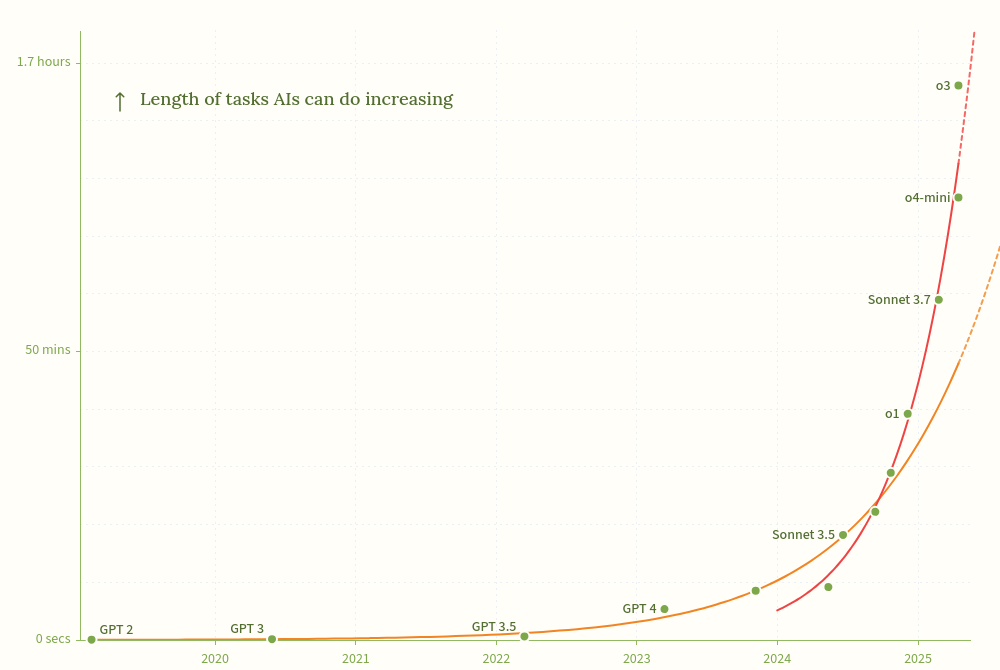

The doubling time for the METR time horizons has moved off the consistent 7 months from 2019-2024 to a new exponential doubling every 4 months at around the end of 2024.

(source: https://theaidigest.org/time-horizons)

Some causes, such as reasoning models, suggest this will revert to baseline. Others, such as AI accelerating research engineering strongly, suggest the trend will continue.

This is confounded by other possible phase transitions in research, but would still be an interesting part of the future to peer into.

Update 2025-11-30 (PST) (AI summary of creator comment): Resolution details:

Uses the 50% time horizon (not 80%)

Resolves YES if: For four consecutive months, when doing a 6 month lookback at the SOTA (state of the art), there is no model released which doubles that SOTA

May resolve before December 31 if the YES condition is met for a four month period

Update 2025-11-30 (PST) (AI summary of creator comment): The lookback period is 6 months (not 4 months as some users interpreted). For this market to resolve YES, there must be 4 consecutive months during which no model released doubles the SOTA from 6 months prior to that model's release.

People are also trading

Here’s where I think this market stands:

o3 doubled o1 in April; <6months

Grok 4 doubled Claude 3.7 sonnet in July; <6months

GPT-5 doubled Claude 3.7 Sonnet in August; <6months

There has not been a 4 month period where the new SOTA failed to double any SOTA from <6months prior, so this market cannot resolve Yes at this time.

Currently, we are more than 6 months from the release of o3, so doubling that will be insufficient for this market. The next doubling will have to beat 2x Grok 4 110min and be released within 4 months of GPT-5 (August 7 -> December 7). Gemini 3.0 is the best bet here.

There has not been a 4 month period where the new SOTA failed to double any SOTA from <6months prior

How does the period since o3 not count? Nothing has doubled that sota to this day (7 months later)

@Usaar33 it doesn’t have to double the sota at release, it has to double sota from 6 months prior. GPT-5 did this, doubling Claude sonnet 3.7, resetting the 4 month counter. Something has always doubled the <6 month sota every 4 months or less. (This could happen as long as 10 months after the sota release if things line up)

Gemini 3 (or something else released before 12/7) will have to double sota from the previous 6 months (grok 4 110 minutes -> 220 minutes)

@Usaar33 just to be clear, I’m not the market creator, but they haven’t clarified the questions below.

Title says 6 month doubling time. GPT-5 showed a <6month doubling, so resets the 4 month counter. Market creator could’ve specified some calculation for an exponential fit or looking at the last two points or something, but outside that clarification, I think it has to be when the doublings happen.

@Mactuary The window to look back is 4 months, not 6 months. 6 month doubling time is simply a rate of progress -- it's akin to saying 12% monthly growth. GPT-5 was released 4 months after prior SOTA O3 (ok 3 months, 3 weeks) and showed far less than 12% monthly growth. No model within 4 months (or 7 for that matter) has doubled O3's score.

@Usaar33 I intend to resolve as: lookback is 6 months, and for 4 consecutive months that lookback has to fail to double SOTA.

I apologize for not specifying the math more precisely when writing this question.

@plex can you explain more.

What sota are you using as the reference?

For instance, if you evaluate this at end of year, you'll start with September. No sota model was released, so do you just ignore the month? Or do you use gpt-5 (released in August) which is over double the sota as of March (which is February sonnet 3.7)?

I assume the former as that's the only thing that makes sense to me.

So then you carry on to October - no new models.

Then November - we evaluate opus 4.5, Gemini 3 and gpt-5-codex against.. what? O3 is sota as of May, but that's an April model, so it doesn't seem correct to consider it either. (Unless you look at the growth rate and take it to the (6/7) power to see effective doubling rate.

My simple position here is that if no model this year hits a 3.5 hour METR time (necessary to be doubling every 6 months relative to o3 which was released in mid April), this resolves true. (I expect this to be the case -- so not worried about the other less likely cases that could also cause a true resolution under what I see as a reasonable interpretation)

@plex could you specify

whether you mean the time series for 50% time horizon or for 80% time horizon (or either/both)

what calculation you will do to determine whether this resolves YES or NO

whether you would resolve before December 31 under any circumstances?

50%

If for four consecutive months when doing a 6 month lookback at the SOTA there is no model released which doubles that SOTA, then yes, else no.

Yes, if someone makes a spreadsheet early and checks and we get a yes for a four month period, I probably won't run the data until market end.

@Usaar33 o3 performed slightly above the 4 month trend line, so if you use that as a start you will find longer doubling time until GPT-5 compared to the general trend. I haven't done the calculations and I find this market somewhat unclear but I suspect that the o3 to GPT-5 growth rate is not sufficient for a yes solution