Loan terms:

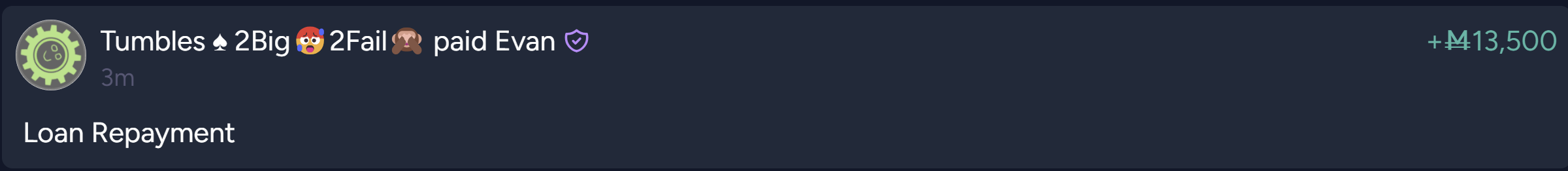

Evan to send Tumbles M10000 now. Tumbles to repay with interest M13500 by 2025-01-07, EoD AoE. Tumbles will place a limit order for M13500 on Yes at 99%, which Evan will fill.

Background:

The intent is to leverage the Manifold loans system and bank of Manifold to guarantee a lower than usual interest rate loan. The amount of the loan will be tied up in the bet at first, but will be recovered by Tumbles via the loan system over the course of the next ~ 25 days.

Tumbles is expected to repay; therefore this market should trade at 99%+ for the duration of the market and not have issues. If Tumbles does not repay, Evan can collect on the loan by resolving the market No. Mods are encouraged and empowered to enforce good behavior on the part of both participants by exercising mod resolution powers in this market; mana transfers will be by clearly labeled managrams.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ245 | |

| 2 | Ṁ91 | |

| 3 | Ṁ47 | |

| 4 | Ṁ16 | |

| 5 | Ṁ5 |

People are also trading

@mods As you can see in the comment below this, this market can resolve YES, but Evan's been inactive

@Tumbles Gotta ping first and then wait 24 hours and then ping the mods again.

@EvanDaniel can you check out this market?

@EvanDaniel would you be willing to let me me bet this up to 98% and then close it until it resolves? Daily loans are limited by expected value

@ClubmasterTransparent If you want to get in on this action, additional loans are available, but they're going to be at shorter timeframes and/or higher rates. This was an introductory experimental offer :)

@Tumbles ha, if you have to pay 35% interest to get a loan I'd have to know you a lot better to take that deal. I'm not Rent-A-Center and I don't see a way to repo your mana if you don't pay.

@ClubmasterTransparent If you don't see a way to repo the mana, then you should go re-read literally the market you are commenting on.

@ClubmasterTransparent Speaking of which, if you and @Tumbles both want to, y'all would be welcome to have that loan tag along on this market. I'm fine with expanding the market to include more loans if Tumbles is, provided they have the same end date.

@EvanDaniel @ClubmasterTransparent Ya if you want to it's literally risk free for you. You send me 2000, I place a YES limit order at 99% for 2700, you buy the limit order, done! You are then guaranteed to receive 2700 on time

@Tumbles nice talk but no one has offered me free guaranteed mana in the whole 2 months I've been here. If this is my one and only chance to get free guaranteed mana I guess I'm just going to look like a chump. If free guaranteed mana is around for the taking I like my chances of finding it later. And I've never believed in the risk-free rate.

@Tumbles ETA if this is a generator of free guaranteed mana then why are people pissing and moaning about "giving mana away like candy" when they could just go loan you mana at 35% and get a fountain of candy?

@ClubmasterTransparent "Repo" in this case is "if you don't get it one way you can take it by force another", which... seems about right? If Tumbles doesn't pay me back, I resolve the market in my favor, I win, they lose. Sounds like repo! Backed by Manifold, I get it back even if they don't have it and go negative!

I wouldn't say this is "free mana" at all. I'd say this is a complicated bet about interest rates, moderation policies, Tumbles' likelihood of repaying, Manifold's continued existence, and so on. Tumbles thinks they can extract mana from other users at > 35%/yr returns for a while. If they can, that's probably in part because Manifold is printing mana. They're taking on risks like "growth of Manifold makes the markets more efficient and it gets hard to do that". Or maybe "Tumbles suddenly can't get more p2p loans to keep the ponzi going". Or "Manifold's loan scheme changes and they don't get this loan after all".

Meanwhile, I'm taking on risks like "it turns out that mana is in practice worth a lot less a year from now, and paying $100 now for M13500 a year from now looks like a bad deal in retrospect". For example, because Manifold is printing so much that no one buys it because the interest rates are awful!

Most p2p loans also have very high rates because the loans are small (meaning the cost of origination is high compared to the loaned amount) and the default risk is high. This structure maybe removes most of the default risk, but doesn't change the origination cost.

Anyway, as I said... not free, definitely complicated. Maybe we can get a few more loans like this running and see what people think the interest rates are and we can make a few more interest rate derivative markets! But basically this market is fairly experimental, and if you don't want to participate in these shenanigans that's probably wise, but if you think it's simple loan sharking I suspect you've underestimated the mess that's going on.

You guys finally figured this trick out, huh? /jack/private-loan-market

But you haven't quite realized the implications yet...

@nikki Being 600k mana in debt is like smoking. A bunch of nerds say it's bad for you but really it just makes you look cool

@nikki Well, one of the major ones appears to be that one gains the ability to go into default on that debt...

@nikki The M600k isn't debt, it's a fine I issued to Manifold Markets for gross incompetence and lying. It could've been much higher.