In 2020, the US Federal Communications Commission, which regulates telecommunications in the United States, approved Amazon's plan to launch more than 3,000 satellites into Earth orbit. The project is called Kuiper and aims to provide high-speed internet to the entire world.

According to the company, the plan is to have half of the satellites in space by 2026, while all of them would be in orbit by 2029. By the time of the project's approval, however, Amazon was still to reveal who would be its commercial partner to launch the rockets.

If by December 31, 2023, Amazon does manage to successfully launch the first Kuiper satellite to orbit the Earth, this market will resolve to "yes".

original: https://futuur.com/q/166949/will-the-first-amazon-satellite-of-the-kuiper-project-be-launched-by-the-end-of-2023

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ310 | |

| 2 | Ṁ164 | |

| 3 | Ṁ94 | |

| 4 | Ṁ59 | |

| 5 | Ṁ53 |

People are also trading

@Sailfish I looked at similar data but interpreted it differently. ULA is running ~ 150 successful launches; team experience counts for something, and I think including the Delta numbers in there matters. I suspect the 2007 NROL-30 launch counts as a success by the standards of this market. And I looked for a point estimate, not a lower bound of a confidence interval, so I took the (S + 1) / (S + F + 2) approach. I think a fair price for this market is a bit over 99%.

Kelly says I should bet a little over half of my capital on such a bet (99.3% success rate at 98.4% offered price). I'm betting... less than that.

@EvanDaniel Oh I definitely think a fair price is higher than that, I don't necessarily think I would just "include" Delta numbers, although ULA is certainly focused on reliability. You should be able to make money in the long run betting against someone selling at around the upper end of a 95% confidence interval (The metric is that there's a 95% chance the underlying true value is lower than 3%). And in fact, I applaud the people who are willing to defend the ragged edge of Manifold's Brier score. I mostly just enjoy mentioning why I make trades because other Manifolders seem to be interested in these sorts of rules of thumb. The other for estimating the mean of a zero numerator statistic is exactly the approach you took, adding one failure and one success (One to the numerator and two to the denominator). This has some fun name but I can never remember what it is. This will give you a fair price at 99% if you count only Atlas V, which could move to a higher price if you account for other data or have an inside view.

Broadly, I just liked this market more at 65% than 98% and I think it's interesting to mention my motivation for making trades, in this case not because I think the probability is wrong but because it's was a disproportionate amount of my portfolio relative to its likelihood.

@Sailfish I basically view including the Delta successes as an "inside view" approach that says I think ULA does a good job at reliability. It's a little tricky, because the variants of Atlas have meaningful differences, so you could make a case for excluding some of them.

The rule goes by a bunch of names, but it's Laplace's Rule of Succession. The special case is the Sunrise Problem, and both can be derived as Bayesian results from an ignorance prior (in this case, the uniform prior).

@EvanDaniel Yeah, I can definitely see having a good non-Atlas track record being important. Hypothetically if Vulcan is at 10 flights and 10 successes you might be willing to bet that Vulcan's true failure rate is much lower than a naive estimate would suggest.

@Sailfish Well, in that case I'd be pretty strongly revising my opinions of ULA ;) But yes, a troubled rocket from a good team seems more promising than from an inexperienced team. Exactly how to balance that and how strong an impact it should have isn't something I tried to evaluate in detail. I'll just watch the launch...

My baseline estimates are well above the 75% here: /Sailfish/will-united-launch-alliances-vulcan , going up rapidly for launches after the first. Getting to 10 successes and 10 failures would be a very large update for me, and I hesitate to make predictions in that context without understanding the other things that happened in that scenario. For example, I'd somewhat expect ULA to go bankrupt or something along the way!

@EvanDaniel I meant ten successes out of ten attempts, or ten total flights, so another zero numerator failure rate. I think in that context it would make sense to bet that ULA has another sub-1% failure rate rocket and not bet the failure rate to 8% or whatever a naive point estimate would give.

@Sailfish Oh! Oops, misread that.

Yes, if Vulcan is sitting at 10 out of 10, and I haven't seen other changes / major new info about ULA, I'll be betting those launch success numbers up to more like 98%+ than 92%.

Planned launch date Sept. 26, 2023, according to this article. Although delays are probably to be expected.

@js I don't think this market has moved nearly enough on this, the test flight got moved from an experimental rocket in Nov. / Dec. (realistically January), to a proven launch vehicle in less than a month. This is gonna happen.

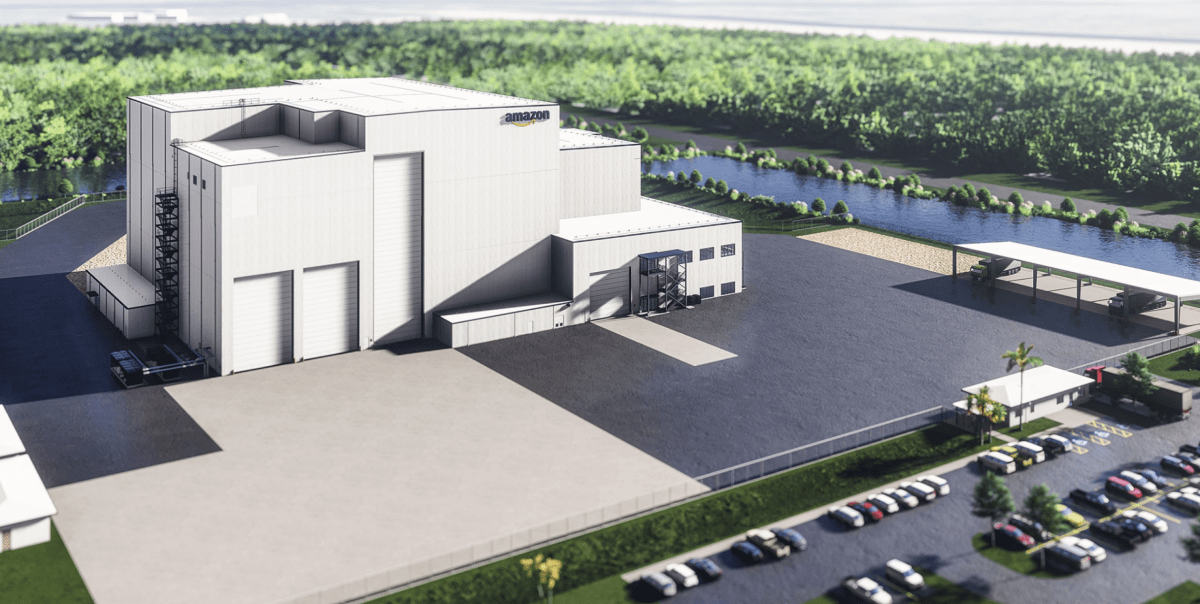

"Amazon will spend $120 million on a new satellite processing facility at NASA’s Kennedy Space Center (KSC), as the company gears up to launch the first batch of Project Kuiper prototype satellites in 2024." https://techcrunch.com/2023/07/21/amazon-is-building-a-120m-facility-in-florida-for-project-kuiper-satellite-processing/

@na_pewno Oops, I suppose this will count: "Two prototype satellites will be launched in the coming months to test the network and subsystems while production launches are expected to start in 2024." Amazon constructing new Florida satellite-processing facility - UPI.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NOUV44KPN5JF5O3JYK6NYRMWH4.jpg)