address the problem of it not being rational to be on long-term markets. Instead, it seems to be a solution to something that isn't a problem. People with large unspent balances are people who don't see any good bets to make with that mana. You're not going to get meaningful price discovery by them being encouraged to invest it. If they had some delta, they would have already invested! So they're just going to park it somewhere safe.

@cthor I can't believe no one in that topic suggested setting up 20% loan instead of 0%.

Instead, it seems to be a solution to something that isn't a problem

The "problem" this plan is attempting to address is not long term markets, but "no one buys any mana".

The "problem" this plan is attempting to address is not long term markets, but "no one buys any mana".

are you sure this is true? it would explain some parts of the changes, but it is extremely hard to square with the decision to offer unlimited 5% interest on all investments, printing large amounts of mana. i guess this is your interpretation of the motivation to encourage users to hold more of their balance in investments?

(i am not quite convinced because the changes on net are extremely bad for encouraging mana purchases and ian/sg have mentioned the long term markets part repeatedly but not reducing mana available for users. that's a reasonable goal!)

@Eliza Woah, that makes less than zero sense. If they wanted to sell more mana the last thing they should do is devalue it by printing millions of mana per year and handing it out to whales for free.

In general, selling mana seems like a bad monetization strategy to me. One of the major things that motivates people to "play" Manifold is the idea of amassing a large net worth and proving you were right about everything. Selling mana cheapens that by making it pay-to-win, like how selling XP ruined Runescape and other MMOs. If someone has lots of mana, are they really good at predicting or are they just paying for it?

But if selling mana is the only way to keep the site running, the answer is to get more users by improving the fun and utility and going viral, not to try to squeeze existing users by cutting off our liquidity supply and worsening our experience. We're not going to start spending, we're just going to stop playing. The path of enshittification leads to a death spiral of the site. I'm not saying that the admins are following it to be clear, just that this is a step in the wrong direction.

As an admin recently pointed out, software development costs are plummeting because of AI tools. That means the site shouldn't need to rake in cash to stay operational and actively developed. Unless there's some VC arrangement I don't know about that demands massive profitability or death. Cutting costs and coasting while providing a real public good seems like a good and noble way to go.

@nikki I think I basically agree with that thesis, and would be interested in reading the full version!

I also suspect that "can't be perfect" is pretty different from "can't be improved over the status quo". I suspect there is room for that, and have a bunch of ideas on how to do it. None are fantastic, though, they're all just small incremental improvements.

@EvanDaniel My experiment here or Metaculus are probably much better calibrated. Those are not small incremental improvements at all.

@ian If you decide to do the editorial control thing you will need different criteria from what counts as 'ranked'. Many ranked markets would not be good choices for editorial control over the interest rate.

@ian What would stop someone from just making a ranked bank account market? What would restricting it to ranked, achieve?

@Eliza Also I think if you inherently penalize unranked markets, it’ll discourage them, and they’re a positive part of the site.

@ian this is a very good, well-defined, ranked market, predicting something high stakes and important. it's also trivial to sink endless balance into it.

/Ziddletwix/gop-share-of-senate-seats-after-202

with modest effort, interest rates on investments is equivalent to interest rates on balances as well, manifold is too flexible for them to ever be meaningfully distinguished, no matter how you write the rules.

(this is setting aside other obvious approaches, like sinking tons of mana into a dependent MC market so you hold NO on every option, or betting on opposite sides of a duplicate market to hold cancelling positions. you cannot outlaw all of these, many of them are perfectly valid uses of the site.)

if the goal is to encourage trading in specific blessed markets, that's great! i do not think interest payments are a good way to do this! people are not particularly sensitive to interest rates. and of all the ways for manifold to give users mana, i do not think it makes sense to dole it out as a proportion of current net worth, making whales richer.

i do not understand what problem interest payments are supposed to fix, and i do not think this is a fruitful direction for the site to explore. if the goal is to bless a curated set of markets, structure rewards specifically for those. if the goal is to manage whether users run out of mana (striking a balance between "we want them to buy mana" and "we want them to have mana to keep using the site"), then adjust the daily loans system accordingly. interest payments are a very expensive way to make EV-sensitive users slightly less sensitive to the duration of a market (when loans handle this case just fine already). it's an expensive way to fix a non-issue.

@Ziddletwix Shouldn't prediction markets, if futarchy is real & workable, be able to predict things that are low-stakes & unimportant as well? & who defines "high stakes?"

@Ziddletwix Paying interest on positions seems straightforwardly good at rewarding trading and subtly discouraging unspent balances. It should encourage engagement and make long term markets more accurate. At 5% a year at current investment levels it should generate 1 million mana less than the approximate yearly betting streak rewards. If investments double (that'd be great), then it would give out about 2x the betting streak bonus per year.

@ian at 30 mana a day, isn't the yearly betting streak reward = 10950 mana? I may be missing something, I've only been on Manifold for a couple of months.

Paying interest on positions seems straightforwardly good at rewarding trading and subtly discouraging unspent balances.

Paying interest on investments encourages users to shift their mana from balances to investments. I don't agree that this necessarily implies much useful "trading", nor do I think this is a useful priority in general.

First, most importantly, the examples I mentioned above. Manifold is infinitely flexible UGC. It is extremely easy with modest effort to shift a large amount of balance to investment without particularly useful/meaningful "trading" going on. the GOP % market is one example, building up positions in dependent MC is another, arbitrage between duplicate markets is a third, the list goes on and on. I do not think it is realistic or worthwhile trying to use rules to enforce which ways of transferring mana from balance to investments are "good" (I have incidentally done all of the above in the normal course of using manifold without having any particular intent of inflating my investments, they're part of normal site usage!).

If you want to directly promote trading in certain curated "good" markets, that's a great goal, but interest payments are an extremely inefficient way to incentivize this.

More broadly, who are the users whose behavior this is meant to change? Many active users are essentially "mana constrained", they do not need any additional incentive, they want to spend their mana, they will receive some interest payments along the way but this won't impact their behavior. This mainly impacts whales who have "more balance than they can easily spend" (e.g., me), who are now incentivized to spend it. I do not think it's worth Manifold paying me 100,000 mana per year to park more of my mana in investments. It won't make me do more useful trading (my constraint on trading is interest, not mana, that's how it works for whales).

