I think the lesson EA leaders are likely to take away from the FTX scandal is that they need to value consensus decisionmaking more highly. Discussions are already happening regarding establishing new accountability practices and reporting; on the whole I think this will cause EA organizations to be more cautious around funding and public image, and more determined to keep decisions about both in the hands of EA leadership.

I have a negative view of this outcome, see my comment here: https://manifold.markets/IsaacKing/at-the-end-of-2023-will-people-in-e#rzrG9lV6DvW9YyyPpDve

Resolves based on my subjective judgment, establish another market if you want more objective resolution criteria. Some ways this could get closer to being operationalized (maybe these deserve their own markets):

There exists a general mood within EA that public perception of EA is precarious and must be safeguarded.

Major funders are asked not to use or reference EA branding if they diverge from CEA-approved grantmaking practices.

Organizations receiving EA funding in 2023 say they are asked to comply with more stringent reporting requirements.

The grantmaking long tail gets pulled in; fewer moonshots with potential publicity consequences are funded.

EA grantees are given more restrictions on public relations. Not sure how I will find this out; when I got such guidance as a grantee last year, it was done privately and I was asked to keep the specific contents of that guidance private.

Moderation on EA forum increases.

More EA leaders receive media training, and norms evolve to discourage speaking about EA publicly without such training.

There are fewer EA spokespeople, and they all say more similar things than in 2022.

I recognize that most likely EA will get more centralized in some ways and less in others; it's possible that I reach a different overall conclusion than you by weighing different pieces of evidence differently than you. (Get the hell out of here, Aumann!)

People are also trading

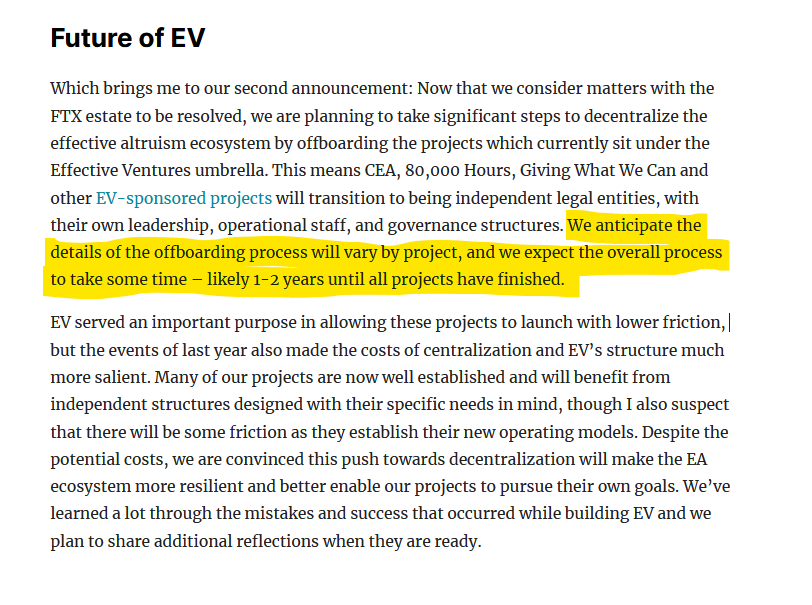

Here is what the update from Effective Ventures on December 13 said on the EA Forum:

Future of EV

Which brings me to our second announcement: Now that we consider matters with the FTX estate to be resolved, we are planning to take significant steps to decentralize the effective altruism ecosystem by offboarding the projects which currently sit under the Effective Ventures umbrella. This means CEA, 80,000 Hours, Giving What We Can and other EV-sponsored projects will transition to being independent legal entities, with their own leadership, operational staff, and governance structures. We anticipate the details of the offboarding process will vary by project, and we expect the overall process to take some time – likely 1-2 years until all projects have finished.

EV served an important purpose in allowing these projects to launch with lower friction, but the events of last year also made the costs of centralization and EV’s structure much more salient. Many of our projects are now well established and will benefit from independent structures designed with their specific needs in mind, though I also suspect that there will be some friction as they establish their new operating models. Despite the potential costs, we are convinced this push towards decentralization will make the EA ecosystem more resilient and better enable our projects to pursue their own goals. We’ve learned a lot through the mistakes and success that occurred while building EV and we plan to share additional reflections when they are ready.

The dissolution of Effective Ventures is a kind of decentralization, though perhaps different than the kind of centralization you have in mind judging from your examples https://forum.effectivealtruism.org/posts/HjsfHwqasyQMWRzZN/ev-updates-ftx-settlement-and-the-future-of-ev

@RobertCousineau Rachel clearly mispoke, hence the description (written after the FTX crisis) was written in present tense: Will I consider EA more centralized at the end of 2023 than it is in November 2022?.

You’ve interpreted her statement in a way which makes the existence, or lack there-of, of FTX as the most important factor in resolving this market. That's ridiculous. FTX was defunct when we started trading on this market. The question is about how others in the EA community reacted to the fall of FTX, and whether this reaction made EA more or less centralised.

