🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ146 | |

| 2 | Ṁ81 | |

| 3 | Ṁ50 | |

| 4 | Ṁ40 | |

| 5 | Ṁ17 |

People are also trading

@MartinRandall sorry to override your N/A but I did do the analysis on this and I am quite confident the result is supposed to be "Bring the % to a nice, auspicious number":

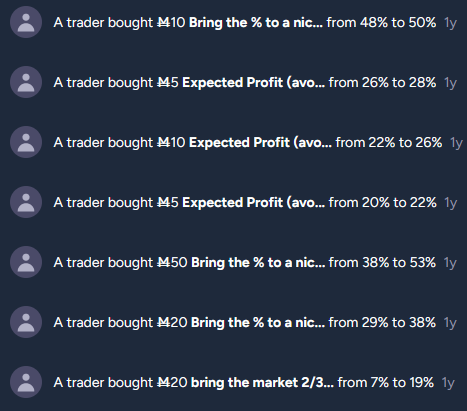

I don't know that we can paste preformatted text into this text editor, so here is a screenshot:

The option "4" is the auspicious number one. There were exactly 10 users who placed a bet on that option, per the creator's instructions:

> This will resolve based on the most “popular” option i.e number of people who bet on each option. NOT the option with the most money.

In case anyone is wondering, one user sold all their shares of that option, but there are no instructions about selling shares. (More than one user sold all their shares of option "1".)

I am quite happy to resolve this to the auspicious number answer.

This might be impossible to resolve at this point; it should resolve to the "number of people who bet on each option, NOT the option with the most money," but I don't see any way to see what that number is, since all trades are displayed as coming from "A trader" with no other information given:

I feel like this ought to resolve N/A as a result. Thoughts? Maybe someone who knows more about the API than me can find a way to figure out how many individual traders bought each option?