At 5% a year at current investment levels it should generate 1 million mana less than the approximate yearly betting streak rewards. If investments double (that'd be great), then it would give out about 2x the betting streak bonus per year.

That sounds like a substantial increase in the total mana Manifold doles out to active users! (except concentrated towards whales, which seems inefficient). If there's any hope in people spending dollars on mana (if anything, I would think these loan changes are about trying to make mana more scarce), the "mana budget" that the site doles out is important, and this seems like an extremely inefficient way to spend it (versus other ways of directly subsidizing good markets or etc).

An additional incentive to store your mana in investments rather than balances has nothing to do with the loan system, and the changes should be decoupled. If the goal of interest payments is to make users more agnostic about the time duration of the markets they participate in, that's a separate argument (discussed elsewhere but I can go into that as well), but I don't think that's a useful/relevant goal either. People are sensitive to running out of mana, not subtle differences in EV based on time duration, the daily loan system is what will determine whether people "run out of mana" or not. If the goal is for users to run out of mana more often, reduce daily loans. If you want users to have a daily reason to log in and spend their mana, make the daily loans strong. Interest payments are an extremely expensive and unhelpful way of achieving any of these goals.

@Ziddletwix since i am saying "this is a bad way to give away mana", if the goal is to give away mana in a way that incentivizes good trading, to be more helpful, my first (minimal effort) suggestion would start with giving a mods a mana budget for explicit curation. e.g., a mod boost gives a market a bunch more liquidity, mods are encouraged to boost ~1 market per day, with basic guidelines for which are worthwhile.

the main reason to give away mana is so users have mana to play with (this is very elegantly handled by daily loans, the fix that people love to complain about for some reason but it works quite well). if you want mana to be more constrained (e.g., so they buy more, or mana feels more worthwhile), then tweak daily loans, that's the tradeoff. if the goal is to incentivize good trading, universal payments for investments is not useful, manifold is not structured in such a way that there's meant to be a meaningful distinction between investments and balance! it's my mana and it shouldn't be hard for me to translate in between those as i see fit. so if the goal is to incentivize "good" trading, there is no shortcut for using manual curation to bless certain good markets and give users mana for participating in them. i think liquidity remains a very elegant solution there (so they earn rewards based on their predictive skill), but sure i suppose there are plenty of alternatives there too for how to reward people for participating in the chosen markets.

@Ziddletwix I guess it's true that whales will be better at parking their mana in low-risk investments. It's also nice to just know that all markets on the site will pay out interest and you don't have to think about whether you have enough of an edge on this market. If we were to choose certain markets to bless with interest payments, that adds another thing a user has to think about, which the current rule avoids.

@ian daily loans had a faaaar greater impact on my willingness to bet on long term markets than the impact of 5% interest will have

Also sent as a direct message to @SG

BTW, if you are truly motivated by encouraging people to invest into long-term markets more, rather then messing with the loan system, PLEASE look into making it possible to partially resolve linked multiple choices / date / number markets, so that for e.g. "when will X happen" type markets the expired options could be resolved to NO while the markets for future options remain open. That would be a huge improvement with absolutely 0 controversy! Thanks!

@WoahD_ Also really wish there was more of a warning about the grandfathered loans. I took my loan today out of habit before seeing this post. I certainly would not have done that if I knew.

It's really annoying adding a new feature that completely destroys the previous experience, only for that feature to be removed shortly afterwards. This is what happened with the trading fees (which led me to decide to donate everything, but Manifold offered loans for donations, and in the end the fee was canceled and everything went back to how it was before, except that even today I avoid buying positions directly and instead place limit orders...).

I'm not even sure I understand how it works and what the goal is. Does the 5% interest only apply to those who don't sell until the resolution? If I sell a day early, perhaps because it has already reached 99%, do I lose the interest? What is it supposed to incentivize?

EDIT: Incidentally, the decision to add trading fees, which were removed after a few months and were therefore clearly wrong, would have prompted me to abandon the site for good two years ago, these changes can have permanent effects even if they are reversed. I would not have returned after a year, starting from zero...

@Emanuele1000 In all this, I don't even know my net worth, one page says 218k and another says 236k.

@ChurlishGambit if you click the loan button one time there is a popup which will show your outstanding balance. DO NOT CLICK THE GREEN BUTTON.

@Eliza I still don't understand what my net worth is. Shouldn't net worth be balance + invested - loans?

@Emanuele1000 I thought the 'Invested' amount had already subtracted out the loan amount, right?

It's the current value of your position (at the market probability) minus your outstanding loan.

@Tomoffer yeah. If they allow this to go over any arbitrary threshold, then you can make some bets and get absolutely everything right but still end up with negative mana. I do not think this was thought out

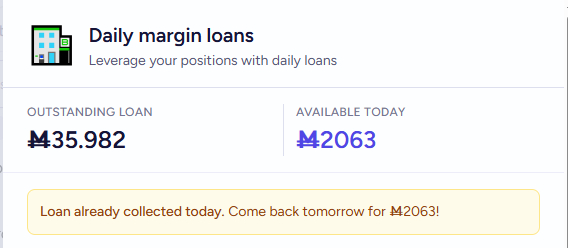

I would be interested to see how the numbers have declined after yesterday.

In terms of:

1) Loans collected

2) total mana bet across all markets

3) # new markets created

Right now I'm keeping >40% of my NW as undeployed mana. I intend to bet the bare minimum everyday until this situation is resolved. And I'm probably not the only one doing this.

@Hakari i dont see a reason for me to not place any more bets right now. just for me to not take more loans (of which im not even sure ill avoid still)

@Hakari That's all on the stats page. But I would wait a few days, most people don't understand their accounts are about to start leaking

@No_uh well I (and probably most others) would at least have to rethink and reduce bet sizes if interest free loans are no longer a thing.

@WoahD_ Is this assuming you're taking loans still or not taking loans? if you're not taking anymore loans why wouldn't you still want to leverage, say, 70% or even 80% of your net worth?

@No_uh hmm if loan interest is here to stay, I would skew pretty heavily towards using loan mana in EXTREMELY near term markets.

I would also never take loans at all unless there are several new functions on manifold:

1) option to stake SPECIFIC market holdings for loan mana - not the current system of "draw a little from every open market and accumulate small increments over time".

