Resolves YES if before 2027-01-01T00:00:00-05:00,

Steve is subject to a motion declaring him to be a vexatious or frivolous litigant in any jurisdiction; or

Steve, or a Steve-controlled entity, loses a motion filed under 231 Pa. Code Rule 233.1, regardless of a determination under (c); or

The same, for any equivalent local rule; or

Steve is convicted of 18 Pa. C.S. § 5109 or any equivalent statute; or

At market close, since 2020-01-01T00:00:00-05:00, Steve has commenced, prosecuted, or maintained, pro se, at least five civil actions or proceedings in any state or federal court, other than in a small claims court, that have been finally determined adversely to him (based off of CA Civil Code § 391(b))

"Any equivalent local rule" (bzw. statute) includes the local rules, whatever called, and any procedural or substantive civil statutes (bzw. criminal statute) in any US-based jurisdiction.

Resolves NO otherwise, or barring evidence of any of the above in a reasonable time after market close.

People are also trading

@kopecs I swear to the gods, if I ever get lucky like him, I am going to take the W, instead of riding it all the way into the ground.

@FrederickNorris @kopecs How is he going to get a lawyer? Won't legitimate lawyers be intimidated by "Bull Blockchain Law" (real name of the law firm suing him). A human lawyer trained in AI, and knowledeable in blockchain cyberspeak is the stuff of Soko wet dreams, I expect.

@KevinBlaw It does appear that Mr. Joel Aaron Ready is prepared to accept whatever Steve is paying him in.

@kopecs Before law school, Mr. Ready completed two masters’ degrees in theology at Liberty University and founded The Ready Media Company. He is active as a member at Trinity Bible Fellowship Church in Blandon where he lives with his wife and their two children.

@FrederickNorris The Ready Media Group last updated their blog in 2019. Very savy operators, who aren't saturating the blogger marketplace.

Also potentially some future action against BlockFi: https://stevesokolowski.com/dcg/blog/june-update/#:~:text=An%20analysis%20of%20causes%20of%20action%20in%20our%20next%20suit%20against%20Zac%20Prince%20of%20BlockFi

@kopecs Is this "the Conneticut action"? He should get sanctioned for filing that. It admits that it is idential, but pleading violations of Conneticut law. I'm now lawyer, but it doesn't seem like the right way to do things. Shouldn't all cases be in one court? You can't forum shop all 50 states....unless AI says you can.

@kopecs Omg, this is just sad. "With perfect execution, we will definitely win the case." This fellow thinks any case is winnable if the right words are used in the right order in filings. He seems to understand his eventual downfall, though, in the section about the "online community" being sharply negative.

Is this "the Connecticut action"?"

Yes, the '870 case is.

It admits that it is identical, but pleading violations of Connecticut law. I'm no lawyer, but it doesn't seem like the right way to do things. Shouldn't all cases be in one court? You can't forum shop all 50 states....unless AI says you can.

Frankly, I don't actually know that you can't do what he is doing here: the issue will be if he loses for 12(b)(6) in MDPA and tries to maintain the CT action (AFAIK claim preclusion won't be an issue until a final judgement). I haven't seen this before because typically people sue in the court that actually has jurisdiction the first time because it would just be frivolous and a waste of time to sue somewhere that doesn't (but Rule 11 doesn't seem to be a great deterrent for Steve).

Tangentially I will say there is something uniquely hilarious to me about this paragraph:

Every attorney I’ve met has either asked us to do research for him (in 2017, an attorney we contacted to determine the legality of PROHASHING asked us what we thought,) held useless meetings to charge more (like having two attorneys present in the same room to double the cost,) offered to provide useless services (like trying to get Zac Prince criminally prosecuted,) or taken five years to accomplish what should have been done in two (my mother’s divorce case.)

@kopecs I'm no expert, but I can't imagine filing an action and asking to have it dismissed tolls the statute of limitations, which is what he seems to think.

@FrederickNorris I believe he asked to have it stayed. But I didn't really want to read that one to be honest.

@FrederickNorris You can see everything I've downloaded from the docket in the DCG case here: https://www.courtlistener.com/docket/69511526/sokolowski-v-digital-currency-group-inc/

Case was assigned to Phillip Caraballo who has an AI policy warning about sanctions. It seems to me that the Sokolowski brothers violated this, but in fairness to them, he wasn't the judge when the case was initially filed.

"Increased use of Artificial Intelligence (“AI”), particularly Generative AI (including, but not limited to, OpenAI’s ChatGPT or Google’s Bard), in the practice of law raises a number of practical concerns for the Court, including the risk that the generative AI tool might generate legally or factually incorrect information, that it might create unsupported or nonexistent legal citations, or that it may disclose confidential information in the public sphere. Accordingly, any party, whether appearing pro se or through counsel, who utilizes any generative AI tool in the preparation of any document to be filed in any matter pending before Judge Caraballo, must include with the document a Certificate of Use of Generative AI in which the party must disclose and certify:

The specific AI tool that was used;

The portions of the filing prepared by the AI program; and

That a person has checked the accuracy of any portion of the document generated by AI, including all citations and legal authority.

Failure to comply with this Order may result in sanctions."

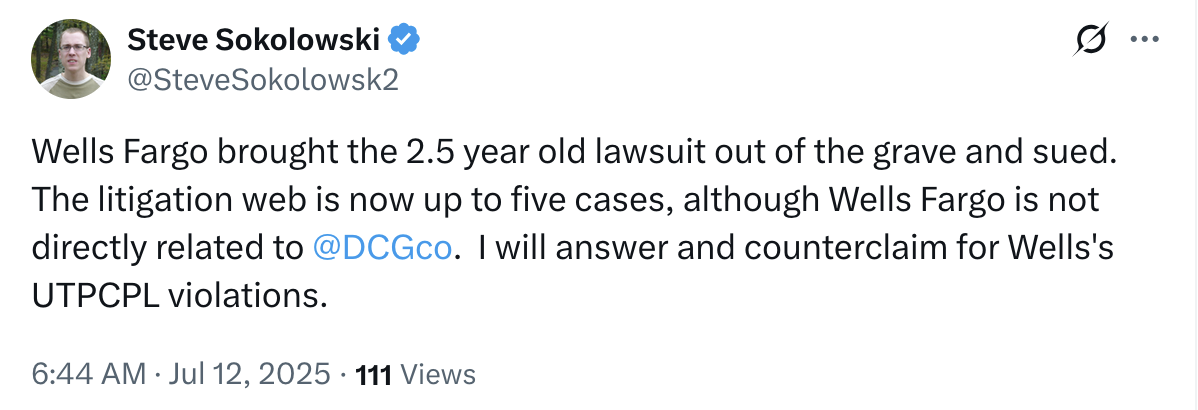

@KevinBlaw This changes everything. It's almost like this Standing Order was meant to head-off the Soko BS. But the main problem with the case remains that the interest was owned and sold by an LLC, and Soko is trying to double dip on his personal name. Not gonna work. Should not work.