This market will resolve to the highest 50% time horizon, as reported by METR as of April 30, 2026, for any AI model released by February 28, 2026.

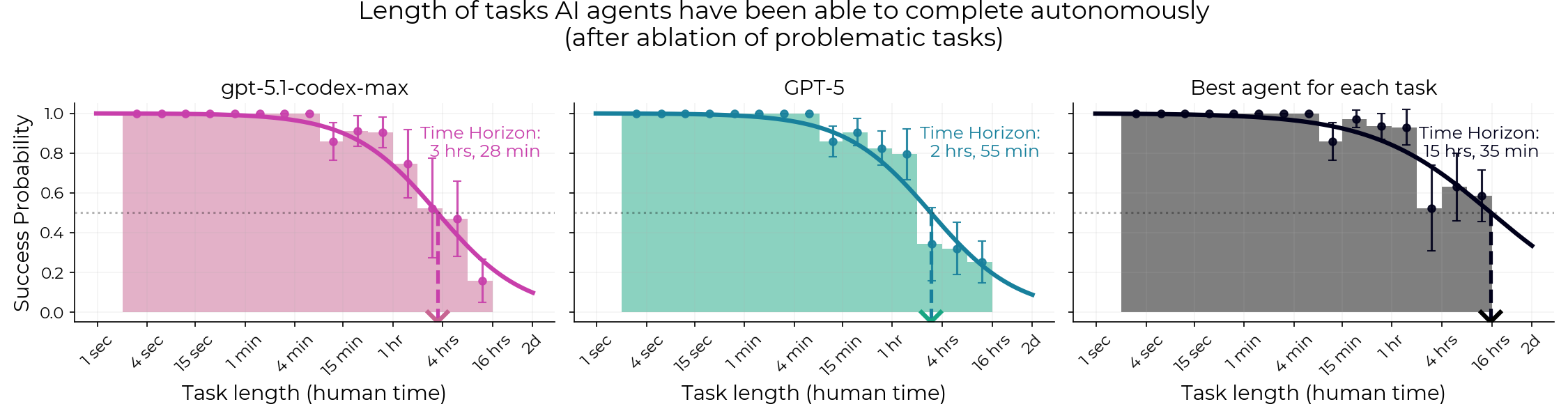

50% time horizon is a measure of AI autonomy based on the length of tasks that AI can do: roughly, it is the time that humans take to complete tasks that an AI system can successfully do 50% of the time. See METR's "Measuring AI Ability to Complete Long Tasks" for the technical definition. Claude 3.7 Sonnet, released in February 2025, was the leading model with a 50% horizon of 59 minutes.

Left bounds inclusive, right bounds exclusive.

Time horizon could vary based on the set of tasks used to measure it, so this market will be based on the time horizon for the most comprehensive set of tasks reported by METR (as of 2025, largely software and engineering tasks). This will be ambiguous if METR stops publishing time horizons across all of their autonomy tasks and only publishes separate results for different subsets; I might N/A in that scenario.

People are also trading

@JoshYou Does 4 to 6 hours mean that the answer will resolve yes if an AI model has a time horizon length of 6 hours or will it only resolve yes if the model has a time horizon length that is less than 6 hours but 4 hours or more?

Left bounds inclusive, right bounds exclusive.

This means 4 to 6 hours resolves yes for exactly 4 hours but no for exactly 6 hours

The members of the AI futures project have given an update and they appear to now be relying on the 80% time horizon length graph from METR for their predictions rather than the 50% time horizon length graph. This implies that a 50% time horizon is not enough. While I think markets for 50% time horizons are useful, I now think that more attention needs to be paid to 80% time horizon lengths. I am planning to create markets for 80% time horizons either tonight or some other time this week unless someone beats me to it.

@MaxLennartson Here is my source: https://www.aifuturesmodel.com/#section-timehorizonandtheautomatedcodermilestone. Sorry for not posting this earlier.

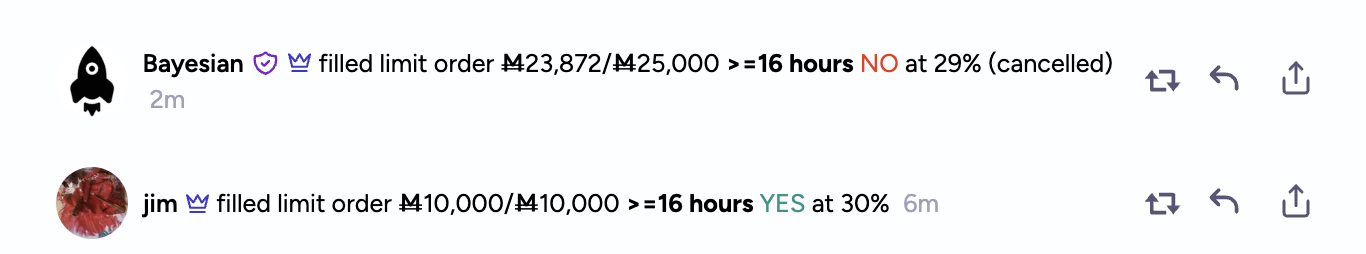

jim order up for the ">=16 hours" option

@jacksonpolack , @Bayesian , @SemioticRivalry , @Velaris , @khang2009 , @Gen , @skibidist , @evan , @brod , @100Anonymous , @Ziddletwix ,, @Trazyn , @bagelfan , @geuber , @nikki , @ProjectVictory , @sahaj , @bohaska , @Odoacre

jim orders are large limit orders, generally at better than market prices.

Opt in / opt out thread: https://manifold.markets/post/jim-order-notification-optin-thread

@JoshYou 6-8 hours is the obvious bet to make based on current trends. I have a couple contrarian jim orders up for longer horizons