Pretend you are creating a new prediction markets platform of some type that you are responsible for. If you had to pick one direction, what do you think would be the best way to combat the, "Alts," problem (and why, if you are so inclined to answer)? You can comment other and offer your own solution which may be a combination of the above or a new solution. You may choose to comment why you picked the solution you did or why you don't like other particular solutions.

The Alts Problem:

Generally, creating multiple accounts in order to serve some other larger strategic goal, e.g. funneling money into a central account, increase one's chance of winnings, whether through the use of alt accounts, with or without an API, using a wide definition.

Why Alts Are Considered a Problem At Manifold

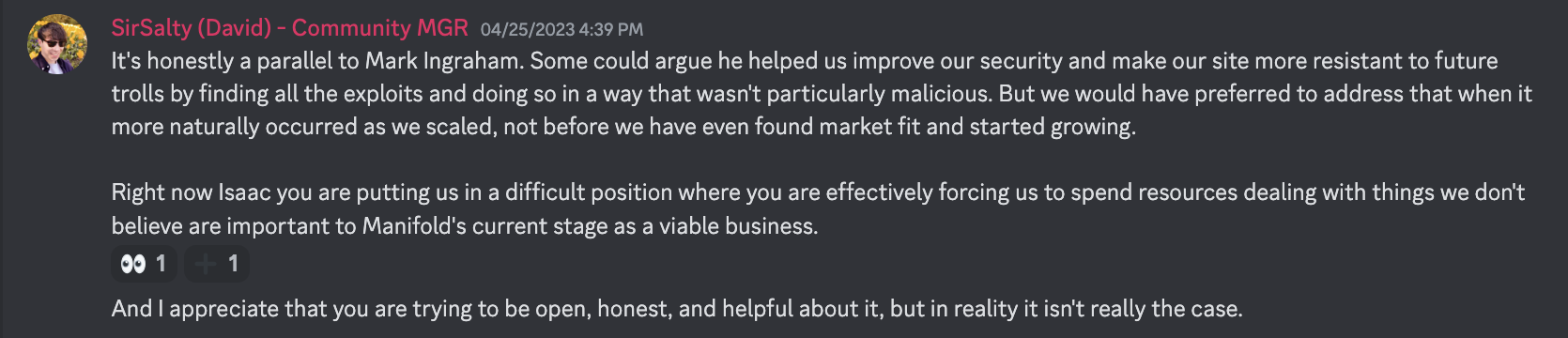

In short, it seems that Manifold (and likely any other platform) would rather spend resources on software, features and user growth than security. This is a common pattern across many companies and software offerings.

E.g., re: the Whales vs. Minnows market:

Example Past Alts Problem:

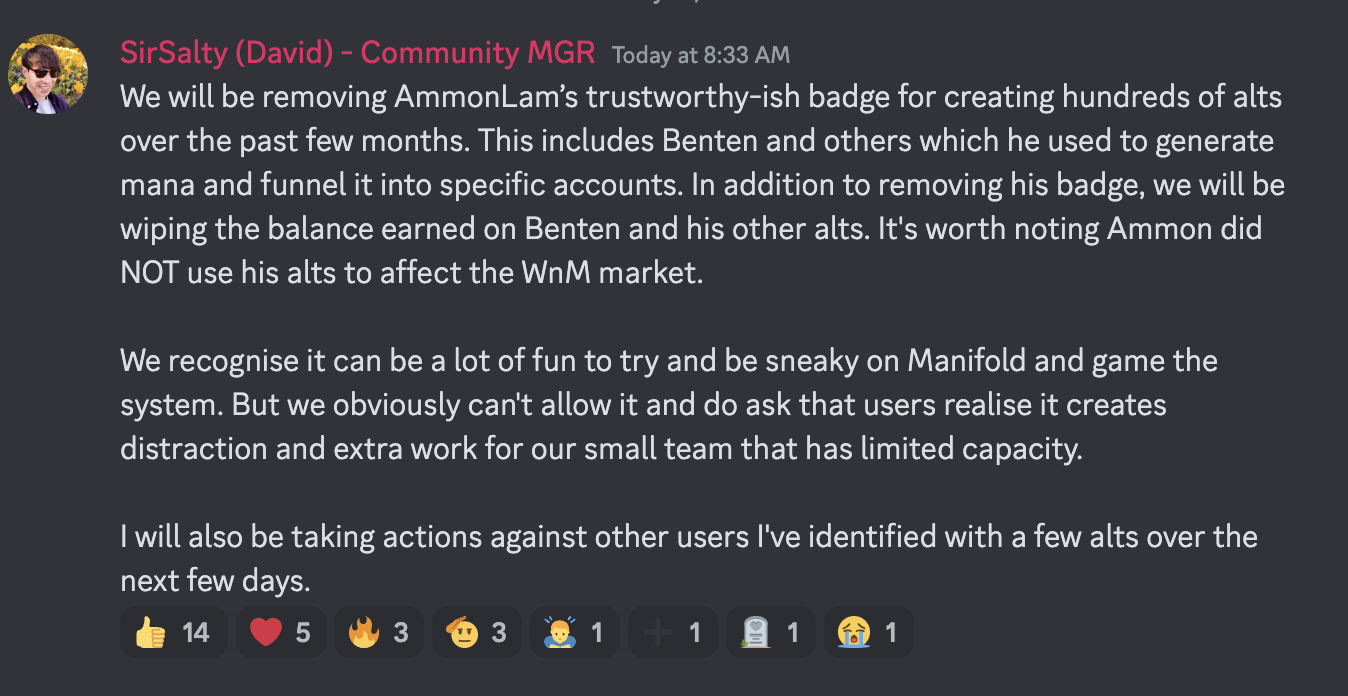

AmmonLam

From a Search on Discord / Manifold:

Then there's a whole thread on @IsaacKing exploits here, with varying opinions, relating to whether rules need to be clearly spelled out, or whether a certain level of non-anti-social environment must be relied upon for a system to work, e.g., "we live in a society."

https://discord.com/channels/915138780216823849/1100521704578625618

People are also trading

@jgyou Not really. Sybil attacks require securing computational resources, which requires money, which is (close enough to) zero-sum. Competition between different actors for a limited supply of money keeps things constrained. There's no such constraint on Manifold accounts.

Reposting from discord: Assassination markets are not a real problem on low value markets or when users are identifiable, but they are a problem when significant amounts of real money are involved and users are anonymous. For any high value real-money prediction market to be ethical, I think it'll need identity verification. (Though it could allow anonymous bets that are only de-anonymized to law enforcement when necessary.) This doesn't necessarily mean that small startups need to start with identity verification, but I think that has to be the long-term outcome, which also solves the alts issue.

I understand that people really like the idea of anonymous betting (as do I), and such a thing would indeed help with private-information-solicitation. But for the general public to accept a high value general purpose real money prediction market, I think you'd need identity verification anyway, so you may as well use it to solve alts at the same time.

@IsaacKing Your thoughts on groups / federated instances and allowing anonymous groups vs. identified groups? Originally in the 1600's (or around that time) I believe companies were actually referred to as, "Anonymous Societies," and all of the partners were literally anonymous from one another. In certain Latin American countries they LLC's are still called, "S.A.," Sociedad Anonyma"

@PatrickDelaney I've heard of Mastodon, don't have an account. Never heard of any of the others. (I just looked them up on Wikipedia.)

