Right now loans are based on the mana you put into the market; your cost basis. Many people have suggested changing them to pay out based on the current share value instead.

Edit: The new system pays out based on cost basis if the market price is above your cost basis, and based on market value if it's below. On average across many markets, this means about half your loans will be on cost basis and the other half with be on the current share value. So if the system doesn't change again before the end of the year, 50% seems like the most appropriate resolution to me. Feel free to present counterarguments if you disagree.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ404 | |

| 2 | Ṁ105 | |

| 3 | Ṁ62 | |

| 4 | Ṁ44 | |

| 5 | Ṁ38 |

Sorry for the late clarification here. The new system pays out based on cost basis if the market price is above your cost basis, and based on market value if it's below. On average across many markets, this means about half your loans will be on cost basis and the other half with be on the current share value. So if the system doesn't change again before the end of the year, 50% seems like the most appropriate resolution to me. Feel free to present counterarguments if you disagree.

@IsaacKing Counterargument: It's only true that about half the days on which you receive a loan in a certain market are cost basis and the other half market value. Going by the loan amounts, it'll be <50% on market value and >50% on cost basis, because market value is only used when your loan amount has become smaller than it would have been under cost basis. So perhaps this market should resolve to something in between 0 and 50% to reflect the real loan amounts in practice. (Someone could probably write a script to determine what the actual fraction will be.)

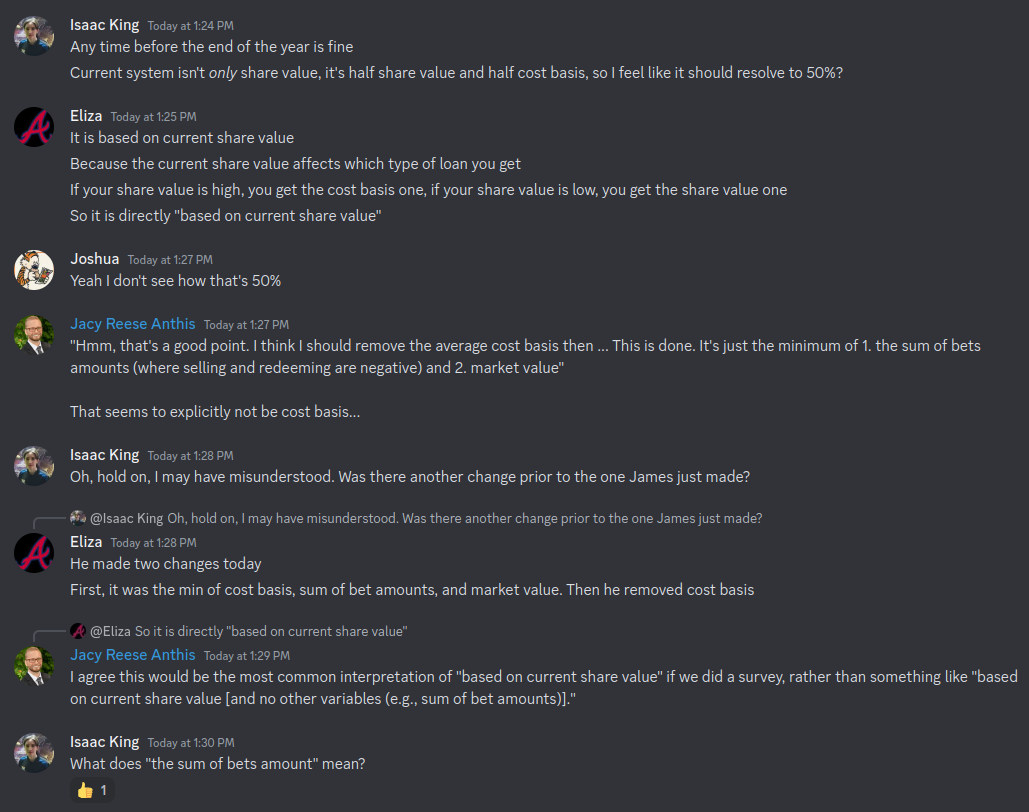

More discussion happening on discord:

https://discord.com/channels/915138780216823849/1150139342690463774

Unfortunately the resolution criteria aren't super clear on a corner case like this, which was probably simply not anticipated. Yes loans are paid out "based on" (in a sense) the share value. The share value does enter into the equation. So the title sounds like YES, unless Isaac says that a partial change wasn't in the spirit, then 50% sounds reasonable.

In the description it says "Many people have suggested changing them to pay out based on the current share value instead". Is this background info, or clarifying the resolution criteria? Share value is used as well as bet amount/cost basis (?), not instead. So that would seem like a NO, except that it reads as background info rather than resolution criteria.

@chrisjbillington Cost basis is no longer used. Only sum of bet amounts (minus sell/redemption) and market value.

@Eliza Hm. Sum-of-bets and cost basis are distinct calculations, but are still based on what the shares cost....perhaps to someone more financial than me the difference is more than a minor tweak, I don't know. I'll read the discord thread to get a better feel for why that bit was changed.

Anyway, the only mention of cost basis in the description is saying how things were at time of writing, it's not clear what comprises part of the resolution criteria and what doesn't.

@chrisjbillington This has nothing in particular to do with the resolution rules of the market in question, but just a summary of the loan behavior so people can help understand it better:

Sum of bet amounts was introduced a few weeks ago (23 August) primarily as an anti wash trading device. There was an exploit related to wash trading to raise your cost basis.

Cost basis was removed completely with the current change.

Market value of shares replaced cost basis as the main determinant of loan basis with the most recent change.

Situations where each of these come up:

1. You bought in to a market and have not bought the other side or sold anything. Your loan amount is the lesser of what you spent to buy your position and what it is worth now.

2. You dominated a market and sold most of your shares for a huge profit. Due to sum of bet amounts your loan is ZERO.

3. You are losing big on a market and tried to save something by selling a lot of your shares at a loss. The market value is still bad. Your loan will end up being based on your current market value.

4. Later on, the market you sold shares at a loss for has recovered and you now have a winning position again. Your loan basis is capped by the sum of bet amounts. Even if your position improves so that your market value is a million mana, your sum of bet amounts limits the loan basis.

I hope that helps!

@EvanDaniel I messaged him on discord. I probably shouldn't have - he traded before answering me anyway. Thought he would immediately clarify here, but he hasn't so here's what I've got.

Lesson learned - trade before asking for clarification!

(There is no more to the conversation, that's all I've got)

@Eliza But if your bet has appreciated, it's based on the bet amount? Or what?

So it sounds like it pays out neither on the bet amount nor the value, but the lower of the two?

I don't think this resolves YES just yet.

@EvanDaniel How is it not a yes? It pays out one amount if your current share value is high, and another amount if your current share value is low. That's "based on current share value".

@Eliza It also pays out "based on the mana your put into the market" by that reading. So it's not "instead".

@Jason sure, but I can wash trade to set the cost basis equal to the current value, so that's only safer because bettors are lazy.

@MartinRandall That could be regulated -- as the IRS does by disregarding wash trades under certain circumstances when someone is trying to generate losses for tax purposes. Also, requiring advanced users to jump through some hoops (even if via API) would make loans safer for less experienced users, who wouldn't be automatically handed loans that may not be justified on as free a basis.