Resolves to MKT (meaning resolves to whatever the market probability is at the time of close).

The market close time will be quasi-randomly extended if there is still ongoing trading activity; using a procedure similar to what @MartinRandall describes on the market linked below. This is to avoid encouraging big last-minute trades to move the market.

Update: added more details on this process in my latest comments below.

I will bet in this market and may bet in any direction.

Motivation: There are many ambiguous, hard-to-resolve questions that people have created on Manifold that use a "self-resolving" mechanism of resolving to the market probability (see examples in https://manifold.markets/group/selfresolving and in the comments). However, there are many concerns about how well such mechanisms work and how reliable they are especially against price manipulation.

This question asks whether Biden will be president on September 15. But instead of me determining the resolution, this is a "self-resolving" market. This experiment uses a question that could easily be resolved by conventional means so we can evaluate how well it did, and potentially apply those lessons to other self-resolving markets that are harder to resolve with objective resolution criteria. This is an experiment inspired by discussion with @dreev and @MartinRandall, see this market:

Note that the question is still about Biden's presidency on 9/15 regardless of when the market actually closes (the idea @dreev proposed was that theoretically the market should converge to nearly 100% after the outcome becomes certain - I am more skeptical).

Close date updated to 2022-09-17 11:59 pm

Close date updated to 2022-09-18 11:59 pm

Close date updated to 2022-09-19 11:59 pm

Close date updated to 2022-09-22 11:59 pm

Close date updated to 2022-09-25 11:59 pm

Sep 25, 4:17pm: Current proposal (summarizing the comments): The market will close with a Poisson process during the window 9/26 through 9/30. Starting 9/26, shortly after the end of each day (UTC time), close with probability 1/3 using a public verifiable random number generator. After the end of September 30, close unconditionally. On close, compute an (exact or approximate) average (mean) market probability over that preceding day (24 hours, midnight to midnight UTC time), and resolve to this value.

Note: Midnight UTC = 5pm Pacific, 8pm Eastern.

Close date updated to 2022-09-30 8:00 pm

Close date updated to 2022-09-26 8:10 pm

People are also trading

Huge thanks to @jack for running this fascinating and enormously edifying experiment! Really impressive dedication to fairness and a beautifully scientific mindset throughout.

Some post-mortem thoughts:

I was stupendously incorrect in my prediction that auto-resolving is robust to price manipulation! (Some buts coming below.)

I learned a fascinating thing about prediction markets (all prediction mechanisms?) that are trying to get to probabilities near 0 or 1. Namely, they're bad at it. Auto-resolving exacerbates that but the problem is more fundamental.

This market seemed to have trouble even far from 0 or 1. What was that about? Tentatively I think that's about the cutoff time.

New conjecture: for markets with no ground-truth resolution criteria (as this market simulated being) we can salvage auto-resolving by stipulating that the price simply must quiesce. If it doesn't then it either stays open indefinitely or it resolves N/A. That doesn't ruin the market. The price trajectory is informative even without converging.

As for the Poisson process here, I think any resolution that depends on past prices in any way is bad because it makes it very hard to reason about whether the current market price is wrong. Like as the end of the first 24-hour period approached, it was probably totally irrational to move the price from the 24-hour average it was converging to (until the randomization revealed whether the next 24-hour period would happen). But I don't think anyone on Team Yes had computed that average. We just continued to naively push the price towards YES. Team No can certainly say that's our own fault for not reading the fine print but it's bad if participation in a market requires too much sophistication. "Price is wrong, pay to move it, profit if correct" is a pretty amazing property that most Manifold markets have.

I should take some blame for the N/A resolution. The way the Poisson process played out was probably fundamentally predictable from what @jack originally outlined. I instead viewed it as roughly "it resolves to what the market price quiesces to; ps, we may sacrifice some fairness to force it to close if it's dragging out too long but probably we can math it out to be minimally unfair". Narrator voice: no we could not. Team No foresaw that and put a ton of work into playing the game as it existed and then I whined to @jack that the game wasn't in the spirit or the original setup (though I do think that) and I can see Team No being annoyed about that and I apologize.

