Across the full year from 01 Jan 2025 through 31 Dec 2025, will Tesla outperform the S&P 500 index (specifically the index, not any ETF tracking it)?

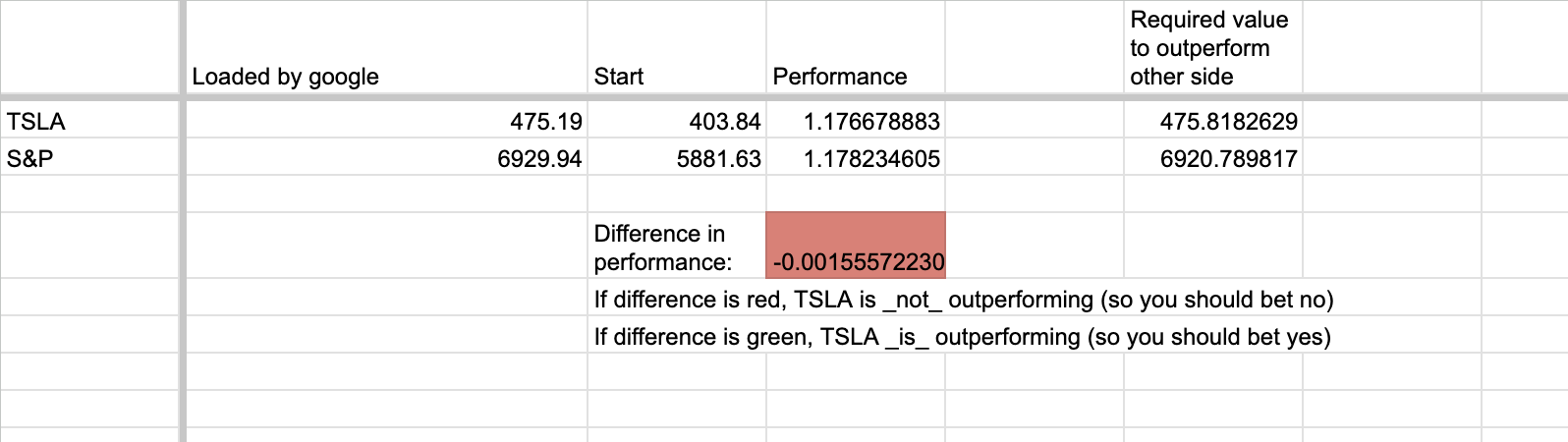

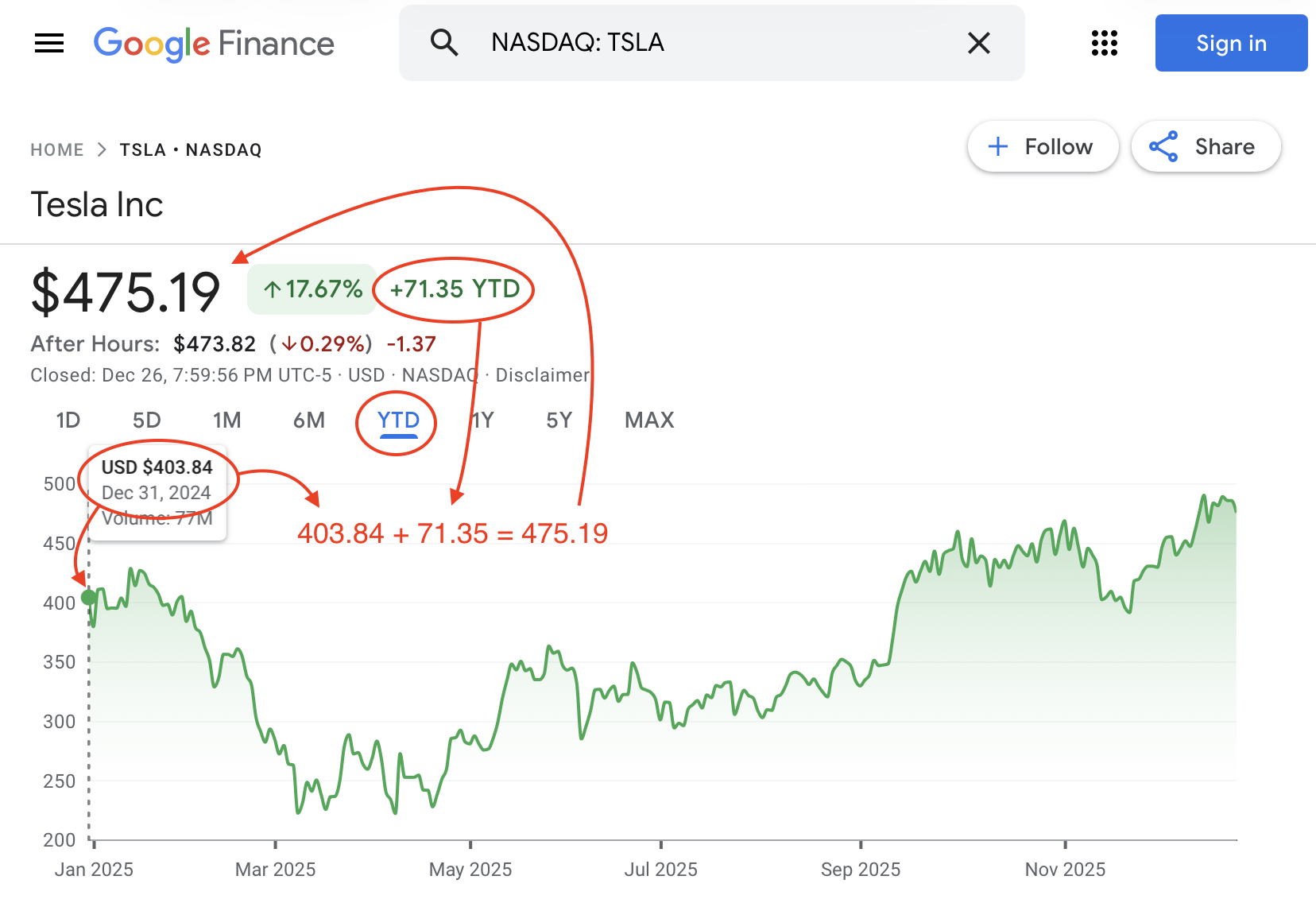

Update 2025-12-26 (PST) (AI summary of creator comment): The market will resolve based on closing prices from December 31, 2024 to closing prices from December 31, 2025, rather than using opening prices on January 2, 2025. This means the starting reference point is the close of 2024 (TSLA: 403.84, S&P 500: 5881.63).

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ3,900 | |

| 2 | Ṁ2,738 | |

| 3 | Ṁ2,077 | |

| 4 | Ṁ1,767 | |

| 5 | Ṁ1,414 |

People are also trading

Despite a nail-biter final week, TSLA's poor performance on the final trading days of the year mean that it not only clearly resolves no via the prior-close-to-last-close rule, but actually (very narrowly, less than 1% difference) would resolve no using the first-open-to-last-close rule.

I'll specify better on future markets!

I made a sheet to track this value live. It uses the GoogleFinance rule to load, whenever it refreshes (which I think should be every time someone looks at it? GoogleFinance tends to be fast enough for me to bet on bitcoin stuff, though I don't make much mana doing that.)

https://docs.google.com/spreadsheets/d/1q1Z3NEJU7qGmo2wZrLSR2yiwGNsa8IbsZ4JHMjQO-Xo/edit?gid=0#gid=0

@DannyqnOht [delete]

S & P : https://nz.finance.yahoo.com/quote/%5EGSPC/

(https://nz.finance.yahoo.com/chart/)

and Tesla: https://nz.finance.yahoo.com/chart/TSLA#e

Tesla, Inc. (TSLA)

