This market will resolve YES, if the next elected president of Argentina is again Javier Milei.

Otherwise, this market will resolve NO.

People are also trading

Interesting analysis! Milei’s chances for reelection will likely depend on Argentina’s economic recovery, public sentiment, and political alliances. It will be fascinating to see how voters respond in the next election. https://brown-leatherjackets.com/products/the-deck-heat-straps-jacket

That's the Argentine center left winning a provincial election for you, fellas

Can't wait for The Guardian columnists and The New School types to explain how this is either all capitalism's fault or good for human rights

Legislative Election Polls (2025 Outlook): For the upcoming Argentine legislative elections scheduled for October 26, 2025, opinion polling uses Local Regression (LOESS) to track voter sentiment. While specific candidate-level data for Milei himself is not detailed, polls suggest his party, La Libertad Avanza (LLA), remains competitive. The polls merge Kirchnerism and Federal Peronism into Unión por la Patria (UXP), showing a fragmented political landscape where LLA holds an edge among younger voters, while traditional parties like JxC and Todos retain support among older demographics. No specific percentages for LLA’s 2025 prospects are provided, but Milei’s personal popularity appears to bolster his party’s standing.

• Public Sentiment (December 2024): A Giacobbe y Asociados survey from December 2024 asked Argentines which politician they’d invite to New Year’s Eve, with results indicating widespread distrust in politicians overall, including Milei. However, his libertarian policies still resonate with a significant portion of the electorate, particularly younger voters, as seen in earlier 2023 polls where LLA led among males and younger age groups.

https://fee.org/articles/voters-markets-and-the-new-virtuous-circle-in-argentina/

