Premise:

@Tumbles owes a lot of mana.

There has been talk of renegotiating this debt with his creditors, and/or more complicated financial arrangements.

How much is Tumbles' debt worth? (i.e. cents on the dollar, except, mana)

Resolution:

This is not straightforward to measure (and broadly this is an unserious market, so bet at your own risk).

This will be evaluated as of June 1st.

I will look for all transactions involving Tumbles' loans between market creation & June 1st.

This market resolves to the total (weighted) average value of the loans involved in those transactions

Loans repaid in full are worth 100%. Any loans that default are worth 0%.

Loan extensions don't count.

Generally, any transaction/negotiation where mana is exchanged between parties & it implies a value of the underlying loans will probably count.

I expect this may not be straightforward to calculate and thus the main rule here will be my good faith attempt to estimate the underlying value of the loans, as implied by what people are paying for them.

Example: if Tumbles defaults on a 100M loan, repays a 200M loan, and renegotiates a future 200M loan so that he only owes 100M, I'll count that as 3 transactions. This market would resolve to (0 + 200 + 100) / (100 + 200 + 200) = 60%.

Other examples:

Forgiven loans are a transaction that count as 0%.

It might depend on the exact details, but a "renegotiation" where a creditor agrees to extend the due date and accept only 50% of the previous value will likely be excluded—that doesn't meaningfully imply the value of the loan, it's closer to an extension (they might accept that promise over default even if they think the loan is worth 1%).

Generally, any transaction where mana is exchanged will be prioritized (plus loan forgiveness + loan default, all of which concretely imply a loan value).