December 31, 2024 (Previous Close): ~$403.84

[January 2, 2025 (Next Close): ~$379.28]

S&P 500 Index

December 31, 2024 (Previous Close): 5,881.63

[January 2, 2025 (Next Close): 5,868.77]

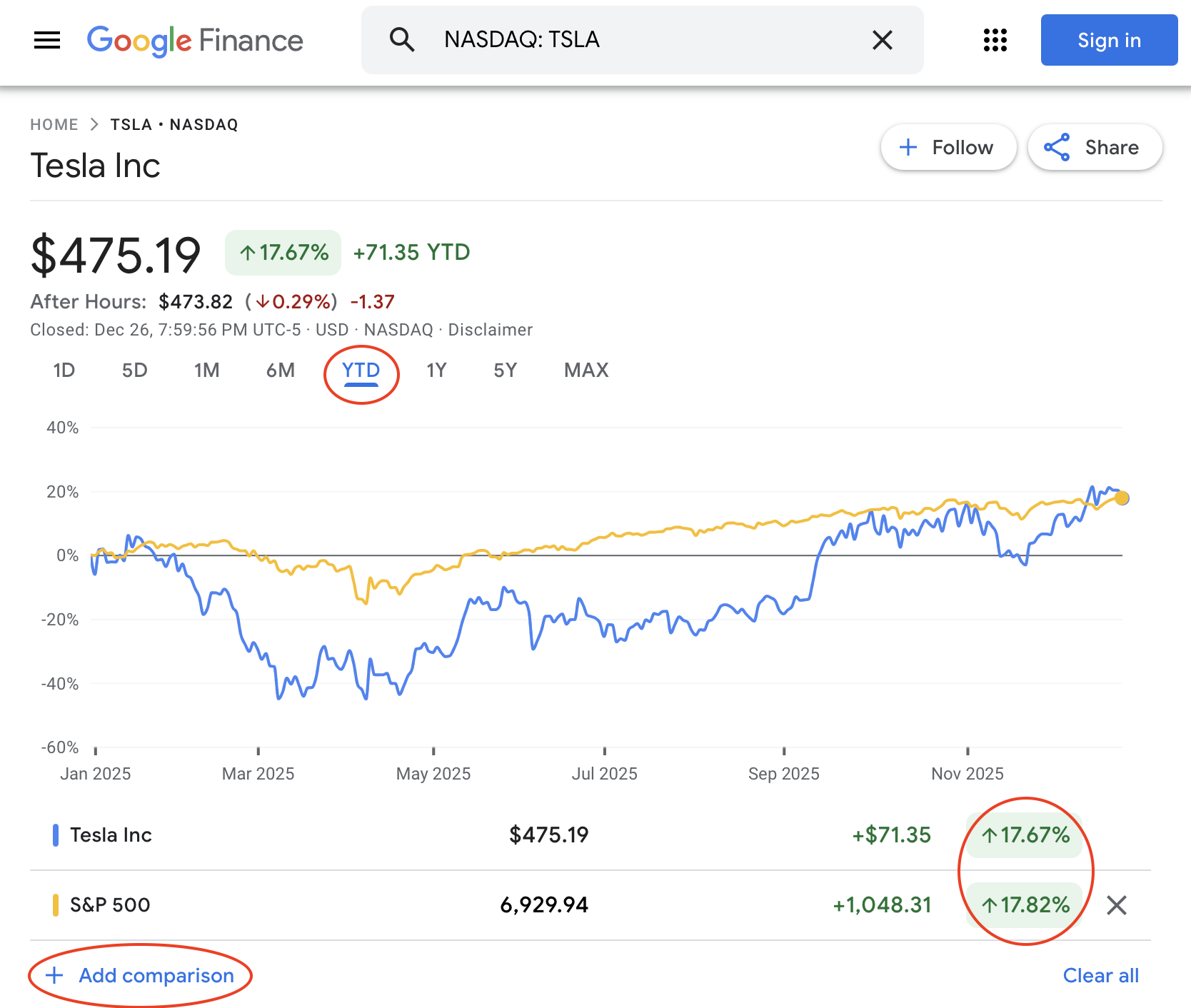

@1bets Tesla 475.19 today, S&P 6,929.94

[delete: per year for now Tesla 1.25287386627

and S&P 1.1808164232 - jan]