VOTERS, MARKETS, AND THE NEW VIRTUOUS CIRCLE IN ARGENTINA

AI generated

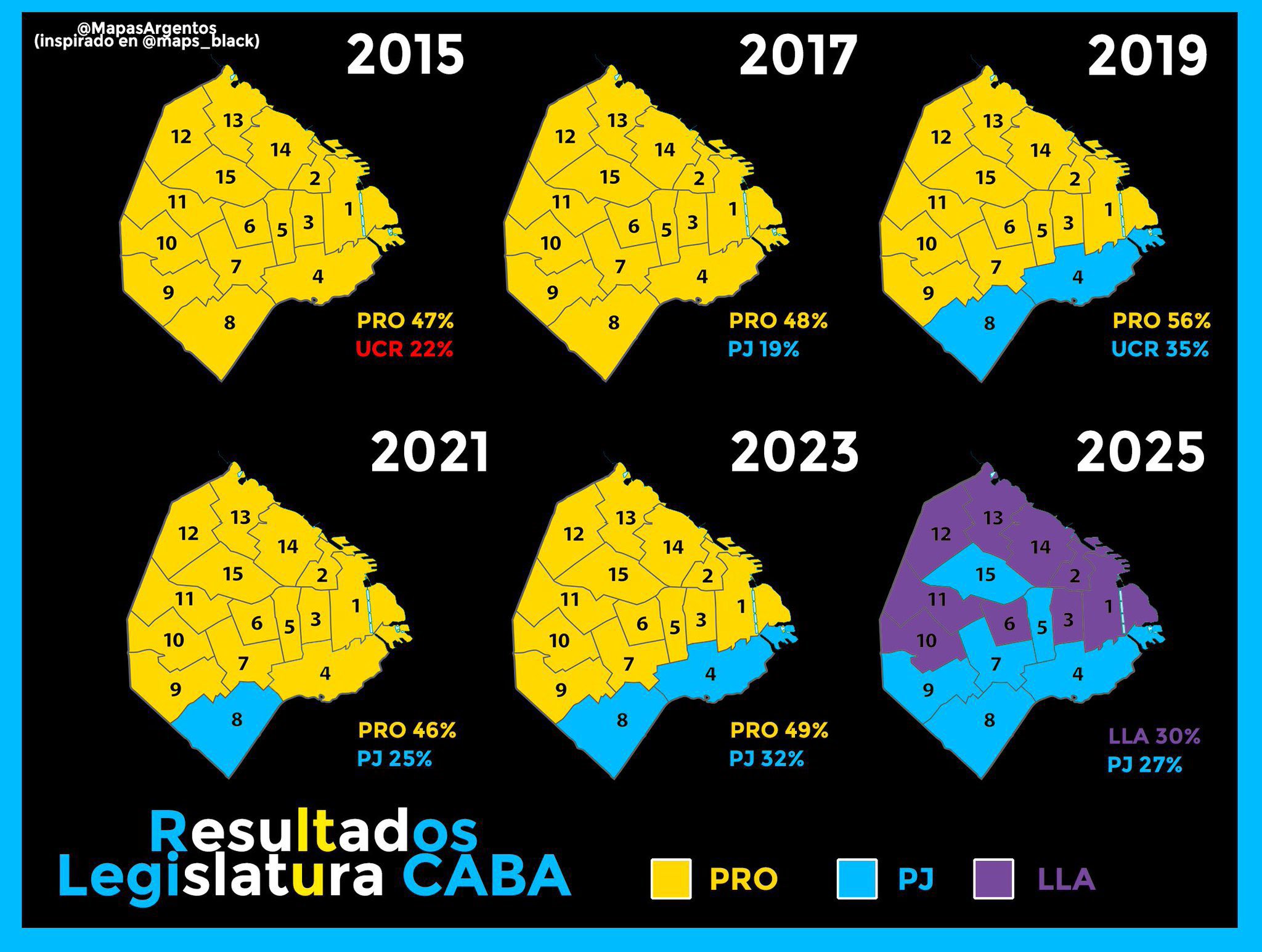

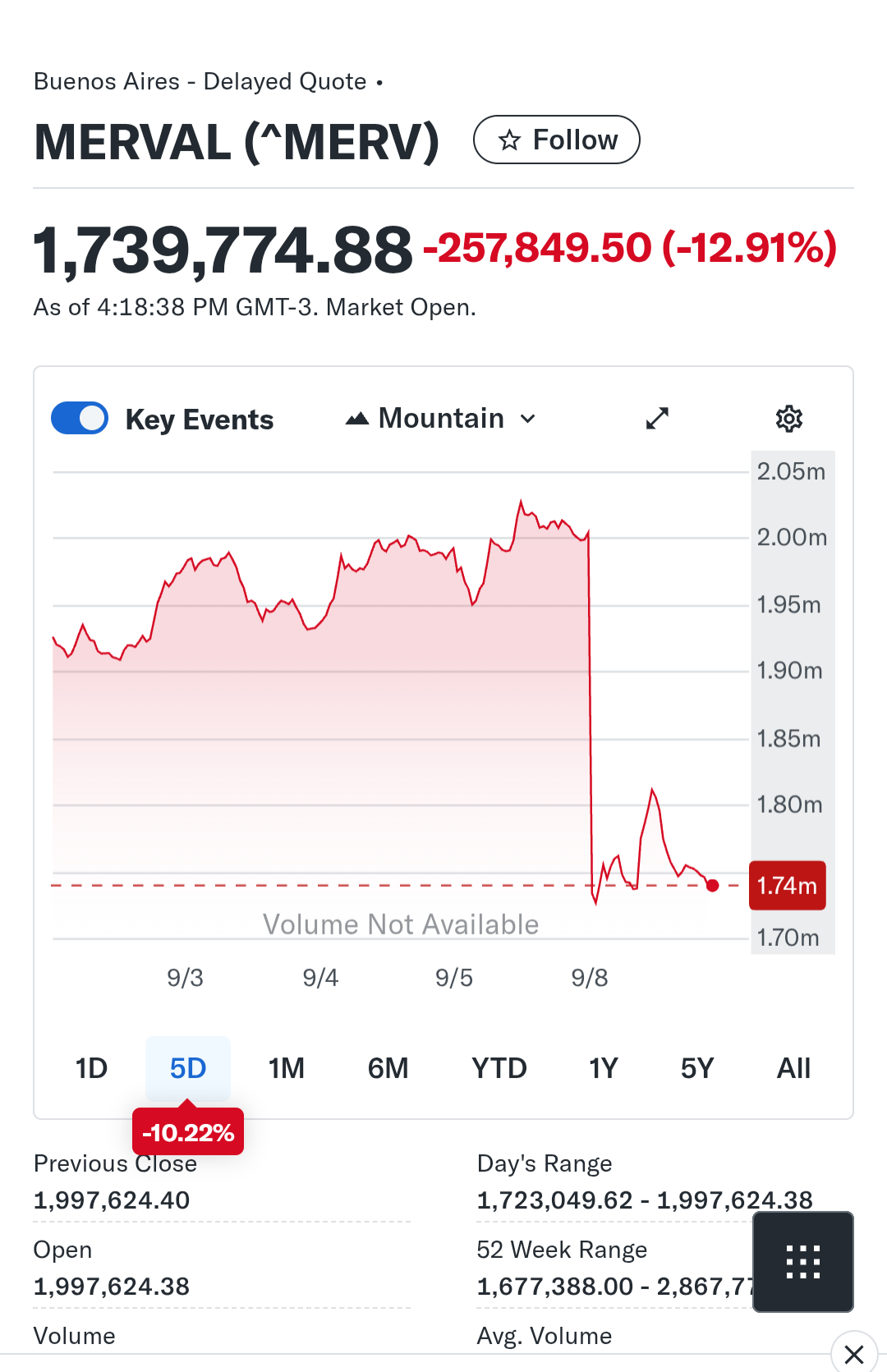

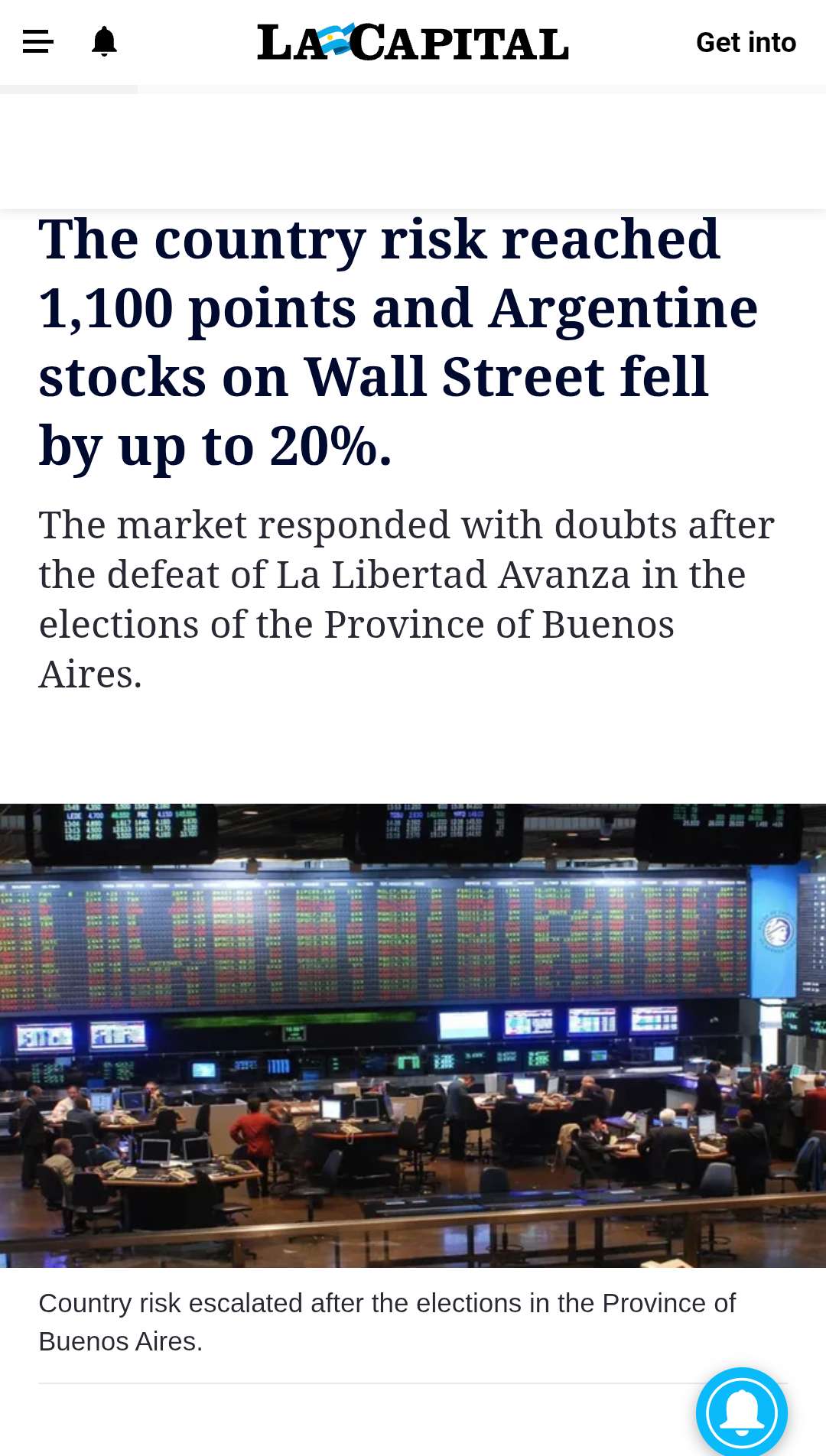

Javier Milei, President of Argentina, celebrated the victory of Manuel Adorni from his party La Libertad Avanza in the Buenos Aires city elections, marking a significant shift as the traditional stronghold of the PRO party turned to Milei's movement. Milei declared that the city, historically a PRO bastion, was now 'painted violet' and expressed his intention to extend this influence nationwide. The elections were marred by controversy, including accusations from Mauricio Macri and the PRO party of a digital fraud attempt and a manipulated video of Macri attributed to La Libertad Avanza, which Adorni and Milei denied. Milei criticized Macri, calling him a 'crybaby' and dismissed the PRO party as obsolete. Following the election results, Milei invited all center-right leaders to join La Libertad Avanza, positioning his party as the main vehicle for political change in Argentina. Additionally, Milei is advancing plans to ease tax regulations to encourage Argentines to declare and use