2) button to "pay back all loaned mana" or even better "pay back loaned mana from a specific market".

3) option to specify/toggle "don't use any loaned mana in this particular bet" while placing bets.

Basically I would do whatever I could to minimize interest and avoid betting loaned mana in long term markets. Loans (even with interest) aren't bad in themselves, but currently there isn't enough granular control.

this is a very bad change—don't try and tweak the numbers, just revert it and go back to the old system.

i don't understand the goals here. do we want people to feel mana constrained, so they buy mana? that's fair, but then it's preposterous to pay universal interest on positions, hugely diluting the value of mana (to be clear, manifold is asking people to pay $1 for 100M while paying me 100k in mana in interest payments each year... seems like a bad deal for new buyers!). note: on a non-curated site like manifold, interest on positions vs balances is a mostly fake distinction. as someone with an enormous balance, this will not force me to hunt down endless markets to place my mana in (not that this should be the goal, i'm already invested in thousands of markets, it's less active users who need the encouragement). instead, people will make markets like this:

/Ziddletwix/gop-share-of-senate-seats-after-202

this is not some glib abuse of the system—a perfectly normal market that people make all the time (and manifold normally encourages people to find weird financial tricks as long as they are valid/good markets!). the result is it's trivially easy for me to find a counterparty to sink 1m mana into this risk free so it can pay me 50k free interest per year. why should the site do that? why dilute the value of mana by paying interest to inactive whales?

is the goal just to encourage betting on long term markets? i think that goal is confused. if market A resolves in a month and market B resolves in a year, interest payments are technically required for users to be 100% agnostic about the difference between them in EV (i.e., the point of brad's blogpost, which is correct on the theory but not particularly relevant for manifold in practice). but (1) people just aren't that sensitive to subtle EV calculations [1], & (2) on a site like manifold, we don't care that much if they're perfectly agnostic, rather, we want them to be able to engage with both markets a little bit! this is best handled by daily loans that ensure they don't run out of mana, at a trivial cost to the site.

(re: "sensitive to EV calculations", this is not the same as saying that people will never skip a market because investing at 99% to resolve in 2 years is not worth it. rather: people are highly sensitive to the simple question of "will i run out of mana", and not very sensitive to the subtle (yet 2x) difference between a 1% & 2% yearly return (evidence: the fact that there's no single coherent interest rate on the site)).

to be clear, i am entirely setting aside the details of implementation here. applying this retroactively to old loans is nonsense. since i groggily clicked the loan button today before reading the changes, i'm now paying 20% interest payments to the site on my 700k in loans. obviously that's a terrible deal, and if the changes stick i'd have to laboriously sell out of my position in countless markets and rebuy them, which is a huge waste of time. but that implementation is so obviously bad i assume it will change soon regardless, & i'm focusing just on the high level issue of interest payments & loans (which might inform the next iteration).

interest payments are bad, don't do them, scrap the entire idea. chaotic iteration is great on e.g., predictle or the calibration page. it's bad when it comes to loans. for people to buy mana, they want the mana economy to be taken seriously. that means being careful about the changes that are made to it. if there's an actual goal for the changes, articulate that and we can discuss options.

the other recent site changes have been good! this is bad.

for major changes like this one that affects mana, I would prefer to be alerted on the email I used to sign up for Manifold on.

I just don't check Discord or even notifications all that often - and I was seriously considering adding a 'collect the daily loan' as a step in any future bots I build. I lucked out today that I read the post before collecting the daily loan.

@Hakari Not gonna happen. The people who run this place think they know better than the dwindling userbase, & consider themselves above such communication.

The semi-grandfathering is unworkable. I have 150k of accumulated loans. Today I could claim ~500 mana as an extra loan, but this would immediately trigger 75 mana PER DAY fees. That's a very steep cliff.

I'd need to claim the loan for at least 100 days before we get into the range where the liquidity is worth the cost. I'm too lazy to do the proper math, but roughly speaking I'm being asked to pay several thousand mana for the privilege of accessing the new loan system.

@VitorBosshard to be clear, at 100 days, I would have 50k in extra loans, which means that de facto I'd still be paying 4x the 0.05 interest rate. That's when it goes from an insanely bad deal to a regular bad deal. It'd take 1000+ days to actually start converging to the stated loan rate.

On an emotional level, I think it's important to understand that everybody has a different learned relationship with money. Debt is playing with fire. Some people can cook with it. Some people have been burned by it.

Some people know how to confidently leverage debt for an advantage. Other people who have been crushed by debt with real money in the past may be very averse to holding loans, and they will apply their learned heuristics on Manifold.

It is important to understand that any loan system that bears interest will never be a one size fits all solution. Having a risk tolerance is part of the human condition. As long as somebody respects the compounding power of debt, they're doing risk tolerance right.

@Quroe That's why it shouldn't be retroactive as well though! I wasn't told that I was suddenly going to have to start paying interest on my entire outstanding loan amount. Feels like such a rugpull

@Tripping I am definitely in line with you here. It feels like you signed on to a bargain without informed consent. That makes people feel violated.

@Quroe this guys is campaigning to become Manifold trop brass the way he talks.

DON'T BE FOOLED WHEN HE ANNOUNCES HIS CANDIDACY!

@No_uh I'll spill my heart out here. As somebody who has seen the horrors of what happens when loved ones fall down social media information silos, I see Manifold as a social media platform that can actually keep people grounded in reality and is an environment resistant to undue influence from propaganda.

I don't think you understand just how badly I want this platform to become mainstream. I truly want this to be a place where everybody can have a seat at the table. We wager our reputations with our mana, not our real life livelihoods. I think that it's actually a boon that we are a play money site and not a real money platform.

Since I'm at the top of the comments, here a summary (I read like 100 of them, nowhere near most of them)

- SG is working on something

- Most of the comments I saw seemed to lean not-in-favor of the changes, mainly the interest on loans.

- reminder to be nice

- you can bet that the 20% loan fee will be reverted in a week

Also curious - why this change?

I kinda liked the simplicity of not needing e^rt when thinking about manifold bets, compared to real money bets. I mean, it still shows up when you consider 'how much do I expect to make on this mana if I save it for the next unknown good bet later, instead of putting in in this bet", but without background interest, that's the only consideration for determining r, I don't need to also consider "what if I just invest the mana instead of betting, at this external rate different from my general goodness-at-betting rate".