But also I guess the bug that Team No found was in fact a big deal so it really did have to resolve N/A after all?

Anyway, to test my conjecture in point 4, I've started a new experimental market (which also has more speculation about self-resolving markets in the description):

@dreev Thanks for the comments.

I think self-resolving markets have a weak, roughly constant pull towards truth, that may be countered by a pull towards profit incentives that is proportional to the size of the investments. As people bet larger and larger amounts in this market, the pull towards profit completely overwhelmed the pull towards the stated question (as I would have expected, although I didn't expect the amounts traded to get this large). My initial prediction was that this would end up around 90%, but then the amounts of mana completely blew up and it basically boiled down to what was the ratio of funds between yes and no. I had a spreadsheet where I was calculating equilibrium price = yes / (yes + no) funds for different possible scenarios.

I still don't think quiescence alone works robustly, and I think it looks pretty similar to a long Poisson process. 3 expected days is a relatively short Poisson process and I think a 30 expected day Poisson process (for example) would incentivize playing for the long game more. But I think it still plays out like a game either way, and same with quiescence - the price is fundamentally determined by the ratio of funds.

Yeah, agreed that the last-24-hours method was not ideal. But I don't think the impact was necessarily that huge. Team no was playing the same strategy as we would have with a close-to-random-timestamp rule or anything like that. Team no strategy was driven by, if we drive the price down by x% for y minutes, how much expected profit is that? That's why we were willing to buy NO down to 10%, even though we were sure that it would resolve much higher than that - because the vast majority of the profit was from the shares already held, the trading during the last day was a small fraction of that.

Another point is that I think if you ran the same market 100 times, you'd get a lot of very different outcomes depending on who decided to participate. And I think this is true of these experiments in general - so I would not rely on a single or even a few experiments to tell whether one rule set plays out differently than another. My prediction going in to this was

self-resolving markets are probably accurate within about plus or minus 20% most of the time, with very large, blatant discrepancies <10% of the time.

and I think we ended up in one of the <10% cases here.

Actually I made a mistake in the average script (again) - if I got it right this time the average was 50.6%, not 69% (which was the result when I erroneously averaged everything from 9/25 and 9/26, not just 9/26).

Here's my script if people want to use it: https://gist.github.com/jackc271/5f85902200445df745eccbab7240cc1f

Unfortunately, after some extensive discussions with the other major market participants, I have concluded that the fairest way to resolve this market is almost certainly N/A. I have closed the market for now.

There were two major reasons:

Not getting sufficient agreement on the Poisson process in advance.

I'm also now convinced that it does have a small but noticeable fairness problem in that the market price early in the day has an anchoring effect on the rest of the day. I had briefly considered this issue when thinking about the design, but had not thought it would be nearly as impactful as it seems to have been, and I had also thought it would advantage team YES more than team NO (who all agreed to it), when in fact it seems to have ended up being the reverse.

This issue alone could potentially have been addressed by some means other than N/A resolution, but there was also...

A bug that had a small but non-negligible impact on this market (details reported to Manifold and kept private for now). The effects would have been difficult to disentangle, making N/A resolution the only clear way out.

I'll elaborate more on this when I have some more time. If anyone has objections let me know, but so far I believe all the major participants are on board. Or if anyone has suggestions for a viable alternate approach, please let me know, but I haven't thought of any that are feasible.

@jack Let's all share our numbers and dream about what might be.

Invested M$4,046

Profit M$36,990

+239.4%

I have literally no idea what that percentage means.

@MartinRandall :) Note that this is the hypothetical profit if it resolved at 50%. I think the average over the last day is at about 69%, if the coin flip had been <1/3.