the estimated $271 billion in undeclared cash, mostly in US dollars, held outside the formal banking system. He stated that he does not care about the origin of these funds and is preparing a measure to integrate this money into the economy. Since taking office nearly two years ago, Milei has gained attention for curbing inflation, reducing the fiscal deficit, and implementing economic reforms, although his leadership style has faced criticism.

Voters in Buenos Aires are casting ballots in local elections that will serve as a litmus test for President Javier Milei's political strength. The elections are crucial for Milei's La Libertad Avanza party as they seek to expand their influence in the capital and position themselves as the leading conservative force in Argentina.

More than 2.5 million people are eligible to vote in the election, which will determine 30 of the 60 seats in the city's legislature, allocated by the D'Hondt method. By midday, over 20% of the electorate had voted. The contest is marked by a significant rivalry between Milei's party and the PRO party, led by former President Mauricio Macri, which has governed the city since 2007.

Milei's party has put forward Manuel Adorni, the presidential spokesperson, as their candidate, while the PRO party is represented by Silvia Lospennato. The election has been nationalized, with Milei and Macri engaging in public disputes. Milei referred to Macri as a 'llorón' (crybaby) and criticized him for being 'de cristal' (fragile).

The outcome of the election could influence the upcoming national midterms in October, potentially boosting Milei's party or reinforcing Macri's influence within the conservative spectrum. The results are expected to be a significant indicator of the political landscape in Argentina.

libertarian 30,1%

center-left 27,49%

center-right 15,71%

center (more left than right) 8,06%

socialist 3,16%

ONLY 50% TURNOVER !!!

tldr is: not too consequential by itself, but sets the tone for the midterms. libertarians won at the expense of their goodwill with the center right (campaigned against them very heavily). so even if the left cant gain a majority in october (90% chance they dont), they are not going to be comfortable and they will have a lot of trouble passing laws.

the left did okay-ish, slightly improved since their last election. not the big win they needed though.