I assume investment markets will show up (Jerome just mentioned a way to make a personal one, but why not just make it public and get the 3m bonus for people using your investment market? Edit: Someone already did)

I can see it as maybe just an incentive to bet rather than hold mana? Is that the goal here? I don't think it'll accomplish that goal (edit: I'm not the only one), just make investment markets. I don't see a fundamental way around the "I can wait for a juicier bet later" reason to hold mana, and I think after the market gets a stab at it, a risk-free rate isn't going to actually make anyone change the proportions of their balance they put on the bets people care about.

Hopefully there's some other really good reason I don't know about!

@SG quick question…. I was just thinking and what would stop someone including myself for making like a long-term unlisted market where whenever I have an extra mana balance I put it in there and it just earn interest but it’s basically a proxy for my uninvested balance… seems like a small work around that would be kind of unfair. Idk though…. also, I do really like this change so I’m not trying to rip on it because most people in the comments always rip on them including myself so thank you for shipping all these features!

@JeromeHPowell yeah someone raised that somewhere below and SG agreed that it incentivizes creating frivolous markets like that.

I have the same question.

My assumption, absent additional info, is that it's based on something like a daily chart of the position value?

Like, if you put 100 in at 50%, you have a position of 200 and a current value of 200*.5 = 100. So while market price stays at 50%, you're getting continuous compounding on your current value, if it stayed at 50% for the whole year you'd end with 105m (and then after that, payout gives you 205).

But if, right after you buy, market price jumps from 50% to 75%, now you have a value of 200*.75 = 150. So I figure you'd get 7.5m over the course of the year now (and again, payout means 207.5).

If it's not this way, then suddenly we all have incentive to recycle any positions that gain value (any time you get profit, sell & re-buy your position so that you're getting more interest) and to not recycle any positions that lose (you can still get your 5% on your losing 100 investment until you sell & re-buy!)

@Gurkenglas Yeah this.. there was a pop up that may or may not have included the warning but we especially here in the EU have been strongly conditioned to click through all popups without reading

If loans have any amount of interest applied, they should not be doled out in daily increments. If I am going to pay interest on a loan I should receive it in a larger lump sum so I can consider what I plan to do with the loan and determine if it's worthwhile.

Part of what makes 0% daily loans so nice is that it increases how much I can use the site with basically no downside (downside for me I mean). They don't add extra math or extra stress and pressure (except making sure I'm not inflating my cost basis in long term markets)

I would say that applying interest to daily loans completely changes the dynamic. For me it feels like daily loans have been removed and replaced with a new system, moreso than the familiar system has been tweaked. That feels really bad since I've felt the familiar daily loan system is a massively positive aspect of my experience on Manifold.

I'm just confused. Making the interest rate on Loans this high means it's very hard to determine whether they're worthwhile; unless you see some really great opportunity and are short on balance. But for that use case, the Loan you can take out will be too small to be very useful.

So this basically means that Loans have been canceled, and long term bets are back to having unacceptable opportunity cost. The Inserest doesn't help for this, since you get the same Interest rate from short-term markets.

Also, the Interest being paid only at closing means you can't sell early, which is distortionary.

My first thought was that this seems like a good idea, but thinking about the implications for me I'm not so sure.

I do a lot of market making, meaning I sell out of positions early if the market moves past my estimate. Sometimes I sell even if it doesn't move past my estimate just because I'm invested too heavily and the market is remaining irrational beyond my ability to correct. This was already kind of complicated because selling resulted in me repaying some of my loan, leaving me with less balance and less opportunity to put that mana to work. But now it's even more complicated because I don't make interest if I sell early. (Maybe that should be changed?)

I also have a lot of loan at this point (>100% of my net worth). Seems like the 20% annual interest rate could screw me pretty badly.

So it seems like the sensible thing is to not take new loans and not pay interest. Maybe I'm very lucky to have that option on such big outstanding loans! But then I'm short of mana in the near future. Even more so if I leave my sell orders in place for my market making (because I'll gradually repay more and more).

I can't get away from the conclusion that my response to all this has to be "use manifold less". I should cancel my limit orders, place a few big bets, and otherwise disengage.

Am I missing something?

@Fion proposals to fix:

Make loan interest rate not exceed investment interest rate

Make investment interest payable on selling positions, not just resolution

Allow users to sell positions without repaying the interest free part of their loan

@Fion To keep reiterating my proposal for interest payments:

Pay interest on all assets, on a schedule (monthly? daily? whatever). Pay them in the asset held. Mana balances get mana payments, loans outstanding get larger, shares held increase in quantity, AMM liquidity goes up. Don't mark to market and pay in mana. You can cash out interest payments in all the usual ways, by waiting for resolution or selling out or whatever.

@Tripping You could have given me a warning before I accepted today's loan, of course I wasn't going to take a retroactively applying 20% p.a. loan

20%! That's so insane, holy crap. Just how positive EV do you guys think the bets I'm making are?!?

@Tripping having an option for us to manage the loan would be nice too, I would be down to take short term loans if we can pay them back later to avoid the fees

As a reminder to everyone, no matter what you think of this change (and I’m personally not a fan), making personal attacks against anyone is not okay.

Manifold is a play money prediction market, this is not going to destroy your account overnight, and it can be reversed. Saying the same things that have already been said here will not convince anyone, and saying them angrily will do even less.

@SG I had zero doubt major changes were coming after such an intense backlash. I think the site has done a pretty decent job adjusting changes based on feedback, at least since I've been around.

@SG I'm not entertained, and I don't trust this process when it comes to monetary / economy stuff.

It's a great process for calibration graphs, the new market creation UI, boost features, a merch store, predictle, and more. But not for things where second-order effects matter.

@SG those loans might be higher than p2p to stimulate the economy

Please consider adding more loans, especially if I am seeking a larger loan with a higher interest rate.

I am also comfortable with a collateral call if my positions drop more than - 50% negative

Interest at that rate is nonsense with the current loan system and I will never take out a loan again until this is changed.

It would make more sense if I could take out a loan secured against my positions in particular markets instead of my total investments. This would avoid discouraging investing in long-term markets.

@ChurlishGambit Is it currently easy to find out which of my positions contribute to my loan balance?