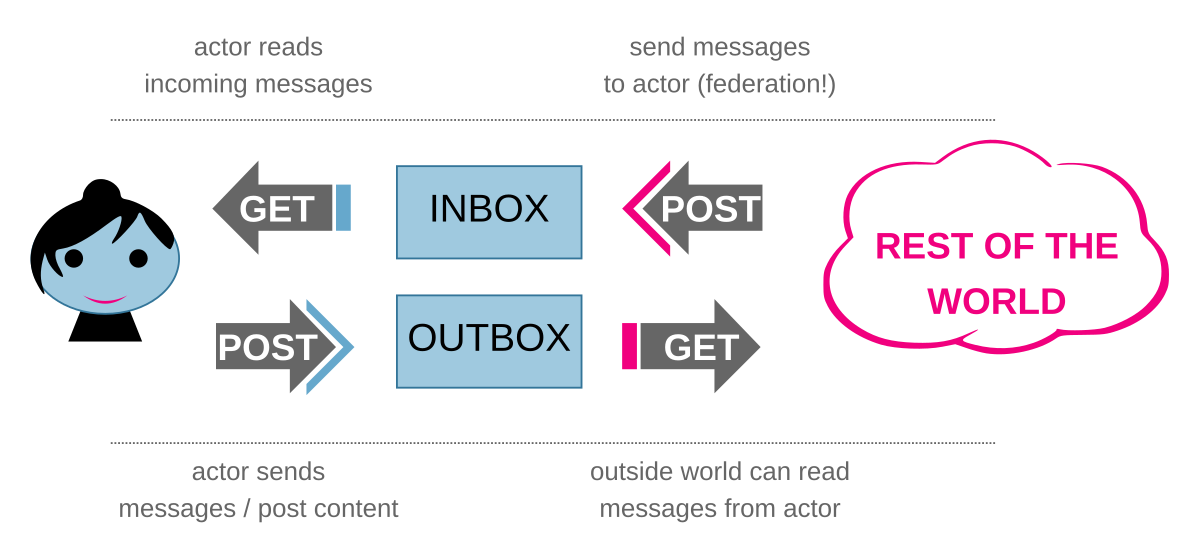

@IsaacKing So hypothetically Manifold or any prediction market platform could implement ActivityPub, allowing your Manifold account to post on Metaculus, Kalashi, etc., so there would be a global prediction space. Seems to make sense since prediction markets link to each other all the time. Why shouldn’t you, as a user be able to comment on any market or bet on any market on the web? Why have multiple accounts other than, all of the platforms are trying to create silos that only they themselves own?

@PatrickDelaney The caveat being, different servers could optionally block each other, so if there is a purely edge lord prediction market that emerges, perhaps Kalashi blocks them but Metaculus doesn’t, because the content is not compatible.

@PatrickDelaney Using those two marketplaces as examples only. I have no idea what content dominates on either of those.

@PatrickDelaney Hmm, seems that might cause some confusion? It depends on how integrated they are, but if a user's UI shows all markets as part of the same general "thing", I could see a lot of incorrect assumptions being made about one platform's moderation practices or market mechanisms vs. others.

I also think "groups should have their own currencies" is a killer idea.

You could have the "sandbox group" that markets go into by default, that works exactly like Manifold, that has all the usual problems.

But you could also have a group dedicated to e. g. "AI predictions tournament", with its own currency, and anyone that wants that currency has to buy it from someone that already has it(the group creator decides the currency issuance policy).

Any markets in a group have liquidity drawn from the group liquidity pool too, and maybe only moderators can make markets.

Then, different groups can have different standards on how stringent their alt policy is. A "real money forecasting tournament" that uses your profits in the group to reward you, might check your id card or require a credit card transaction or public social media account or vouch from an existing group member or something. But the sandbox, anyone with a Google account or even just an email can sign up.

@Mira Why stop at, "different groups," within a single system? Why not federated instances of a hypothetical, "PredictyMarketPlatform," which allows anyone with a computer and internet connection to set up their own Prediction Market platform with their own currencies, own users, open or not, allows blocking of other instances that they choose, and then via ActivityPub, currencies can be exchanged and used on different unblocked federated instances? Essentially...nation states rather than groups. If some group of folks want to create a worthless 3rd world prediction market with a worthless currency, that would be their prerogative to do so.

@PatrickDelaney Like, if there's a Mira AI platform that only allows high end AI/ML predictors as a specialty, the admin could set an exchange rate with other currencies across other platforms. If there is some sort of, "pure memes and trolling," instance, you could still trade on those platforms but perhaps at a 1000:1 exchange rate (or whatever is agreed to between the users). Or, you could just block the memes prediction platform entirely. You could even have one admin run both different kinds of instances if they really wanted, a curated and non-curated one.

@PatrickDelaney That's a neat idea to get some traction: If every Fediverse server had its own currency with embedded prediction markets, with a bit of UI support for Mastodon, MissKey, Pleroma, etc.

