Original Lesswrong thread here.

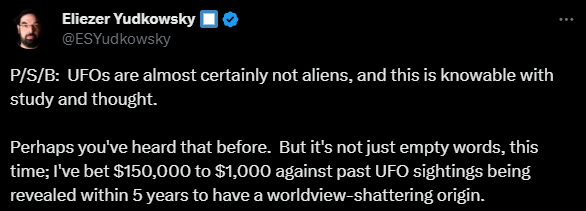

Original tweet here:

Unlinked market with shorter timeframes here: /Joshua/when-will-we-know-that-any-past-ufo

People are also trading

@FergusArgyll Thank you. But it seems to be a different question. I can imagine the government announces that NASA found techno signatures, or something similar, which does not mean UFO have worldview shattering origins..

@Irigi Yeah for sure, and the dude could lie. I didn't think this would drop to 70% but I thought it would get affected

@FergusArgyll Gwern claims that many government officials genuinely believe in aliens, but only because of some kind of prank:

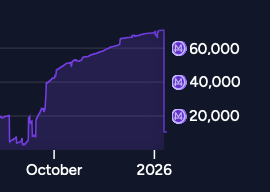

@Robincvgr it's not clear to me that the new loan system should be negative for yes on this market. if you're charged 5% interest but also get 5% interest on shares held, that nets to zero, same as before - no?

@draaglom you're charged 15% interest and get paid 5% interest. So the min value this market should trade at (given 2.5y to resolution) is 1/1.1^2.5 ≈ 79%.

On the other hand, lots of people who have spare cash sitting around might now opt to park it in this market, which exerts YES pressure.

Overall pretty unclear to me how this will play out. I was expecting a move towards NO but so far it's been a move towards YES (even after @Robincvgr's large trade).

Now I just need to fight really really really hard to not reflexively press that loan button.

@RenaoJedi Yudkowsky initially and the lesswrong community if disputed: https://www.lesswrong.com/posts/t5W87hQF5gKyTofQB/ufo-betting-put-up-or-shut-up