I made a poll about this and I'm hoping it can go to the top of the page to warn unsuspecting users that the loan button could trap them:

https://manifold.markets/Eliza/dont-click-the-loan-button-without

I'm not sure if polls can go to the top or not but we can see if people vote for it. Even though there is a popup on the loan button I think people will click right through it.

This is going to utterly crush engagement on the site. I bet on markets daily with the liquidity I get from 1) loans, and 2) selling out of markets that have trended in the direction I bet on. You kill #1 by charging 20% interest (probably more than my alpha), and you kill #2 by paying out interest on resolution, so I lose if I ever sell early.

Now I'm going to bet, what, 25 mana from the daily quest? I get that you want us to buy mana, but most people have a budget of $0 for internet play money.

Furthermore, this recent trend of randomly pushing out half-baked and badly communicated changes to the fundamental workings of the site makes me want to stop spending time on it. I'm not going to invest time into something now that feels so precarious and uncertain in the future, rather than something I have confidence I'm going to keep using.

If you want to make big changes without alienating users, it would be prudent to start with a clear and well reasoned design document laying out the what how and why, then a period of gathering user feedback, then implementing.

@xjp 💯 I’d bet my balance to near zero and then collect my loan and do it again. Now I’m not collecting my loan so I’m just waiting for old markets to resolve. Don’t see how long term accuracy improves like sg claims. I don’t have mana to bet on them

@Jack1 Yep, I won't be making new bets until extant ones resolve...& a lot of my bets are in things with long or indeterminate duration, so...

@Simon74fe 3 tier. I am ok for 25% loans per month - 1.005^30 = 1.1614000828953

1.007^30 = 1.2327758460713

How is this supposed to work with long-term markets that don't resolve for decades/centuries?

When i bet on these assumed I would get most of the mana back as loans long before they resolve, but now I cannot take loans anymore because the accumulative fees would be much higher than the interest I would eventually get, so all the mana is now stuck in these markets?

@dp9000 Fantastic point.

I think interest being paid in shares that you can sell would help with this (but not fix it entirely)

@SimonWestlake It should help calibrate the amount you put in on long term markets to be relative to how important you think they are and how many other traders you will have as counterparties to sell your appreciated shares, I think?

@Eliza So now, instead of betting on things I find interesting, I bet to minimize loan fees? That doesn't seem like it will incentivize market accuracy

@ChurlishGambit I was speaking about Simon's suggestion of paying interest in shares rather than mana, which makes a lot more sense than the post here.

Thinking about this further, the interest on loans makes sense for an entirely different loan system. If I were able to take out a large loan for a week when I had a short term market to use the mana on, and then pay back the loan at the end of the week, then paying a small 0.3% fee is totally reasonable.

But with how loans work, you only receive the loaned amount over time - over several months - and you can’t pay it back until the market resolves or you sell your shares. That system only makes sense if you gradually take out your entire net worth as a loan and use it as balance whenever you happen to need mana. It’s an entirely different model, and this model is broken with the new fees because you’re paying an 18% fee on your entire net worth.

Looking concretely at my account, if I have to start paying loan fees, I’m going to pay more in fees than I made in profit over the last year!

In conclusion, the loan fees make sense for an entirely different type of loan. If we switch to that different model, then it’s fine, but until then the system just isn’t usable for me.

@Gabrielle Exactly the same conclusion I have. Needs a different model, not just a different pricing structure.

@Gabrielle Another very well-put explanation of where (at least) several of us have landed. It's cool seeing how different people have described the exact same core concept very differently

The interest is a good change. I am in the process of finding a bunch of EOY markets near 0%/100% and betting a lot to earn something rather than nothing.

For loan rates, maybe it would make some sense if they were 5% a year, matching the interest rate? So if you have too much mana, you avoid taking loans and earn the interest. If you don't have enough, you avoid the interest and take the loans

@brod when you collect your loan, it’s nothing to your balance. When others do it, it has a much bigger impact. If you have 0 and collect a 1k loan, that enables you to bet. If you have 1.2m and collect 5k, of course it doesn’t matter to you

@Jack1 5% loan rate + 5% interest = effective 0% loan rate, as before. BUT, if you choose not to take loans (if you don't have close to 100% of your balance invested, see like everyone in the top 20 traders), you are incentivised to do something with it. Push the 'Did Bill Clinton have sex with Trump' market to 0%, for example

@brod I think we need a market on how far Active User Balances will shrink in 30 days from today:

Can it fall under 100? 90?

@brod It seems like this new loan system is actually incentivizing you towards weird/undesirable behaviour. You're not improving the accuracy of long term markets or having fun, you're wasting your time looking for sure bets that nonetheless pay out 5%, and tying up your cash that might actually be used for bets you genuinely wanted to make in the future.

@xjp Yes, ironically, they've managed to financialize prediction markets, further reducing their already-questionable utility

@xjp without interest i avoided taking long term bets precisely because I didn't want to tie up cash for bets I wanted to make in future that would have a greater annualiesd EV. now, waiting for these hypothetical bets to show up is more costly, I'm foregoing interest. so there is greater incentive to take +EV bets even if it ties up mana for a long time

there's no 'weird' behaviour it's incentivising (in the sense of incentivising taking -EV bets). whichever side of the market has higher EV, you earn interest either way

@xjp and if you're betting on a sure things (or close to it) then you are improving the market's accuracy!

@brod You mentioned markets near 0%/100%, which is near zero EV. Basically you're incentivized to bet a million mana right now that the sun will rise in 2027 rather than waiting for actually +EV bets. And you can't bet beyond 1%/99% so you aren't improving accuracy in that case.

@xjp if you expect to find markets with more than a 5% annualised edge in the next year you are emphatically NOT incentivised to pump your entire balance on the sun rising, bc you forego those opportunities (or, have to pay 20% loan rate to take them). but i dont expect to find enough of those opportunities to be liquidity constrained. there are plenty of markets expiring in like 2028+, that have no shot at happening, which trade at above 2%+ precisely bc nobody wants to bear the opportunity cost of pushing them to 1%. that opportunity cost is now lowered, because you are paid for it

I think people are mostly fired up about the disconnect between 5% annual interest on positions vs 20% annual interest on loans.

If loans NEED to have interest, they should be <6% annually IMO, i.e. in the ballpark of interest paid on positions or just slightly over 5% to act as some small penalty for leverage without profits.