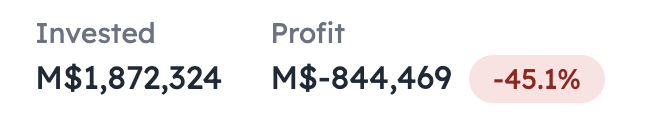

Here's mine:

Invested

M$12,701

Profit

M$97,691 +512.6%

I added some more discussion on the concerns with the current Poisson process (using an average of the previous 24 hours on close) in the comment thread below. And:

I believe that simply closing at a random timestamp and resolving to MKT then works fine and has no such fairness problem. It does still have the "needing to sleep" problem - i.e. potentially advantaging people who can trade more hours of the day, and incenting people not to sleep. I think this usually isn't a big deal, but it becomes one when the amount of mana at stake becomes this large. As mentioned above, some plausible solutions to this could involve limiting trading hours somehow, but I think that creates more problems than it solves.

Also, it's very interesting to note that this market functioned worse and worse as larger amounts of mana were at stake. I think this is generally true of resolve-to-mkt in my experience, and it makes sense because I would say there's a moderate tendency towards truth typically, but a large enough profit incentive can easily override that. In this market, as NO bettors built up larger positions, I went from simply predicting that 99% was overpriced given the market structure, to actively being incentivized to "win" the market for profits.

And obviously this market did terribly at answering the question, whereas if this market had not been [resolves to MKT] it would have resolved YES right away on 9/15. But I still don't think resolve-to-mkt is a clearly bad idea for ambiguous, hard-to-resolve questions in general. What I think is absolutely clear is that for markets that get more trading interest, it's important to have some guardrails. Simple ones can go a long way, like author discretion to resolve if the community comes to a consensus, or if the market probability is obviously wrong. I think you still have to be aware that it isn't robust, but it can work ok on average. And the main other option is polls, which work sometimes, but polls aren't as good at updating on information as markets, for example.

Using this self-resolving market as an example, I think it's providing some types information that would be much harder to get from a poll, such as aggregating new information from Magnus Carlsen's statement. If you ran a poll, you'd probably have to first decide that it's an event worth updating on, and then go out and poll a bunch of people again to get their thoughts. Here, a much smaller number of traders can update the market probability much more efficiently.

@jack Thanks for creating this market! I, too, had a really good time trading along -- I got a lot more invested (mana and emotionally) than expected :sweat:

I think self-resolving might still be pretty good if there was an eg 10% chance of a genuine resolution? This is interesting to me because leverage on different markets would allow for more market estimations with lower resolution costs...

@NinthCause :)

Yeah, that's an idea I've thought about as well! I think it helps substantially, but on a market like this one, 10% chance of me resolving it without self-resolution would still have left massive price incentive to manipulate the market, so I still think it would have failed. But it definitely changes the psychology a lot, which is sometimes even more important - empirically having some small chance of external resolution appears to make an outsize difference.

After analyzing the effects of the bug more closely, I believe it substantially changed the course of the trading on this market. This is the main reason I plan to resolve N/A (I'll leave 24 hours from when I closed last night, just in case).

The way this market turned out is not the way it would have without the bug, although it still is a way it very well could have gone, so it is still good evidence about the fact that resolve-to-mkt can fail badly, especially when the mana stakes are very high.

If it had just been the disagreements about the Poisson process, I think NinthCause was satisfied with them beforehand, and dreev was not. Since NinthCause was by far the biggest YES buyer, we probably could have worked something out where we exchanged shares to essentially undo dreev's position. But since it was not just the Poisson process disagreement, it'll have to be N/A.

My current plan is to have the window in which this market will potentially close be 9/25 to 9/30. I think 5 days is long enough to let the market settle while short enough to avoid excessive delay. But let me know if you have any objections or suggestions otherwise. (Note that while the market has been open a while, I think there's a significant chance that trading behavior will differ once there is a chance for the current market price to be used for resolution).

Current proposal: Starting 9/26, shortly after the end of each day (UTC time), close with probability 1/3 using a public verifiable random number generator. After the end of September 30, close unconditionally.

If the market closed after the end of the day, then compute an (exact or approximate) average (mean) market probability over that preceding day (24 hours, midnight to midnight UTC time), and resolve to this value.

