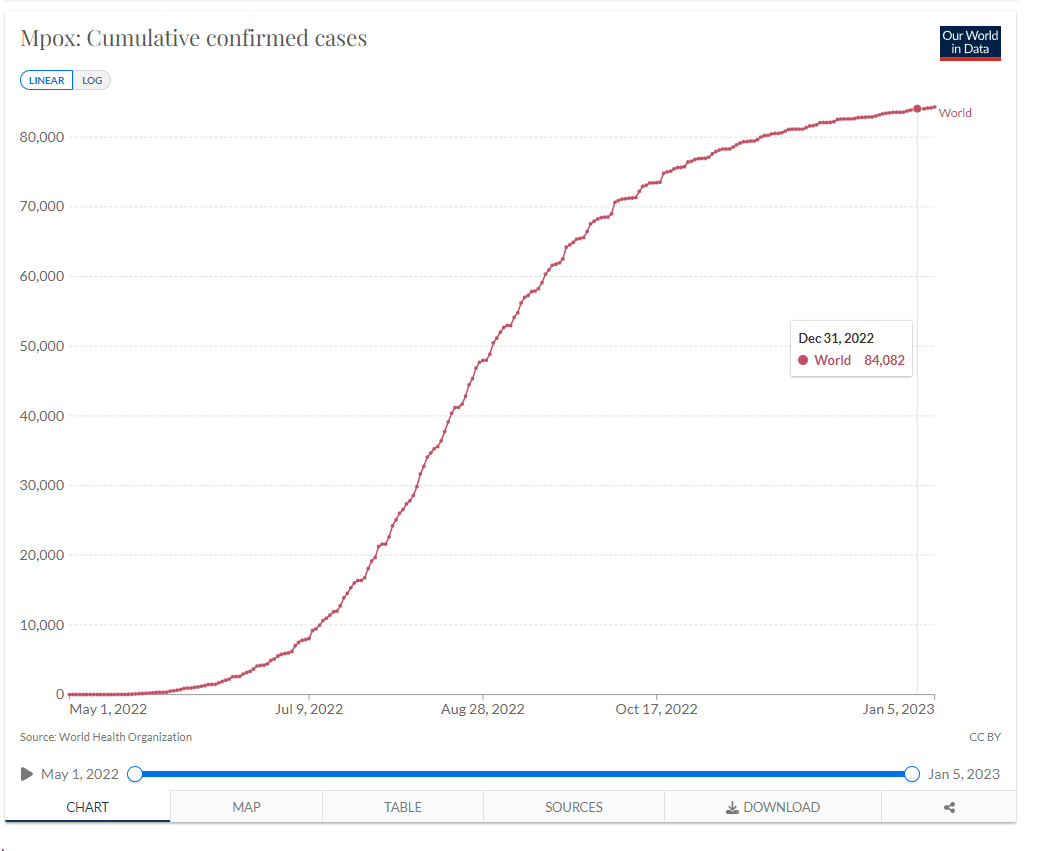

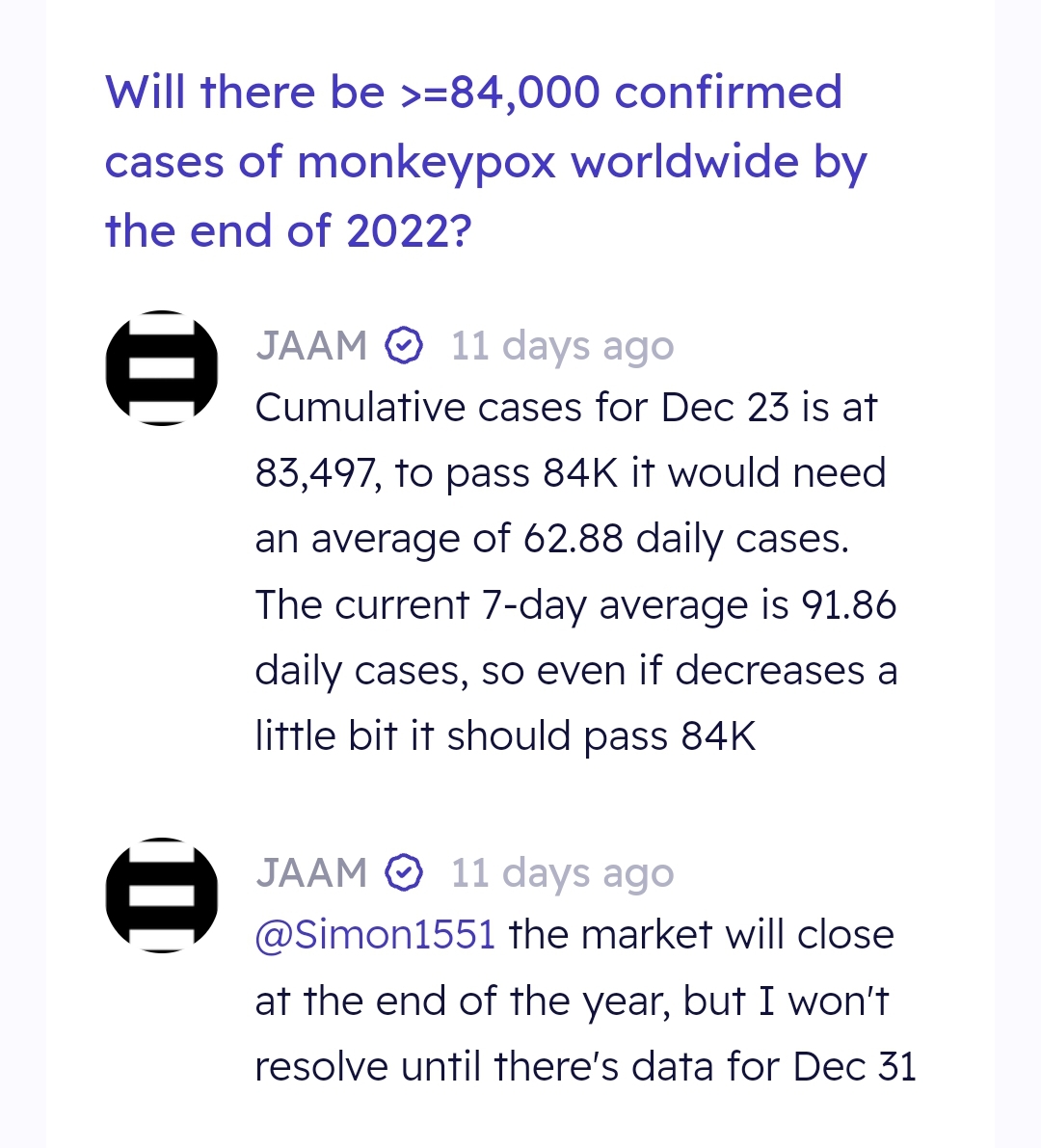

This question resolves to YES if there are >=84,000 confirmed cases of monkeypox worldwide by year end, using the cumulative confirmed cases of December 31, 2022 from Our World in Data: https://ourworldindata.org/monkeypox

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ4,750 | |

| 2 | Ṁ2,671 | |

| 3 | Ṁ2,341 | |

| 4 | Ṁ2,331 | |

| 5 | Ṁ2,203 |

@Kamlisha I've banged on about this in a few other markets but I think one of the major flaws of this platform is that most markets tend to get resolved on technicalities rather than the "intention" of the market.

Hypothetical scenario, if I was manufacturing drugs or other treatments for MP and I wanted a trend or threshold to be met before I committed my resources, then late data like this wouldn't affect my decision. I'd be going back to my boss saying "Hey, they revised the numbers and it does look like it's fitting the curve we expected, we should commit to producing more vaccines".

Manifold resolutions don't follow this sort of logic however.

@SamuelRichardson I agree everyone gets really nitpicky about the details most of the time and it's hard to get markets that actually refelct the question the creator wanted to ask (unless they are playing with the technicalitities, which is not uncommon)

