All these predictions are taken from Forbes/Rob Toews' "10 AI Predictions For 2026".

For the 2025 predictions you can find them here, and their resolution here.

You can find all the markets under the tag [2026 Forbes AI predictions].

Note that I will resolve to whatever Forbes/Rob Toews say in their resolution article for 2026's predictions, even if I or others disagree with his decision.

I might bet in this market, as I have no power over the resolution.

Description of this prediction from the article:

AI research labs OpenAI and Anthropic are such unique organizations that it can be easy to forget that, ultimately, they are venture-backed businesses. And not just any venture-backed businesses — they are the fastest-growing and most capital-hungry venture-backed businesses in history.

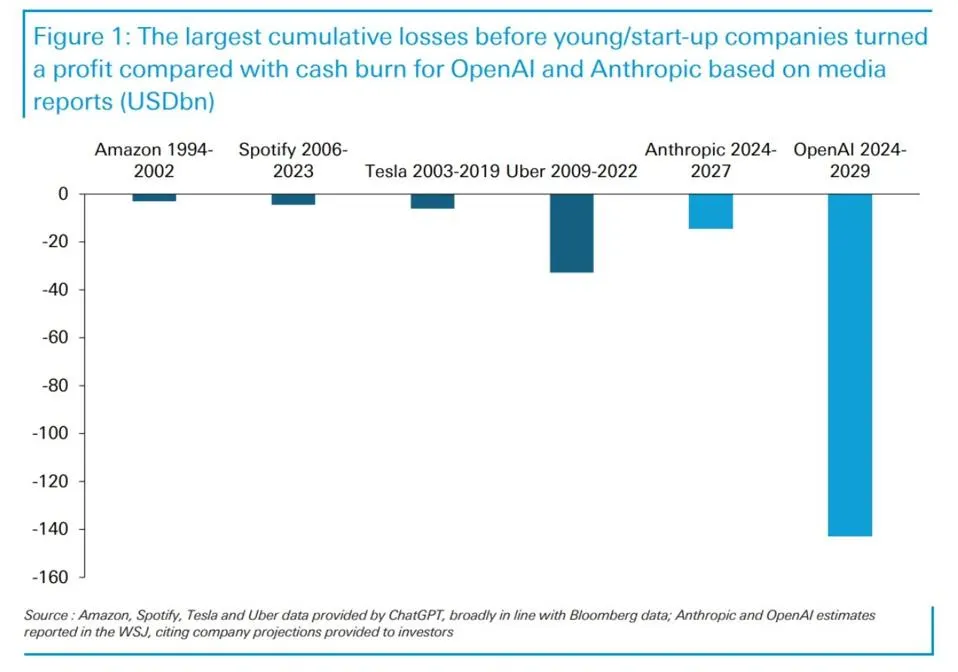

According to its own projections, Anthropic will burn through close to $20 billion before it becomes profitable, making it one of the most capital-intensive businesses in history. But that figure is dwarfed by OpenAI, which according to its own projections will need roughly $150 billion before it starts generating cash.

Companies with such staggering capital needs have no choice but to tap public capital markets in order to raise larger sums of both equity and debt financing.

Luckily for them, OpenAI and Anthropic are also two of the fastest-growing companies in history.

In 2025, Anthropic will grow from $1 billion to $9 billion in ARR (annual recurring revenue). OpenAI, meanwhile, will go from $6 billion to $20 billion ARR. Growth like this has never before been seen at this scale. Especially given the present AI exuberance, there will voracious demand for these companies in the public

Both companies have raised a lot of money from a lot of institutional investors over the past few years, many of them crossover investors whose primary focus is public markets. Pressure will begin to mount from this investor base to go public sooner rather than later in order to provide liquidity.

In 2026, Anthropic will debut on public markets. It will be one of the biggest and most highly anticipated IPOs of all-time.

Anthropic has reportedly already chosen a law firm, Wilson Sonsini, to work on its public offering and has begun spending time with investment bankers for the process. Hiring a heavy-hitting CFO is an important prerequisite to going public; last year Anthropic brought on Krishna Rao, who previously helped take Airbnb public, as its first CFO.

Just like Uber and Lyft in 2019, a race dynamic will emerge between these two competitors to get public first, which will further incentivize Anthropic to move quickly.

What about OpenAI?

OpenAI, too, will eventually become a publicly traded company. But not in 2026.

For one thing, OpenAI CEO Sam Altman has demonstrated a greater ability than any other CEO in history to raise capital from private markets. (OpenAI is currently seeking to raise a new private financing round of up to $100 billion.) This will enable OpenAI to put off the public markets for longer.

OpenAI is also a more complex and opaque business than Anthropic. While Anthropic has a more well-defined focus on the enterprise AI market, OpenAI is simultaneously pursuing opportunities in consumer AI, enterprise AI, consumer hardware, robotics, semiconductors, data centers, space, brain-computer interfaces and more. Public markets mean increased scrutiny and transparency. Altman and OpenAI will have more incentive to delay the public markets for longer in order to avoid having to explain and justify their investments in all of these areas.