The averaging will be computed as follows:

- If someone has an API script that can compute it exactly, we'll use that. The mean market probability over time is simply the sum over each pair of consecutive bets of the market probability times the length of time, divided by 24 hours. (Haven't been able to get it to work myself as of yet, pymanifold is giving me some errors when I try to retrieve market data.)

- If not, I'll use public RNG to generate 10 random timestamps, and compute the mean of the market probabilities at those 10 timestamps.

To walk through this with an example: The first RNG check will be after the end of 9/26, i.e. around 9/27 12:01 am UTC. We generate a random real x between 0 and 1 via public RNG, and check if x < 1/3. If it is, then we close the market, compute the (exact or approximate) mean market probability over the day 9/26 (24 hours midnight to midnight UTC time), and resolve to that. If x >= 1/3, we repeat the procedure the next day.

@jack Is it too late to voice objections? I don't think there should ever be a hard cutoff. That was the main thing we wanted to avoid, sniping. I guess I also don't like the averaging scheme. There are bots pushing the price down and I have to, y'know, sleep.

The more I think about it the more the average-price resolution feels unfair. It's at odds with how we've been reasoning about it all along and we don't have a good way to compute that average price. I mean, we could replicate the script but that feels like an unfair burden -- something we needed to have known before getting invested in this.

@Yev Exactly. The averaging solves the cutoff problem but introduces another problem that I'm not sure is less bad.

@dreev I think it's too late to change today's resolution criteria, but we can probably do something different tomorrow if the 3-sided coin doesn't land heads.

@Yev That doesn't seem right to me. I think we have a good argument for why the averaging scheme isn't fair after all, so we shouldn't do that. I guess people have been betting furiously under the assumption that that was finalized? What do we do if there's just nothing that can be done that's fair to everyone? Resolve N/A?

@dreev People have already spend thousands of mana trying to keep the price low during this averaging window. It'd be unfair to them to suddenly declare that none of it mattered.

N/A would be fair (although quite anticlimactic).

Oof, yeah. But to be clear, if the averaging scheme stands I'm crying foul, for the reasons I've articulated above, plus just the fact that it's asking too much to follow the discussion that closely, as I failed to do till now and till after I'd spent a ton of mana betting under the previous assumptions. (Maybe there should be some mechanism to alert traders to a change in resolution criteria? And probably 24 hours is a lower bound on a fair amount of warning?)

It would certainly be anticlimactic to resolve N/A. What about pure quiescence where the market can just stay open indefinitely? Probably eventually it would quiesce? The sky-is-blue market did. Arguably that's still unfair to the people who thought they just needed to keep the price briefly suppressed?

But if so, that just drives home the point that the averaging scheme fails at the key stipulation about price manipulation resistance.

PS: This has me wondering -- and I don't want to sound like I'm trying to salvage my original claim about auto-resolving markets cuz I'm totally ready to eat humble pie there -- why not just always use pure quiescence? Some arguments:

The loans feature means people's mana isn't tied up indefinitely.

The market still may be (in general, not in this market) providing useful information even as it oscillates.

We've talked about how auto-resolving fares better if there's even a chance of ground-truth resolution. Resolving only to what the market quiesces to is sorta similar to that.

It becomes kind of a conditional market: what will we agree the market price should be, if we do agree?

In short, an auto-resolving market is like saying "this resolves to whatever we all agree it should resolve to". Until it quiesces, we haven't all agreed yet, so it can't resolve yet. Maybe that's ok-ish?

PPS: As I'm typing this I'm trying to respond to the bots and push the price back up but I have no idea how to reason about the new rules and it feels like a totally new game we're playing. So I just want to reiterate -- and still within 24 hours! -- my strong objection to the new resolution rules.

@dreev Thanks for bringing up your concerns, it's never too late to voice them, although I'll have to think carefully about any changes to ensure fairness. I think at least it is probably possible to change the resolution procedure for 9/27 and onward without being too unfair to anyone. I thought you were happy with the broad strokes of the proposal (including the fact that it would run 24/7 in particular) based on your earlier comments, I'm sorry if I misunderstood. In retrospect I should have explicitly polled the major participants to get a consensus on the final proposal, but I felt it had not really undergone any substantial changes from the earlier proposals so we had agreement already.

