Resolves Yes if Trump wins and Joe Biden pardons Hunter Biden (or commutes his sentence), or if Trump loses. Resolves No if Trump wins and there is no pardon or commuted sentence.

This is a derivative market; it will resolve exactly according to:

/jack/who-will-win-the-2024-us-presidenti-8c1c8b2f8964

and

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,278 | |

| 2 | Ṁ1,190 | |

| 3 | Ṁ1,019 | |

| 4 | Ṁ874 | |

| 5 | Ṁ651 |

People are also trading

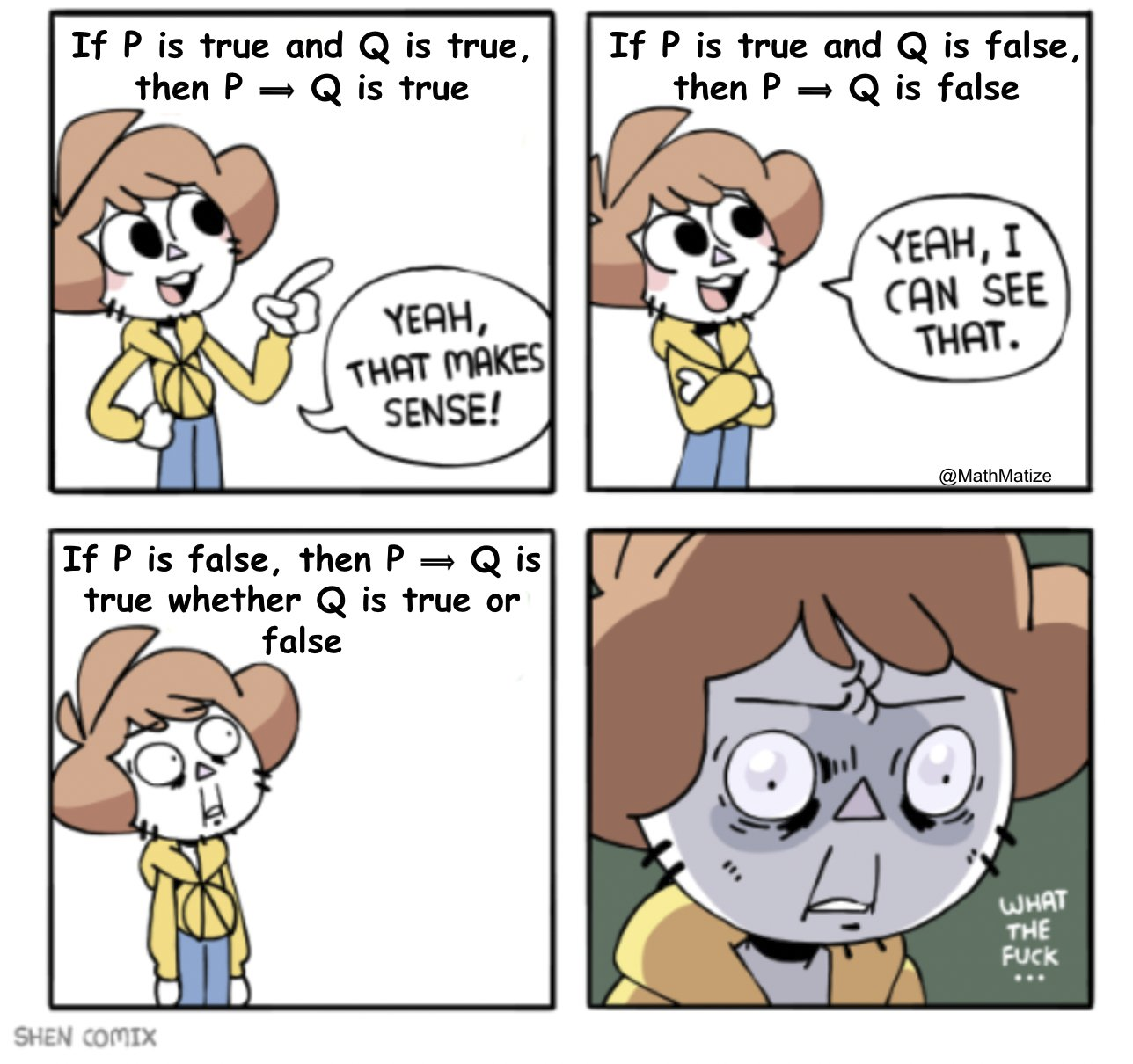

https://en.wikipedia.org/wiki/Material_conditional

The thing that would refute the logical implication is if Trump wins and then there is no pardon. "A implies B" is the same as "(not A) or B" is the same as "not (A and (not B))".

@ScipioFabius Alternate interpretation of "why", as in why build the market this way instead of some other way:

With two underlying markets, there are 4 possible outcomes (assuming neither resolves N/A), which require 3 prices to fully specify. There are a bunch of ways to do that, each with drawbacks. You can write an entire 4-way market, which is redundant with the underlying prices. You can write the market I wrote, or something similar like "will Trump win and Biden pardon Hunter"; in any form of this you're trading on one of the 4 possible outcomes. You can write conditional markets (n/a if one of the underlying markets resolves a certain way), but n/a is bad. And you can write an XOR/XNOR market like "will the two underyling markets resolve the same way" or "will Biden pardon Hunter iff Trump wins".

In theory, any of those structures provide you with the additional pricing info to find all four implied prices. But things like interest rates, fees, and what limit orders are possible make them not actually equivalent. (And in the case of structures involving n/a outcomes, it makes arbitrage hard, and you can't actually trade on the implied prices at all because you might find only one half of your trade goes through.) So the question is just, which structure is best to accomplish your goals? And I wanted to try one I hadn't done recently, and it was a good fit for the comment that this market was created in response to:

https://manifold.markets/MaximLott/will-joe-biden-pardon-hunter-biden-014exmuzui#0f9ek7f4aruj

And it seems DataChef doesn't actually want to bet this in the way that "guaranteed" would imply, so I'd say the structure I chose was fairly revealing.

@EvanDaniel I still haven't convinced myself I fully understand this. Say (hypothetically) that I believe odds of Biden pardoning are higher given that Trump wins (what a conditional market would answer/price). How should I price this market, and doesnt my participation automatically open an arbitrage opportunity between this and the underlying?

Current market prices are 49% for a Trump win, 20% for a pardon, and this market "Trump win implies pardon" at 60%. Rounding to whole percentages for simplicity. I'll ignore fees and interest rates.

The current implication market price of 60% is the price of (Trump loss) OR (Trump win AND pardon). Since only one side of the OR can happen, you can add probabilities. So you get 0.60 = P(Trump loss) + P(Trump win AND pardon). We know P(Trump loss) = 0.51. So 0.60 = 0.51 + P(Trump win AND pardon), which gives P(Trump win AND pardon) = 0.09. You can then derive the other three implied prices: P(Trump win AND no pardon) = 0.40 (since Trump win is 40% overall). Since P(pardon) is .020, we then get that P(Trump loss AND pardon) = 0.11. And therefore P(Trump loss AND no pardon) = 0.40.

Summarized:

P(T win AND pardon) = 0.09

P(T win AND no pardon) = 0.40

P(T loss AND pardon) = 0.11

P(T loss AND no pardon) = 0.40

You can then find the conditional probabilities of a pardon given a Trump win (or loss):

P(pardon | Trump win) = 0.09 / (0.09 + 0.40) = 0.184

P(pardon | Trump loss) = 0.11 / (0.11 + 0.40) = 0.216

So, if you think the pardon is more likely in the case of a Trump victory than a Trump loss, and think that the underlying markets are correctly priced, then you should buy YES in the implication market.

Hopefully that's making sense so far.

Now suppose that what you actually wanted was to bet M100 on a position like "win if Trump wins and there's a pardon, lose my investment if Trump wins and no pardon, get my mana back if Trump loses". (That is, a position equivalent to a conditional market with N/A resolution.)

If you had all four individual options available: You start by getting 100 shares in "Trump loses" at a price of M51. Then you put the remaining M49 on "Trump wins and pardon" (priced at 0.09, this gets 544 shares). (This is the same as betting M100 in the conditional market that's priced at 0.184; check it.)

With the implication market structure, to get the same payouts, you'd instead need 544 shares in "Trump wins implies pardon" and 444 shares in "Trump wins", at a total cost of M544. You're guaranteed to get back M444 of that, so you have the same payouts. Unfortunately it's not as capital efficient as if all the options were available. (Try working out all 4 possible outcomes to check it yourself.)

Sorry it's complicated; this is the sort of thing that should be handled by a good UI for conditional or otherwise compound markets.

@EvanDaniel I think this is the right way to structure it. No possibility of N/A. And after thinking about it some more I definitely think leaving Hunter vulnerable to being indicted again after leaving office is not a possibility. Especially with Trump so fixated on revenge and Hunter being obviously the most vulnerable person close to Joe.