Resolves very subjectively, I'm not even going to bother to try to define this exhaustivly. Feel free to ask about hypothetical scenarios and I'll answer how I'd judge them. I'll add clarifications to this description as they're worked out.

"A leader in EA" refers to anyone who has significant influence/social status within the EA community or has the power to move large quantities of EA-allocated funds. Heads of EA organizations, writers of EA-aligned books, grantmakers, etc. I'll be fairly liberal with this definition; I'll lean towards more people being "leaders" rather than fewer. (It does not include SBF or anyone else who could be considered FTX/Alameda leadership.)

The "unethical behavior" in question must have been related to fraudulent investiment strategies that involve spending other people's money without their permission. If SBF engaged in unrelated unethical behavior, such as walking past a child drowning in a pond or illegally harvesting organs, that doesn't count for this market.

"Cover up" refers to knowing about the unethical behavior and chosing to keep that knowledge private. There doesn't have to have been any particular action taken; inaction is morally equivalent to action, after all. Some clarifications:

The EA leader in question must have assigned a decent probability to fraud/theft occurring. It it seems that they had enough evidence to conclude there was fraud happening, but naivety/motiviated reasoning prevented them from realizing it, that does not count as a "cover up". (I won't be too generous with this; if it seems like any reasonable person would have known, yet they still profess innocence, I'll count that as a cover-up.)

If they were afraid of retaliation and didn't publicize their concerns out of fear for themselves, that still counts as a cover-up. Any charitable organization where whisleblowers are discouraged that strongly has a serious problem.

If they only found out about the fraud after signing an NDA and couldn't legally say anything about it, that does not count as a cover-up on their part. (It would certainly be a cover-up from FTX, but we already know that happened.) After all, the whole point of this scandal is that we don't want EAs breaking laws just to do what they personally think is right.

If actions were taken to maintain plausible deniability, or it otherwise seems like they were trying to "avoid finding out" about the fraud, that still counts as a cover up. Bayes cannot be fooled by such games.

Market resolves YES if at least one EA leader satisfies these criteria. Multiple "leaders" is not a necessity.

I will not be placing any trades in this market. I will discuss my intended resolution with the community here before actually resolving it, to ensure people feel my resolution is reasonable.

If anyone wants to submit information completely anonymously, you can do so here.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ5,922 | |

| 2 | Ṁ2,583 | |

| 3 | Ṁ1,928 | |

| 4 | Ṁ1,505 | |

| 5 | Ṁ1,052 |

People are also trading

It's now been several months and I haven't heard anything, so I'm pretty confident the answer is no. (The market is only about evidence that emerged in 2023, but I'm not all that tied-in to the EA community, so it could have taken a while for me to hear about it.)

I said in the original description that I'd ask traders here for feedback before resolving, but now that markets can be re-resolved that doesn't really matter. I've resolved this NO, and if anyone thinks I'm mistaken, present your evidence and I can ask the mods to re-resolve if necessary.

@IsaacKing I think the recent examiner's report brought up some relevant evidence (though of course that report was published right now, in 2024). In-particular it highlighted that a bunch of FTX executives were probably paid large hush-payments to keep going I think all the way back 2019 to keep fraud-adjacent things quiet when they left.

There are some EA-leaders among people in that reference class, though not many.

@OliverHabryka Thanks. I believe that doesn't qualify for two reasons: A) this information wasn't publicly known by the end of last year, and B) I had exempted any FTX official from counting as "EA leadership".

@IsaacKing > B) I had exempted any FTX official from counting as "EA leadership".

