Resolves as YES if there is strong evidence that, before January 1st 2035, old consumer computing hardware experiences a qualitatively new, AI‑driven price boom, such that at least three of the criteria below are clearly satisfied.

What this market is about

This market is trying to capture a world where:

New wafer capacity and manufacturing are heavily tilted toward high‑end AI accelerators and memory,

Consumer‑grade new PCs and consoles are relatively under‑supplied, and

Software + cloud integration make even 8–20‑year‑old devices surprisingly useful as AI agents / inference endpoints,

…with the result that “junk” laptops, desktops, and consoles become much more valuable than a 2025 observer would expect.

We’re not interested in ordinary cycles (e.g. DRAM supercycles) or pure nostalgia/speculation in collectibles. We’re looking for strong, systemic, AI‑driven revaluation of old hardware.

Definitions

Old consumer hardware: mass‑market laptops, desktops, and home video‑game consoles that are 8–20 years old at the time being measured.

Devices must have been mainstream, non‑luxury products (e.g. Dell/HP/Lenovo laptops, MacBooks, PS4/5, Xbox, Switch) rather than workstations, servers, or limited collector editions.

Prices are measured in real terms: all comparisons are after adjusting for inflation in the relevant currency (e.g. vs CPI).

Typical resale price means the median of completed/sold listings on major marketplaces (e.g. eBay, regional equivalents) or a widely used third‑party price index, for working units in normal condition with standard configurations.

The market creator (or designated resolver) will use reasonable judgement about which datasets and models count as “mainstream” and “mass‑market,” avoiding obvious cherry‑picking.

Resolution criteria

This market resolves YES if, before 2035‑01‑01, there is strong evidence that at least three of the following are true. In borderline cases, the resolver should default to NO unless the spirit is clearly met.

All percentage thresholds refer to real (inflation‑adjusted) prices.

Old laptops/PCs reach resale parity with launch price

There exists at least one widely sold mid‑range laptop or desktop line (not a workstation, not a luxury/collector model) that is ≥10 years old,

For standard configurations of that line, the typical used resale price is at least equal to the device’s original MSRP in real terms,

This condition holds for at least 6 consecutive months, in at least one major region (e.g. US, EU, or China), and

Multiple independent sources (e.g. tech press, analysts, marketplace reports) explicitly link this price level primarily to the device’s usefulness as an AI agent / inference box / AI client (including hybrid local+cloud setups), rather than to nostalgia, aesthetics, or pure collectability.

Intuition: a “2012‑class laptop sells for 2012‑class money” in the early 2030s because it’s a good AI machine.

Old consoles become valuable AI appliances

There exists at least one mainstream home video‑game console with ≥10 million units sold that is ≥10 years old,

Typical used prices for working, non‑collector units (loose or with standard bundle) are at or above the console’s original real MSRP for 6+ consecutive months, and

Credible coverage explicitly attributes this sustained price to using the console as an AI device (e.g. inference box, robotics brain, “AI terminal” in the living room, cluster node), not mainly to retro‑gaming collectability.

Broad basket of old PCs doubles in price

A broad index or dataset covering a representative basket of 8–15‑year‑old mass‑market laptops and desktops (defined by a third‑party analytics firm, major marketplaces, or equivalent) shows that the median real resale price is at least 2× a 2024–2026 baseline,

This doubled level persists for at least 12 consecutive months,

It is observed in at least two of the following regions: US, EU, China,

And reputable analyses describe this as being primarily driven by:

increased use of these devices as AI agents / inference endpoints (often combined with powerful cloud models), and

scarcity or high prices of new entry‑level PCs because chip and memory production is skewed toward AI/datacenter parts.

Large AI projects hoover up old hardware and move prices

There are well‑documented cases of large‑scale AI projects (corporate, governmental, or major open‑source/community efforts) purchasing, leasing, or otherwise aggregating millions of old consumer devices (laptops, desktops, consoles) specifically to use them as AI clients, inference nodes, or “agent hosts”, and

At least one credible analysis estimates that this demand has raised average resale prices for the relevant device category (e.g. certain age bands or models) by 50% or more in real terms relative to a 2024–2026 baseline, over a period of at least 6 months.

Consumers are squeezed out of new hardware, old devices become the default AI box

For at least one full year before 2035, major tech or market‑research reports simultaneously describe:

New wafer and manufacturing capacity for CPUs/GPUs/accelerators being significantly biased toward high‑end AI/datacenter chips, leading to persistent shortages and/or unusually high prices for entry‑level consumer laptops/desktops/consoles, and

Old (≥8‑year‑old) AI‑capable PCs/consoles having typical resale prices that are at least 50% higher in real terms than in a 2024–2026 baseline,

And those reports explicitly tie the elevated prices for old devices to their role as practical AI devices (often combined with cloud models) for consumers and small businesses who cannot or do not want to buy new hardware.

Additional notes / exclusions

Cause matters: For a criterion to count, sources must make it clear that AI‑related utilisation (local or hybrid AI agents, inference workloads, participation in AI networks) is a major driver of the price pattern, not just a side note.

