Resolves as YES if there is strong evidence that a five‑year or longer period of superexponential “intelligence explosion” growth in frontier AI capabilities has occurred before January 1st 2040.

For the purposes of this market:

An intelligence explosion is a period where advances in frontier AI capabilities are largely driven by AI systems themselves (e.g. AI‑assisted research, engineering, deployment, and scaling), creating a sustained, self‑reinforcing acceleration in broadly general cognitive/agentic performance and impact.

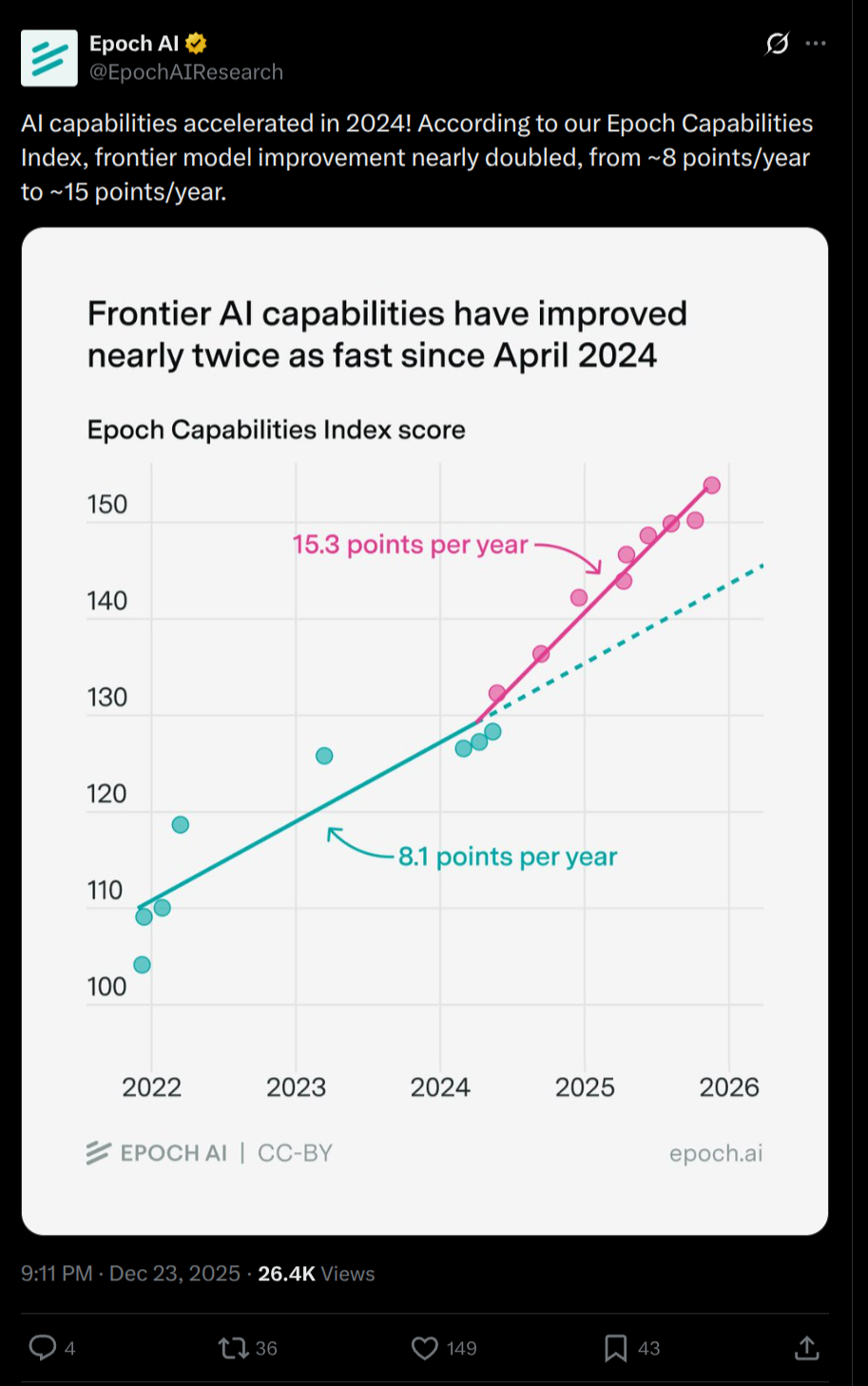

