Resolution criteria

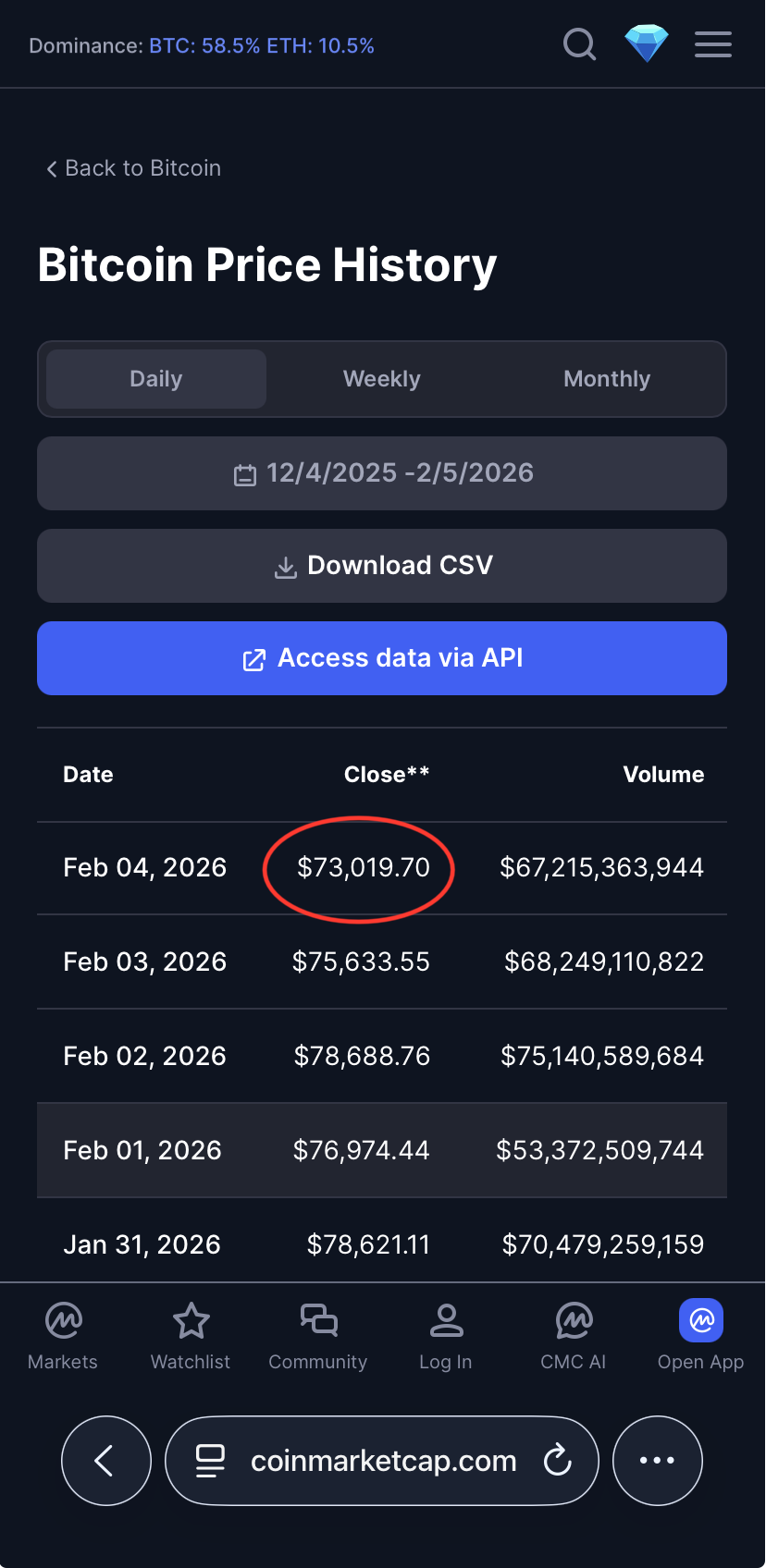

