Resolves YES if we set the daily loan rate to any number lower than 4% any time before September (even if we later re-raise it).

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ269 | |

| 2 | Ṁ116 | |

| 3 | Ṁ112 | |

| 4 | Ṁ108 | |

| 5 | Ṁ106 |

People are also trading

made a somewhat related question about variable loan rates: https://manifold.markets/AndyMartin/will-manifold-use-a-loan-rate-that

@DanMan314 Yeah, confirmed in Discord that it was a code issue so it wasn’t them setting the loan rate to anything. Shouldn’t affect this market.

If I understand correctly, loans grow your portfolio linearly (i.e., you don't get "compound loans"). The loan amount is based on the mana that is both invested and belongs to you, so basically 4% of net worth every day if you always reinvest.

For users (like me) who care about risk of ruin and pursue a balanced, low risk trading strategy, this sets the correct incentives, namely broadening and broadening the portfolio over time.

For less careful users, this just means that a bunch of them wipe out way into the negative, and a small amount shoot up to balances in the millions. Since manifold doesn't charge users for negative mana, this means they'll be giving away a lot of mana.

For reference: starting from 1000 and reinvesting into the same market every day, a user will have a position in that market of 91K after a year, 314K after 2 years.

Math:

def daily_growth(networth, loan):

... return networth + 25, loan + networth*0.04

...

>>> networth, loan = 1000, 0

>>> for i in range(365):

... networth,loan = daily_growth(networth, loan)

...

>>> networth, loan

(10125, 81030.0)

>>> for i in range(365):

... networth,loan = daily_growth(networth, loan)

...

>>> networth, loan

(19250, 295285.0)

I will gladly take 1% of the mana this comment saves manifold as a commission :)

@VitorBosshard Previous loans count against your total invested amount, making the growth sublinear. For your math to be accurate you need to subtract the current loan amount from the networth before multiplying by .04.

Return networth+25, loan + (networth-loan)*.04

This is one of the primary mechanisms to stop the compounding you point out from spiraling out of control.

I feel like maybe 2.5% or 3% is the sweet spot? I feel like 4% is the point at which the cons become more apparent - it feels like it might make the site's most powerful whales too powerful.

Then again, higher loans make it easier for me to create markets - especially multiple-choice markets with a lot of options, which I like making and are also pretty expensive to make. I think prediction markets are generally more accurate the easier betting is, as well, and letting people get invested in a more broad portfolio of markets more easily is probably a good thing too.

tl;dr I think I like 4% more than 2%, but maybe something like 2.5-3% might be more balanced.

@evergreenemily Progressive trader bonuses I think are the answer here. I'm not sure what the statistics are but I would guess, (and also bet, if someone wants) that the majority of markets do not pay back their initial liquidity cost, and that this is doubly true for multiple choice markets. Perhaps a larger user base would fix this problem, but not as is. It's curious to me that manifold seems very willing to throw mana at some problems, loans and streaks are probably the best example, but certain others, like a dearth of interesting markets, users are actively disincentivized to solve. Perhaps the argument is that loans and bonuses are the intended solution but the counterfactual is receiving the bonuses and loans anyway, regardless of if a market is created or not. Quests are the exception, but I'm not even sure those are still viewable.

It's also interesting to me that trader bonuses stop paying out after some point. @QuantumObserver has plausibly done more to grow manifold than the average actual employee, why not offer huge incentives to create huge markets? The win for manifold here, I think, was a first mover advantage because the userbase was on the ball, so it makes sense to pay out to the specific person who made the first market, because it actually is that much more beneficial than the counterfactual of the market being made a few days or even a few hours later.

@Sailfish I'd be willing to bet on that as well. I'm in the top 106 market creators on the site, with 55 followers, and most of my yes/no markets still don't get enough traders to break even - I'm not sure any of my multiple-choice markets ever have, either (though it helps that it's 3 mana per unique trader per answer, which means the more answers you have, the more trader bonuses you get, at least in theory.) I've just internalized market creation as a cost at this point - I'm well aware that I probably won't get back the mana I spend creating a market until it resolves. I can still afford to make markets because I have a lot of investments to sell for liquidity but A: not everyone does and B: much of that is from buying mana specifically because I ran out and wanted to make a market. The trader bonuses used to be 10 mana per trader - I understand why they were reduced, but I think it also removed a major incentive for market creation. Creating markets is just as valuable to Manifold as earning profits by betting on markets - arguably more so - but it's also a mana sink unless you make a market that gets really, really popular. Also, quests are still viewable if you click on the streak icon on your profile.

Also, wait, do they??? I don't think I've ever had trader bonuses stop paying out on any of my markets, even the ones that have hit 50 or more traders.

@Sailfish Huh. I feel like that's a bit of a low cap - if you make a market that over 100 people want to trade on, I feel like you should still be rewarded past that point. Big, active markets are good for the site.

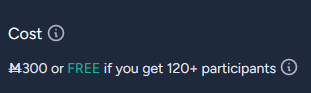

@MartinRandall I'd hope so - otherwise large multiple choice markets will never break even. FWIW, Manifold's UI does say this if you try to create a multiple-choice market with 12 options:

@evergreenemily Agree. Also, RE:

Regardless of if this is implemented, but especially if it is, the "destroyed mana" should go into a shared liquidity pool to subsidize market creation. Creating markets being free seems obviously bad (people will create too many, and there does need to be a starting liquidity subsidy) but the current cost is too high. Some users value markets being created, let them subsidize it directly.

For what it's worth, the other current mana-sink, boosts, is also overpriced.

@Sailfish Boosts also don't bring in new traders, in my experience - I've just stopped boosting my markets since it's just burning mana.

As for subsidizing markets directly - that's a good point. I've seen some bounty markets like that...I actually might create one myself, since I can afford to.

@evergreenemily I actually wrote this out but it seemed a little too far off topic so I didn't post it.

In my experience, manifold's twin issues are a lack of interesting markets and the difficulty of finding the scarce existing interesting markets. Spending hundreds of mana to make a market is almost always negative EV and loans are currently the only thing that makes this feasible, unless you are already a 1%er (Many of whom, to their credit, seem to have bounties to pay users to make markets, although this imposes a familiar grant-application-cost tax), or willing to pay real money for mana. Manifold seems to be following a problem somewhat analogous to EVE Online, where the dedicated users you might expect to pay for Isk have no issue simply making it in game. I don't think 1,000 mana is worth ten dollars, but I don't know how you could ever change this without revealing some uncomfortable truths about the charity pseudo-peg.

EDIT:

(NB, I would pay real money for mana with no additional changes to site functionality if boosts were sold on a market instead of at a fixed price)

@Sailfish Yeah, I broadly agree. If I wasn't in a financial situation where I feel comfortable buying mana, then I wouldn't have been able to create nearly as many markets as I have. I don't think the situation has reached EVE Online levels yet, but it definitely feels like the site's whales/1%ers have disproportionate influence not only in how markets are priced, but what kind of questions get asked, too.