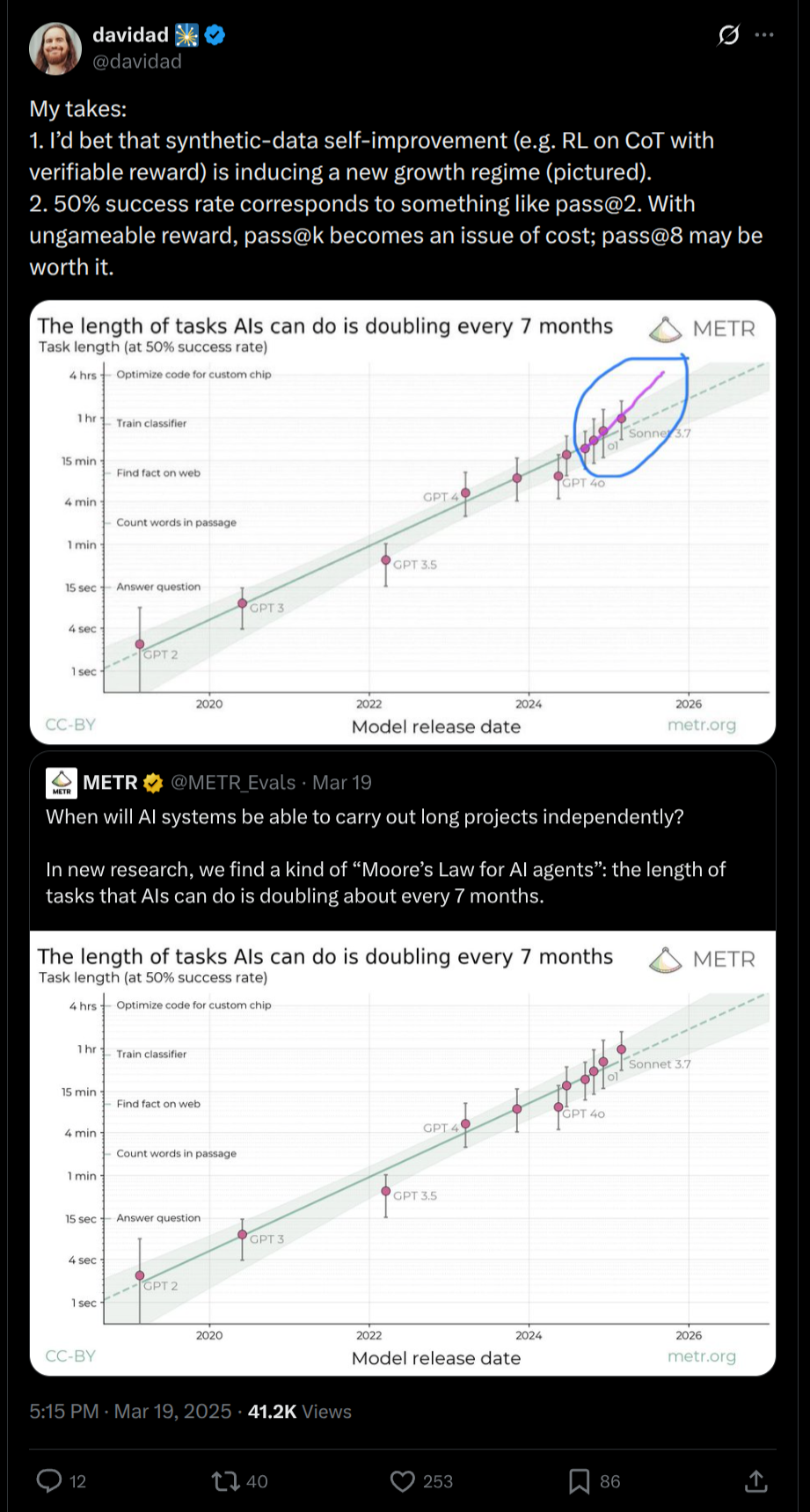

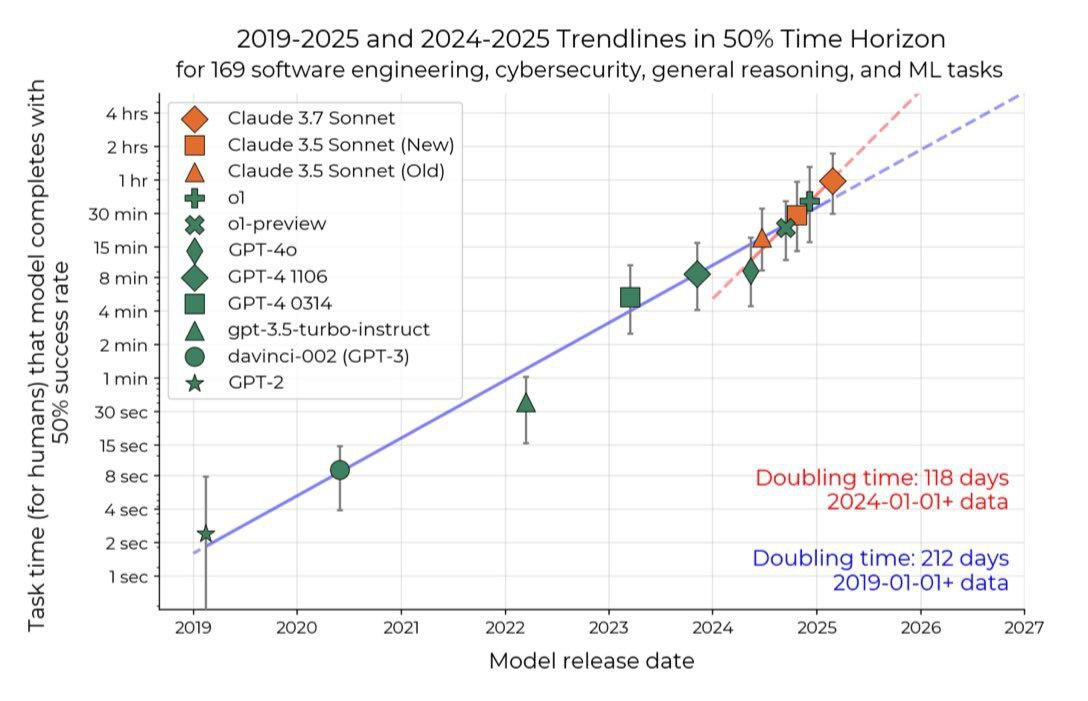

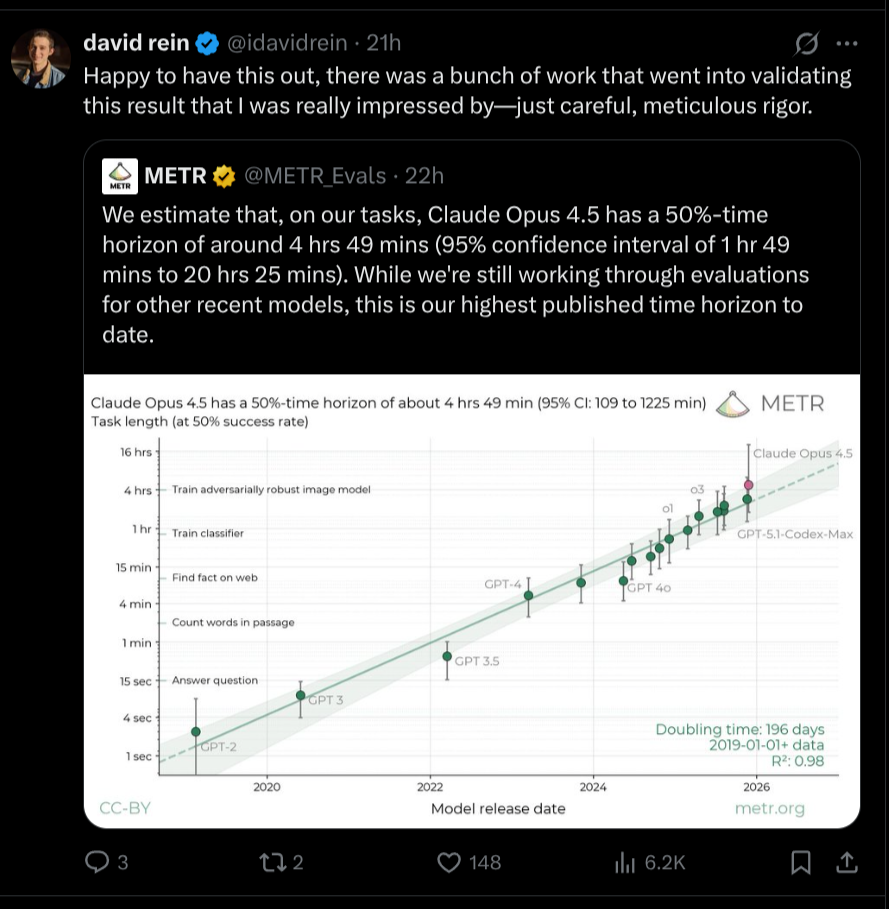

A superexponential regime over some time interval means that a reasonable scalar measure of global frontier AI capability (or tightly linked, AI‑driven economic/strategic impact) shows:

Substantially and fairly smoothly shrinking doubling times across that interval (not just a single freak jump), and

A single constant‑rate exponential curve fit to the early part of that interval would systematically underpredict observed capability levels in the later part of that same interval.

The five continuous years condition is satisfied if there exists at least one interval of ≥5 consecutive years, ending no later than December 31st 2039 (inclusive), that meets the above superexponential criteria. The interval can be anywhere in time (e.g. 2026–2031, 2029–2034, 2032–2037, etc.) as long as it ends before 2040.

The market may resolve early if such a ≥5‑year superexponential regime becomes clearly identifiable before 2040 (for example, by 2035 we might already have strong evidence that 2030–2035 was such a period). If no qualifying interval can be identified, or the evidence remains weaker than described below, the market should resolve NO on or before January 1st 2040.

Exponential vs superexponential: what happens to “players”?

This question is specifically about whether we enter a regime where early actors are pulled ahead more and more over time, rather than just locking in a fixed lead.

In a purely exponential intelligence explosion, once two players (labs, companies, states, or coalitions) have both gone “all in” and are riding the same underlying exponential curve, each year multiplies their capabilities by roughly the same factor. After both are on the curve, the capability ratio between them is mostly a function of when and how strongly they committed, and then remains roughly stable over time. The world may change very fast, but the relative gap doesn’t automatically widen just because the curve is steep.

In a superexponential intelligence explosion, the effective growth rate itself increases over time. Early entrants spend more of their trajectory in the later, faster‑growing part of the curve, where each additional year multiplies capabilities more than the previous one. As a result, the capability ratio between early and late players tends to grow over time: a modest early lead can be amplified into a very large and persistent advantage as accelerating growth keeps stretching the gap.

This market is about whether reality ever enters that second kind of regime – a ≥5‑year superexponential intelligence‑explosion period before 2040 that strongly amplifies early‑mover advantages, instead of merely preserving them.

What counts as “strong evidence” for YES?

The market should resolve YES if, by the time of resolution, a reasonable and well‑informed observer would judge that:

There is a clearly identifiable ≥5‑year interval before 2040 that fits the superexponential intelligence‑explosion description above; and

This judgment is supported by a combination of:

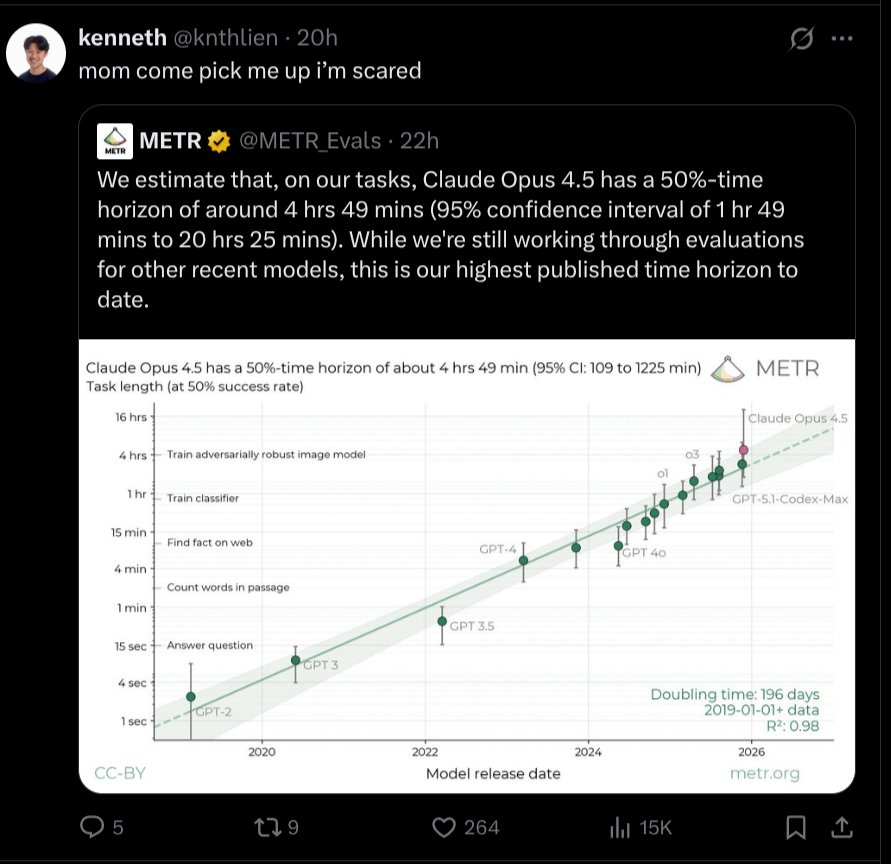

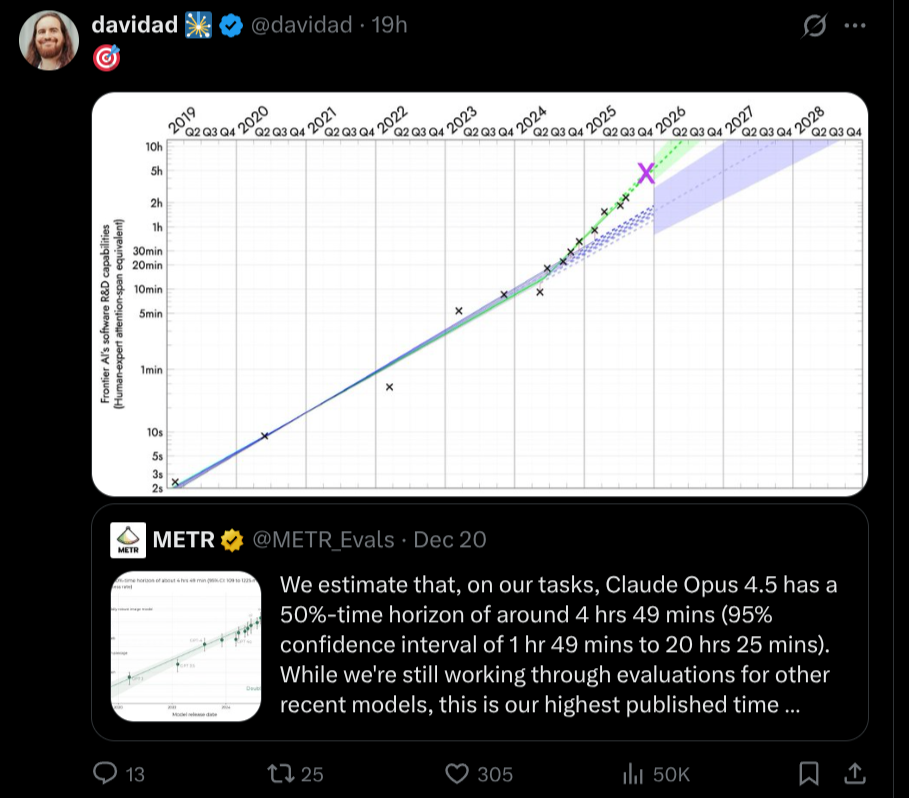

Quantitative data on frontier AI capabilities and/or closely linked AI‑driven economic/strategic impact (e.g. capability benchmarks, AI‑driven output, AI‑mediated R&D progress) showing shrinking doubling times and clear underprediction by exponential fits; and

Serious, widely‑discussed analyses (e.g. from major AI labs, forecasting groups, academic or policy bodies) that characterize that interval as an intelligence‑explosion‑style regime with faster‑than‑exponential growth, not well‑explained by merely exponential trends.

If by January 1st 2040 no such interval can be robustly identified, or if the evidence is best interpreted as “impressive but roughly exponential” rather than superexponential, the market should resolve NO. Borderline cases are ultimately at the discretion of the market creator (and Manifold moderators if needed), who should explain their reasoning at resolution time.

Note that we must be (or have gone through) an intelligence explosion in order for this question to resolve YES. We will use this question as a baseline for "intelligence explosion": /MalachiteEagle/will-there-be-an-intelligence-explo

If are discrete changes to the capabilities curve (that are broadly observed and reported on), then at least three of these must occur distinctly within a 5-year span for this question to resolve YES. The start of this 5-year span cannot be prior to the start of the intelligence explosion (using the above question as a baseline).