Resolves YES if the winner of the 2024 presidential election is the candidate predicted most likely to win by Nate Silver’s model (released today, here) on Election Day. NO otherwise.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ20,107 | |

| 2 | Ṁ2,773 | |

| 3 | Ṁ661 | |

| 4 | Ṁ351 | |

| 5 | Ṁ328 |

People are also trading

Having got this wrong myself (thinking Silver has some edge over a coin flip and expecting a candidate to emerge as more likely to win) it is very amusing to reflect that, after all that, he pretty much said it is a coin flip… or as I prefer to characterise it… “all my expertise, knowledge, analysis and commentary leaves me no edge over a monkey throwing darts or a random person flipping a coin”.

@AdamRudd if you thought it would come down to anything other than a coin flip, or a roll of the dice, or whatever way you picture sampling from a probability distribution, than I have to wonder what you were expecting instead?

The real product was always the plot showing the frequencies of various EC results, based on the 50ish probability distributions the model calculated.

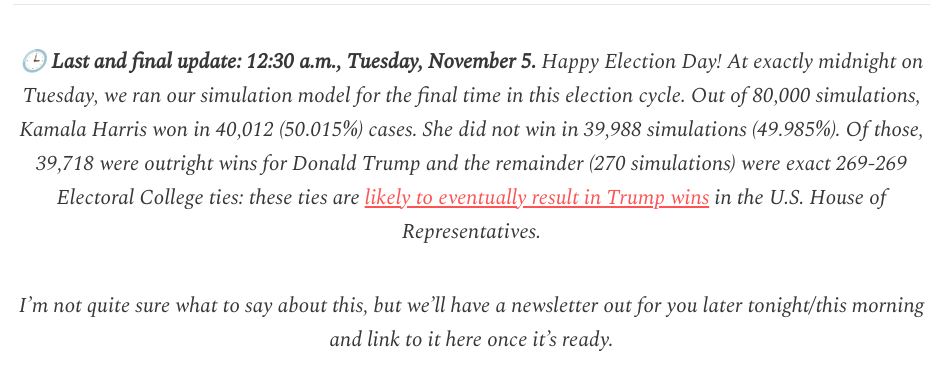

@Kraalnaxx within the margin of error with a gap of 290 out of 80,000 which implies a 95% confidence interval

of

Harris 40,012 ± 277 out of 80,000

Trump 39,718 ± 277 out of 80,000

There's a ~15% chance (or closer to 50% giving 269 269 to Trump) Trump is favored using Silver's model but he didn't generate a sufficient amount of samples

@ChinmayTheMathGuy True enough, just wanted to let traders know that this market will resolve YES if Harris wins, where they might have been assuming model would predict Trump if they hadn't checked.

@Kraalnaxx I just want everyone to appreciate that even if each individual simulation were exactly 50%/50%, the probability of the number coming out this close to exactly half is less than 7%.

@EricNeyman If the model predicts Harris, but Trump wins, this market will resolve NO.

I will extend this market until there is a clear resolution.

@Najawin I think it's more probable than not that Silver's model is higher on Kamala than the markets on election day

@SemioticRivalry Agreed. The polling average likely won't change much and the fundamental model which the shifts the margin Trump will be phased out by then. My guess is Kamala will be 65% favored in the model and a bit below that by markets.

@PlainBG Silver has responded very poorly to any criticism of his model, or to any criticism of his commentary at all. I don't think he understands that people are actively targeting his model in order to claim the election is rigged.

@adele "Isn't Silver pretty selective about which pollsters he includes polls from?"

The opposite. He includes some of the lowest ranked pollsters under 538's methodology. See discussion here. (I don't, for the record, think he's upranking them consciously. I think they're gaming the system.)

@SemioticRivalry I don't know why I'd bet on that? My contention is that Silver's model is being gamed, not that it's being gamed in such a way that electionbettingodds will be independent of this fact. Since electionbettingodds will clearly take into account Silver's model, (and he arguably has the most influential model, so they'll likely take it into account quite a bit!) the two are correlated to a fair degree. (Other models can correct for his mistakes, sure, but then other biases can manifest as well. It's basically a coin flip imo, as others suggested.)