You could probably find some big servers to handle it, and they could handle the alt problem themselves. Wouldn't be an inherent property of the software.

@Mira So here's the beauty of the Fediverse, if you're a user on Mastodon already, then if Mastodon/FediPredictyMarketPlatform both use ActivityPub and are designed to be compatible with each other (or Lemmy, PeerTube, whatever), then you wouldn't need to ask the humans administering Mastodon_Server_X to set up a currency, you as a FediPredictyMarketPlatform_Y admin could allow someone from Mastodon_Server_X or Lemmy_Server_Q to just post on your FediPredictyMarketPlatform_Y with a preallocated account balance. Basically, if you have one account on the Fediverse already, you could hypothetically already be set on FediPredictyMarketPlatform servers that your Fediverse server is already whitelisted on.

Here's how this works already with Mastodon/PeerTube. https://framacolibri.org/t/activitypub-how-to-follow-a-peertube-user-from-mastodon/10804

It's mostly a problem because Manifold gives out free money. Every alt is M20 in the liquidity pool, M25 per day on the streak + some amount for quests, M1000 for new user bonus, maybe M200/month for a bronze or silver league prize.

Another problem is people screwing with the statistics by e.g. sending money to an alt to bet against them, but you could fine them or something to undo it so it's not that serious, and it wouldn't affect most people.

Alts are also useful for pseudonymous betting: People are often scared to bet against me, so I don't make as much money as I could as if they didn't know it was me on the other side.

Alts could be used for spam. Mark Ingraham's markets and comments were spam, and Manifold's ChatGPT spammers are "alts" of their creator.

I think your poll is focused on "Given that it's a problem, how do we deal with it?", but you haven't said asked why it's a problem(though you've pointed at Manifold admins concluding that it was a problem). Maybe you want information on the exact reasons too, since if the reason ends up being "we're printing too much money", it immediately tells you how to stop it.

@Mira Very excellent points. Please boost if you so choose:

https://manifold.markets/PatrickDelaney/prediction-markets-poll-if-the-alts

Beyond the free money, another big problem is artificially inflating your profits. This could be a problem on other platforms too, e.g. someone could easily trade with themselves on Polymarket to inflate their PnL, but I don't know whether it actually is a problem in practice.

but you could fine them or something to undo it so it's not that serious, and it wouldn't affect most people.

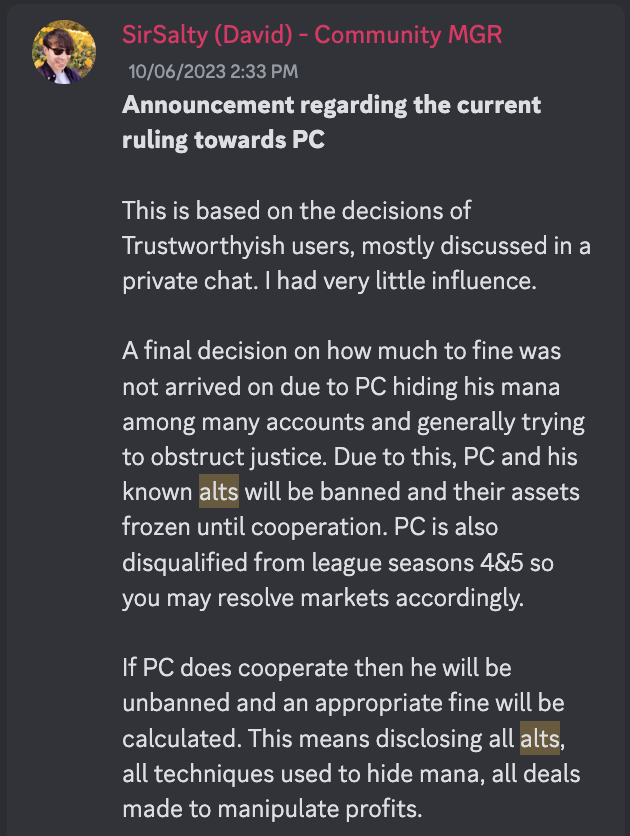

That assumes it's easy to detect these things, which definitely is not true in general.