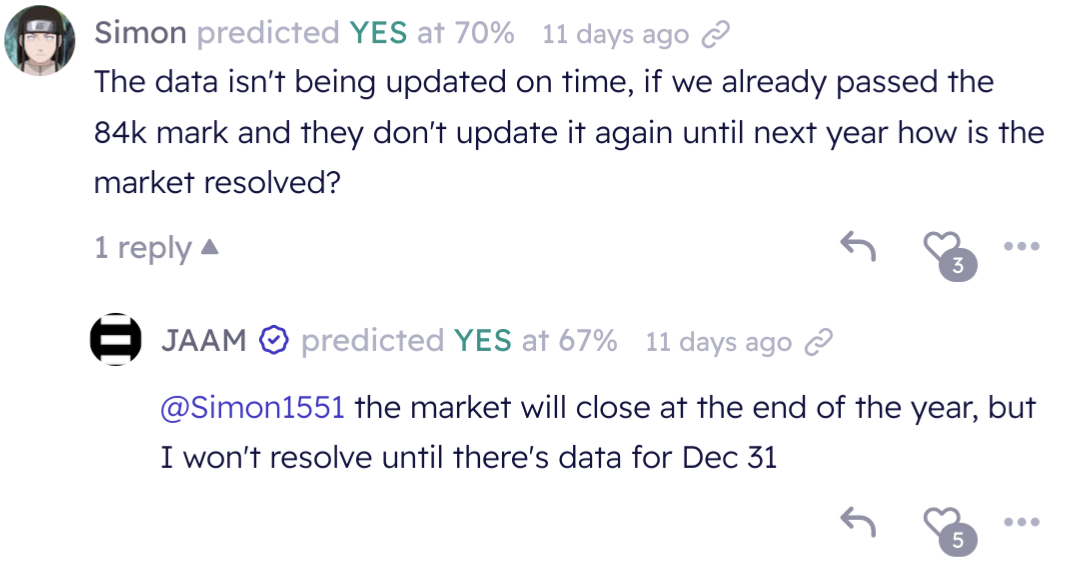

@Simon1551 sadly I cannot do anything after I the market resolved. I used the cumulative cases when they were available, so I do not think that it was resolved incorrectly.

In any other market I would cover the loses of those that lost money to keep everyone happy. However, this market had more than N$91K volume, and I cannot send half of that to those that bid YES. BTW I lost M$1,855 here so I would be on my own interest to try to make this market resolve N/A (I'm not sure if that can be done by administrators), but I don't think that would be fair to those that made money betting NO. Maybe many of those took into amount that data would not be complete for the holidays until after market resolution.

I'm really sorry that it went this way, I definitely didn't consider what to do if they change the data for Dec 31 after a week. I'm also open for more discussion.

@Duncan I believe so, and I think that I had made it explicit in a comment that I was going to resolve once there was data for Dec 31, which is what I did. But still it sucks that the actual data changed for everyone that bet YES, and I can understand why they are not happy with the resolution

@egroj It's really not your fault I don't think it would be fair for you to cover the "damages". When it's OWD that released incorrect info. Personally I don't think that there's anything unfair about taking money from those who bet NO

@egroj True, but if you changed it, another group could say wait another month (or year), maybe they'll get better data and change it back. Close markets are always a risk, and the people investing in them know they are risks.

@Duncan actually the case of data changing had been covered in the comments, but I should have changed the market description so that it was more explicit

@egroj Personally I don't think that there's anything unfair about taking money from those who bet NO, regardless of me betting YES or NO.

Now there could be an argument made on whether we bet to the actual outcome or on the information we have.

For example (I remember this during the WC) a market on whether France would lose against Tunisia, a creator at the end of the game resolves it but then later there's info saying that the goal should've counted. Because there was a back and forth about Griezmann's goal and France's Football Federation appealed to get their goal validated. If they managed to get their goal validated should those who bet on that market get their money back?

@Duncan I agree with you that there are always risks but what are the limits? What's the line between the risks of a particular situation happening that we should expect and a situation that we can "demand or deserve" a compensation?

@Simon1551 Presumably, in the case where in your judgement the market comes down to a coin flip, you should either not invest or invest towards 50%. As far as uncertainty goes, that's the limit. However, if you mean how clearly do resolution criteria have to be defined for all possible conditions, that's an open question, in part because people will disagree over it, even when all terms are clear.

@Adam Wow. Is it possible that the market will be resolved again, or will it just stay like this? Brutal

@Gen Yeah. I guess this teaches me to trust that markets will be resolved correctly and not account for that uncertainty in my betting >_<

@Simon1551 I'm 85% sure that JAAM has enough money to payback every single person that voted YES

@Simon1551 Unless we weren't predicting the actual outcome but what information would be available to us and in that case this market's resolution was the right one

@Simon1551 I feel that the wording in the description is ambiguous enough to support either interpretation.