Firstly, I want to reiterate that I am committed to ensuring that the resolution process is a fair representation of the market probability. I tried to come up with a mechanism to be as fair as possible to all participants, and I will continue to make adjustments if they can improve the fairness.

1. Average-price resolution

> It's at odds with how we've been reasoning about it all along and we don't have a good way to compute that average price. I mean, we could replicate the script but that feels like an unfair burden -- something we needed to have known before getting invested in this.

The averaging is simply modifying a previous proposal, which was to randomly resolve at any point in time. That's easy and fair but highly volatile. I believe averaging preserves roughly the same expected resolution, while reducing the volatility when prices are wildly oscillating.

Note that the original idea of resolving randomly at any point in time would have exactly the same result: other people trading while you are asleep could move the price, and it could have randomly resolved in the middle of your night. I'll address this point further below.

Regarding the calculation - I got most of a script for it mostly done (https://gist.github.com/jackc271/5f85902200445df745eccbab7240cc1f). And earlier I proposed that if I couldn't get the exact average computation working, then we'd just approximate the average by taking a random sample of 10 timestamps - that would have exactly the same expected value, but with some more noise. I think they are equally fair, it's just some tradeoffs between implementation complexity and noise.

2. Bots and sleep

> I guess I also don't like the averaging scheme. There are bots pushing the price down and I have to, y'know, sleep.

Thinking about this more, I think the issue isn't about averaging, it's about the fact that a) the market is open for trading 24/7 and b) the market price at all hours is being counted in the resolution mechanism. Would you agree with that assessment?

Note that I had always assumed in the discussion of the Poisson process that it would effectively run 24/7 unless we explicitly chose not to - see Martin and my comments in the discussion threads on both markets. (On my lower-stakes markets, I typically just say I'll resolve at some arbitrary time in the day, but I want to avoid any potential bias on higher-stakes markets like this one.)

A hypothetical: let's say we kept the market open only during some chosen market hours during the day. (Doesn't have to be stock market hours, could be whatever is most convenient for the traders). This has the advantage of making it easier on the traders, and concentrating liquidity during that period of trading. It has the disadvantage that people are on different timezones and different schedules, and there are e.g. UK traders who would be trading at very different hours than US traders. Leaving the market open 24/7 makes more fair between participants in different timezones.

Similarly, we could hypothetically use market data only from specified hours of the day for resolution. E.g. we could say that the market will only resolve based on the market price during the daytime PDT, or only between 7pm and 9pm, or whatever. (This could be implemented as only having the Poisson active during those hours, or only using those hours for the average, it works out basically the same.)

It does have some advantages, if all the major market participants can agree on some good hours, I am happy to use those, but I don't want to unfairly disadvantage someone in a different timezone.

3. Hard cutoff

> I don't think there should ever be a hard cutoff. That was the main thing we wanted to avoid, sniping.

I don't think it's an issue. Even when we hit 9/30, we are still resolving to a random/average price during the day, so it still avoids the last-minute-trading problem. One of my previous proposals was to not even have the 5-day window but instead just a 1-day window, I think that would still work fine.

And the reason I want it is I think it is it's a big help for traders to know they'll get their payouts by some predictable date, and it's a big help for me as the author who has to keep operating the procedure every day until it's closed. That said, I'm not opposed to removing or adjusting the hard cutoff, if that's what people prefer. For example, another option is to gradually increase the probability of close every day e.g. increase it by 10% every day.

4. Why not just quiescence?

Because the market might never settle, or take absurdly long to do so. I would bet it would be months at least. An author could certainly create a market like that, but having a reasonable timeframe for close was always my intent.

Just as an analogy, the stock market is constantly fluctuating, but people still use average prices and daily close prices as meaningful numbers. (A tangential interesting fact: stock close price is far harder to manipulate than a Manifold market, and also illegal to manipulate, but even so there are many stories of people manipulating it! See https://www.bloomberg.com/news/articles/2022-02-16/what-block-trades-are-and-why-the-sec-s-investigating-quicktake for example.)

