This market resolves to the number of ICE officers/agents convicted of criminal offenses by December 31, 2030, for conduct occurring between January 20, 2025 and Jan 19, 2029. Counts sworn ICE personnel (ERO officers, HSI agents) who were ICE employees at the time of the offense. Includes all offense types (on-duty or off-duty, federal or state), guilty pleas, and convictions under appeal. Excludes contractors, private detention staff, and detailees from other agencies. Excludes charges without conviction, civil judgments, and administrative actions. Resolution based on court records, DOJ/AG press releases, and credible news reports as of January 31, 2031.

Update 2026-01-22 (PST) (AI summary of creator comment): Criminal offenses include misdemeanors and felonies only. Civil infractions (such as traffic tickets) do not count. However, DUI or reckless driving charges that are classified as misdemeanors or felonies would be included.

People are also trading

Just to clarify, crime here means misdemeanor and felony? Or are you counting infractions, which most traffic offenses fall under? For context, a rough estimate is that ~10% of all Americans get speeding tickets each year, so at 22k ICE officers active, you'd expect >2k of them to get one in the next year (let alone by 2031).

@pietrokc "Criminal offenses" means misdemeanors and felonies; civil infractions (e.g., traffic tickets) do not count. DUI or reckless driving is often a misdemeanor or felony, though, so that would be included.

The fact that this includes a not insignificant time period for the administration following the current one to have the opportunity to try and convict ICE employees makes this much harder to forecast since there is such a high level of unknowns there.

I mean, just based on whether the incoming administration is Democrat or Republican will likely have such a large impact on this market.

The fact that this is going to be resolved by an LLM makes this market an insane risk to trade on.

@BlackCrusade It won't be resolved by an LLM. I'll take full responsibility for the resolution. But I'm not volunteering to put in the number of hours that a good manual search might call for; I'm going to baseline asking an LLM to do some research, reading that research, and reading the comments before resolution, and I'm trying to be up front about that.

If there was a good non-partisan data tracker for this sort of info I would have written it as "resolves as per data from xyz" but that didn't seem viable.

@EvanDaniel For my markets that do resolve by pure LLM, I try to be very up front about that as well.

@EvanDaniel I think it might be prudent to add something to the description saying that the resolution will be assisted by LLM research or something. I know a good number of people who would currently not trust an LLM to be involved in fact finding and would see that as additional risk.

I mean who knows, maybe by 2031 LLMs (or some other form of AI assistant) will be better at fact finding than most humans! And then people will see it as less risky to trade on a market with an LLM assisted resolution.

@BlackCrusade Alternately, anyone worried about the resolution could just do their own research and post it in the comments. I will read them. Or they could suggest a data source that tracks this info in a systematic and reliable way and I could switch to that for resolution source.

@EvanDaniel unfortunately I am not invested enough in this topic to want to assist in that kind of thing, but hopefully someone will be able to assist you in accurately resolving this without you having to do so yourself.

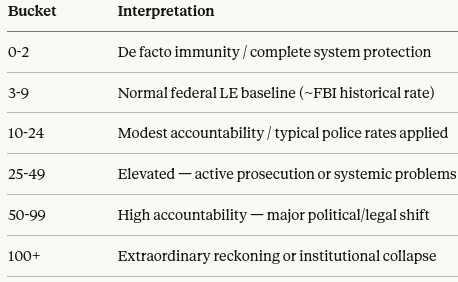

There aren't good data sources. If we find one, I might switch over to counting that, if it aligns well with the current criteria. As is, this is probably going to resolve based on a mix of things reported in the comments + LLM-driven research. I won't trade until / unless we get some cleaner criteria. I used Claude to gather some background info and draft resolution criteria. If you don't want to read the whole chat, here's Claude's interpretation relative to base rates:

@EvanDaniel LLM-based? No thanks, not gonna bet. The misinfo on this is already insane, relying on an LLM for criteria & real answers makes this a worthless market.

@EvanDaniel you may want to change the description to say you will be resolving with an LLM instead of the resolution criteria you have in the description. I found that to be misleading.