See https://manifold.markets/AlexLiesman/manifold-plays-chess-move-1

The invisible hand of the market is playing as white, vs Alex as black. Alex claims to be rated ~2000 on lichess.

Resolves to "Yes" if we win, or "No" if Alex wins, or "Prob" at 50% in case of a draw, or "N/A" if the game is not complete and I judge that it's not likely to continue further.

I'll update the close date if it approaches and things are still going.

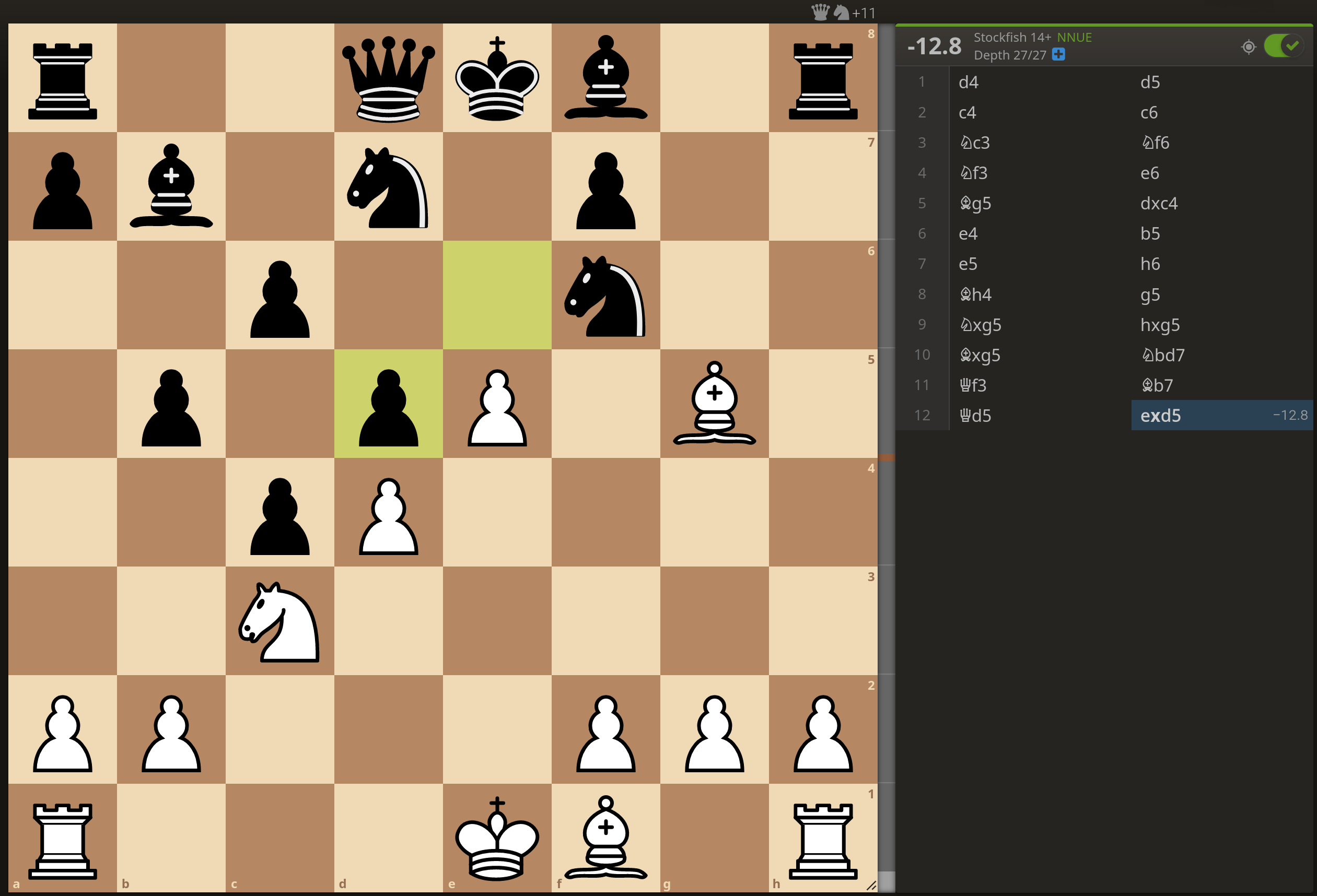

d4 d5

c4 c6

Nc3 Nf6

Nf3 e6

Bg5 dxc4

e4 b5

e5 h6

Bh4 g5

Nxg5 hxg5

Bxg5 Nbd7

Qf3 Bb7

Qd5 exd5 0-1

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,131 | |

| 2 | Ṁ55 | |

| 3 | Ṁ51 | |

| 4 | Ṁ49 | |

| 5 | Ṁ42 |

People are also trading

@AnselFreniere Yeah, as proven by @jfjurchen trying to manipulate the policy markets in order to profit off this one.

