Will I find a violation of universal free fall in my experiment?

If this market resolves NA, this one will resolve NA as well. If it resolves YES, this one will resolve YES as well. If it resolves NO, then I will generate a random integer i between 1 and 100 (inclusive) using @FairlyRandom. If it turns out to be i=37, I will resolve NO. Otherwise I will resolve NA.

It works exactly as this market, except for the different underlying.

People are also trading

@AntonBogun if the real probability of me finding a violation of the principle of universal free fall is very low the main market will not be able to resolve it. For instance if it is 0.14% it’s unlikely to ever go below 1%. This market is an attempt at alleviating this problem.

In case you are asking about the whole universal free fall thing, the point of these markets is to measure the probability that some interesting science may result from awarding me an ACX grant. At present we are between 3% (from the main market) and ~0.5% (from this market) probability that a violation is detected in my experiment and at around 30% probability (from the third market) that I find a non completely trivial explanation for the violation. All told >0.1% probability of getting something cool (a shot at new physics) out of this grant. If you estimate the value of having a good chance of discovering new physics at about the price of a big science experiment (~10^7-10^9 $) then this is pretty good value for the grant money (in expectation).

@mariopasquato Sorry Mario, my bets were not well calibrated. I didn't take the time to bayes this out on paper.

@a appears to have conformed this market to the main market using bayes.

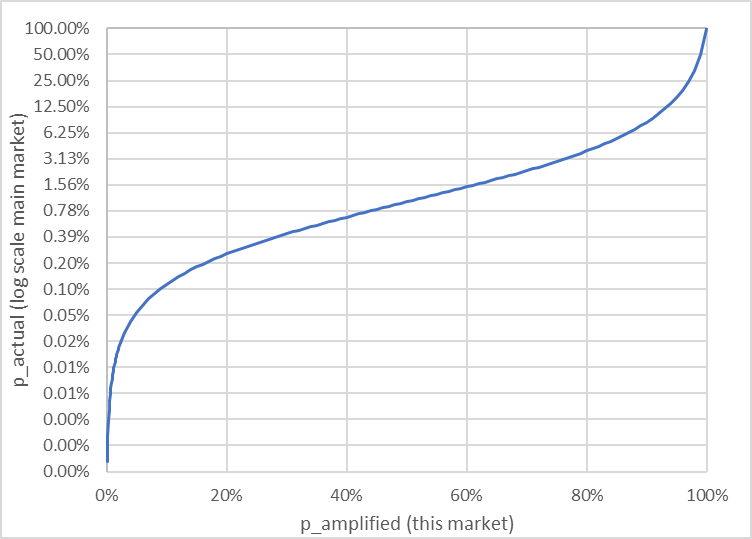

For anyone curious how this amplified market plots out to show a magnification of the regular market here are two plots of p_actual and p_amplified, assuming a 0% chance of an NA resolution. You can see that this is most useful for looking at relatively small p_actual. Note some of the scales are logarithmic.

(this market) /mariopasquato/universal-free-fall-violation-ampli

vs

(main market) /mariopasquato/will-i-find-a-violation-of-universa