@JoshuaClark @Simon1551 actually there is a comment from JAAM were he clarifies, that the first available Datapoint for Dez 31 will be the resolution criteria.

@Svenbonne I remember reading the comment but I can't seem to find it, could you link it?

@Simon1551 Maybe I'm misremembering but I thought someone asked what would happen if the data was updated later. The comment you've sent doesn't seem particularly clear on that matter.

Super unfortunate but nobody could have reasonably foreseen this.

I'm a bit surprised that nobody foresaw it actually. These data updates are extremely common in my experience looking at Covid case counts, and I assume the same applies to other diseases. I wouldn't necessarily expect any individual to foresee it, but surprised that nobody asked about it in the comments.

@jack I specifically bet NO here because I assumed Christmas, NYE and the weekend would fuck with the data keeping. Don't think this should have been undone at all, nor should it be possible to do so.

@WieDan I predicted YES but understood that the data process potentially being slow was included in the resolution.

@WieDan The resolution criteria weren't clear imo. It could have been made clear by choosing one of the following:

Resolves based on the first officially reported data for 12/31

Resolves based on the reported data for 12/31 as of 1/10. If the data is corrected, the most recent data will be used.

The thing being able to undo the resolution allows is the freedom to pick a third option:

Resolves based on the officially reported data for 12/31. If the data is later corrected, re-resolves based on the corrected data.

This way you can allow for a much longer cutoff for corrections without locking up people's mana for a long time.

@jack I agree it could have been more clearly stated, but it was at least stated in the comments. Maybe there’s an argument that you’re not expected to read every comment to bet based on the description.

@jack I agree the resolution criteria could be better, I was just agreeing with the above poster than some people bet either specifically on the basis of the resolution working that way, or at least with the knowledge of it.

@jack I agree that the market resolution wasn't clear enough to consider this case, the reason is that I wasn't expecting the data to change. On my defense I don't think that anyone expected that either, or they would have asked in the comments and I would have made sure to think about what to do if the data changed.

@egroj yeah I agree, I don't fault you for this and I think the resolution is not incorrect (although yes or n/a would also not be incorrect imo). And I was surprised nobody thought to ask it in the comments. There's a good chance I would have thought to ask about it if is been more involved in the market, it happens all the time for COVID data is my impression.

@jack Interestingly enough, I'm arguing in this market about whether "confirmed cases of January 10" even means the Jan10 datapoint, or the data reported by that date. Clearly, it needs to be specified (or discussed) in future.

I'll certainly seek clarification on any future markets of this nature

@egroj Sorry I didn't see the notification do you still need the comments? It was deleted from here but if you look through your comments on your profile you should be able to find what you're looking for.

@Simon1551 thanks, no I think it's ok. DM on discord though to be able to tip you for your comments here

@jack If markets were open to their creators revising the outcome at will for extended periods after close, I would not want to participate in those markets. I think such a system would give much greater temptation for market creators to resolve unfaithfully. consider a market creator that creates one market a week, and each market gets M$10,000 in bets. In the current system, if they defect and resolve unfaithfully, they may be able to steal M$10,000 (usually less but let's say that). in a system that lets them revise market resolutions, they could instead build up a series of positions that they can then revise unfaithfully, across many markets, all at once. They could even be lead into the temptation to do so even without explicitly taking positions they know to be losing; perhaps they could make a series of bad bets, and realize they can make all their money back and then some by revising the results of closed markets.

@Adam There are many ways to implement a outcome revisit for creators without it having the risk of being abused they could make creators have to appeal and a human would say if the change in the market would be allow or not. If you're just worried about creators abusing that feature for their own benefits or for a third party that's fair but it probably goes for any market resolution in general, creators abusing revisits would get ostracized. I think

@Adam There are many ways to prevent that, such as:

This could be subject to reasonable limitations - e.g. can only fix the resolution within some grace period, or perhaps it could require approval by the admins or other parties.

And Manifold is planning to implement this in large part so that they can fix fraudulent misresolutions. So if an author did abuse it, Manifold could cancel that.