Resolves positive if it appears that FTX violated its user agreement before Nov 6, 2022; resolves negative if it appears that everything FTX did was formally adhering to the letter of the user agreement.

(Update: I'm interested in whether what FTX has done was technically in line with the letter of the user agreement. The popularly cited part of it says that FTX does not own users’ assets; I’m not sure it says anything about FTX having to store the digital assets in a way prohibiting lending to Alameda.)

Note that as clarified in the comments at the time of market creation, only applicable FTX.com user agreements count.

(I'm trading on this market and frontrunning information that I find before communicating it, being in a trader hat, but this shouldn't affect the markets resolving fairly when I'm in the market creator hat; I do have an occasionally unfair advantage of better understanding myself than other market participants though.)

Close date updated to 2023-07-01 2:59 am

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,810 | |

| 2 | Ṁ267 | |

| 3 | Ṁ233 | |

| 4 | Ṁ160 | |

| 5 | Ṁ83 |

People are also trading

I have inconsistent private evidence from a trading firm on the uniqueness of Alameda’s access bypassing CloudFlare. The definition of “trade execution” doesn’t seem obvious. I think the No resolution is closer to the spirit of the market, but it’s not clear to me; also, I regret being a market participant, as it makes it much harder to be transparently unbiased in markets without a clear resolution

@Shump I need more info on whether only Alameda was able to bypass Cloudflare (SBF defence says no, the prosecution didn't say it was only allowed for Alameda), and whether the commonly used definition of "trade execution" includes not just the mechanism of picking an order to fill from a queue, but also to the formation of the queue, or otherwise more opinions on priority in trade execution. I'm not confident enough that both answers are No

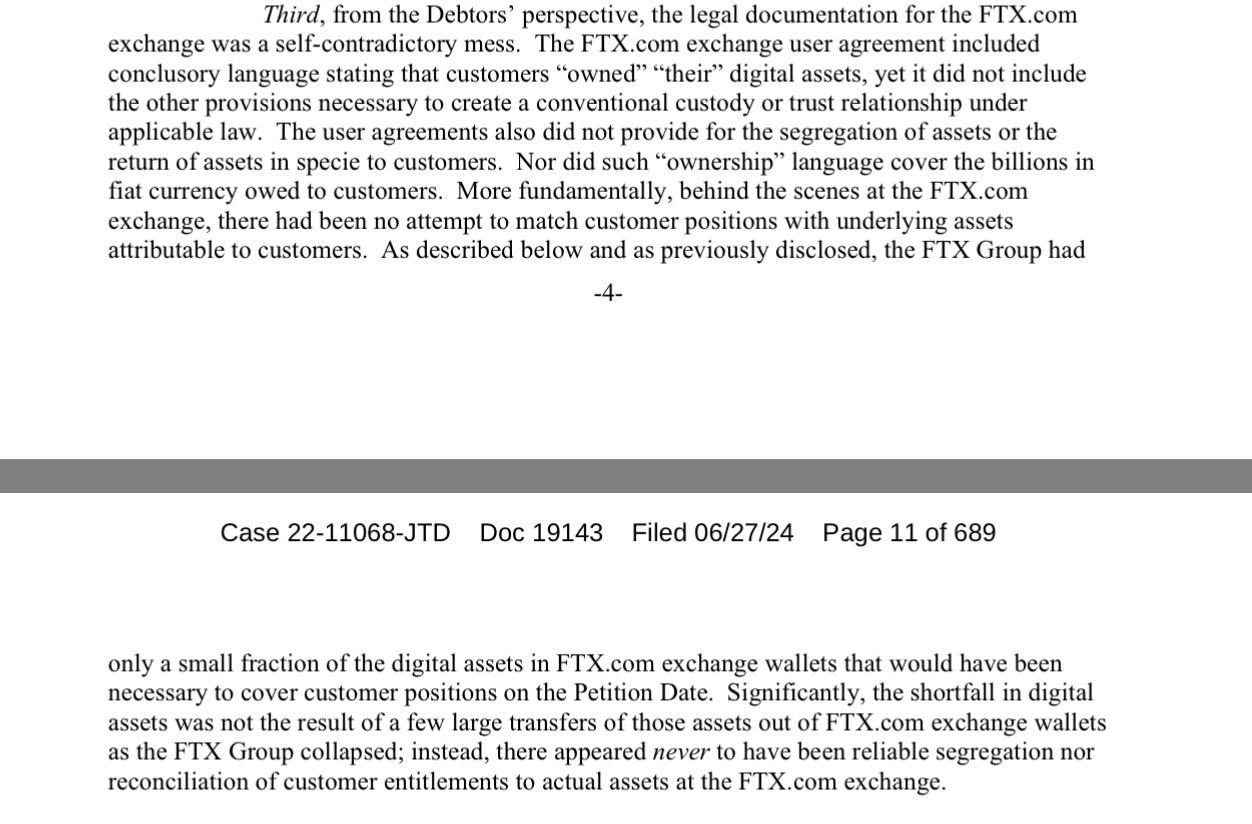

@AndrewHebb there's one specific clause in Terms that some people thought letting Alameda borrow money was violating. In reality, it did not. That part of the terms says just that FTX does not own users’ assets. And now we know there's no applicable law that says that you can't make loans with assets owned by their users: according to John Ray III, FTX intentionally wrote the FTX.com user agreement in a way that would allow them to do it (even though they knew what is the industry practice, and in jurisdictions with tighter requirements FTX, indeed, had user agreements that indeed prohibited loaning user assets).