29/12 475.19 6,929.94

@1bets oh now i see:

"Update 2025-12-26 (PST) (AI summary of creator comment): The market will resolve based on closing prices from December 31, 2024 to closing prices from December 31, 2025, rather than using opening prices on January 2, 2025. This means the starting reference point is the close of 2024 (TSLA: 403.84, S&P 500: 5881.63)."

@1bets Glad the concrete numbers were helpful to resolve ambiguity! How do you feel about deleting some of these comments to make the reply thread cleaner for discussion? I'll delete (edit & replace with "deleted") this one if you delete yours :P

@MachiNi should resolve N/A then. The description clearly says January 1st, not December 31st as the start. Making new rules over 300 days into the question is bad form.

@HillaryClinton someone could have asked for clarification. using the accepted standard of prior close as starting point is kinda clear imo, I brought up the discussion since the price action seems to be influenced by traders misunderstanding.

@Mochi the market price was stable enough that it reflected a different yet clear enough standard. Why would we ask for clarifications since we all seemed to understand it similarly (as being calculated after not before January 1)?

@MachiNi I don’t think the market price reflected common understanding of traders until very recently that it was bought up to near 100%. If anything I think the discussion I brought up largely affecting the price even without creators comment shows that most traders genuinely believe they mispriced the market.

@Mochi your recent bets revealed that misunderstanding but prior movements were simply based on the Google data.

@Mochi exactly. It was unclear for 100s.of days. Yea someone should have clarified this 100s of days ago. It's a little late.

@HillaryClinton no new rules have been made. It always said "from 01 Jan 2025" and if on 01 Jan you looked on any financial site or exchange you'd see the quoted price as the price of the last transaction during regular market hours, $403.84 (for which there is a historical record, and some ephemeral value for after-hours or pre-market which is only available until the next regular session opens).

So for example, if you looked today, Saturday Dec 27, you'll see $475.19 as the "current" price, which matches yesterday's close. BTW, not sure why or how some were getting wrong YTD data from Google but it's currently giving me the correct YTD value based on last year's close as the comparison.

Edit: also convenient on Google, click on YTD, then +Add comparison, and select the S&P 500 index (.INX), it gives you the exact % performance comparison you need for this market:

