Shaan Puri made some 2023 predictions. https://twitter.com/ShaanVP/status/1605277930749579264

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ3,970 | |

| 2 | Ṁ1,335 | |

| 3 | Ṁ1,176 | |

| 4 | Ṁ1,043 | |

| 5 | Ṁ911 |

People are also trading

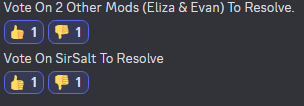

@traders Please come vote who should resolve this:

https://discord.com/channels/915138780216823849/1192144618268147804

@MichaelSmith1e9f Feel free to join the discussion in Discord. I understand what you are saying, I am not able to make the final decision at this point in time.

@traders You can join the Discord discussion here https://discord.com/channels/915138780216823849/938171760237477998/1192144618268147804

Or click here to join discord, it will be in "Market Discussion"

@EvanDaniel or @Eliza if you want to chime in on Discord, please do.

@TP8ac2 So are you completely ignoring the fact that there is a $100B proposed valuation on the table by the same investor of the $27-$29BB from Thrive Capital?

Why would an older offer for $86B still be on the table if they have an offer for $100B?

Neither of which has been closed on or filed.

@SirCryptomind The expected $100 billion valuation for the new funding round being negotiated so soon after the previous tender offer further supports the $86 billion valuation having been officially accepted by the market and doesn’t detract from it.

@SirCryptomind My understanding is that the $100 billion round is for the company (same as with the tender offer) while the new venture raise is another, separate funding round.

⚠Inactive Creator

📢 ̶R̶e̶s̶o̶l̶v̶e̶d̶ ̶t̶o̶ ̶N̶O̶ UNRESOLVED

Proof Posted In Comments By Simran and Myself.

I feel like this was something worth discussing with other mods, given it was a debated resolution with no consensus? And the debate was more about how to interpret the words in the description than about any facts. Not a big issue thouh

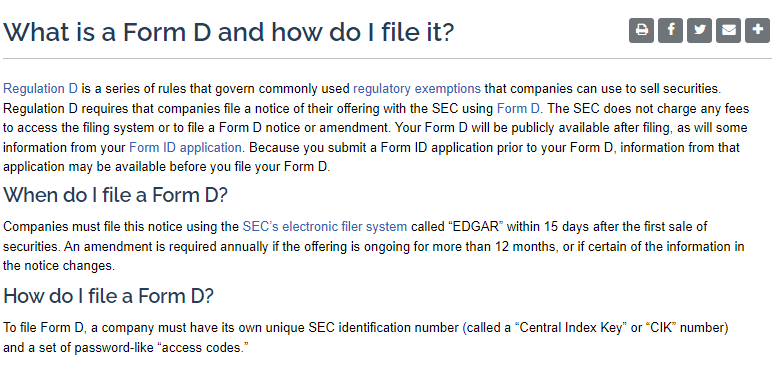

@jacksonpolack I researched this for 40+ minutes last night and 20 minutes this morning. They have not raised any new funding at any valuation other than the $27-$29B range.

Everything else being reported is just "potential deals", they have not filed any reports required legally stating any rounds of funding have been closed.

If you would like to have another mod look it over, feel free to post in Discord. You know I am fine with pushback and can admit mistakes. I think this one is very firm NO though.

I believe the debate is if the ongoing tender offer above 75B counts as being 'valued', so whether it needs to close to count for this market, as opposed to whether or not it closed. I can understand the claim that this doesn't count, but can also understand the claim that it does - if Shaan was grading his predictions, he'd probably say he was right, because he correctly guessed the valuation, and wasn't thinking about the timing!

(I have resolved only 0.0013% of all markets I have resolved in my history on manifold incorrectly)

This would require you to have resolved seventy-five thousand markets, lol, you probably mean .13%?

@jacksonpolack To be valued, something had to close to prove that value, do you not agree with that?

(5 out of 3639, I may have more resolutions than that, but that is what I have tracked myself = 0.001374)

I will say though, 3 of them were within the past 3 days (1 per day), but I have resolved 360 markets in that time frame, so still low %. , and I will admit my mistake and apologize, always.

To be valued, something had to close to prove that value, do you not agree with that?

Right, this was one of the positions in the debate. I think it's pretty reasonable, but if you're going to mod-resolve IMO you should try to address the other side's arguments about why the other interpretation is better, rather than just pick one without even stating it and resolve. This might be a good place to get input from a number of mods, too, since peoples' interpretations differ. Again, consider that Shaan would probably grade his prediction YES, he got the number right and the time of close wasn't really the issue. And people are still buying the shares:

Tender offers do not involve the issuance of new equity. Instead, Thrive and other involved investors will buy existing units belonging largely to employees, giving them liquidity. The $86 billion round is three times OpenAI’s previous fundraise in April, which valued the company at around $28 billion.

Another person familiar told CNBC that the round had been extended to January 5.

@SirCryptomind there was lots of discussion a few months ago. feels rough to switch to a super strict legal ruling here when societally the deal is pretty solid. But I can see why at least legalism is defensible. It just makes lots of claims not that meaningful/interesting. OpenAI being very very close to a huge valuation is basically what the original claim was going for. "be valued at" has many meanings, one legal, one human (are there investors willing to pay that much? yes, yes there are)

There is no new news here, there has been no reporting that the terms of the deal are finalized. The employee opt-in date is not the issue here - rather that the deal will not officially close until end January 2024. As of Dec 31, the only status of this deal is “set to close” not “closed”.

If you had no knowledge of the company OpenAI or AI in general - and you asked for the last known valuation of the company on 12/31/23: it was $29B, the round closed in April.

From official databases utilized by investors in PE/VC (my background and training):

Crunchbase Insights: https://www.cbinsights.com/company/openai/financials

Dealroom:

https://app.dealroom.co/companies/openai

Tracxn:

Let’s resolve on facts.

@Samuel

Can you resolve this market?

This is the only one that closed I found:

$27B-29B

This is what I have found as proposals:

$100B Valuation (CNBC)

$80B Valuation (NYT)

This is their private worth tracking: