Resolves to the person who wins the majority of votes for US President in the Electoral College, or selected by Congress following the contingency procedure in the Twelfth Amendment.

(May resolve provisionally if both the Associated Press projects a winner and the losing major party candidate concedes; if Manifold allows provisional resolutions.)

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,126,227 | |

| 2 | Ṁ938,852 | |

| 3 | Ṁ806,126 | |

| 4 | Ṁ424,550 | |

| 5 | Ṁ421,292 |

People are also trading

AP and all the other decisions desks have projected Trump win. I plan to (provisionally) resolve once Harris makes her official concession, as per the rules above.

Provisional means that it's not final, and we'd plan to unresolve if either of those conditions (AP call or Harris concession) changes. The final resolution will be to the electoral college winner, as per the rules.

Resolves to the person who wins the majority of votes for US President in the Electoral College, or selected by Congress following the contingency procedure in the Twelfth Amendment.

(May resolve provisionally if both the Associated Press projects a winner and the losing major party candidate concedes; if Manifold allows provisional resolutions.)

https://www.nbcnews.com/politics/2024-election/harris-expected-call-trump-concede-race-rcna178931

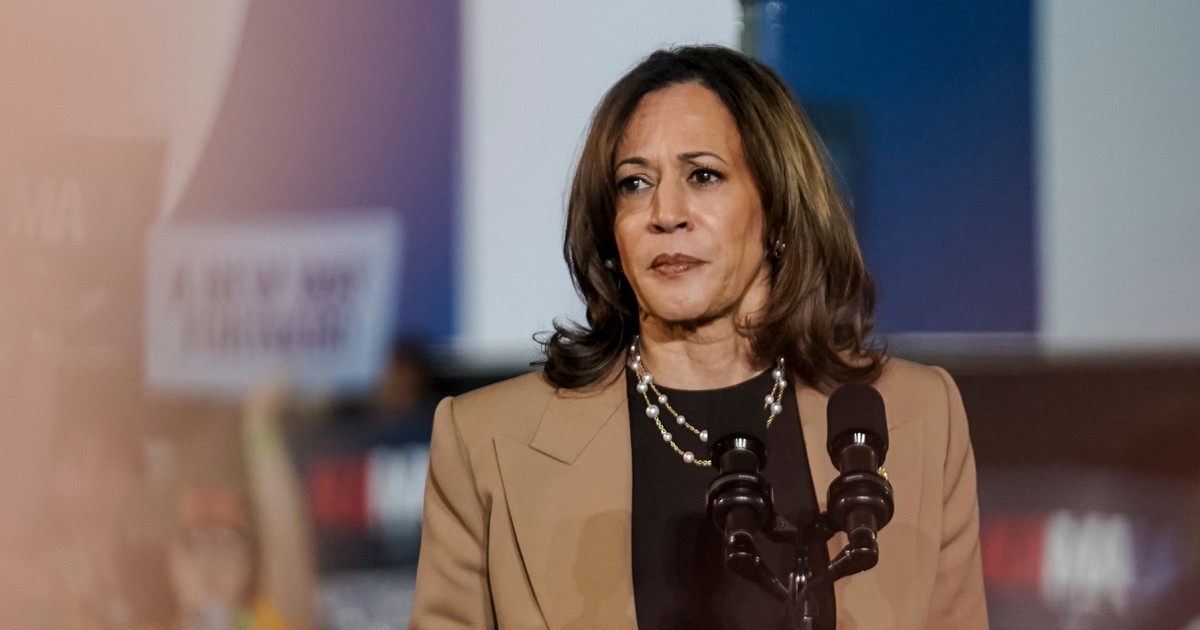

Vice President Harris is expected to call President-elect Donald Trump on Wednesday to concede the 2024 presidential race and is also expected to speak publicly, according to two Harris aides.

Harris is expected to address the nation at 4 p.m. ET at Howard University, her alma mater. In the meantime, she is working on her speech, one of the aides said.

https://apnews.com/live/trump-harris-election-updates-11-5-2024 Harris calls President-elect Trump to congratulate him on win

Resolves provisionally to Trump!

(May resolve provisionally if both the Associated Press projects a winner and the losing major party candidate concedes; if Manifold allows provisional resolutions.)

I mean Jack could change his mind but currently he left open the chance to resolve once Kamala concedes

Since you boys and girls did great this election I decided to create some more degen markets you can apply your prediction skillz to

https://manifold.markets/dlin007/will-hillary-clinton-live-to-see-a

The key takeaway from this election is the following:

The "deeply divided nation" stuff was all BS.

That was a narrative pushed by the media. It was clear to me, at least, that the polls were herded, even though I ultimately predicted the wrong direction. There probably were people getting what they thought were ridiculous results, like Virginia being close, and they were discarding those polls.

I'm extremely heartened that this result was decisive, regardless of which direction it was in. There is absolutely no doubt that a majority of people support TRUMP. Whether you agree with them or not, he completely swept all branches of government and the popular vote. There will be no riots or destruction of property or problems on January 6.