Collectors’ items don’t count: Limited editions, sealed‑in‑box collectibles, or obviously rarity‑driven spikes should be excluded wherever possible. The focus is on hardware being valuable to use, not to display.

Short‑term spikes don’t count unless sustained: A brief 1–2‑month spike that then collapses does not satisfy any of the time‑window requirements above.

Existing cycles aren’t enough: Ordinary or even extreme component cycles (e.g. DRAM/NAND supercycles, crypto‑driven GPU bubbles) do not make this market resolve YES unless they also produce the specific old‑device patterns described above.

Judgement: The market creator (or chosen resolver) will make a good‑faith judgement using public data (price indexes, marketplace data, analyst reports, news articles). Ambiguous or borderline cases should err on the side of resolving NO, unless the “intelligence‑explosion‑driven old‑hardware boom” described here is clearly realised.

If January 1st 2035 passes without at least three of the above conditions being clearly met, this market resolves NO.

People are also trading

@Dulaman My brother in Christ I transitioned to Linux years ago and I will resent Nvidia drivers until my dying day.

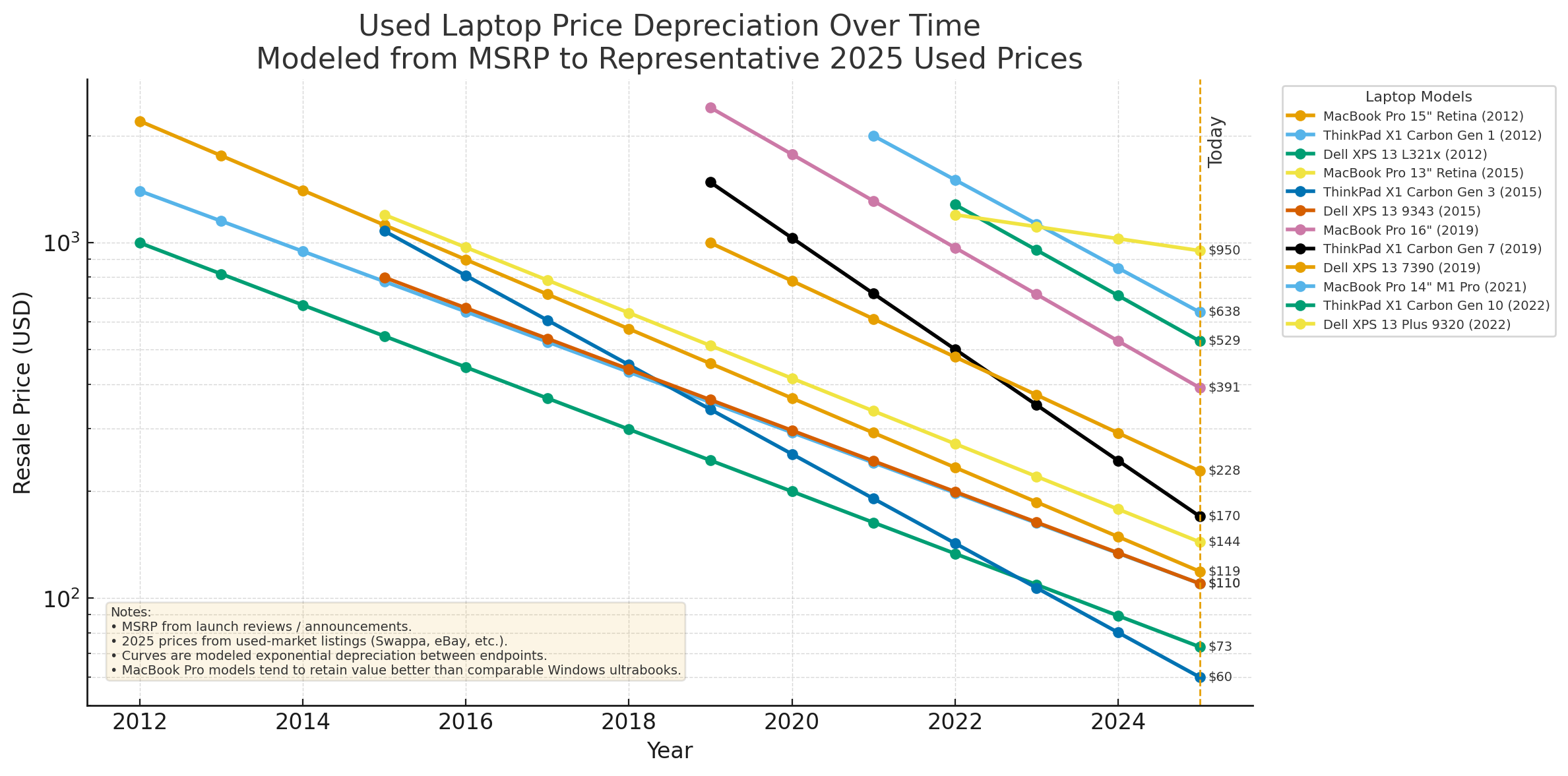

(rough estimate of price curves with gpt-5.1-pro)