Resolves YES if Sokolowski v. Digital Currency Group, Inc., 4:25-cv-00001, (M.D. Penn.) survives defendants' motion to dismiss (e.g., 12(b)(6) or a bankruptcy related motion), In the event that such a motion is granted in part, I will resolve to a % based off of the number of defendants and claims remaining (e.g., a MTD which results in the dismissal of 2 of 3 parties will result in a 33% resolution).

Resolves NO if a motion is granted in full; or plaintiffs dismiss the suit with or without prejudice prior to the last deadline for defendants to file such a motion.

The docket can be found here (or on PACER here). A copy of the original complaint can be found here.

The MTD by defendants Silbert and DCG (ECF 16) is available here. (Mooted by amended complaint but should represent closely the pending brief on renewed MTD)

People are also trading

@SteveSokolowski "survive a motion to dismiss" means to get beyond the motion to dismiss stage, which will never ever ever happen.

@SteveSokolowski Disagree. You haven't "survived" a motion to dismiss by being allowed to file an Amended Complaint that will eventually be dismissed. PS. Please unblock me.

@FrederickNorris Complaints are amended all the time. That's not what the market states - it asked whether a motion to dismiss will be survived.

Nice try, but you lost :) And there's a reason you lost - the case has merit.

@SteveSokolowski This case is not going to survive a motion to dismiss. You will never get to the discovery phase, and there is a reason. Your new Complaint, alleging that you are reading numerically coded messages, is "out there" to put it mildly.

@SteveSokolowski I just read the R&R. The fact that you aren't chastened whatsoever by this, and think it indicates this case has merit, is instructive on your state of mind.

As to this market, the motions to dismiss being moot, because your pleading is garbage and has to be re-done, isn't a Win for you. Sorry.

@SteveSokolowski @kopecs @FrederickNorris I think that if you file an amended complaint and it's so good that the defendant's don't file a motion to dismiss, but instead file an ANSWER, then this market resolves YES. Just for the record, I have a small position on YES.

A more interesting, but unlikely scenario, is that when you attempt to file a "short and concise" complaint, that the court sua sponte dismisses it, because then it won't be dismissed under a 12(b)(6) motion. The way that I read the R&R is that unless the Sokolowski Brothers get a lawyer, you are out of luck. I hear good things about Block Chain Law though. Really aggressive and tenacious litigators.

@KevinBlaw The R&R absolutely sets up the possibility of a sua sponte dismissal based on FRCP 8. But that would not be "surviving" a motion to dismiss.

Bit out of date on following this. Frankly this market should've specified a specific complaint number (just so people didn't have to think about the merits of a future AC).

If a responsive pleading is filed (one which waives 12(b) defenses) I would be inclined to resolve Yes, on the basis that such a motion was filed, was mooted, and a new one was not pending and could be granted "prior to the last deadline for defendants to file such a motion."

Which is to say I agree with Kevin here:

> I think that if you file an amended complaint and it's so good that the defendant's don't file a motion to dismiss, but instead file an ANSWER, then this market resolves YES.

I wasn't anticipating the possibility that this case gets dismissed after the first MTD got mooted in such a way that there is no relevant complaint for defendants to move to dismiss (e.g. all attempts at an AC get struck under rule 8). Will think about this as I catch up on the docket.

@SteveSokolowski Insufficient to just moot a pending MTD to get a YES here. Need to get past the stage where 12(b) is relevant.

@kopecs you mean you don’t follow the Sokolowski docket with baited breath?

The R&R suggests that sua sponte dismissal may be a real possibility here.

@KevinBlaw Only on slow days at the office. If there isn't a Rule 8 compliant complaint I will regret my use of the active voice in "plaintiffs dismiss the suit" under NO. But I don't see how it can be YES based on the criteria I listed. Need to think more between NO or N/A, but if you are telling me you banked on sua sponte dismissal as being "not NO" that's fair.

@kopecs I'm just busting your chops. When the market got down to 1%, I took a position thinking the judge could punt it or some other irregularity caused it to be dismissed, including that the Soko brothers just moved on with their lives.

@kopecs I'm removing settlement as a possibility, but there could come a point at which BTC is lower than what Sokolowski sold it at, which would force him to abandon this case OR disgorge the $.75M he was paid, and take BTC in return.

But if there's never an Answer filed, this case hasn't "survived" a motion to dismiss. An Answer filed, I'd agree, resolves YES s to any answering defendant.

