Will Trump win the 2025 Nobel Peace Prize iff there is a ceasefire before 2026?

Resolves Yes if there is a ceasefire and he wins the prize, or if there isn't and he doesn't. There does not have to be any stated connection between the events.

Resolves exactly according to these underlying markets:

/Mediapunk/will-donald-trump-win-the-nobel-pea

/WalterMartin/will-there-be-a-bilateral-ceasefire-5z0zRtdl5P

Update 2025-10-11 (PST) (AI summary of creator comment): The market resolves YES if both underlying markets resolve the same way (both YES or both NO). It resolves NO if the underlying markets resolve differently (one YES and one NO).

Update 2025-10-11 (PST) (AI summary of creator comment): The market will NOT resolve N/A. It uses logical IFF (if and only if), meaning it resolves YES if both underlying markets resolve the same way (both YES or both NO), and resolves NO if they resolve differently (one YES, one NO).

Since the Nobel market has resolved No, this market will now resolve opposite to the ceasefire market.

People are also trading

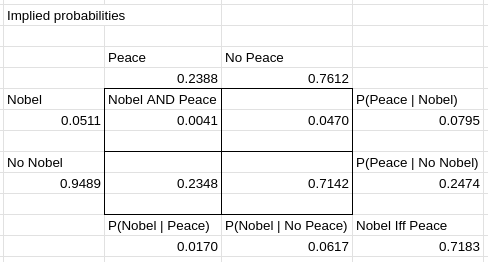

Spreadsheet is now updated, you can view some calculations here:

https://docs.google.com/spreadsheets/d/1_AnZwqGO8MsWs4ycTZEim41uuaiiWnVmHrMmPjdrzEY/edit?usp=sharing

This shows the correct price for this market assuming no correlation, alongside the min and max possible values from the underlying prices. (Those min/max values are what my bot is trading.)

I also added calculations for the implied probabilities for A AND B, A|B, etc.

Note that it doesn't refresh on its own. It refreshed when one of the cell values changes. You may want to make your own copy of the sheet, change a value, and change it back if you need to get it to refresh.

@strutheo No. It's about logical IFF, not an n/a style conditional.

Given that the Nobel market resolved No, this will now resolve opposite the ceasefire market. This market asks whether the two underlying markets resolve the same way. "A iff B" is the same as "A == B".

@strutheo And I wish we could do away with markets that unwind trades entirely; there are better constructions. But since we don't have good UI for the better math constructions, I'm trying various ways to use the UI we do have.

Did you read the linked Wiki page and its truth table? That's how this market works.

will trump win the prize if and only iff there is a ceasefire in ukraine

there isnt a ceasefire in ukraine

so he wont win the prize?

edit - oh i see, yeah thts confusing imo

@strutheo Correct, if there's a ceasefire this resolves no -- that would falsify the double implication.

@ProjectVictory Oh, I'm extremely aware, and have a long series of markets and comments about the problem :)

Here, I was curious whether a market trading not especially near 0% or 100% might exhibit the same problem, and whether posting math and tools about it would help. I was also curious whether having an arb bot occasionally trading would help. I assume it did a tiny bit based on trade volume and such, but I'm guessing it mattered more that people had time to look at math and place relevant limit orders. I'm guessing the big holders on this market know what they're doing. I saw several limit orders that looked like they might be arb attempts, given they were outside the arb limits by a fair bit.

Spreadsheet is now updated, you can view some calculations here:

https://docs.google.com/spreadsheets/d/1_AnZwqGO8MsWs4ycTZEim41uuaiiWnVmHrMmPjdrzEY/edit?usp=sharing

This shows the correct price for this market assuming no correlation, alongside the min and max possible values from the underlying prices. (Those min/max values are what my bot is trading.)

I also added calculations for the implied probabilities for A AND B, A|B, etc.

Note that it doesn't refresh on its own. It refreshed when one of the cell values changes. You may want to make your own copy of the sheet, change a value, and change it back if you need to get it to refresh.

@creator This market can never be accurate or well-calibrated because most people would bet on "no ceasefire and no prize" but people are scared to bet on "ceasefire and prize"

@realDonaldTrump in that case, if the market is predictably and reliably mispriced, I suggest taking their money :)

And trying to find more ways to create popular and predictably mispriced markets.

it's interesting to think through the dynamics of this market — to me it seems more helpful to only ask "if there is a ceasefire, will he win the prize?" @EvanDaniel why did it seem helpful to also add "if there isn't and he doesn't" — what are you trying to gauge here?

@paw either version, along with "a and b" or "a or b", technically fills in the remaining degree of freedom in the existing markets. You can compute whichever implied probability you want.

I think markets that resolve n/a are, in general, bad design when there are alternatives; they remove the ability to make profit from predicting movements instead of results, and are generally difficult to hedge, so I don't like that answer. You would probably also want two conditional markets if going that route.