FTX was letting its customers borrow money, but this did not violate the letter of the terms. The clause prohibited FTX itself from borrowing money but not from letting its customers, including Alameda, borrow money. FTX did not say "hey y'all, sorry, now those are our assets, we don't have an obligation to return anything, we own it now". They knew how much the customers owned and kept the balance.

@ms "That part of the terms says just that FTX does not own users’ assets."

It doesn't just say that. See my response to you below. It also says that they cannot borrow them and that the users can withdraw them at any time.

"And now we know there's no applicable law that says that you can't make loans with assets owned by their users" How do we know that?

"Like, when you put your money into an ATM, you still own the money; but not the specific paper." There are two important difference which are that the bank is borrowing from you and does own the cash you give it. Once you deposit the cash, you don't own any cash in the bank's possession. You own the deposit.

How do we know that?

As I wrote next to it, "according to John Ray III, FTX intentionally wrote the FTX.com user agreement in a way that would allow them to do it (even though they knew what is the industry practice, and in jurisdictions with tighter requirements FTX, indeed, had user agreements that indeed prohibited loaning user assets)." I don't think I want to spend my time discussing this, sorry, this part seems pretty clear.

Valid re banks. The terms also use language like "deposit Digital Assets that you already own into your Account".

The terms say, "None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading", but they do not say the Digital Assets may not be loaned to FTX' customers. The assets were loaned to FTX customers, including Alameda, but not to FTX itself.

The market is about events before Nov 6, so the "can withdraw them at any time" isn't relevant

I do not think that Alameda borrowing FTX customers' money was in violation of the TOS (see discussion earlier).

The only possibility of a Yes resolution is if only Alameda was able to bypass Cloudflare (SBF defence says no, the prosecution didn't say it was only allowed for Alameda), which would make it Alameda's advantage in sending API requests to place orders, AND the commonly used definition of "trade execution" includes not just the mechanism of picking an order to fill from a queue, but also to the formation of the queue, for that advantage to count as a priority in trade execution.

A friend doing HFT told me it's a common practice for exchanges to have dedicated IPs for traders with large volumes, and if anyone can satisfy the criteria and get a dedicated IP to place orders without Cloudflare, and there are companies who did that, this should resolve to No. If no one except for Alameda was able to place orders without Cloudflare, it's likely I'll resolve this to Yes, pending someone clarifying the whole what "priority in trade execution" means

I'm not sure I'd update much based on this specifically, but it does suggest to me that the resolution is not (yet) as clear-cut as was argued by the creator.

https://www.coindesk.com/policy/2023/10/16/sbf-trial-what-did-ftxs-terms-of-service-say-about-customer-funds/

@NicoDelon 8.2.6 was discussed earlier, I'm pretty sure now it wasn't violated.

"Affiliates shall not be afforded any priority in trade execution" seems like it could've been violated though- is Alameda an "Affiliate"? Is "priority" referring just to the execution mechanism, once the trades are placed, or does it include the time it takes to place the trades?

IIRC, Alameda could use the API without CloudFlare in between, which meant it could place trades faster. I think this happens on traditional exchanges as well- trading firms try to get as little delay as possible, including making agreements and placing servers next to the exchange, but while they place trades faster, there's no priority in trade execution. Not sure if it's also the case here- I guess the FTX engine could've prioritised Alameda's trades. Is there any info on this anywhere?

@ms I don't know more than you; I'm just the messenger. It's frustrating to not be able to find clear, simple answers.

@NicoDelon well, that doesn’t update me at all. Alameda was allowed to borrow money, the terms were explicitly written in a way that would allow it

@ms The TOS say that the digital assets are not loaned to FTX. If they are not loaned to FTX, then FTX clearly does not have permission to loan them to someone else. It even says that the owner of the digital assets has control over them and can withdraw them at any time by sending them to a different blockchain address, something which is impossible if they've been loaned to someone else. They also say that as the owner of the digital assets, you bear all risk and that FTX is not liable for fluctuations in the fiat currency value, implying that that is the major risk, not that the people FTX loans the assets to will default. This is deliberately misleading if FTX thought these TOS gave them permission to lend the assets to third parties.

Note that this has nothing to do with segregating customers' assets. It is possible to not agree to segregate the assets but still not have permission to loan them to third parties.

Imagine I was moving away for a few months and couldn't take my bicycle with me so I asked you if I you could hang on to it until I get back. Furthermore, we explicitly agreed that you would not use it and that I could get it at any time if I came back early or asked a friend to come pick it up. I come back from my trip and discover that you lent the bike to a friend and he sold it, and you've both gone bankrupt and neither of you can replace the bike. Did you really not violate our agreement? Does it really matter that you didn't promise to keep it locked up in the shed and instead decided to keep it in the same place as your other bikes that you sometimes lend to friends?