Also, I support whoever suggested paying the same 5% interest on mana balances to cut down on frivolous markets that @SG acknowledges people would create to get the interest.

@Hakari I think it's reasonable for loans to have a higher interest rate (though maybe not this high), but only if loans can be received as larger lump sums, instead of having to slowly accumulate them over time (paying interest the whole way)

@SimonWestlake yeah if we're being somewhat analogous to the real world, bank loans are usually just 1-2% over the current risk-free rate. I would expect +15% over the Fed rate from shady moneylenders and payday loan apps.

@Hakari True, this makes loans only useful for very short-term purchases (or at least it would if we could collect a loan all at once)

@Hakari the 15 or 20% apr (depending how you calculate it) seems fine to me; the structure seems wrong, and getting rid of the free loans seems wrong. High APR makes sense because the loan is poorly collateralized and not risk managed well, and manifold has little recourse for non payment. It's more like a credit card in that way, and rates are in line.

@EvanDaniel Not all bets are like credit cards though. So if you are betting on something at 20% or a 97% yes /3% no close to sure thing you pay the same. So if you want to bet no on Jesus Christ returning before 2030 Don’t waste your time if you rely on loans. So Long term accuracy isn’t improving

@EvanDaniel I don't think the poorly collateralized argument holds up since we're not talking about real assets.

Rates here are a driver of behavior. For credit cards that behavior is "pay back cc balances in full at the end of every month otherwise you may be headed towards a debt spiral". Manifold doesn't have a regular payment cycle like credit cards, so I have to wonder what behavior the high APR is encouraging - apart from "don't take loans".

As for recourse for non-payment, the current system of slow loan accumulation works pretty well in minimizing/capping large defaults. You get bigger loans if and only if you're a consistently profitable player.

@ChurlishGambit I don’t think it’s sinister, I think he feels he didn’t do enough work today, so he makes something up in 5 minutes without thinking it through so he feels he did something at work today

@ChurlishGambit No. This is how Manifold actually works. They just haven't done anything in the last year. It used to be a weekly thing. Announce crazy changes at a random time and 🍿 the fallout.

@ChurlishGambit he definitely didn’t think through the fact that some people take a while to resolve markets, so you’ll be paying interest on loans for markets that should have resolved already

@Eliza "he direct inspiration for writing up this piece comes from an interview with Dominic Cummings on Dwarkesh's podcast..."

Governed by Dwarkesh listeners. This site suddenly makes so much more sense

I’ve played a few different sites/games in my life. Only two of them I haven’t spent money on. What the two have in common, only thing for purchase is the currency and the people that run the site/game are out of touch and have no idea

I suspect for a large number of people, they're better modeled as having an amount they're willing to spend on Manifold, rather than an amount of betting they want to do and a flexible pocket book. So if you decrease the leverage ratio -- the money velocity -- people just trade less, rather than buying more mana.

I hope you've done a lot more looking at relevant data and modeling of this question than I have. (I've done none, I'm working on intuition.) I hope it supports your decision here, and not my intuition. But I suspect that neither of those things is true.

@EvanDaniel modelling? These aren’t thought through. Like when you pointed out a balance cap on loans would ruin limit orders. It’s made up quickly.

This policy doesn’t make sense. He hasn’t announced anything to make resolutions quicker. People will be paying loans on markets that should have resolved earlier.

My thoughts, as someone who typically has too much spare mana at any given time:

- Loan fees are unattractive so I will never deliberately use loans

- Interest is... interesting. It means having mana sitting in my balance is not accumulating interest. So I am motivated to find long-term coinflip markets or similar, with good liquidity, that I can use like a bank account to deposit and withdraw from, earning interest on my "savings". Why not cut out the middleman and give me interest on my balance? But then if everything earns interest, what's the point? It's just inflating mana for no reason.

@retr0id If everything earns interest, Mana keeps up its value relative to the dollar in a useful way, which helps long term market forecasting if you care about the dollar peg at all.

@SG can you confirm whether you get interest on selling before resolution? Otherwise, no, not really...

@SG I don't see how it encourages trading in long term markets. it only discourages having unused mana. the path of least resistance is for me to "invest" in long-term coinflip markets rather than something actually predictive.

@EvanDaniel the dollar peg is interesting and I hadn't really considered that. Maybe it should be explicitly linked to the USD inflation rate?

For whatever it’s worth, I will no longer be using the loan feature while this is in place. I have large positions on markets that will not resolve for several years, with expected rate of return much lower than the ~20% per year that the fees here demand.

I just hope that I don’t accidentally forget and click the button once, and then start having to pay tens of thousands of mana per year extra. I’d rather just pay the loans back.

Separately, I expect this to decrease accuracy of long term markets. The reason that the previous loans helped them (and one of the biggest advantages of Manifold over real money sites) is that you can invest in long term markets even if the expected rate of return is only one or two percent per year. With this new system, you should never invest in a market resolving more than five years away, and less than that you need a ~20% gain for every year in the future. For a market on who wins the presidency in 2028, I would need a nearly 60% margin, which is basically impossible.

@Gabrielle long term markets are better than ever to invest in with 5% interest. in the past, loans equaled long term betting, but this is not true any more

@SG Let’s say that I think Gavin Newsom is 25% likely to win the presidency in 2028, and the market is 20%. I can make a 25% return on my investment, great! I invest 1000 mana, and expect to receive 1250 mana on average when the markt resolves in three years. And just from holding the shares, I’ll get an extra 187 mana as interest, cool.

Now I use the loan feature. I get loaned back all my mana, also great! However, when the market resolves, I get charged a fee of 912 mana. This means that the expected value of my position is 1250+187-912=525 mana. So I invested 1000 mana and my expected value after 3 years was 525! I lost mana in expectation even though I correctly had a large edge.

@Gabrielle Did you really need a loan for that entire duration though? What if you paid back your loan much sooner than that. (I think it would be helpful to your situation if you could pay back a loan sooner.)

@Eliza If you routinely use loans for short-term stuff you can profit on, it probably means that the long-term stuff that you wouldn't use a loan for has too much opportunity cost.

@EvanDaniel What is the actual P2P loan rate on Manifold these days? Sometimes it has been more like 20% per month.