> The loans feature means people's mana isn't tied up indefinitely.

Loans do not solve the problem of tying up funds. If this market lasted a month or a year, most of my investment funds here would be tied up for most of the duration.

> The market still may be (in general, not in this market) providing useful information even as it oscillates.

Yeah, the timeframe in which the market is open and in which it resolves is a design decision for the market, and different markets call for different lengths of time. E.g. if it is resolving uncertainty about the answer, that's probably good, and could take some time.

> We've talked about how auto-resolving fares better if there's even a chance of ground-truth resolution. Resolving only to what the market quiesces to is sorta similar to that.

Hmm... I don't think that's similar, the whales in this market could also achieve quiescence by putting up massive limit orders around the equilibrium price point.

> It becomes kind of a conditional market: what will we agree the market price should be, if we do agree?

There may be some truth to that, but isn't the market price supposed to be that too? Obviously market price can be manipulated, but so can quiescence I think.

To summarize things a bit, I believe that I can boil down @dreev's main concern here is on averaging vs resolving at a randomized time. I view these as basically equivalent in terms of the expected value of the resolution, and therefore they have almost the same market incentives. Averaging just reduces unnecessary randomness and volatility. But if participants prefer, I am happy to just resolve to a random point in time (that's why I gave both as proposals earlier).

@jack I'd prefer non-random as it reduces variance and (given a public script) is easier to replicate.

@jack I'm opposed to changing the resolution criteria tomorrow, if that becomes relevant, as my bets in this market were based on my expectation on how it would resolve over the five day period. Sorry to be awkward.

Please let me know if I have misunderstood your main concern @dreev, or your other concerns.

A few other comments:

But if so, that just drives home the point that the averaging scheme fails at the key stipulation about price manipulation resistance.

Not at all, my argument all along has been that resolve-to-mkt is fundamentally subject to price manipulation. All this stuff about randomized or averaged resolution is purely to address the smaller problem of last-minute price manipulation. Price manipulation in general is (I claim) impossible to robustly address without some sort of rule that at least potentially allows non-mkt resolution. But we can at least ensure that the market price over a longer period of time matters, to give everyone a chance to trade and have price input on the market resolution.

(Maybe there should be some mechanism to alert traders to a change in resolution criteria? And probably 24 hours is a lower bound on a fair amount of warning?)

Copying my earlier comment: I thought you were happy with the broad strokes of the proposal based on your earlier comments, I'm sorry if I misunderstood. In retrospect I should have explicitly polled the major participants to get a consensus on the final proposal, but I felt it had not really undergone any substantial changes from the earlier proposals so we had agreement already.

To add some more details: I posted the first outline https://manifold.markets/jack/will-biden-be-president-on-915-reso#Kw05SzzVLw7jKREuugpM 9/23, so there were two full days (9/24 and 9/25) for comments. This outline has what I think is the key point, which is using a Poisson process to close at the end of a random day, and generating a random timestamp during that preceding day and resolving to MKT prob at that time. And I interpreted your comments as meaning you were happy with this proposal (please correct me if that was not true).

Then, based on discussion there and in my market on how to resolve-to-mkt, on 9/24 I posted a more detailed set of proposals https://manifold.markets/jack/will-biden-be-president-on-915-reso#heILj7OnjOh9AeyDTN8b which included the proposal of either averaging over the day, or resolving to a random timestamp during the day. My view is all the variant proposals are fair, and I don't have a strong opinion between them. But based on discussion, people were leaning towards preferring averaging.

So on 9/25 morning I picked the averaging proposal with the intent that it would come into effect at midnight UTC. I did this because I didn't want the process to drag on, and in my mind averaging and randomization did not substantially change market incentives, and the comments so far had agreed that they were basically equivalent in terms of market structure but preferred averaging as simpler and lower-variance.

I'm opposed to changing the resolution criteria tomorrow, if that becomes relevant, as my bets in this market were based on my expectation on how it would resolve over the five day period. Sorry to be awkward.