I’ve activated DeepSearch mode to iteratively search the web and analyze the most recent and relevant information regarding Argentine President Javier Milei’s approval rating as of May 16, 2025. Below is the synthesized result based on the latest available data, critically evaluated for accuracy and context.

---

### Javier Milei’s Approval Rating as of May 16, 2025

No precise approval rating for Javier Milei on May 16, 2025, is available from the sources accessed. The most recent and reliable data points are from early 2025, with some variation across polling firms. Here’s a detailed breakdown:

- March 2025 (Opina Argentina): A poll from March 11, 2025, reported Milei’s approval rating at 48%, a 6-point drop from 54% in February 2025. This was noted as his lowest approval since September 2024. Support was higher among men (54%) than women (48%).[](https://buenosairesherald.com/politics/mileis-popularity-slumps-amid-bahia-blanca-tragedy-and-imf-negotiations)

- March 2025 (Zuban-Córdoba): A Zuban-Córdoba poll from March 2025 indicated 58.4% disapproval of Milei’s government performance, with 58.5% holding a negative image of him. This suggests an approval rating potentially below 41.5%, though exact approval figures weren’t specified.[](https://buenosairesherald.com/politics/mileis-popularity-slumps-amid-bahia-blanca-tragedy-and-imf-negotiations)

- January 2025 (Forbes): A Forbes article citing a November 2024 survey reported Milei’s approval at 52.3%, with optimism about economic conditions rising (47.4% felt hopeful).[](https://www.forbes.com/sites/afontevecchia/2025/01/14/the-ecstasy-of-javier-milei/)

- December 2024 (Gallup): A Gallup poll from December 2024 reported Milei’s approval rating at over 50%, with 59% approval among the richest 20% and 39% among the poorest 20%.[](https://en.wikipedia.org/wiki/Javier_Milei)

- November 2024 (LatAm Pulse/AtlasIntel): A Bloomberg-reported poll showed approval at 47%, up from 43% in October 2024, reflecting economic recovery and cooling inflation.[](https://www.batimes.com.ar/news/argentina/milei-gains-popularity-as-argentinas-economy-shows-sign-of-life.phtml)

### Analysis and Trends

- Recent Decline: The March 2025 polls suggest a downward trend in Milei’s approval, likely driven by public discontent over issues like IMF negotiations, the government’s response to a natural disaster in Bahía Blanca, and ongoing economic challenges (e.g., poverty at 52.9% and persistent inflation).[](https://buenosairesherald.com/politics/mileis-popularity-slumps-amid-bahia-blanca-tragedy-and-imf-negotiations)[](https://www.aljazeera.com/news/longform/2024/12/7/a-year-into-javier-mileis-presidency-argentinas-poverty-hits-a-new-high)

- Economic Context: Milei’s austerity measures, including subsidy cuts and deregulation, have reduced inflation (2.7% monthly in October 2024) and achieved a balanced budget, boosting market confidence. However, these policies have increased poverty and strained the middle class, contributing to negative public sentiment.[](https://www.batimes.com.ar/news/argentina/milei-gains-popularity-as-argentinas-economy-shows-sign-of-life.phtml)[](https://www.aljazeera.com/news/longform/2024/12/7/a-year-into-javier-mileis-presidency-argentinas-poverty-hits-a-new-high)

- Demographic Divide: Approval remains higher among wealthier Argentines and men, but lower among poorer citizens and women, reflecting unequal economic impacts.[](https://news.gallup.com/poll/654089/javier-milei-argentina-charts.aspx)[](https://buenosairesherald.com/politics/mileis-popularity-slumps-amid-bahia-blanca-tragedy-and-imf-negotiations)

- No May 2025 Data: The absence of May 2025-specific polls limits precision. Given the March 2025 decline (48% or lower), approval today is likely in the 40-48% range, assuming no major events have shifted public opinion significantly since March.