What woukd be the correct way to defend against this? In a future market we could add a "N/As on manipulation" clause but that only encourages subtlety, not honesty.

I think a more resilient structure would be to have a pile of markets for each round: "will white win if Qb3?" where they all close at the same time and only the best doesn't N/A. But that requires spamming lots and lots of markets.

Maybe with Manifold support we'd be able to do it in a way that isn't totally clunky.

I think the design you're suggesting there (if we don't care about spamming markets) would be:

- At each step of the game, make one market for every legal move: "Contingent on move X being played, does white win?"

- Select the move corresponding to the highest-probability market. Resolve all other markets N/A. Leave the chosen market unresolved for now (not sure it matters whether you close it or not).

- Repeat until game is over.

But I think that's still manipulable in practice by the mechanism of "bet NO (hopefully at good odds) for the best move on every early market, hold those NOs, then bet YES on blunders later," since it costs you nothing to bet YES on a blunder that doesn't get chosen. If there are 10 candidate blunders and I can time my bets to "right before closing" then I can effectively 10x my bankroll - if I have M$1000 to bet YES on a blunder, and the actual best move is trading at 50%, then the honest bettors would need to commit M$10k to prevent me from pushing a blunder of my choice to 51%. And betting NO on the good moves (which the manipulator already wants to do in order to get their profit) also lowers the margin that the manipulator has to push the blunders over!

It would be less manipulable if you express something like "I have a M$1000 bankroll, and I would like to bet M$1000 on NO for each of these obviously bad candidate moves - this is okay because we know that only one of those markets can possibly resolve something other than N/A, so I can't go negative." That would mitigate the "bankroll multiplication" issue. A good way to close markets at an unpredictable time and/or write reliable trading bots would also help prevent a manipulator from swooping in at the last second.

@jfjurchen By "reliable trading bots" I mean a way to express something like "if someone buys M$10k of YES on this market at the last minute, buy NO down to 10%" and have confidence that it will actually execute. Today you can bot-trade through the API but if two bots are trading on the same market it's effectively a coin flip which one goes last - what I'm envisioning is that the bots run on actual Manifold servers, and at market close time they can respond to each others' bets MTG-counter-war-style until they both pass. The order book is an approximation of this but it has the downside of being public (so adversaries know exactly how to exploit your strategy, e.g. "oh you're going to stop at M$1000 so I can bet exactly M$1250 at the last minute and push the market to where I want it") and being very limited in what it can express.

One approach that might work is to only allow folks with "skin in the game" to vote on later markets. So something like this:

- For the first move, anybody can bet any amount on any move, with the "contingent on choosing this move, does white win?" structure described above. We select the move with the highest YES probability.

- Once we've selected that move (let's say it's 1. e4), its market just means "will white win?" - the "contingent on 1. e4 being selected" clause is no longer relevant.

- For the second move, we only let you buy up to N shares for any particular move's market, where N is the total number of YES shares you own on that market. So you can bet M$1000 YES on a blunder, but only if you've got M$1000 YES already locked in for "will white win?". There's no reason for a rational bettor to bet YES on a blunder in that situation.

- Once we select the second move, the second-move markets also reduce to "will white win?". We add together your positions from the first and second chosen move to get your total YES/NO exposure - this could be up to twice your initial YES bet. Then we repeat the process.

With that approach, there is still a bit of a sybil problem. You can imagine a bettor buying 1000 shares of NO on account A and 500 shares of YES on account B, and then using account B to vote 500 shares for blunders on every subsequent move. But I think it makes the attack riskier and more expensive.

But you probably need a much larger userbase than Manifold has today for this to work well.

Oh, actually, I'm overcomplicating things. The way I'd expect it to work under the pure "contingency market" design (assuming unlimited bankrolls, e.g. via loans) is that, for any given move, everyone with X shares of YES across all the earlier markets should buy at least X shares of NO on every blunder market. This is basically hedging their earlier bets - if the blunder is chosen then their NO shares pay off, and if not it resolves N/A and they've lost nothing.

