The market also resolves Yes if it is a well accept fact that an human director of any S&P500 exclusively exercised their power using recommendations of some artificial agent for more than 2 years.

I will not sell my shares.

I wrote some script to automatize my daily bets.

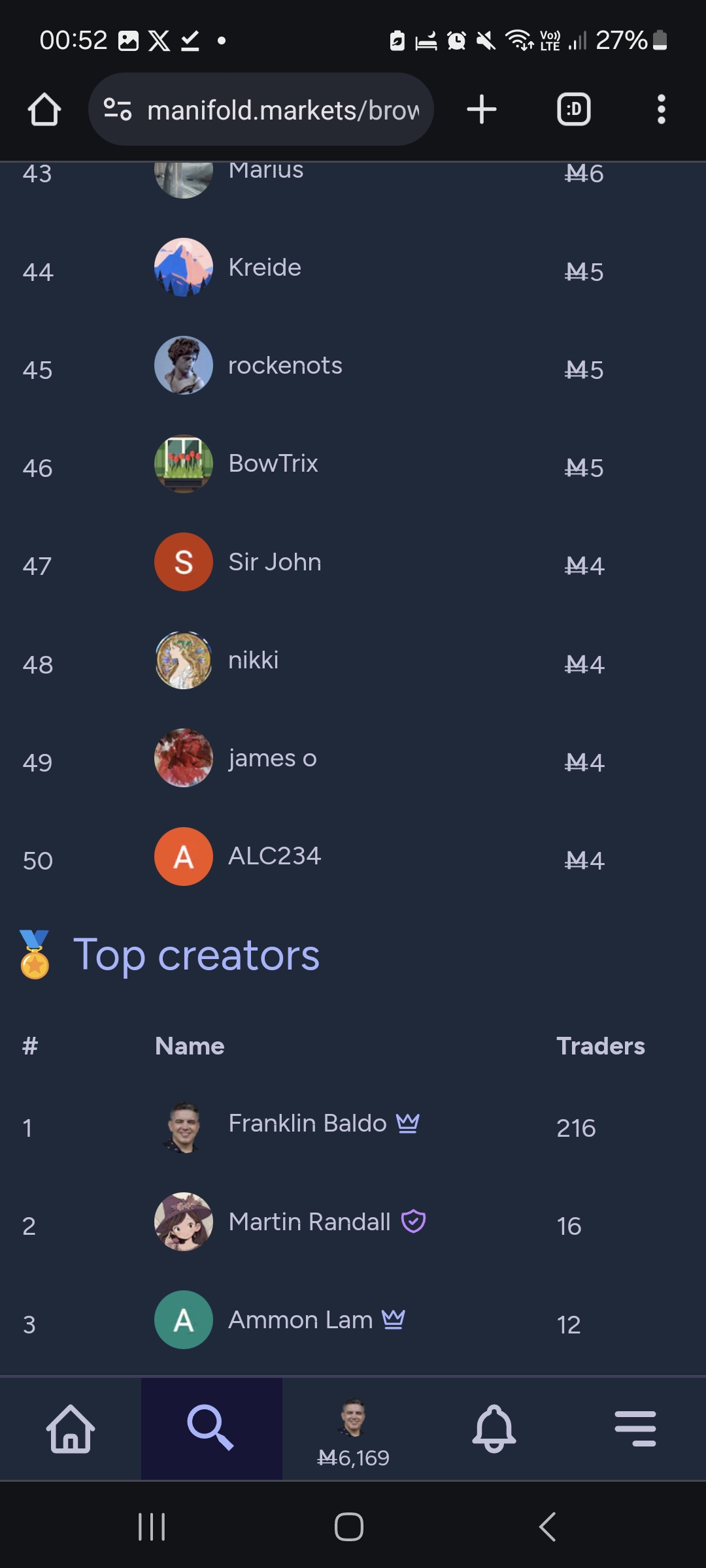

People are also trading

@GastonKessler on the other hand, the YES condition might never occur. If you're going to pump your loans into a sure bet, there might be better opportunities.

@Fion well above that 80-85% threshold, maybe (although I'm not sure I would be able to find them) but below that, I don't think I'd find many better options.

.

@FranklinBaldo FWIW this case is explicitly listed in the guidelines as something that would be unranked because it "could only ever resolve one way"

https://manifoldmarkets.notion.site/Guidance-for-running-a-market-8cb4257ed3644ec9a1d6cc6c705f7c77

Why would you want it to be ranked? That basically just means that people will battle over it at the end of month for leagues lol.

@jack Jack, I see your point that according to the guidelines, this market is the type that should be unranked since it could only resolve one way. However, I think this particular market has some prediction value .

My main interest in inquiring about the "unranked" tag is that it seems to have additional effects beyond just Leagues. For example, I created a new tag called "ai-in-sp500-board-of-directors" and add it to the market but it does not show up in the tag markets listing here: https://manifold.markets/browse/ai-in-sp500-board-of-directors

So I'm curious if the "unranked" designation impacts tag visibility and potentially other aspects of how markets function on the platform. The leagues and competition side is less important to me. Although more drama coming from leagues would be fun for this market.

@FranklinBaldo I think there's a tag limit of 4 for something, possibly causing this issue? In which case if you remove one of Free Money or Free Mana, which are basically the same thing, my guess would be that this problem would go away. someone please confirm or correct me if they know better

@FranklinBaldo Your daily M25 buys more NO's at 80% than at 70%. So for your own benefit, why not 90-95%?