### Critical Evaluation

- Source Reliability: Polls from Opina Argentina, Zuban-Córdoba, and Gallup are reputable but vary in methodology and sample size. Zuban-Córdoba’s focus on disapproval may overstate negative sentiment, while Gallup’s December 2024 optimism may not reflect recent challenges.[](https://buenosairesherald.com/politics/mileis-popularity-slumps-amid-bahia-blanca-tragedy-and-imf-negotiations)[](https://news.gallup.com/poll/654089/javier-milei-argentina-charts.aspx)

- Potential Bias: Some sources (e.g., Forbes, Bloomberg) highlight market successes, potentially skewing toward Milei’s economic achievements, while others (e.g., Al Jazeera) emphasize poverty and public hardship, which could understate approval.[](https://www.forbes.com/sites/afontevecchia/2025/01/14/the-ecstasy-of-javier-milei/)[](https://www.aljazeera.com/news/longform/2024/12/7/a-year-into-javier-mileis-presidency-argentinas-poverty-hits-a-new-high)

- Data Gaps: Without May 2025 polls, I’ve extrapolated based on trends. Events like the May 2025 immigration decree or midterm election campaigns could have altered public opinion, but no evidence confirms this.[](https://en.wikipedia.org/wiki/Javier_Milei)

### Conclusion

As of May 16, 2025, Javier Milei’s approval rating is estimated to be approximately 40-48%, based on March 2025 polls showing a decline to 48% (Opina Argentina) and rising disapproval (Zuban-Córdoba). Economic gains have bolstered support among wealthier groups, but poverty, security concerns, and IMF negotiations have eroded broader approval. For the most current figure, check ongoing polls from sources like Universidad de San Andrés or Torcuato Di Tella University, as they regularly track public opinion.

If you’d like me to dig deeper into specific events (e.g., the immigration decree or midterm election sentiment) or cross-reference additional polling firms, let me know[](https://news.gallup.com/poll/654089/javier-milei-argentina-charts.aspx)[](https://www.batimes.com.ar/news/argentina/milei-gains-popularity-as-argentinas-economy-shows-sign-of-life.phtml)

@itsTomekK 45% sounds a lot more reasonable. id say polling here isnt very good (compared to other countries), but if you NEED to get a %, its probably that.

@itsTomekK i live here and there isnt any path for his reelection other than a miracle in the next two years. too many scandals, the stats people are getting here (such as poverty decreasing, salaries going up, inflation being under control) are mostly propaganda, and he relies entirely on the center-right to support him in congress and legacy media. all this will be clearer after the october midterms.

@TiagoChamba Idk for sure but approval rates consistently climbing as it shows the promised results.

@Guilhermesampaiodeoliveir What promised results? (Btw, his approval rate was 61% in december when he got elected and is 49% now.)

@Milanesa Inflation, RIPTE, exports, industry output and so on, recently he achieved 2.7% MoM inflation, his election approval of course will take a while to match.

@Guilhermesampaiodeoliveir RIPTE? Wages are super low and haven’t recovered from Milei's major devaluation, specially informal jobs. Exports? Argentina's biggest export (agriculture) went up, but it's a distortion on the data, caused by the historic drought of the previous year. Industry output? It’s at historic lows levels, with a deep recession and critically low consumption. Heck, is comparable or even worse than during COVID. The economy hit rock bottom months ago and still isn’t showing a consistent recovery. Are we talking about the same country?

But yeah, inflation is going down, and that’s the only thing keeping Milei's approval rating from collapsing. But to keep inflation down, the dollar is at an artificially low price, sustained by the central bank reserves intervening in the currency market. That's delaying the opening of the exchange rate restrictions (you need dollar reserves to open them up). Also, with this we have yet another carry trade scheme, just like under Macri (2015-2019). That time it all ended in a major devaluation and inflation spike.