Ah yeah, that I think excludes that evidence pretty solidly

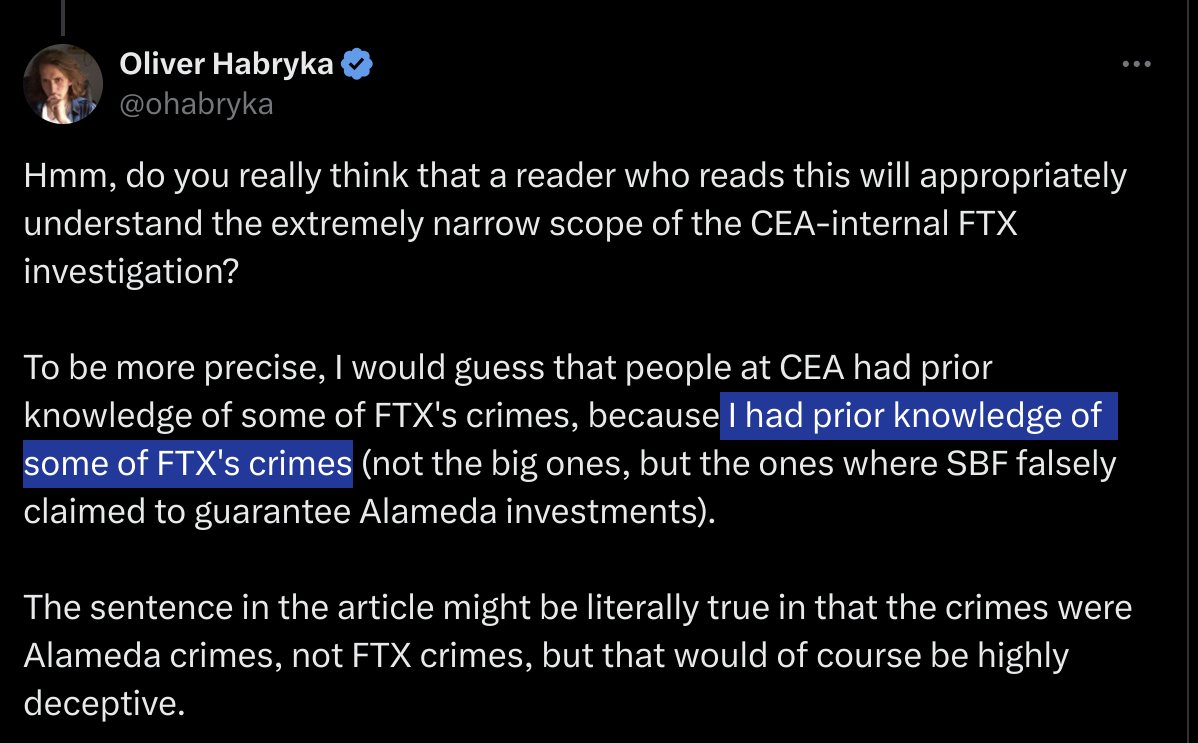

@OliverHabryka Claims he knew about some of FTX crimes. I think they don't include "spending other people's money without their permission", but sharing in cases somebody disagrees.

@Lorenzo Same thing I was referring to in this comment: https://manifold.markets/IsaacKing/by-the-end-of-2023-will-substantial#5jjXkWrJveD8ZlNgb0Hm

Mintz’s independent investigation found no evidence that anyone at EV knew about the alleged fraudulent criminal conduct at FTX and Alameda. This conclusion was later reinforced by the evidence at this fall’s trial of United States v. Sam Bankman-Fried, where the three cooperating witnesses who had all pled guilty (Caroline Ellison, Gary Wang, and Nishad Singh) testified that only four people knew about the alleged criminal fraud – those three people plus SBF. Accordingly, the testimony at the SBF trial was consistent with our conclusion that there is no evidence that anyone at EV knew about the alleged criminal fraud.

@JCE All of the accusations of fraud refer to things which happened after the Alameda schism, as far as I know.

@Benthamite I think I’m wondering specifically if the 4 million that was lost and not disclosed count

@JCE I think it says somewhere in the comments that it must be customer money, not investor money, so no

@Benthamite If I remember correctly, Sam had claimed multiple times to early investors that Alameda was operating in a pure-Alpa/pure-arbitrage fashion, which turned out to be a straightforward lie, as far as I can tell. I thought that was in the pre-split Alameda times. Seems like that would count as fraud.

@JonasVollmer I’m curious why the scope of the unethical behavior criterion precludes investor money. From digging through the numerous comments it looks like @IsaacKing was more or less nudged to restrict it to customer funds even though that ostensibly was not the intended meaning in the original description (correct me if I’m wrong).

@NicoDelon presumably because investors gave permission to spend that money, right? If investor funds were spent in a way they obviously didn't give permission for, then it seems like that should count, but that's a pretty high bar for startup investors who are basically giving the founder a blank check to figure out how to create value for them.

@ErickBall Sure, but I don’t think investors gave Sam permission to commit fraud with their money. My question is why that bar hasn’t been met given how brazen Sam’s actions were.

@NicoDelon Like, I’m not sure they gave him a blank check to do this: https://www.sec.gov/news/press-release/2022-219

@NicoDelon yeah I mean lying to investors to raise money is more out of the Theranos playbook, it's certainly still fraud but can have a lot more great areas around how to tell if it's fraud. But I don't see any reason it should be categorically excluded from this market.

@JCE ignoring anything else here, supposing there were unethical investing practices in early Alameda and there is overlap between those people and "leaders", it doesn't follow that any leaders knew about practices and chose to cover up. Could be that people who knew tried to make a fuss, but that others didn't trust those people enough over e.g. SBF to infer there was a serious problem vs. interpersonal drama. (I was pretty distant, commenting on logic of epistemic situation more than specific people.)