This market is part of Manifold's 2023 Predictions, a group of forecasts about what's in store for Manifold this year. Markets will be resolved by the Manifold core team.

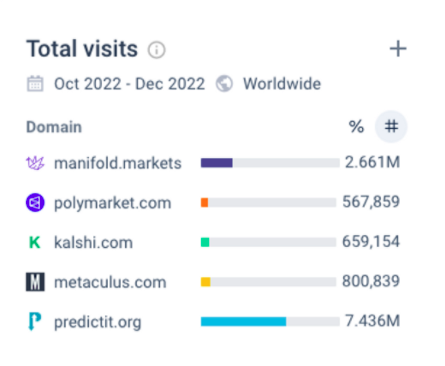

To measure page hits across competitors, we plan on using Similarweb. Note that as of Dec 2022, we had eclipsed Metaculus, Polymarket, and Kalshi, but Predictit beat us all:

[Update 2023-10-06, by Austin]: This question resolves based on what Similarweb says about the number of visits made in the month of December, not the 3 month period Oct-Dec, despite what the default Similarweb screenshots show.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,563 | |

| 2 | Ṁ1,554 | |

| 3 | Ṁ1,519 | |

| 4 | Ṁ451 | |

| 5 | Ṁ403 |

People are also trading

@bohaska Bailing out here, I don't see a spike happening soon, at least not one large enough for Manifold to surpass everyone else, and I don't want to risk bankruptcy.

@bohaska I think that's reasonable. If we're deciding a Time article on Manifold is pretty unlikely, then there's not anything else on the horizon that's likely to do it.

accidental duplicate

November data:

Manifold: 866.3K

PredictIt: 674.7K

Metaculus: 439.1K

Polymarket: 358.7K

Kalshi: 56.5K

Manifold gained 165k visits, but is still not enough for a YES resolution

If manifold.love is included in resolution, then it'll add an additional 166.6K

Wait, would https://manifold.love count towards resolution?

@chrisjbillington Right, but I think the point is that any similar surge has a good chance of resolving this question yes, and if there were already multiple examples earlier this year then 16% seems too low.

How's the current Sam Altman surge?

@jack Yes, and I'm certainly gambling on that. But it'd have to be a big one if the average over Aug-Oct didn't quite make it. e.g. I don't think an article in Time Manazine about manifold.love would do it.

@TheBayesian Also possible that predictit visits go down a bunch after election season. But overall I agree, and that isn't enough to make up for it. The wildcard would be a sudden popularity spike on Manifold, which seems more plausible than sudden drops elsewhere (I kinda assume popularity is sudden up / slow down in general). Maybe from Manifold.love.

@EvanDaniel But we now have @Gen in charge of marketing for Manifold! At least thats something.

Better hope that he does the job well.

(this is pure hope, not sober predicting)

Followup check (August 2023 data):

Manifold: 2.5M <https://www.similarweb.com/website/manifold.markets/#overview>

Polymarket: 838.6K <https://www.similarweb.com/website/polymarket.com/#overview>

Metaculus: 427.6K <https://www.similarweb.com/website/metaculus.com/#overview>

Kalshi: 71.6K <https://www.similarweb.com/website/kalshi.com/#overview>

PredictIt: 879.3K <https://www.similarweb.com/website/predictit.org/#overview>

Total non-Manifold: 2.21M

Manifold is on track to actually resolve YES. This is a steal! 🥳

If they'll resolve like in the picture, then that means they'll measure October-December 2023 data for resolution.

https://analytics.umami.is/share/ARwUIC9GWLNyowjq/Manifold%20Markets

September was comparable to June in Umami, at ~3.2M pageviews. If you want to extrapolate that to similarweb, September should have been ~3-400k. Polymarket also got a boost in August but Manifold is most likely still trailing PredictIt alone.

@Sailfish Hmm, interesting... Still think this market should be trading a bit higher though, at around 35-45%.

@bohaska Keep in mind PredictIt will likely continue to go up as primaries get closer. And august was likely high for manifold due to lk-99. See manifold.markets/stats

@bohaska I don't feel too strongly about whether to use "Dec 2023 only" or "Oct-Dec" for the resolution of this market (though we should decide soon...).

I'm leaning towards updating the question title & resolution criteria to say Oct-Dec to reflect the screenshots we've been using, but let me know if anyone would strongly prefer "Dec 2023 only"

@Manifold I think the title and description as they stand can really only mean "views in month of December", but I think Oct-Dec is a more interesting question, and my preference is probably that it be changed. The only issues I can think of:

A superconductor like spike is now broadly three times more likely, switching benefits "Yes" in this case.

Moderate spikes now have less effect, one or multiple semi-popular markets are now eaten by the return to the mean, benefits "No"

December is likely the most active month for Manifold by far, the "New Year's Resolutions" I expect will drive a ton of traffic, perhaps even much more traffic this year since this has by far been the most active year of Manifold and so the most accumulated year-end markets. Maybe greatly benefits "No"?

The first and last I think could be the two greatest sticking points, but overall I feel like it's a wash and I don't expect I would change my position after a switch to an Oct-Dec resolution period.

@bohaska FWIW, I think if you cast free trial you can access the sacred texts (data which is not a month old) without needing to pay the usual mana cost.

I mean, I would be stoked if manifold was on some sort of monotonically increasing engagement trend, I just don't think that's actually happening. I'll manalink you (or whoever) Ṁ250 if you post September data from similarweb.

@Sailfish I got these graph when signing up for free trial.

And they only have data up to August

Actually, ignore the above, I found out they have a "last 28 days" option. So here's September.

And here are the detailed numbers:

@Manifold It would be good to decide what the resolution criteria for this will be, now that we are about a week into October. Also noting that I now think I would change my position depending on the range of resolution criteria.

@jack I personally think Oct-Dec would just have been a less noisy way of asking how Manifold will be doing at the end of 2023, I don't think it's really possible to switch the market now that we know there will be a NYT bump at some point in the new resolution period.