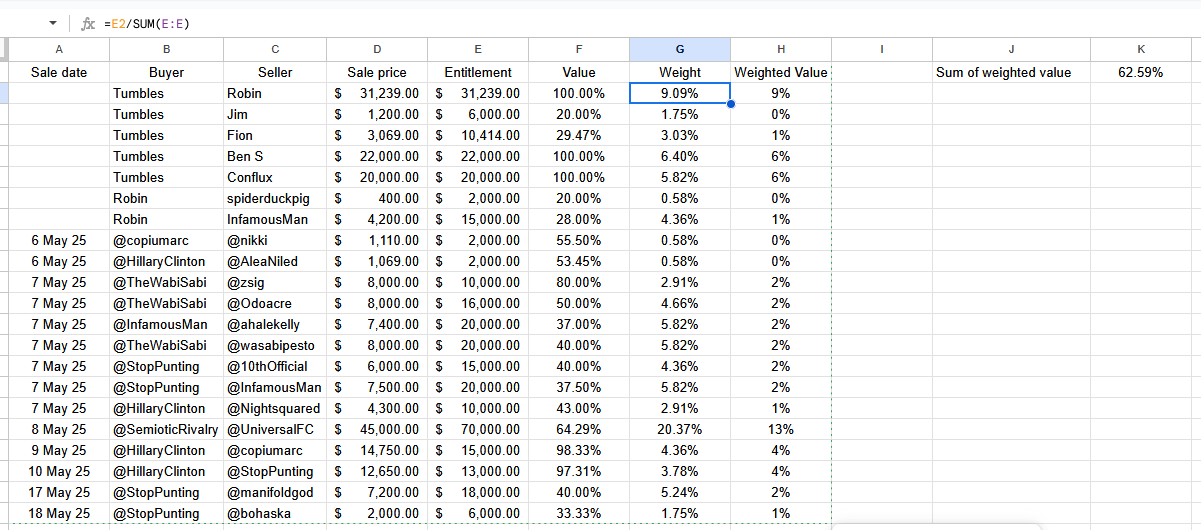

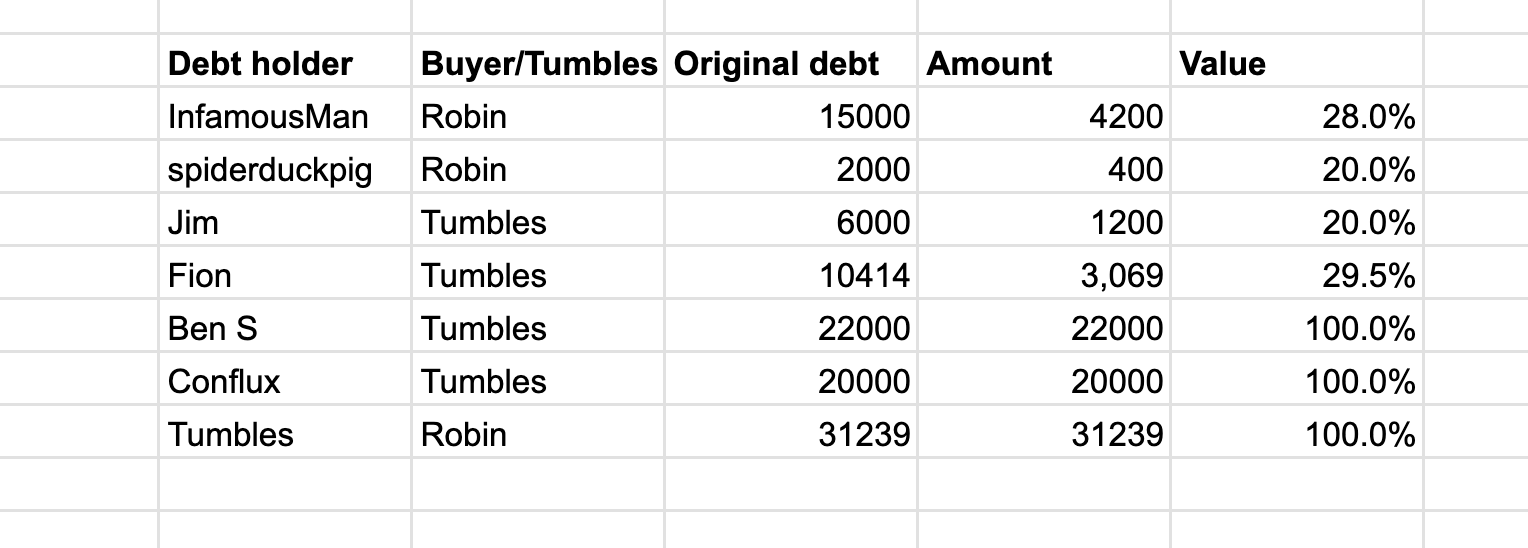

TRANSACTIONS I'M AWARE OF CURRENTLY (this is not a binding/comprehensive list):

Update 2025-05-01 (PST) (AI summary of creator comment): * The creator has indicated that tracking the original amounts owed for Tumbles' debts is proving difficult.

Due to this difficulty, there is a reasonable chance the market may resolve N/A if the creator cannot find a sufficiently good log of the original debts to perform the calculation outlined in the description.

Update 2025-05-07 (PST) (AI summary of creator comment): * The creator has updated the process for gathering transaction data:

They are unlikely to manually track down all Tumbles' debt transactions themselves due to increasing complexity.

Instead, they will rely on users to submit transactions they are aware of.

The creator will compile these submitted transactions and calculate the weighted average value as per the original description's methodology at the end of the month (for evaluation as of June 1st).

The creator noted that the market could resolve N/A if this method of relying on user submissions does not yield a sufficient basis for calculation. This potential for N/A resolution is related to the challenge of compiling comprehensive transaction data and is in addition to any N/A risks previously mentioned (e.g., difficulty in tracking original debt amounts).

Update 2025-05-07 (PST) (AI summary of creator comment): If the calculated total (weighted) average value of Tumbles' loans (as per the methodology in the original description) exceeds 100%, the market will resolve to 100%.

Update 2025-06-02 (PST) (AI summary of creator comment): The creator has provided a more specific plan for data collection and processing ahead of resolution:

Data sources for transactions will primarily be:

The "loan transfer tracker" in "Jumbles".

Non-duplicate transfers that have been posted in this market's comment thread.

Loan repayments found in "the main tumbles market".

Regarding loan repayments from "the main tumbles market":

The creator notes it's possible these repayments might be double counted if they also appear in records from the other specified sources.

The creator states this potential for double counting "was always part of the deal."

Users are advised that if they are aware of any loans they believe should count, and these are not in the "Jumbles" tracker, they should ensure these are posted in this market's comment thread.

