At what annualized rate can you earn risk-free mana at? Risk free is defined as anything equally or less risky as the UFO market. For us whales, pretend that liquidity is no issue. Pick the closest number that matches your experience.

People are also trading

I'm still not sure whether I'm supposed to assume loans to exist? With interest-free loans, I'll buy a risk-free Yes-in-a-year to 97%, use the loans to buy another risk-free Yes-in-two-months to 98%, another at 92%, etc. and maybe end up with +40%. This makes me pick up my loans and trade every day. Without loans, I might buy some risk-free Yes-in-a-year at 85%, will be out of Mana soon and trade a lot less.

I put 10% in the poll.

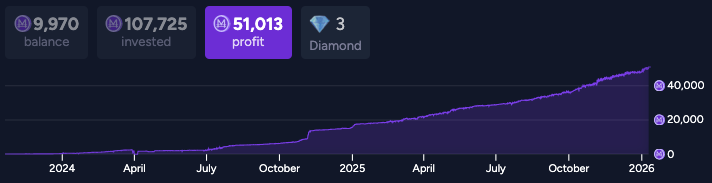

Not going to lie this question is nonsense as worded currently. I’ve gone from 1,000 to 90,000 since basically mid September and the vast majority of that is with minimal to no risk markets. Let’s call that 4 months.

90x times 3 is what, north of 25,000 percent?

And if liquidity is truly not an issue you may as well call the risk free rate a googleplex. If I sat down with my spreadsheet I could absolutely find a risk free ready to be resolved market right now that will return 30% in a max of 30 minutes of searching. If I could truly get more than about 1,000 mana of liquidity on it, yeah we are back to googleplex territory quickly.

https://manifold.markets/nikki/what-is-the-annual-risk-free-rate-o#vq0dnzlab6c googleplex? pfft! rookie numbers

@ChurlishGambit Like if you saw a market that said "resolves NO on Jan 1st 2027" what % would you bid it down to, and assuming you can't sell your shares? (at least this was my interpretation)

@nikki I voted 5% just because I don't think 0% is what was happening even before today. The daily bet bonus and new trader bonuses exist and are inflationary over enough time.

I just don't think it should be 0. I would have voted 1% if that was an option. Haven't really given it much thought tho.

Thank you for pointing out the UFO market, I bought some shares, and would welcome other examples.

I chose 0% in the poll because I don't consider time value at all. I used to when I had less mana. Also, I tend to assume there's a 1-5% chance I've misunderstood the resolution criteria of any particular market, so maybe my idea of risk-free is different from other people's.

@nikki key clarification needed - are you asking what it was before of after the loan fee introduction?

@nikki thanks. I think I was in the 40-60% in nearly-risk-free arbitrage (you can see my chart - 99%of my trades are all arbitrage or 0-risk), but probably with a > UFO risk of black swan resolution surprises, so I voted 40%. I would imagine that I was averaging 2.5-3% edge buying and 0.1% edge selling, mostly on markets that I originally entered fairly far out (but then of course continued to trade till the last day), often years out (right now I am probably the most invested in 2026 and 2028 election results). This type of edge when amplified with interest-free loans and volatility (where I can often profitably liquidate parts of my position) used to result in 40%+ yearly.

the risk free rate of return is a function of effort and liquidity. in the UFO market, you can get ~6% return over 2.5y (for up to ~500k) mana. that's the low effort, low hanging fruit (but note it's only a few percent). if you scan the new queue, you can easily find markets promising enormous returns for a tiny amount of mana. the more you look, the more liquidity you can put down at good rates.

in practice, the risk free rate that matters (i.e., you can scale up easily without working hard) is <5%. if you disagree, please link me to the markets where that isn't true! and if you have to spend hours hunting for opportunities to find the 10%+ rate for 100k mana, that's indistinguishable from "trading edge on manifold" and it's not useful to view that as a risk free rate of return.

For us whales, pretend that liquidity is no issue

I will not do that because it does not make sense. When you find a market resolving tomorrow at 5%, it is not useful to imagine that the risk free rate is thus 20x per day. the risk free rate cannot be divorced from liquidity.

@Ziddletwix The question says what is "your" risk free rate, not "the" risk free rate. So I think you scale it based on your own energy/input/time/work/whatever.

fair. in that case, my 5% vote is too low, but not by that much—i place lots of risk free bets at far higher rates of return, but (1) in terms of volume they're going to be dominated by a few markets where i can bet a ton even for a small return (e.g., UFO, "how we survive AGI", etc), which i placed expecting minimal return due to the daily loan system, & (2) at EOY there are lots of risk free profit opportunities but for it to be meaningful you have to annualize that over the whole year, the fact that i only tuned in to place the bets in december doesn't mean it's my actual rate. (just like if i waited to place all my bets until 1 day before resolution, it wouldn't imply my risk free rate of return was enormous because you have to 365x each bet)

@Ziddletwix I'm going to ask a slightly different question out of curiosity: How about if you think back to your first ~100k of profit before your stack got really big. How much of that was via risk-free (as defined here) opportunities you couldn't ignore vs. just making good bets?

@Eliza honestly, not sure. probably <20%? it was a while ago, so my memory is fuzzy. and it's a bit hard to draw the line. for my early 100k profit, i was extremely active & very mana constrained. so i would constantly sell shares for markets at >95% resolving in more than a month (& near the end of each month i'd sell even more aggressively). so that means i required a very large edge, which ~generally pushed me from many sources of true risk-free returns (which tie up your mana for a while as you wait for resolution). still, there were plenty of risk-free opportunities (newstrading & etc, whether or not i actually held until resolution), and then a lot on a middle ground (e.g., in practice there's not much difference when newstrading "the final box office numbers are out and it's time for resolution" and "early box office numbers are out and now you can be ~99% certain of resolution"). it's also hard to judge because risk-full opportunities might contribute much of the profit but they also are offset by losses that are easy to forget. but my guess is that ~most early profit came from "low-ish risk" opportunities (some news gets released, the market price hasn't updated yet, but it's not ready to resolve, just very out of sync).

@nikki that seems fine. plenty of sports markets or bitcoin up or down markets that are to be resolved but still at 20% / 80% ish, that represent 20% returns in a few seconds. i can do better with "will bitcoin go up or down in the next millisecond" style markets though, where i can do risk free like around 10^5000x per year according to my napkin math, ignoring backend not supporting that large of numbers type issues

500req/min per the api rules. create 100 option multichoice with infinite liquidity at 50% on will bitcoin go up or down in next 150ms. lasts for 10 seconds each. means 10 market creation requests per minute, ~60000/150 ~= 400 bet requests per minute, we're in the clear. each one assume we're first to react, make 2x risk-free. 400 bets per minute, 525600 minutes in a year, ~200 million times 2x per year, that's 2^2milx returns at api rate limit capacity, for one api key