As long as they do this, everyone with a net YES position will be made whole when a blunder is chosen. Since these are all parimutuel markets, the fact that every honest bettor is at least made whole means that the manipulator cannot have made any money. And in practice they'll have lost a ton on the final market, since smart bettors will be buying as many shares of NO on the blunder as they can afford.

@citrinitas If Manifold could implement a "maximum bet" option for the market creator, that would be good for poll markets like this. As it is, poll markets are "most money wins".

If I were designing the chess futarchy markets, my first instinct was the same as suggested above: for each move decision to be a set of binary markets, each one being "If we play move X, will we win?" Then you pick the move with highest probability, and resolve at the end of the game.

I think this works pretty well, but I think one big issue with this design is that people's mana will stay locked up for the entire duration of the game - it's very capital inefficient. And loans aren't a suitable solution to that because those markets are all 100% correlated (they all resolve the same based on whether we win).

You could try to strike a balance by evaluating the position after N moves. Examples could be, after N moves resolve to some simple evaluation of the board position (say, will we gain/lose material, or the evaluation of a weaker stockfish), or to manifold's evaluation of the win probability from another market.

Here's my ruleset proposal I currently have in mind for Manifold Plays Chess 3:

- One main market: Will Manifold win?

- For each move, we ask a much weaker stockfish to generate 5 candidate moves. We create a market for each: If this move is chosen, what will be the win probability on the main market after 5 moves? The one with the top probability is chosen (the others resolve N/A). There will be anti-snipe rules (e.g. use the average probability over the last 5 hours, or allow the market to extend if there's excessive volatility just before closing).

@Mateon1 Not trying to troll, just seemed like betting on bad moves was neutral-to-positive EV on the underlying market and +EV on this one (with the caveat that I do not have a good intuition for how parimutuel markets work). Hadn't been thinking about the ongoing subsidy, but I think it's appropriate to bid this market way down regardless because it just takes one blunder to lose.

@jfjurchen Sure, but how much money have you lost already? You can't have more than 4k NO shares on this market, and you paid over 2.6k for them. I'm pretty sure you already lost more than you could possibly profit.

@Mateon1 I've gotten unlucky with the RNG on the "what move should we make markets" so far, so I'm likely to end up losing money, but I don't think those bets were negative EV and I'd happily continue to make them with my daily streak money forever (and I expect other traders will eventually do the same).

If there are 50 moves in the game before we get to a state where white cant blunder it away, then I'd buy NO on this market down to below 10% if I expected blunders to typically get even 5% of the vote in the underlying market. They've been getting more than that so far. And the loan mechanic means I can go in on this market pretty hard and still participate in the "what move to make?" ones - I'm just going slow for now because I'm worried that I'm missing something about dynamic parimutuel markets and choosing blunders on the move market isn't actually neutral EV.

I feel like I'll let your loss of money over time speak for itself. I figured out you can check someone's positions on their profile, you only gain ~800 mana from this resolving NO. If you vote early and decisively (and accurately) on a move, you can probably get about 100 profit per move, which you'll get unless someone trolls, pays enough to get a meaningful percentage, and then wins the dice roll.

@Mateon1 The die roll is neutral EV regardless of how anyone else bets (unless they push me below 0.1%) - it's parimutuel and there's nothing about the resolution criteria that rewards betting on good moves. You're just buying a share in a slightly-subsidized lottery where the winner also gets the option of blundering in the chess game.

If someone trolls me by betting $1k to push their answer to 80% when I've got 250 in, then there's an 80% chance I lose 250 but a 20% chance I win their 1000. The fact that I've lost two die rolls in a row doesn't prove that they were bad bets.

@jfjurchen In isolation, sure, but you have to consider that this market being at 20% is a significant incentive to play winning moves.

@Mateon1 Yes, definitely, and that's why I'm no longer buying NO past 20%, but there's a massive asymmetry in that winning requires ~50 good moves in a row, but losing only requires a single sufficiently-large blunder. I just wish the "what move to make" market didn't close at 3AM Pacific...

@jfjurchen I can't exactly say how you're miscalculating, since I don't fully understand the parimutuel rules, but as of this moment, your expected profit is -23% on the 8th move. The expected value of the market per manifold is pretty accurate, since the resolution is effectively PROB, so you are certainly miscalculating something.

@Mateon1 Yeah, I still think NO is a good buy at 20% but I'm gonna dig into the math some more before I make any more big bets on the "what move to make" markets. I'm starting to think that making bets on that one before the last minute is negative EV, and I'm not awake at market close.