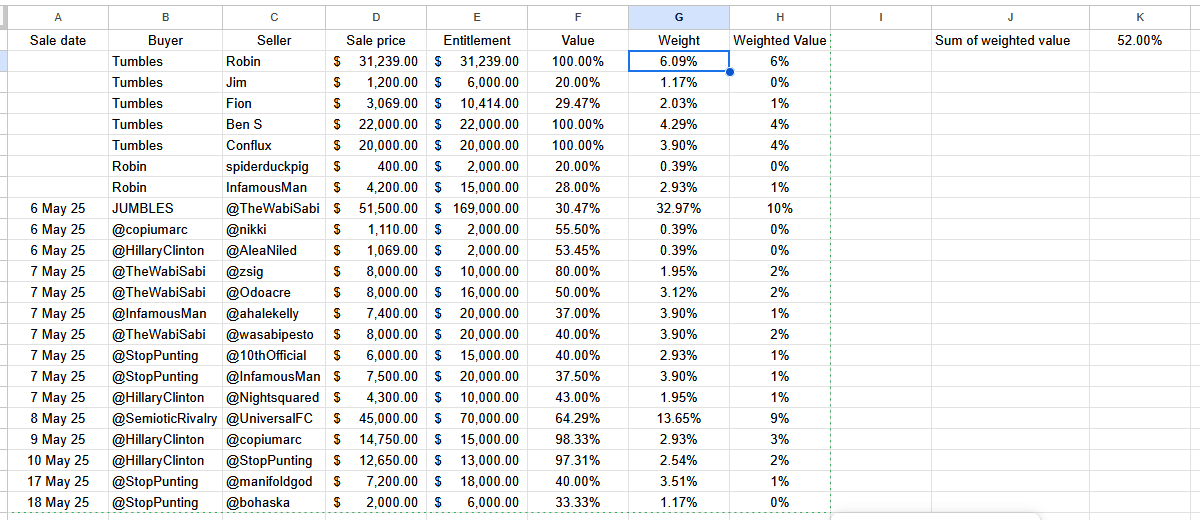

Update 2025-06-18 (PST) (AI summary of creator comment): The creator has announced they are resolving the market to 52%. See the linked comment for their final reasoning and data compilation.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ143 | |

| 2 | Ṁ53 | |

| 3 | Ṁ24 | |

| 4 | Ṁ21 | |

| 5 | Ṁ11 |

People are also trading

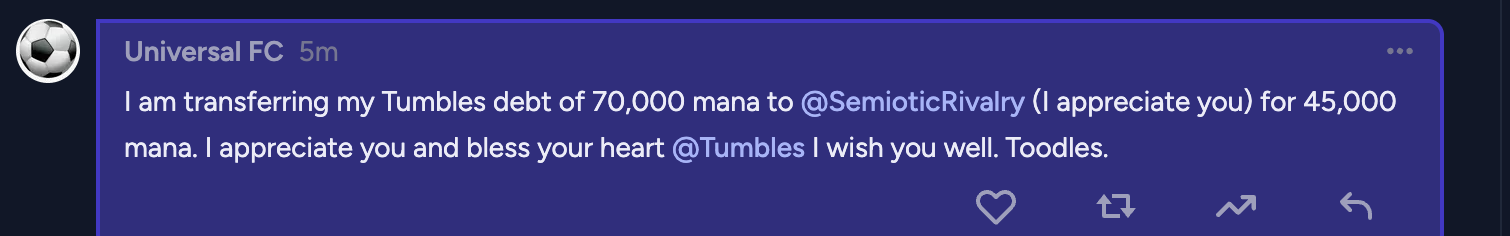

@Tumbles was 5 million in debt, had no plan to become solvent, and still for a whole month has debt traded at 50c on the dollar. this is a beautiful testament to his legacy (and debt holders definitely should have sold!)

@cthor hold up, forgot the original JUMBLES debt purchase, that drops it by quite a lot since it was the biggest piece of debt purchased.

@cthor ah thank you for compiling this! this looks good to me—don't spot anything obviously missing, & am inclined to trust the experts here (given limited time to investigate further). only thing i'd consider is whether any of this counts as double counted, but i only really want to block that in the extreme case (where the trades are meaningless), if someone trades debt and then it trades again because the value changed i'm fine counting those i don't really care where they came from. i hope this doesn't miss any debt payments tumbles made, but i don't remember any others that aren't here. i'm going to resolve this to 52%. much thanks!

Oh dear I'll need to resolve this soon. Ok my plan is simple (and ngl I am not going to promise that I don't miss anything).