@FrederickNorris You have so little faith. Is there anything in the world I could possibly do that would convince you that this case has merit?

@SteveSokolowski I would turn the question around to you. What will it take for you to understand that you made a risky loan, you had a bankruptcy claim as a result, sold it, and that's the end of the situation?

Do you realize that YOU are the cause of the shutdown of Prohashing (maybe a blessing in disguise) because you bragged about having so much liquid cash that you made yourself a target?

You should get a regular job and get offline. That's my honest opinion.

@SteveSokolowski I will add: the smartest thing you've said about the case is "There is such a negative reaction from online people, maybe there is something I don't grasp about why this isn't a case." (that's obvious a paraphrase). You should give up this nonsense, be glad you sold your BTC, though involuntarily, still at a big profit, and just move on with your life in the real world!

@FrederickNorris this is such sound advice such that I took a small position that he might voluntarily dismiss the case and this survive the motion to dismiss.

https://www.nytimes.com/2025/11/07/business/lawyers-ai-vigilantes.html

It's not just pro se Sokolowski's submitting AI slop.

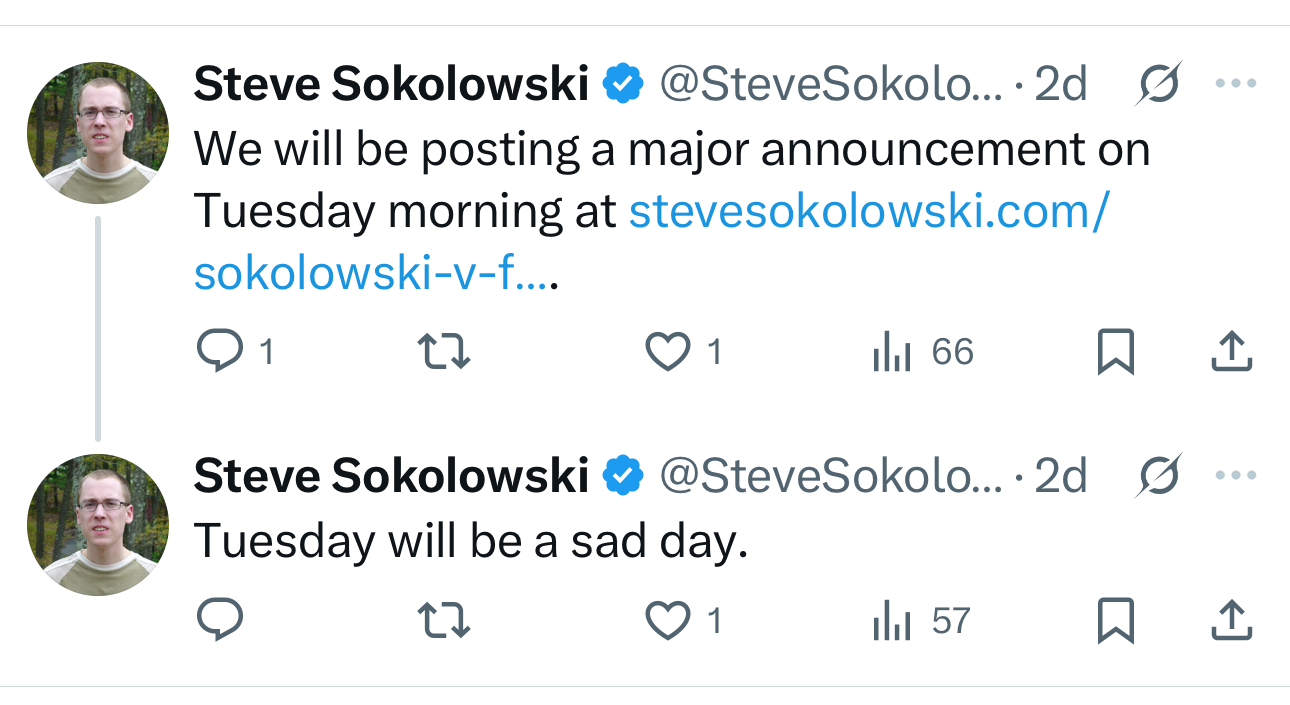

I think the news will be the fraudsters won because he’s thrown in the towel to exploit the growing AI Halloween music market that all today’s kids can’t get enough of.