@Milanesa Not sure where you are getting your data from but if you are talking about achieving the levels right before his election in all departments, it will not happen any time soon, but afaik all metrics are consistently crawling towards improvement.

@Guilhermesampaiodeoliveir You mentioned Milei showing promised results in inflation, wages, exports and industry output. But only inflation is improving (after a big spike when he devaluated the peso 54% in December) while the rest collapsed tremendously to almost historic lows and are showing very slow and inconsistent recoveries at best.

-

Wages - Official data was released by INDEC (Instituto Nacional de Estadística y Censos) just yesterday: https://www.indec.gob.ar/indec/web/Nivel4-Tema-4-31-61

You can read this news report from today for more context about why wages are not recovering (in Spanish): https://tn.com.ar/economia/2024/11/13/la-inflacion-baja-pero-los-salarios-no-repuntan-los-motivos-que-explican-la-caida-de-los-ingresos-familiares

- "Since the third quarter of 2023, there has been a phenomenal liquefaction of real labor income of total jobs: they fell 12% between then and the second quarter of 2024". "If we observe the recovery of public and informal wages, we can see that it is very tenuous or even stagnant. For example, in the public sector, wages have been flat for several months." "As of September, they are 16% below November last year."

-

Industry and Economic activity - the best official data is the Estimador mensual de actividad económica (EMAE) by INDEC. Here is the last one, from the end of October: https://www.indec.gob.ar/indec/web/Nivel4-Tema-3-9-48

- "In August 2024, the Monthly Economic Activity Estimator (EMAE) decreased 3.8% with respect to the same month of 2023. The seasonally adjusted indicator increased 0.2%, while the trend-cycle indicator registered a decrease of 0.2%, both with respect to the previous month". Basically, Argentina's economy is 3.8% worse than before Milei, and is only 0.2% better than the previous month, showing a stagnation, and not a clear recovery.

-

Exports - Official Comercio exterior data: https://www.indec.gob.ar/indec/web/Nivel3-Tema-3-2

- The current account is positive, but that's because there was a big drop in imports caused by the recession and the extreme Milei's devaluation. Exports are growing compared to last year because last year there was a very big drought that severely decreased exports of agricultural products. Sadly, all this surplus is calculated to be lost in the next months: due to the extremely low price of the dollar, Argentine tourists will spend their summer vacations abroad instead of within the country, reducing the Central Bank dollars reserves (and with serious damage to the national tourism industry).

-

Where are you getting your data from? I'm not asking in a bad way, I'm just curious because it's quite different from what I see from official data, economists, etc. Heck, even the wages news report I linked is from a right-wing TV channel (TN, from Grupo Clarin), famous to spin everything in a good light for neoliberal governments. So, things not showing a consistent recovery it's quite a consensus among economists.

@Milanesa, we are looking at the same data, yes it collapsed, and will stay collapsed for a long time until the private sector picks up the slack, sure, the healthy improvements so far have been slow but are happening and will not surpass the debt fueled status of the previous government perhaps for years, but i realize that theoretical improvements might not actually raise his approval levels, perhaps you are right it wouldn't sway Argentine citizens if the situation at the end of the day still still considerably worse than before.

@Guilhermesampaiodeoliveir Just an aclaration to add more context, but the "debt fueled status of the previous governemnt" was from debt actually taken in 2018 by Macri and Caputo. It was the biggest loan in IMF's history and condemned Argentina to the IMF austherity policies for decades to come (same than in the 70's and 80's with the genocidal dictatorships): https://www.theguardian.com/world/2018/sep/26/argentina-imf-biggest-loan

The payment of the interests from that debt were of course a big problem for the previous government. Specially if you add the drought that limited exports. The funny thing is that the same Caputo that took that debt, sustaining a bubble of carry trade and financial speculation that ended up collapsing in 2019, is now the Economy Minister under Milei, and wants desperately to keep taking even more debt to keep doing the same.

@Milanesa Iirc he need the IMF loan to remove the currency controls, not because he wants to fuel more spending.