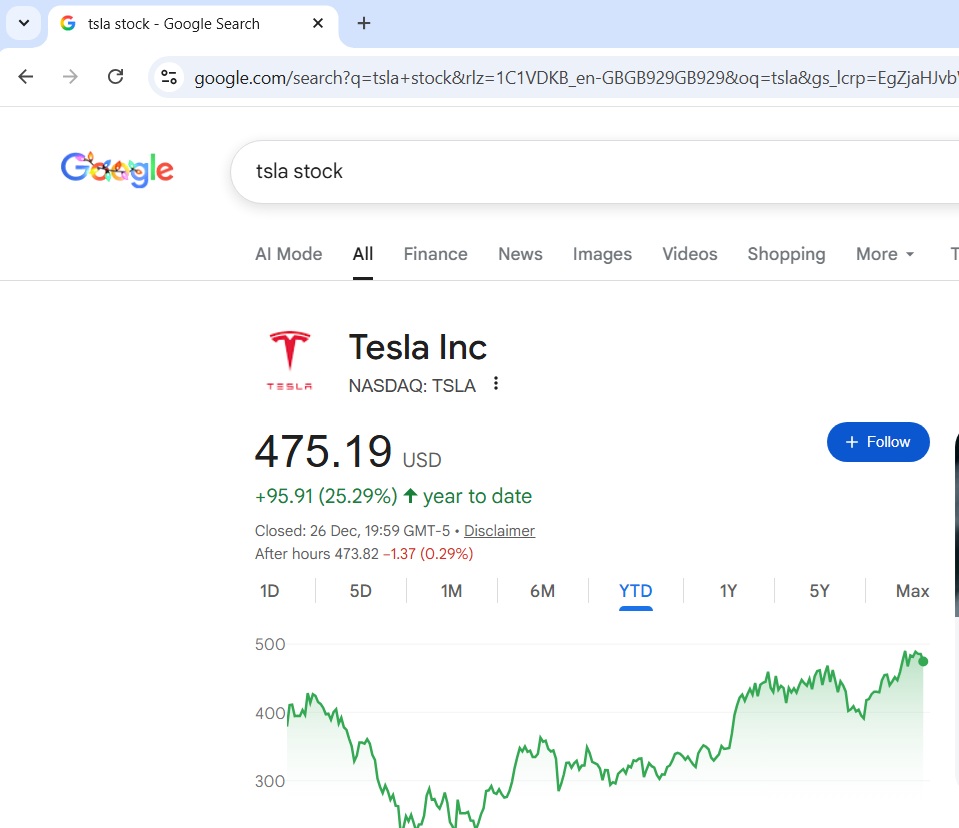

@deagol It gives the January start price in the regular Google search view. You are on specifically Google Finance. This market had a bad description. To fix and clarify it now makes all previous trades misleading. This is not a binary choice @SeekingEternity. Mannifold has the 3rd option of N/A resolution for this very reason.

@deagol

That isn't what I see now or yesterday

🤷🏻♂️

Edit:

Hillary explained before I posted. This is google search still displaying it wrong, Google finance does it correctly.

@ChristopherRandles yeah, i see the search results page (source is Google's Knowledge Graph) gives it wrong. When you click on "More about Tesla Inc" takes you to Google Finance where the YTD starting point is correct.

This market had a bad description.

Nah, it's so straightforward. It asked to compare with the prices on Jan 1, which if you had looked it up on the required date it would show some value, wherever you looked (again you can try it right now with markets closed). What crazy logic requires you wait to Jan 2, contradicting the description, to get a new price?

As has been said, the standard everywhere in finance for any period performance is to compare with the last price of the prior period (daily, monthly, annual, etc.). The description was fine, and it was recently reiterated and clarified (not changed nor fixed) consistent with well accepted practices. You just misread it and were overconfident.

@MachiNi Sorry if my tone came out as derisive, wasn't my intention. I'm just a bit surprised that a couple of veteran traders who most likely have seen and traded on dozens (if not hundreds) of "will it close higher" markets are confused by this. I will acknowledge the creator should have been more timely in correcting the bad assumptions which indeed were being posted months ago, but imo that doesn't require nor justify N/A. I highly doubt every market where a few traders have a mistaken interpretation which doesn't get clarified for months (or at all) gets canceled.

@Mochi google seems to be calculating year to date from close price on Jan 2 which is surely wrong the 2nd of Jan should surely be included. 379.28 at end of Jan 2nd is quite different from 403.84 eoy 31 Dec 2024.

@SeekingEternity

Is the start of year price to be used eoy 2024 or opening price on 2nd Jan (390.10 per https://uk.finance.yahoo.com/quote/TSLA/history/ for Tesla). You seem to have specified 1 Jan which is perhaps a bit ambiguous: it could be closing price 31 Dec 2024 or opening price on 2 Jan 2025.

@ChristopherRandles yea the starting price may actually matter in this case. And I found this out by checking yahoo finance YTD option, and yahoo is using the 2024 eoy price as the starting price for YTD calculations.

@Mochi There was no price on January 1st because the market was closed. The earliest price we have in 2025 is the opening price on January 2nd.