"The reason his topline is so different is because of the convention adjustment"

So different? Yes. But it's still different than others, in important ways. He specifically thinks the race is at a statistical tie, rather than slightly Harris favored without the convention adjustment, and, notably, he also thinks the convention adjustment is correct.

Compare this to 538, who explicitly said the recent change in their model came from:

"new polls were mostly from partisan firms or those with a lower 538 pollster rating, which receive a low weight in our forecast"

And noted that they expect their model to largely adjust to better polls when they come in, so this is temporary. 538 is aware that this is a temporary issue caused by a weakness in their model and the polls. Silver thinks it isn't, and that's the problem, it makes his model vulnerable.

@Najawin the betting odds are definitely not tracking the SIlver model. On August 24th, trump's polymarket price was 50 cents. Today, his price is also 50 cents. In that same time, the Silver model has gone from Trump 46% to Trump 61%. if you think that the Silver model is systematically biased towards Trump you should clearly buy no. Or if you think that the betting markets will have a systematic bias towards Trump of the same size, you should obviously put a significant amount of money into the markets on Harris.

@SemioticRivalry I didn't say they were only influenced by Silver's model. I said that the two are correlated. If people disagree with Silver as to the reality of the convention bounce, (which people can clearly do if they're influenced by Silver's model but not only Silver's model) but think his model is reliable otherwise, we'd see precisely the behavior you're talking about.

And, yes, I already have a significant amount of mana tied up in Harris markets on this site. I don't personally bet real money and never have. It's not something that interests me. But as for mana, I have, idk, ~16k mana invested in Harris in various ways. I very much do think the markets are underrating her systematically, and have expressed that insofar as I'm interested in doing so.

@Najawin they're pretty much only correlated in the sense that they're both correlated with a third variable (polls). and if people are plotting to flood the zone then it seems like that should accelerate near the election and the delta between the true odds and Silver's model should only widen and get more and more pro-Trump. It seems unlikely that markets would be specifically dumb in the exact same way as Silver.

i notice that almost everyone who has a strong conviction that the markets are very wrong never wants to put money on it. mana is one thing. but if you think she's 65% to win, it's obviously smart to put a nontrivial amount of money on that at the current 48% odds. $5k on Kamala would equal $1.7k of profit in expected value if the true odds are 65%. It seems dumb to not pick up $1.7k lying on the ground. I do think that most people like to pick up free money when they can, so it seems like the revealed preference here is that when real skin is in the game it becomes much harder to defend that one has an edge over the 800 million dollar market.

@SemioticRivalry "they're pretty much only correlated in the sense that they're both correlated with a third variable (polls)."

Yes, this is the issue. They're correlated with bad polls that Silver takes more seriously than other models do.

"i notice that almost everyone who has a strong conviction that the markets are very wrong never wants to put money on it"

I don't bet real money on anything, outside of the stock market, bonds, etc. And my investments there are really standard stuff, nothing like options.

"$5k on Kamala would equal $1.7k of profit in expected value if the true odds are 65%"

When you average out over all possible worlds, yes. Do we live in all possible worlds, or just one? If we live in a single possible world and we believe that markets will continue to be irrational for as long as the information doesn't meaningfully change the markets' rationality (that is, we think they'll continue to be irrational until the election), you can't make profit over buying low and selling high, and since you live in only a single possible world rather than an average of all possible worlds there are specific possible worlds where we make profit and specific possible worlds where we lose money. Even if we think about it on the scale of 80%, there's 20% of possible worlds where I lose all the money invested. You can think of it as leaving money on the table, but the reality is that the money's only there in some situations and the level of risk tolerance different people have varies. It's not free floating in every possible world, able to be accessed, unless we assume the markets are rational and we can buy low/sell high. And I just reject that assumption here.

@Najawin I still think you should pick up thousands of expected dollars, even if they are not guaranteed.

@SemioticRivalry Suppose you have to bet $1mil to play, and you only win in .1% of possible worlds, but the payout is such that you pickup thousands of expected dollars. Do you play? I think the answer is clearly no. Everyone's risk tolerance is different.