I suspect what Rachel intended to say, is: "[…] so T=0.01 after collapse vs EOY 2023", i.e. clarifiying that the existence of FTX is not the dominant factor in this market.

@ElliotDavies I cannot speak to whether or not they misspoke (although if that was the case, this market probably ought be N/A'ed as there are mutually contradictory resolution criteria). Nevertheless, it doesn't take much interpretation to read "..., so pre-collapse vs now" as this question being about pre-collapse versus now. Further, I was not invested in this market prior to them adding that clarification; I had no (strong) incentive to interpret it one way or the other.

It does take a lot of interpretation/mental gymnastics to say you know what the creator meant when they explicitly stated the opposite. You also had a large incentive to do said creative interpretation because I placed large limits orders at far above 50%, which you bought into (and subsequently sowed FUD).

@RobertCousineau I think the resolution criteria is pretty good to be honest. She just wrote a quick response that you interpreted in a strange way, despite the fact your interpretation would have been in direct contradiction to the title and resolution criteria.

Then EV announced they were disbanding, basically what this entire market was designed to predict. Instead of selling at a loss, you invested more in "YES".

Then I pointed this out, and you bought more YES.

Now you want to resolve N/A. Kinda seems like you had many opportunities to update?

On your attempted operationalizations for resolution:

There exists a general mood within EA that public perception of EA is precarious and must be safeguarded.

I feel this is far more true after than FTX collapse. Ben's unprecedented investigation of Nonlinear is a clear operationalization of this, but I'd be willing to place a pretty big bet if someone did sentiment analysis type stuff on the EAForum that it'd hold true there too. It is certainly true in my local (Seattle) community, and in how I talk about EA to people.

Major funders are asked not to use or reference EA branding if they diverge from CEA-approved grantmaking practices.

I'm not sure here.

Organizations receiving EA funding in 2023 say they are asked to comply with more stringent reporting requirements.

Not sure here, although I know that there has been examples of EA funded orgs rewriting a lot of their guiding documents to say less about utility maximization.

The grantmaking long tail gets pulled in; fewer moonshots with potential publicity consequences are funded.

True per what you said below, and per EA funding decisions noticeably raising the bar in expected impact.

EA grantees are given more restrictions on public relations. Not sure how I will find this out; when I got such guidance as a grantee last year, it was done privately and I was asked to keep the specific contents of that guidance private.

Not sure here.

Moderation on EA forum increases.

Not sure here.

More EA leaders receive media training, and norms evolve to discourage speaking about EA publicly without such training.

I'd be quite surprised if this wasn't true - things like them hiring a professional law firm to investigate if there was any knowledge of FTX fraud indicates to me though it is.

There are fewer EA spokespeople, and they all say more similar things than in 2022.

Not sure here.

My also very big point is that at the end of the day, the major alternative funder disappeared. That, from first principles and from priors will significantly increase centralization.

This market should be at 10% right now. Let's recap:

- EV announces that work is ongoing to offboard all of it's "projects" into independent organisations

- There's more local groups than last year, including in places like Brazil, Chile, Rowanda and Liberia (to name a few).

- There's 427 organisations (most completely independent) in the EA ecosystem. I'd estimate this is between 30-50 more than this time last year.

- The AI safety community has partially spun out of Effective Altruism. It's gained mainstream recognition, with the UK Gov setting up an AI safety division

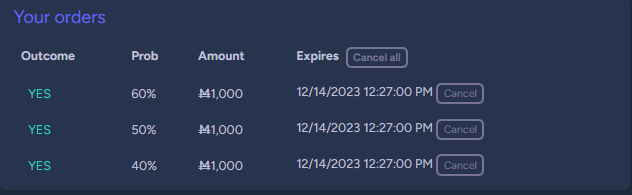

@ElliotDavies I'm responding to you below - I can copy paste it up here if you want. Regardless, bet on your beliefs; show, don't tell (me what the market probability should be). I have large limit orders open; take them if you are so confident of 10%!

@RobertCousineau Re: betting on your beliefs, I totally agree, hence why I am the largest holder. I’d love to buy through your limit orders, but I’m out of cash. I’ve liquidated my position in several markets, but I recently hedged 3000 M$ NO on a market at 96%, and lost (predictably). So I am short on cash right now

If you (or anyone else) would like to loan to me, I'd be happy to buy no.

@ElliotDavies I'm happy to be a bank of last resort. If you post in discord about a loan first though I would not mind that to avoid excess risk.

@firstuserhere I was busy logging into discord, and finding a channel, just to have the same conversation there haha

EV announces that it will spin off many of its projects with the explicit aim of creating a more decentralized EA ecosystem: https://forum.effectivealtruism.org/posts/HjsfHwqasyQMWRzZN/ev-updates-ftx-settlement-and-the-future-of-ev

@Radicalia That is really good news in my opinion. Nevertheless, I do not think it should indicate the market price here goes down (but rather up). This is a statement from EV that they currently see the EA landscape as highly centralized and are looking to fix that in the next 1-2 years, not that they have successfully de-centralized their now admittedly highly centralized position.