@AndrewHebb for calculating the price movements for the year, usually the prior closing price is used. When media reports spy went up 1% today, they don’t mean it went up 1% relative to the open price, they refer to it going up 1% relative to the prior closing date.

@AndrewHebb the opening price itself is a movement in price for the year 2025 instead of a starting point

@AndrewHebb You can argue price on 1 Jan is the last price set in trading hours on 31 Dec 2024. Alternately the ref to 1 Jan might be a mistake not realising there was no trading on 1 Jan and meant opening price on Jan 2.

The first of these is more normal as Mochi has said.

@Mochi That may be how it's normally done, but this question explicitly refers to price movements during 2025.

@AndrewHebb the price did not move until open, the opening price going up or down is the first movement of 2025. Prior to the movement the price is still the same as eoy 2024

@ChristopherRandles There is no price when the market is closed. Had the market been open, we don't know what the price would have been.

@AndrewHebb That might be a possible interpretation but it is not useful as the split is unknowable. The more normal interpretation is closing price 31 Dec reflected sentiment at that time. The opening price reflects sentiment 2nd Jan so this movement happening at the time of the opening. The price at close 31st dec 2024 is the latest price until there is a new trading hours price. This movement happens in January 2025.

@Bayesian More normal to compare like with like ie. closing price end of last year to closing price end of this year.

@ChristopherRandles The price gapped down and opened at 390.10, that's not a trading movement, that's simply the price at which trading started.

@Bayesian A poll of a few people here would not establish what is normal for large numbers of market traders.

@Bayesian the opening price is a price movement, and it wouldn’t make sense to the spirit of the question to compare vs the opening price as the opening price movement is part of the 2025 movements

@Mochi i don't think i understand what you mean when you say the opening price is a price movement. i would think it's a price value?

@Bayesian Why not look at what is reported to traders? Google is clearly doing this wrong. Yahoo uses close at end of last year. If you want to try to find some sources that use opening prices then go ahead find them.

@Bayesian I would take the bet if it’s polled on folks working in finance. Like Christopher mentioned, no finance data source uses the opening price to report the % movements

@ChristopherRandles i asked claude and it turns out you are right that the yahoo way is pretty much universally used. not totally intuitive to me but seems sensible to follow precedent

@Mochi Google and yahoo are just data sources free and digestible to the public, not what traders use

You know my hot take is that this should have resolved NO in the beginning of the year as it asks if TSLA outperformed "across the whole year" which it clearly did not

@Mochi The price is only defined at the exact moment a trade occurs. If there is no trading, there is no price. Price movements can only be considered to happen from one trade to the next. They are not instantaneous.

https://x.com/i/grok/share/DW3NDk3bfPSK6QeXhOzulQ4mT

In summary, using the previous year's year-end close (Yahoo's method) is the more normal and widely accepted standard for consistency and accuracy in financial reporting. Google's approach may vary due to how it handles holiday/non-trading days, leading to the difference you noticed. For precise comparisons, cross-reference multiple sources or use adjusted historical data that chains prior closes.

Oh dear, sorry for the under-specified question, everyone. I am aware that the 1st is a market holiday but didn't think about the implications, or envision such a big price shift between 2024 close and 2025 open.

Unless there's some way to see what prices people were effectively using when placing orders outside of trading hours on the 1st, I'll resolve based on the prices I'd have seen checking on midnight of the new year which means the close of 2024 (and same for close of this year).

Again, my apologies for not being more specific. I haven't traded this market recently, and won't going forward.

@SeekingEternity you could resolve N/A. A situation where people have been betting for 100s of days with unclear rules is exactly what that function is for.

@HillaryClinton argh. This is exactly why I posted the assumptions 4 months ago with no clarification until 3 trading days left https://manifold.markets/SeekingEternity/will-tsla-outperform-the-sp-500-ove#v2k4d24sia