The country is not divided at all. There exists a minority of people, of course, who will be in opposition as there always is, but this isn't like the last time that Trump was elected or any other time this century except for Obama's first term. The lack of violence is a good thing.

The media will likely continue to push the message that people disapprove of Trump's behavior and are "divided," when that clearly is not the case.

@SteveSokolowski if the popular vote is 52%-48% that is still a divided nation. If you look at other democracies there is often a larger and more changeable popular vote gap between the top parties.

It does mean that Trump has a popular mandate that he lacked in his first term.

I think you are completely missing the point. As the Sydney Morning Herald pointed out, there hadn't been a country before that ended a democracy through a fair and free election. In prior examples like Russia, Putin came to power by manipulating the system and installing his cronies first. In places like Turkey or Hungary, the autocrat took power by promising something else and then slowly whittled away at institutions.

In the United States, it was extremely clear what the choice was because Trump had actually attempted to turn the country into a dictatorship once before, not simply say he wanted to do it. The country's institutions are currently functioning as its constitution designed. Nobody who voted for Trump was unaware of those two things, and if they were, Harris told them about it every single day.

There has never in the history of the world been a case where citizens saw the republic as so fundamentally broken that they willingly ended it so decisively. The results were not due to some electoral college manipulation, or gerrymandering, or whatever as often occurred in the past. The election was 100% fair, without ballots being destroyed or people being denied votes or opposition leaders being killed - and it was not close whatsoever.

I see what happened as one of the most united things that any nation has ever done in world history. It takes guts to make such a dramatic choice. Whether you approve or not, the United States is not "a divided country."

So Stevie has been a nutcase all along. Big reveal. /s

Trump still has to attempt to erode democratic institutions and frankly that old fart doesn't have it in him to do anything anymore. It's more likely that the country just installed a technocratic dictatorship run by Theil, Musk and the rest of the PayPal mafia.

@NivlacM popular vote was what--like 20/80 going in? if The Needle projection holds, that's more like losing a dice roll.

Prediction: the MSM and Dems (what's the difference?) will continue to call Trump a fascist/racist every day during his presidency, resulting in a Republican 2028 candidate that is as Trumpy as possible as a counter-reaction against those lies.

@BahLahmah I knew she lost when bezos held back an endorsement for business security but like I said earlier I counted the mana in this market as gone anyway.

I knew she was in trouble because curtain ppl at Google apple and Amazon a few other mega corps have far better analytics on where ppl are politically than polls. They have everyone's data.

I'm sure if Google and Apple released polling data they would get it right within a percentage.

@NivlacM Trump winning the popular vote shows is a tail even in the coinflip model, do you think this is what happened? that we are that many sd away. it's more likely the 50-50 was bad and pollsters had no signal...

@BahLahmah I was also a large Kamala holder (I think M25K for total exposure) and expected a more concerted October smear campaign by the Dems + media (i.e. a true October surprise). I think I misunderestimated how unsurprisable Trump is at this point, and how badly Kamala consolidated the factions within her own party, though a proper post-mortem of exit polling and other data would be required to figure out what drove her under-performance relative to polling. Also, I may have mocked the depth of Tyler Cowen's "vibe shift" too much. Plenty to learn for us all.

@BahLahmah This is very easy. I thought that young men were not a reliable voting bloc, and when TRUMP went all-in on them with that Madison Square Garden rally,

For them, it wasn't really about the economy, it was about reversing history. In retrospect, of course, this should have been obvious. The Me Too! movement affected a lot of men in a negative way. I've talked about how rather than solely punishing men for serious crimes like rape, it expanded the definition of "sexual harassment" to things like asking a woman out at work. I expected that the rally energized a lot of other people, and it clearly did. What's amazing is that if the rally had not been held, Trump might have achieved another percent or two even above this.

One thing I'm not surprised with is that the messaging about Trump being a felon failed. As I said way below, most people are not concerned about things like the law - that's why when there are no cops around the majority has no issue driving 10 miles an hour over the speed limit. People should not be surprised at how fellow citizens simply got fed up with pretending that the vast majority of people will do anything they can get away with.

@SteveSokolowski I think it was not just young men but also the white women demographic that really pushed him over the edge. Harris was banking on their full support but they split for trump instead

@BahLahmah Polls are lagging data. They don't account for last minute surprises, bad decisions or things said in closing statements. They also don't account for last minute plays by media and technology companies.

I cleared my Harris position in the market when I saw Ricky Martin on stage doing a bad rendition of a 30 year old gay anthem. Of the dozens of musicians her campaign could have put on stage to appeal to working class Hispanic men, she decided on someone that would alienate most of the Hispanic male vote. All voting blocks want some leverage from the politicians they support and Harris didn't offer anything other than tone def pandering to a group seriously considering her as a candidate in the last weeks of her campaign. It probably cost her the election and maybe even the popular vote.

Trump did a much better job targeting men and making Harris' messaging for men look like advertising for chemical castration, but that messaging was baked into the polls going into the final week.

@beaver1 but the 50/50 is all the info I had. I don't claim to have any special insight to the American electorate. I probably should have put more trust in the real money market odds