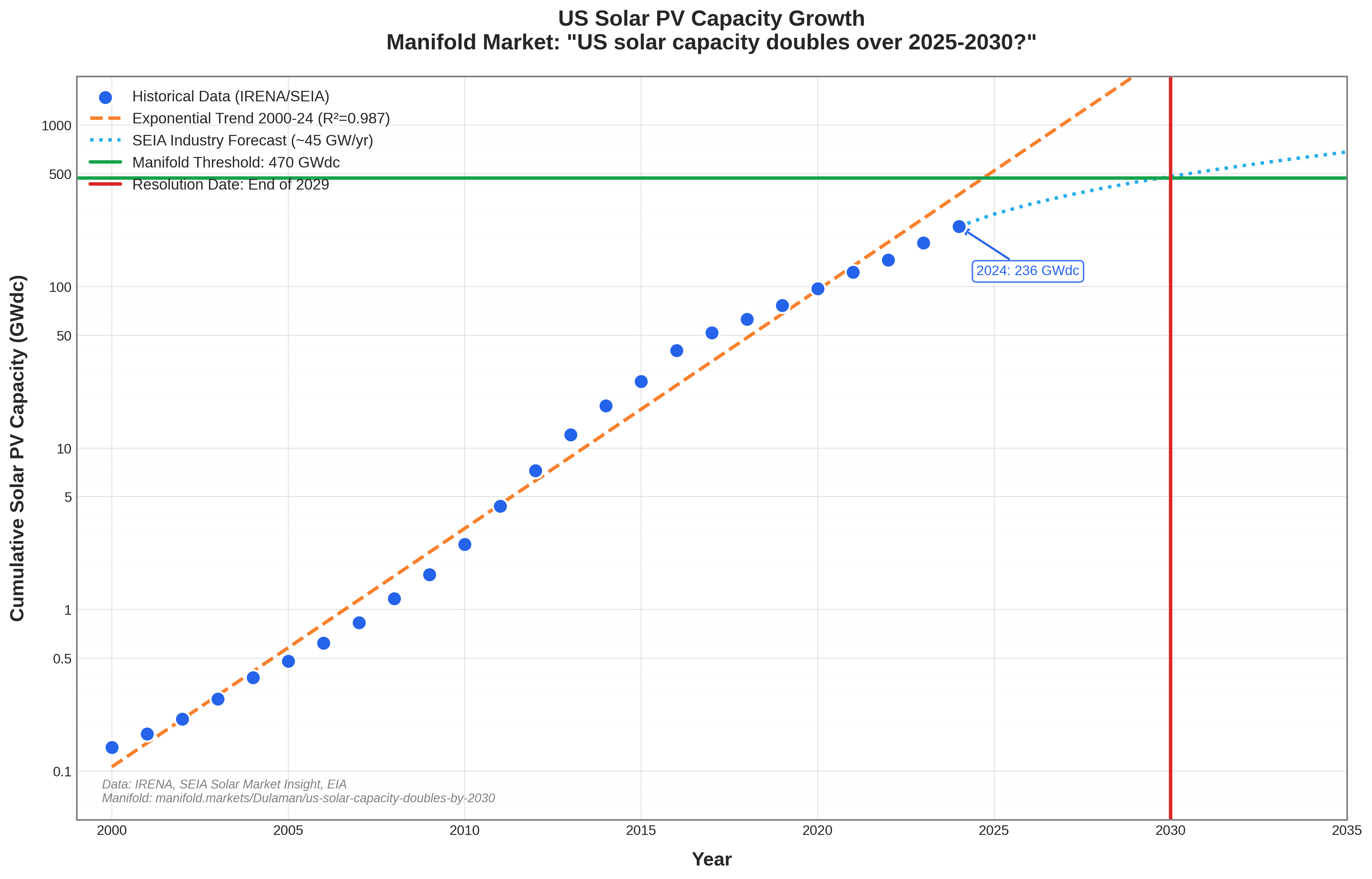

Resolves as YES if there is strong evidence that cumulative installed U.S. solar PV capacity reached at least 470 GWdc before January 1st 2030.

For the purposes of this market:

“Cumulative installed U.S. solar PV capacity” means the total nameplate direct‑current (DC) capacity of all grid‑connected solar photovoltaic systems in the United States (utility‑scale, community, commercial, and residential), as of the end of calendar year 2029.

The primary reference for resolution should be the cumulative capacity figures in SEIA/Wood Mackenzie’s “US Solar Market Insight” (YIR or Q4 report).

If that report clearly states that year‑end 2029 U.S. solar capacity was ≥ 470 GWdc, the market resolves YES.

If it clearly states it was < 470 GWdc, the market resolves NO.

If that exact report is unavailable or ambiguous, the resolver should use the best available national‑level data series for cumulative U.S. solar PV capacity (e.g. EIA, IEA, or other reputable statistical compilations), preferring:

Data that explicitly reports GWdc;

If only GWac is reported, a clearly documented DC‑equivalent figure or DC/AC conversion used by that source.

Clarifications and edge cases:

Timing: The condition is about capacity in service as of the end of 2029 (i.e., systems that have reached commercial operation and are counted as installed by then), even if the confirming report is only published in 2030 or later.

Geography: “United States” includes the 50 U.S. states plus the District of Columbia. U.S. territories may be included or excluded as long as the chosen national data series is used consistently across years (i.e., the resolver doesn’t mix incompatible series).

Technology scope: Only solar PV counts. Concentrating solar power (CSP) is excluded unless the main data source explicitly bundles CSP into its “solar PV” capacity figure and does not separate it out (in which case the bundled number may be used as‑is).

Revisions: If multiple reputable sources disagree slightly, or figures are revised later, the resolver should use the most recent, methodologically consistent estimate for year‑end 2029 capacity available at the time of resolution, and explain the choice in a comment.

Intuition / scale (not part of resolution):

470 GWdc is roughly a doubling of the ~236 GWdc installed at the end of 2024.

Using typical land‑use estimates for utility‑scale PV, this corresponds to roughly 10,000 km²–13,000 km² of panels if it were all built as ground‑mounted solar farms—though in reality, a significant share will be on rooftops, parking lots, and other already‑developed spaces.

People are also trading

On one hand, it's a mature tech with modest upfront costs and low operating costs. Data centers and EVs both bring load growth, so there are reaaons for building new projects that don't focus on retiring more expensive and/or polluting assets early.

On the other hand, western states (who have the most suitable climates) have already built out a lot. If more is built in California, it pretty much must be paired with storage to avoid frequent curtailment.

And there are Trump's policies to contend with.

I think utilities will keep choosing solar, but not at a rate that will cause a doubling. I think the policy issues will be central to utilities' decisions, and smaller scale residential or C&I projects won't be sufficient.

@DanHomerick I have a feeling that satellite images of nevada will look kinda different 10 years from now. But 2025-2030, hard to tell