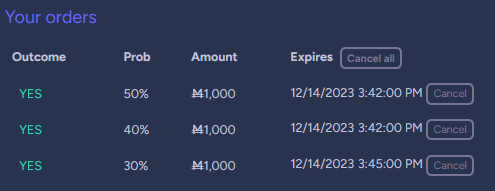

PS: If you disagree, I have some substantial limit orders in place:

@RobertCousineau I don’t understand the logic you’re describing above. None of EV’s organisations were brought into EV after market creation. Is it possible you have misunderstood the question?

I pressume you have now removed these limit orders? I didn’t seem to encounter them

@ElliotDavies Added them back in - they were time limited to expire after 3 hours (I was not sure if the market creator would comment something contrary). I do not believe I have misunderstood the question.

@RobertCousineau Also, although EV organisations won't spin out before 2024, the work to spin out is clearly ongoing, right now. For the largest EA umbrella org to be currently decentralising is clearly a massive update towards no.

Agree, I'd be interested to hear @noumena 's thoughts

@ElliotDavies I interpret that as admission things are highly centralized (compared to when FTX existed, which I clarified is the intent of the question). They are trying to reduce that centralization; great! This market is about the actual state of centralization at EOY 2023 though, not about projected centralization in 2024/2025. They made no statements saying 80k, etc are no longer under EVF.

The 427 organization you reference below are cool. What percentage of them are funded by EVF (in whole or in large part)? What number of them are new compared to 2022, pre-FTX. How many are now much more reliant on EVF, post-FTX?

You mention more local groups. Cool, if true. Nevertheless, I both doubt that is actually true (groups don't get removed very often at all from that page, unless someone explicitly requests it. of course the number goes up over time) and doubt that it makes much impact even if so.

On AI safety - this is one area I mildly agree. Nevertheless, by amount dedicated, I sincerely doubt it is more today than when FTX was a thing. They were allocating hundreds of millions (if I remember correctly) at GCR reduction, which to the best of my knowledge no government has done.

@RobertCousineau

- I'm saying things are less centralised than they were in Nov 2022. All of EV's "projects" were created prior to Nov 2022

- The work to spin off organisations from EV has started and is currently ongoing. This announcement will likely have a large cultural impact immediately.

- I suspect Rachel misspoke when she said pre-FTX, in terms of finances, of course EA is going to be more centralised going from 2 big funders to 1 big funder (hence: The description, everyone's comments previously, the market not being at 99%). Rachel made mention to finances in her description, and that was for a reason

There really wasn't that many EA Groups in non Anglo/european countries prior to this year.

What number of them are new compared to 2022, pre-FTX.

- I'd estimate 30-60

@ElliotDavies

- I'm saying things are less centralized than they were in Nov 2022. All of EV's "projects" were created prior to Nov 2022

That indicates to me pretty strongly that EA cannot be less centralized by this metric. If they were all in existence prior to the FTX collapse and some of them got FTX funding (which is now gone), that can't be a win for decentralization.

- The work to spin off organisations from EV has started and is currently ongoing. This announcement will likely have a large cultural impact immediately.

Currently started/ongoing without any in practice effect should not impact the resolution of this market. I'm curious how you'd operationalize/pre-register statements along the lines of large cultural impact immediately though!

- I suspect Rachel misspoke when she said pre-FTX, in terms of finances, of course EA is going to be more centralised going from 2 big funders to 1 big funder (hence: The description, everyone's comments previously, the market not being at 99%). Rachel made mention to finances in her description, and that was for a reason

Finances are huge! People both consciously and unconsciously avoid biting the hand that feeds. I think EA is unusually good at accepting diverse viewpoints and staying intellectually honest in face of results that contradict their/their existing funders viewpoints, but we are by no means perfect. At the end of the day, you know where your check comes from and you will have a bias against pissing that entity off. On the market not being at 99%: it would be really silly to bet a subjective resolution up that high without explicit confirmation from the creator. I'm quite confident in my position, but only willing to bet up to around 75% because I'm not her. Further, right after I clarified this was about Pre-FTX (not the day the market was created) the market stayed at or above 66%.

I agree that she made mention to financials in the description. I think this is far more bits of evidence towards my position than yours though?

- There really wasn't that many EA Groups in non Anglo/european countries prior to this year.

I'll trust you here. That is good! Low overall impact to the resolution per my estimation, but yay!

- What number of them are new compared to 2022, pre-FTX.

- I'd estimate 30-60

Fair - do you think that counteracts the lost members from the FTX scandal and the SamA drama? I've noticed in my Seattle EA-sphere, people who prior to FTX/SamA would say they are EA's pretty confidently now don't.