If from now until Inauguration Day we have a financial markets' panic (stock market, bond market, volatility, dollar) going risk-off due to the increasing realization that Trump is the Republican nominee and that the election is a coin-toss, this market resolves to YES.

I'll rely on the financial media calling it that way. In particular, I'll rely on Bloomberg's John Authers newsletter and FT Alphaville, but also the Wall Street Journal, Financial Times, and the Vital Knowledge investment newsletter. A panic will be called if any of these conditions are valid:

The S&P 500 is in a 10% drawdown in less than 45 days

The 2y treasury is a 50bps drawdown in less than 45 days

The 10y treasury is a 75bps drawdown in less than 45 days

The DXY is up 7% in less than 45 days

The VIX Index is above 35

Then having a panic being called, I'll rely on my own judgement as also the wording of the above mentioned financial media participants to determine whether it was triggered by Trump's election.

I won't bet.

EDIT: Actually, I am betting. @Joshua gently agreed to be a 3rd party adjudicator on this market and I'll abide by his call if any controversy arises. What constitutes a panic is well defined, therefore, it's just a matter of presenting evidence that the financial media is attributing it to Donald Trump.

Related markets.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ106 | |

| 2 | Ṁ76 | |

| 3 | Ṁ76 | |

| 4 | Ṁ63 | |

| 5 | Ṁ57 |

People are also trading

I'm betting YES at 9%. Just added this to the description. It's just too cheap and it seems I'm the only one that thinks this is likely to happen.

> EDIT: Actually, I am betting. @Joshua gently agreed to be a 3rd party adjudicator on this market and I'll abide by his call if any controversy arises. What constitutes a panic is well defined, therefore, it's just a matter of presenting evidence that the financial media is attributing it to Donald Trump.

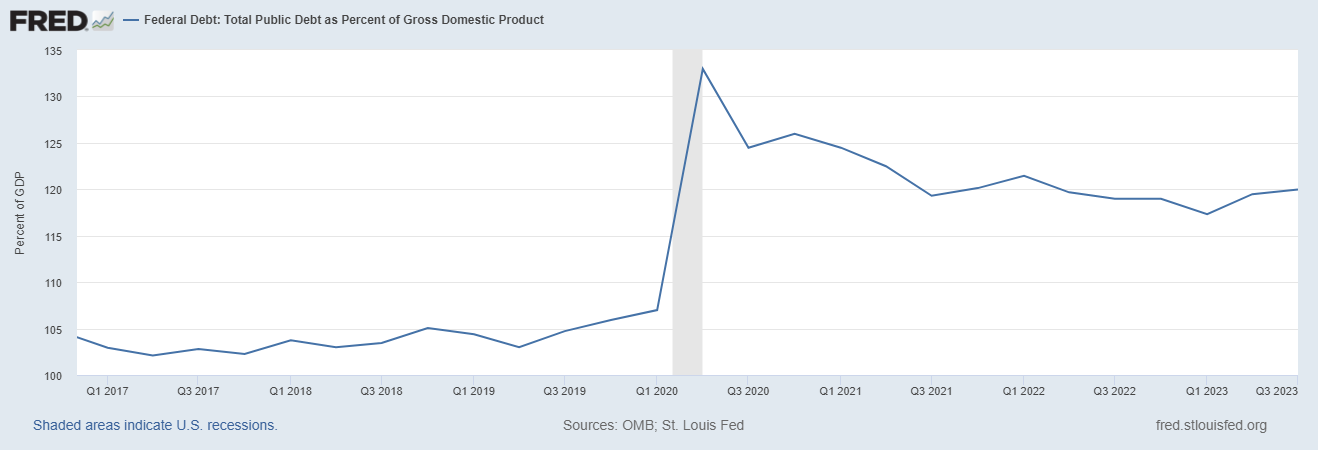

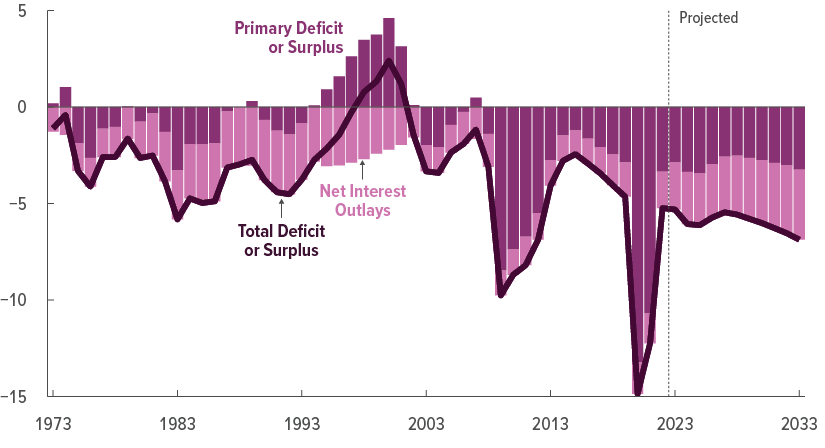

@AaronBreckenridge you could be right, obviously, that's why I created the market. But, two charts for you

1- Federal debt

2- Fiscal defict

The structural fiscal deficit is substantially worse and the federal government is 14pts more indebted today than in the Trump years (and the interest rate on that debt is 5x bigger). The idea of a new round of corporate tax cuts is exactly what could cause a panic

@AaronBreckenridge also, on the SBF book, Michael Lewis tells the story that financial assets used to go risk-off during news that said that Trump would win. People only changed their view after the victory speech

@AaronBreckenridge Lefty media outlets will blame anything on Trump. Might probably blame it on Putin too.

@MP No because he will dismantle the regulatory state. I would expect the exact opposite, the market will explode 30 percent between Election Day and his 100th day in office. I don’t expect there to be violence sparked by Democrats.