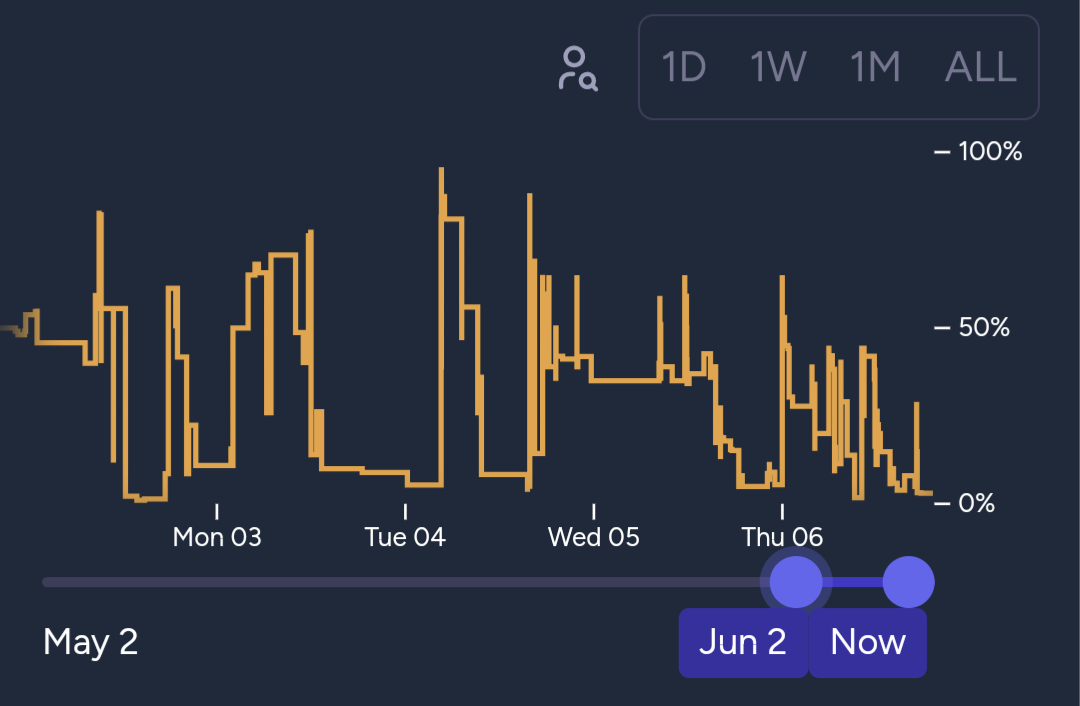

96% -> 0% -> 80% -> 5% -> 95%

If anything as bad happens on a pretty liquid market, where the probability jumps this much from similar extremes over many days, all remaining options resolve YES. If it hasn't happened by an option's date, resolves NO for that option.

If ambiguous, it will resolve according to the judgment of a small group of mods, or similar.

Detailed criteria: (Up to change before the end of march)

- 70%+ swings

- 4+ times

- The swings' high and low points are quantified using the most extreme average over 3 hours. If from 1 to 4 pm it's at 74% on avg, and then from 4 to 8pm it's at 76% on avg, and then it crashes to 1%, it counts as the high being 76%.

- the high and low points of the swings must get 5+ traders to count, non-withstanding obvious market manipulation of this market.

- the market must have a total of 100+ traders at the end of the swings

- the market's swinging option must have at least 1000M in liquidity

People are also trading

Hmmmm intuitively it wouldn't bc it's very low liquidity so a swing costs barely 100M which is worth literally 10 cents so really isn't significant. I don't think it fits with the spirit of this market, though if you disagree I welcome you to explain your reasons ig. if it ends up not counting i would consider adding to the description something about how liquidity has to be somewhat significant, because back in the pre-pivot days any active market got injected automatic subsidy that made all big markets highly subsidized, but now this popular market still has massive swings bc no subsidy gets injected anymore, which I had not planned for

I thought the Rafah market was close, but it's only had three swings in the past week instead of four. https://manifold.markets/ManifoldPolitics/what-will-happen-first-a-ceasefire?r=VGltb3RoeUpvaG5zb241YzE2

@Ziddletwix Right, we need min # of traders too.

@Bayesian pinging you again in case you missed this

so far this is what i got:

70%+ swings 4+ times;

the highs and lows are quantified using the highest average value sustained over 3 hours ig? so like, if the market hangs around 75% on avg for 3hours, that's what counts for the peak of the multi-swing. seems like what i did when eyeballing the values for the altman market

and you need something like 5 traders per high / low for it to count? but also if they're bots or alts to manipulate this market i don't want it to count

any criticism / improvement on the above?