@ChurlishGambit That is announced as a likely new feature, see this post:

https://manifold.markets/post/interest-of-5-on-all-positions-loan#cRR52hgI

@Eliza If I were able to pay back the loan early, like if I were able to only take out the loan for the length of a week while I’m in a mana crunch, that would be great. If that’s the next implementation of this feature (and it somehow doesn’t affect existing loans, of which I have a lot), that’s totally fine. But as it is today, the loan button is strictly a trap if you have any positions on markets that expire more than a year out or so.

@Eliza They add & take away features on a whim, I can't trust they'll ever do it. Who knows if this feature will even be here in 24 hours? I'm not touching the loan button ever again

@Eliza Yes! Right now I have some liquidity because a bunch of end-of-year resolutions, but more often than not, I would take a loan in the morning and have it all invested by the evening... For me, ability to pay off would not help - most my net worth is permanently locked into long-term positions... Once any resolve, it typically all goes back in fairly quickly...

@Gabrielle Let’s say that U think Gavin Newsom is likely to win the presidency in 2028, and the market is 20%. U can make a 500% return on ur investment, great!

U invest 1000 mana, and expect to receive 5000 mana when the markt resolves in three years. And just from holding the shares, U’ll get an extra 4000 mana plus 5% per year as interest, cool.

Now U use the loan feature. U get loaned back all ur mana, also great! However, when the market resolves, U get charged a fee of 912 mana and intrest of 600 MANA. This means that the expected value of ur position is 5000+600-912~~4700 mana. So U invested 1000 mana and ur expected value after 3 years is 4700! U won mana in expectation

@Gabrielle long term markets are better than ever to invest in with 5% interest. in the past, loans equaled long term betting, but this is not true any more

@SG you are completely missing the point. Yes, on day 1, I may invest my money into a mispriced 1-year market. But guess what, now on days 2 through 364 markets stay mispriced because I have nothing left to invest (and using loans for long-term investment is now a suicide). But realistically, now the Day 1 market stays mispriced as I am holding off for a more mispriced one...

@SG As mentioned by others earlier I would prefer if there was a way to toggle/disable this button from appearing on UI altogether so I don't accidentally click.

I would like the option to take out margin loans at 20%(ish) APR, on my own terms and my own time frame, and pay them back when I choose. That sounds valuable! But if I'm taking them out, I want to take them out when I have a bet to make, in the desired size, not daily in case I might need them tomorrow or only one day's size when I do want them.

This is a good capability, and I'm glad to see it. But I don't like it replacing the daily loan mechanism, for a variety of reasons that I've tried to spell out in recent forum posts.

Hopefully I've made it clear why I think my recommendations aren't merely selfish or good for traders at the expense of Manifold's long term health, but rather can be beneficial to Manifold as well.

@EvanDaniel This is really well put. The direction is fine, but only if we're given much more direct control over taking out and paying back loans.

It's still possible the changes would overall harm long-term markets because of reduced liquidity, but that may be a reasonable tradeoff.

@SG That's a good start. Everyone should pay back their loan balance ASAP if they have any intention of participating in the loan system going forward.

The remaining problem is that then when you want a loan, you're constrained to a tiny one, because it no longer makes sense to slowly grow your loan balance over time.

@SG You could also improve things by only charging interest on margin in use, which is fairly normal. So loan amount - cash balance. Then there isn't an urgent need to pay things back, and it is safe to click the button if you're already paying interest.

@SG what are you doing??? The new loans fee is absolutely ruinous. I am absolutely can never take loans again (as that will trigger the crazy fee on all existing loans). So now I no longer have liquidity, and have to pretty much leave stop betting (can probably bet at about 1/10 of my current volume)??? How is this supposed to make anything better???

@Eliza yeah, but previously I was happy to invest in a market that would return 2%in a year, and now I will likely not be able to afford to go for less that 5-10% profit.

@SG you need to add instant resolution or Fine slow market resolvers. I’m not paying interest on markets because the person isn’t active

A significant percentage of my net worth is tied up in longish-term bets.

If I were to take out a loan under the new system in order to get more leverage for a short-term bet, how can I pay it off without selling my longer-term shares?

If there is not a good answer to this question, I think this change will be counterproductive for long-term markets, regardless of the loan interest rate.

@Quroe woah, this comment section is like longer than like the Bible…

This is actually really good because now we know what our risk free rate is going to be and now we will be able to offer bonds at a bit of a more accurate price and this could base rate the whole P2P system… Not to give too much away :)

@SG I would rather take targeted (size, duration) loans based on my entire portfolio that I can pay back in a separate interface, than the daily loans taken a small bit at a time from each market.

@Eliza Strong agree. I think this change can make sense (maybe even with the high interest rate for loans), but it needs to be presented entirely differently in the UI.

It is going to be extremely funny when @jack clicks the loan button and starts paying 0.05% daily interest on 1.5 million in loans.

@Eliza Am I seeing this right that if he clicks he might get a M600 loan, and start paying interest at M750 a day?

@KarlWang In a vacuum, perhaps. But if you think you have just that much of an edge on a market you find, it could be worth it.

@KarlWang it's also helpful for betting on short term markets.

previously, we were using margin loans to incentive long term trading. now we're incentivizing that directly by paying 5% interest. loans now serve the purpose of letting users increase their leverage

@KarlWang 15% yearly is 1.1% monthly. if you think you have more than 1.1% of edge on a market resolving in a month, and you are capital constrained, it’s still sensible to take loans

@brod I think it makes a lot more sense to have an investment value of 200k, go to an interface requesting a loan of 10k (right now, not taken 5 mana per day), use it for your short term market, and pay it back directly after.

The current drip drip drip version would not do so well here.

@brod I may be missing something mathematical here, but I'm not convinced that's how it works.

Let's imagine that I have my assets on a market that closes in 2030 and I don't have any liquidity. I ask for a loan, invest it in a market that closes the next day, and earn 10%. It seems like a great deal according to your reasoning, 10% versus 0.05%.

But the loan hasn't closed, it doesn't depend on the market that closes one day, but on the one that will close in 2030. 100% interest versus 10% gain.

Then, of course, you can reuse that money, but it becomes “will you be able to earn 1.5% per month for an indefinite period of time, which is impossible to calculate, depending on all my positions, which can close at any time, each with a different loan percentage”?

@Emanuele1000 SG already said he will allow you to pay back the loan early, how does that factor in your analysis?

@Eliza Above all, they must give borrowers the option to repay the loan at any time, otherwise it becomes impossible to calculate whether it is worth taking out a loan, not knowing when it will be repaid.

EDIT: Okay, I just read that there will be the possibility to repay loans. If they completely severed the link between loans and individual markets, it would be even better.

If they don't want to give people the option of borrowing large sums, they could give them the option of accumulating loan days: "I don't see any markets that interest me, so I don't ask for loans. After 30 days, there is a market that interests me, and I am sure I can make a profit, so I ask for a loan worth the sum of the loans I could have requested in the 30 days when I didn't ask for one".

Also because I'm not sure if it's true, but at a glance, unlike real stock markets where it's better to invest everything right away, on Manifold you earn a lot from a few markets, not a little from all of them, so it's much better to keep some liquidity to take advantage of big opportunities (like the one on Trump and Clinton having sex, I earned about 5000M by being able to bet a large amount of liquidity) than investing all your liquidity and then investing 2% of your loans every day on whatever comes your way that day, especially now that you pay 15% interest per year on the second option.

The fact that I now pay 20% on loans seems to me to make it more convenient to bet less and keep some liquidity. The fact that I now pay almost 15% interest per year on loans means that I won't bet on markets that I believe will earn me less than that 15% per year, right?

@Emanuele1000 you always can sell the market with profits and do not wait the resolution. The poll is leading to no - you can cash out

@1bets I'm not sure what you're referring to, but what you say isn't always true. If I'm a large holder, I could greatly devalue my position. Even with the “sex between Trump and Clinton” market, I would lose about 600M, bringing the percentage from 1.5% to 4%, and it's a market that I would say is risk-free and not niche.

@Emanuele1000 agree, I can be mistaken , happens often.

Just place the limit order with profit - people will buy out

@Quroe on net, 15% since loans also earn interest. this is inline with real-money platforms' margin interest rates / perp funding rates.

@SG Bottom line, yes. But, that's a 20% opportunity cost to consider when I need to choose to take that loan or not.

@SG But this isn't like a real-money market, so why do you want this to be in line with that aspect of real-money markets?

@Jack1 Seems like a good deal for anyone who has more mana then they know what to do with, but a bad deal for anyone who was counting on the loans to get their daily liquidity. My loan-getting days are over as long as it's set up this way, and I'm going to be strongly disincentivized from placing long-term bets.

I do like the idea of interest, and appreciate the effort to improve the site. Hopefully I'll be able to afford long-term bets again someday (one way or another).

@Jack1 Is the loan rate still 2%?

So you get a loan of 2 mana on day 1, 1.96 mana on day 2, etc.

Then your loan fee on the first day is 0.05% of 2 mana which is 0.001 mana. Your loan fee on the 2nd day is 0.05% of 3.96 mana which is 0.00198 mana, etc.?

I think it should be around 15 mana then in that case. So you earned 5 mana on interest and paid 15 mana in loan fees?

@Jack1 If you immediately stop taking loans, the interest on positions held will increase your net worth (whereas loans didn't increase your net worth). So it is free money in a way that loans were not.

Unfortunately, losing interest-free loans has a much larger impact on many of us.

@moobunny Good question. Right now, it's implemented in a very simple way where you would earn six months of interest but only when the market resolves, not when you sell.

@SG If you sell at 95% like that and immediately rebuy it and hold until market close, it seems when it resolves YES you’d make six months of interest on 100 mana and six months of interest on 190 mana (your new cost basis), whereas if you held for the full year you’d make a year of interest on 100 mana, losing out on six months interest on the 90 mana. Am I understanding that right?

@moobunny Disclaimer: I didn't look at it yet.

This exact thing you're describing was in Charles Lien's loan disaster document

https://docs.google.com/document/d/1jFSPFjSKfstW7fP-EclxhUkGsvM4n5icQiPbVBofSEU/edit?tab=t.0#heading

The team learned why cost basis resetting was breaking loans and they changed the loan implementation to cause profitable sells to count against the basis.

I'm guessing they would do something similar here?

@Eliza I feel like the conceptually right thing here is for the interest to be paid regularly on and in shares, so if I buy 100 YES shares and hold for one year I have 105 YES shares. If I sell them at 80% then I would get 84 mana with the extra 4 mana representing interest for holding the position for a year.

@SimonWestlake This figure is actually included in something called user_portfolio_history, I'm not supposed to say how to find that info but if you know how to use the browser console on your own user profile you can probably figure it out.

@SG Will the loan button still immediately result in a loan, without any confirmation step? Up to this point, the first thing I would usually do after opening the app is click the loan button, before looking at any notifications. Frankly, that's going to be a hard habit to break.

@SG It will be very important to let users pay back their loans on any market and have a loan overview so they can have much finer control over their loan amounts without needing to sell off stuff.

@SimonWestlake @SG same here, I too used to click the loan button first thing. I'm lucky that today I happened to open Manifold and click on this post half an hour before the loan button resets.

like @Eliza suggested, we need more detailed loan overviews so that I can smoothen out the interest curve based on whatever markets I'm invested in. Perhaps you could display the interest payment curve somewhere on the site so that users are not surprised if they login after a week or a month.

I would also appreciate more granular control of which of my bets the loan is taken from.

For now, I will likely stop taking loans.

@Eliza No, but it would be annoying. I think it's inevitable users will do more stuff like this though.

@Eliza You do, right now. But now that I'm thinking about it more, that seems dumb. I may change it to pay out only winners.

@SG Why not just... pay out interest monthly (or daily, or whatever), on all positions, in the asset held, to all holders (specifically including the AMMs)?

Seems simpler, less weird stuff happens, compounding works correctly, you don't have to worry about who to pay or not pay to. So my count of YES shares slowly grows, and then either pays out or doesn't or I exit it at a profit or loss.

@EvanDaniel The nominal liquidity in each market growing over time is a funny consequence, but it makes sense - it was paid for with past mana that's more valuable than present mana, and it's mana invested for a purpose so it "deserves" to get interest unlike money in your pocket.

@Eliza No, it's not guaranteed. It's currently implemented by calculating the payouts at market resolution using a global variable....

The ManiFed will adjust the rate in response to economic needs lol