I'll start with the "loan transfer tracker" in "Jumbles"

I'll add to it any non-duplicate transfers that have been posted in the comments of this market

I'll check the main tumbles market to count any loan repayments there (it's possible some loans get double counted, but that was always part of the deal).

that means if there's any loans that you think should count, and they aren't contained by the Jumbles trackers, make sure they are posted here.

Meowdy! Looks like the Market's feeling a bit jittery with a 64.4% chance that Tumbles' debt value will tumble—purrhaps investors are sniffing out some shaky paws on those numbers! Given that probability, I’d say there’s a fair kitty-chance this binar-owl will fall into place. places 10 mana limit order on YES at 64.4% :3

Purchased at 98.3 cents on the dollar.

June 2nd 2025 - Ṁ15,000 @copiumarc

@Robincvgr that's a good way of describing it. Yea, it's entertaining for sure. I did not see it coming.

@Ziddletwix Serious question, how will you handle this if Tumbles debt value goes above 100%? It's extremely unlikely, but average Tumbles debt value inching above 100% in May is becoming a tail end possibility. Just resolve YES?

@Robincvgr it would resolve to 100%, that's the best available resolution option (since I can't make NO shares worth less than 0)

@Ziddletwix plus to add this is in part a subjective-ish resolution, in the sense that if someone is like trading back and forth tumbles debt at inflated values and those transactions don't mean anything real about the value of the debt, they'd just be excluded. the mean of the current transactions so far is <50% so it'd take some very very large over-pays to put this above 100%.

(and, if it wasn't clear, this is all about the value of the debt that tumbles owes, not the amount he was originally lent. so for the "double your mana" deal, selling that debt for 60% of what tumbles owes is still 60%, even if technically the lender made a profit)

@Ziddletwix cool thanks

if someone is like trading back and forth tumbles debt at inflated values and those transactions don't mean anything real about the value of the debt

yeah i figured. we just suspect that certain creditors might be in genuine good-faith negotiations with WTBLTPBAL YES whales to sell debt for >=100%, and if enough of crazy stuff surrounding that happens, it might be crazy for this market

@Robincvgr can you explain more the situation where the debt is worth more than 100%? I don't think the debt can ever be valued at more than 100% because if a WTBLTPBAL YES whale buys debt for more than 100%, somebody can just force pay it off afterwards for 100% (no different than if the YES whale owns it or not)

somebody can just force pay it off afterwards for 100% (no different than if the YES whale owns it or not)

For what reason would they do this? Merely paying off one item of debt does not really help any particular individual prima facie.

I was just thinking if the issue was the YES whale owning the debt to prevent Jumbles. I guess can you explain the situation where the debt could be valued at more than 100%? If it would benefit NO or YES, to purchase the debt at a value more than 100%, the other side could just eliminate it by paying it off for 100% (obviously that does assume coordination). Would it be for paying the loses if the creditor is already a NO holder?

@StopPunting if a NO holder paid off a YES holder's debt, the YES holder could use that payment to go acquire more debt. The NO holder would be back in the same spot again but with a big sunk cost. They'd have to do it in coordination with the execution of TARP (or some other bailout) to avoid this.

JUMBLES is attempting to track debt purchases since the announcement of TARP: https://manifold.markets/news/jumbles

Purchases tracked so far:

6 May 2025, @copiumarc sent @nikki Ṁ1,110 for Ṁ2,000 debt

6 May 2025, @HillaryClinton sent @AleaNiled Ṁ1,069 for Ṁ2,000 debt

7 May 2025, @TheWabiSabi sent @zsig Ṁ8,000 for Ṁ10,000 debt

7 May 2025, @TheWabiSabi sent @Odoacre Ṁ8,000 for Ṁ16,000 debt

7 May 2025, @InfamousMan sent @ahalekelly Ṁ7,400 for Ṁ20,000 debt

In addition, JUMBLES made this purchase before the TARP announcement:

6 May 2025, @cthor sent @TheWabiSabi Ṁ51,500 for Ṁ169,000 debt

@cthor thank you for these updates! this has gotten much messier since i started the market so to be blunt i am unlikely to manually try and track down every transaction myself (this would be nearly impossible from tumbles' balance log) and could have to N/A but if people want to submit transactions they are aware of in this market (or i can check the jumbles dashboard) i will happily add them to a spreadsheet and calculate the avg value at the end of the month

@Ziddletwix JUMBLES will be tracking all purchases going forward to the best of our ability, so checking the dashboard for further updates should be sufficient