@Najawin Easily solved by marginal utility. Suppose you have to bet 1 mil to play and you only win in .1% of worlds, and if you win you get X dollars. Is there no X such that you would play?

@stardust As @BoltonBailey 's wikipedia page points out, it's heavily dependent on your own ability to absorb that risk. If we're fixing 1mil, we need to have a much larger amount of money already. (As b->inf, f* -> p, so we'd need, in the limit case, our total wealth to be at least 1bil.)

But even still, the Kelly Criterion assumes that we're making multiple bets, which I don't believe is an applicable assumption to this case.

@Najawin The point is that the Kelly Criterion in this case doesn't map onto what is rational in this case. If we're going by your b approaches inf, f* should approach p argument with the idea that you should never bet more than the Kelly bet as proportion

Suppose that you own a grand total of 10 dollars and live on the streets. Someone gives you the chance (and let's say you know it's not a scam) to wager your 10 dollars. If you lose, you lose it all. If you win, you get paid back 1 million dollars, and there is a 50% chance of winning.

Do you really go "sorry can't do that, come back when you can wager me 4.99"

@stardust I think this is an unhelpful hypothetical - our intuitions are primed by the fact that we often have more than $10. For someone for whom $10 is a lot of money, I'm honestly not sure how I'd answer.

But I do agree that the Kelly criterion isn't completely relevant as it's about iterated bets. I used it as a limiting case, not as an answer in itself. My answer is, to the original hypothetical, I don't believe there is. Not only is $1mil a fair bit of money to me currently, it's a fair bit of money within pretty much all social contexts, so unlike the $10 hypothetical a loss here is even more dehabilitating, with the effort it'll take to recoup the investment being substantially larger.

Suppose the hypothetical was for 10x the world's GDP, a truly economy warping amount that could do anything you wanted, but you have a .1% chance and you have to bet 10x your total net worth. I just don't see how this could be worth it. Even if instead of 10x it was 20x, or 30x. The risk is too high here.

@Najawin But the point of the hypothetical is that $10 isn't a lot of money, not here. It's a fact that in a western country, if you have $10 dollars and live on the street, you're hardly richer than someone who's bankrupt and lives on the street. But it's still all your money, the only criterion that the Kelly bet math cares about.

To the original hypothetical: with those odds, I'd agree. Since the plain EV says you should bet at >1 billion reward, and I can't see how I wouldn't already have anything I could ask for personally with 1 billion dollars. The marginal utility of any extra dollars isn't really anything. But I would contend that you're not arguing for your point here. You're just arguing with the numbers you gave that the marginal utility for extra dollars steeps off rather quickly.

Suppose we run that same 1 million bet w/ 0.1% success, but instead of 10x the world GDP, if you win, world hunger is solved indefinitely. Or that an AI safety plan which is guaranteed to work for all of history is developed. Or all diseases are eradicated and cancer is cured and ..., plug in any issue that money can't buy here. Would there be no such issue where you would say that the subject should take the bet for?

@stardust "But the point of the hypothetical is that $10 isn't a lot of money, not here. It's a fact that in a western country, if you have $10 dollars and live on the street, you're hardly richer than someone who's bankrupt and lives on the street."

I'm just not sure! I don't know the psychology of someone in that position. As I said before, everyone has different risk tolerances. It's entirely possible that in the position I'd take the bet. But I just don't know.

"But I would contend that you're not arguing for your point here. You're just arguing with the numbers you gave that the marginal utility for extra dollars steeps off rather quickly."

This certainly seems to be a subset of my point.

"Suppose we run that same 1 million bet w/ 0.1% success, but instead of 10x the world GDP, if you win, world hunger is solved indefinitely."

Ah ah ah. The 10xGDP question had a bet of 10x your net worth. The point of it was to be completely and utterly debilitating, should you lose - risking your entire life on this point. And given that, no, I can't see a situation where I'd do that. If you believed in that you wouldn't be on this site, you'd be spending all your free time making money to send to the Against Malaria Foundation or something. It's supererogatory at best.