Totally fair and understandable! However, I am optimistic that we can either explain why the current system is fair to everyone's satisfaction, or make minor adjustments that everyone agrees are fair as well.

Also I want to be clear that everyone was aware that we were going to add the poisson process if quiescence didn't happen soon enough, and team NO bet accordingly - during the pre-poisson period team NO built up a huge position of NO shares bought at good prices (90s), while ensuring that the price did not quiesce; and then when the poisson window opened they moved to "correct the market mispricing". I don't think the details of the poisson process make a substantial difference, either way this was the team NO plan from the beginning.

(Think of this analogy: if this were a normal author-resolved market on whether Musk would win the lawsuit vs Twitter, and team NO had insider info that they knew would remain private until the trial started, and team NO therefore gradually builds up a large position at favorable prices prior to that date. Then the trial starts and the price starts moving a ton.)

To close the loop on this a bit, I was talking with @dreev on discord and actually the issue wasn't averaging, he agreed he had the same objection to using a random timestamp in the previous 24 hours. After more thought, I'm also now convinced that it does have a small but noticeable fairness problem in that the market price early in the day has an anchoring effect on the rest of the day. Firstly, consider if you don't have any Poisson process and just average over 24 hours - then halfway through the day, half of the price has already been determined and you have upper and lower bounds on the outcome with a range of 50%. With the Poisson process as well giving a 1/3 chance of close, instead of being 1/2 determined it's actually 1/6 determined halfway through the day, which is not nearly as bad but still a substantial amount.

I had briefly considered this issue when thinking about the design, but had not thought it would be nearly as impactful as it seems to have been, and I had also thought it would advantage team YES more than team NO (who all agreed to it), when in fact it seems to have ended up being the reverse.

I believe that simply closing at a random timestamp and resolving to MKT then works fine and has no such fairness problem. It does still have the "needing to sleep" problem - i.e. potentially advantaging people who can trade more hours of the day, and incenting people not to sleep. I think this usually isn't a big deal, but it becomes one when the amount of mana at stake becomes this large. As mentioned above, some plausible solutions to this could involve limiting trading hours somehow, but I think that creates more problems than it solves.

Another possible approach to market design (not for this market, but in general) is to take a more quiescene-oriented approach. One idea I had considered was to start with a threshold of closing the market if the price stayed within 1% for 24 hours, then gradually increase it (say 1% per day). This has some pros and cons, and you'd still need to figure out how to actually pick the resolution value - if you try to use say the midpoint of the range is manipulable, and if you try to use average over the day that has the above problems.

@jack I honestly thought this was a pretty obvious consequence of your mechanism design, and that anyone with several thousand mana on the market would realize it and act (or object) accordingly. Both sides had fair and equal access to the same strategies - recruiting partners, writing bots, setting limit orders, etc. This is why I sold out 10,000 NO shares for at m600 at the start, I thought this was a good price.

I was completely wrong-footed when I later realized that Daniel and Austin weren't paying any attention to the market during the crucial initial stages of the Poisson process, and perhaps weren't playing to win. I was further confused that nobody else bought YES shares at ultra-low prices like 20%, which would have given them a 3-4x return with minimal risk. To repeat something I said before on this market, nobody behaved like I predicted.

@MartinRandall Yeah, it was super interesting. I think NinthCause was a couple hours late (quite possibly because they were busy with building Manifold lol) and then put up a big batch of limit orders, which wasn't an entirely unreasonable strat given they were assuming that their limit orders would hold, or even baiting NO into buying mana to fill them.

Also, for reference, the structure of the Poisson process here is consistent with what I had in mind from the beginning and I think the market text is reasonably clear about it, although @dreev interpreted it very differently. It's also consistent with what I have been doing on my other self-resolving markets (see https://manifold.markets/jack/what-is-the-probability-that-a-coin or https://manifold.markets/jack/how-clear-do-you-think-manifolds-co for example), but just with a more formalized / secure / verifiable way to do the randomization in order to avoid any bias or potential for bias.