@Najawin I don't think it is. Because the original original statement brought up was betting a few hundred (not a million) dollars on Kamala Harris in some prediction market. The marginal utility doesn't steep off nearly as quickly in that case, so the million dollar bet doesn't describe it well.

"If you believed in that you wouldn't be on this site, you'd be spending all your free time making money to send to the Against Malaria Foundation or something. It's supererogatory at best."

If it's supererogatory you're still conceding that the person should make the bet, just that he doesn't have to. Which is a far cry from the original, where you were arguing that it may not be smart to make the Kamala Harris bet.

Side note: I have different morals to secularists, you know this. I don't donate money to the Against Malaria Foundation. However, I do donate a substantial portion of my money to the Church. I understand the response would be "surely you're not donating all the money you could then, if you care about donating to the Church." But trying to parallel utilitarian argument is fruitless if you're talking to a Christian because neither God nor the Church command us to give everything we have to the Church, especially seeing as it would get in the way of other commands, such as "be fruitful and multiply."

If God commanded so and I was on this site, that would not be evidence that I do not believe so but that I like all humans am tainted by sin. It would not be a supererogatory act I am failing to do, but rather that I am failing my moral duty and only have the chance to be saved because of the Lord's mercy. Lord Jesus Christ, Son of God, have mercy on me, a sinner.

@stardust "Because the original original statement brought up was betting a few hundred (not a million) dollars on Kamala Harris in some prediction market. The marginal utility doesn't steep off nearly as quickly in that case, so the million dollar bet doesn't describe it well."

But the b->inf case is precisely where expected payout goes to infinity. We're saying that even at $1bil marginal utility is so small that no amount of payout can move us. We need not just that margutil(i)->0, which is easy enough to get, but that SUM_i=1^inf margutil(i) = small. Which is a much weirder thing to believe! So even if marginal utility drops off fast, it needs to drop off so fast that this sum converges quickly. Which comes down to my original point.

"If it's supererogatory you're still conceding that the person should make the bet"

See "at best". Note the bold and italics.

Interesting hypothetical. My first thought for a reason why the Kelly criterion is misapplied to the "homeless person in a western country" example is that even a homeless person has some form of social capital that isn't entirely unfungible with money. For example, if the homeless person knows they can sell their shoes or spend the next day begging or something to make $1, then it isn't really between $10 and a 50/50 shot for 0 or $1000000, it's between $11 and a 50/50 shot at either $1 or $1000001, in which case Kelly correctly says to take the bet.

@BoltonBailey I think that's a satisfactory response. But we could easily modify the original hypothetical and suppose that, say, it's illegal to give money to the homeless. Would that change the math? Yes. Would it change the intuitive choice? I don't think so. Because realistically if you don't take the bet, there's a near 100% chance you starve or something, but maybe 1 day later. If you do take the bet, it's 50/50 between starving 1 day earlier and living a very good life. I find this almost analogous to "suppose you find yourself with a rare disease. The doctor tells you that you have 1 day left to live, but you can take an experimental treatment. There's a 50% chance it catastrophically fails and you die, and a 50% chance that you live and go back to normal." And I find the answer obvious. That's not to say that the Kelly equation is generally un-useful, just that it doesn't present a satisfactory framework for everything. The same way that Newcomb's Paradox tests CDT.

@Najawin We're playing a strange game when talking about money and infinity, because money doesn't have inherent value. It caps, because money corresponds to something in the world that there's a finite amount of; which is why I brought up, say, an AI safety plan that would work for the rest of history. If you had an amount of money equal to 10x the world GDP, that would be no different from having an amount of money equal to 1x the world GDP, which would probably be worse than just having a trillion dollars because of all the consequences doubling the money supply overnight would have. So I don't buy this analysis.

@stardust "money doesn't have inherent value. It caps, because money corresponds to something in the world that there's a finite amount of"

Yes? And? It would be equivalent to the ability to completely restructure the entire world's economy (bound by material constraints), no? Which isn't the case for either 1 or 10x the world's GDP, as that would eventually lead to devaluation. (Obviously you cap the flow at the point were you've restructured it as you wish.)