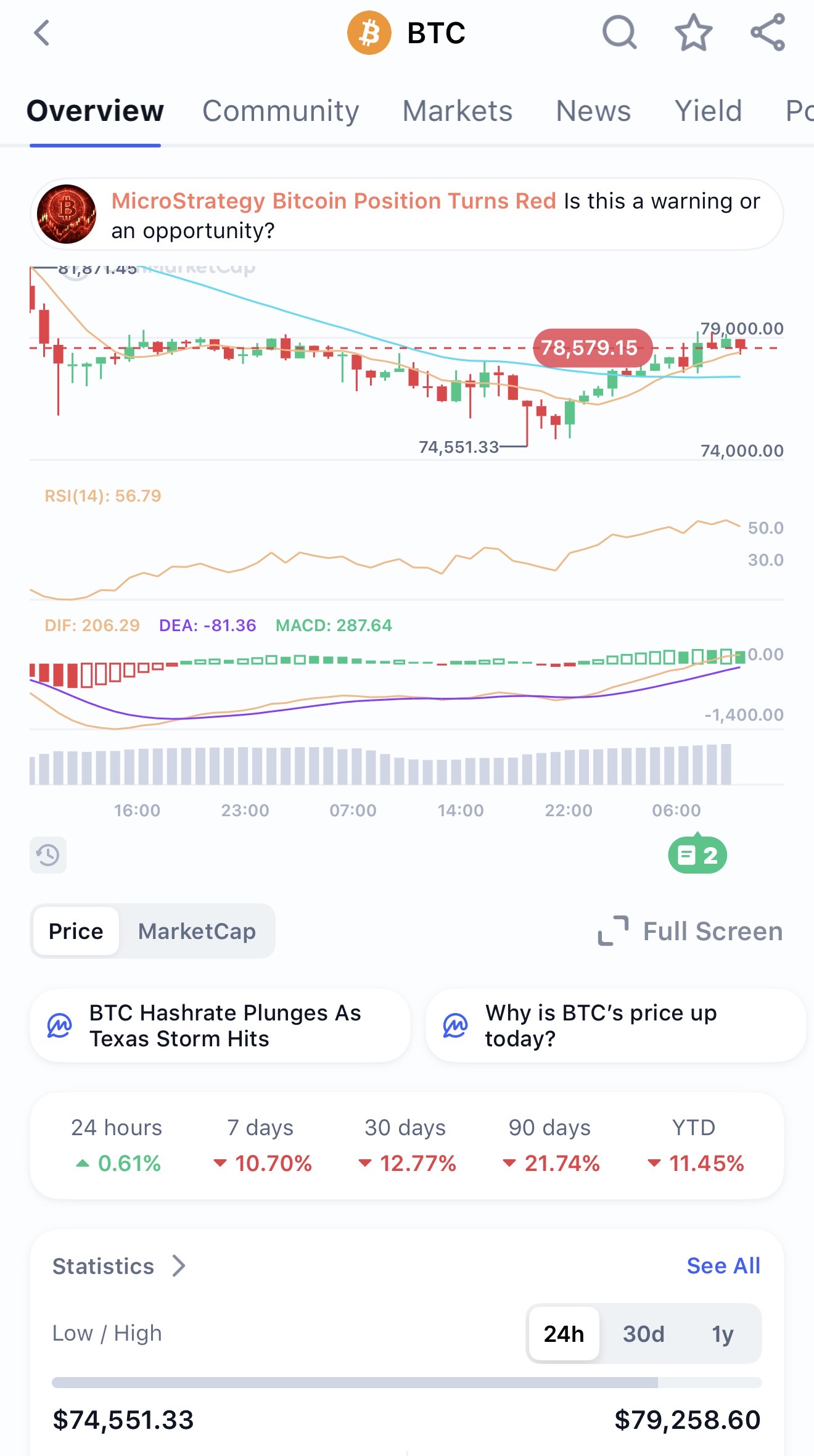

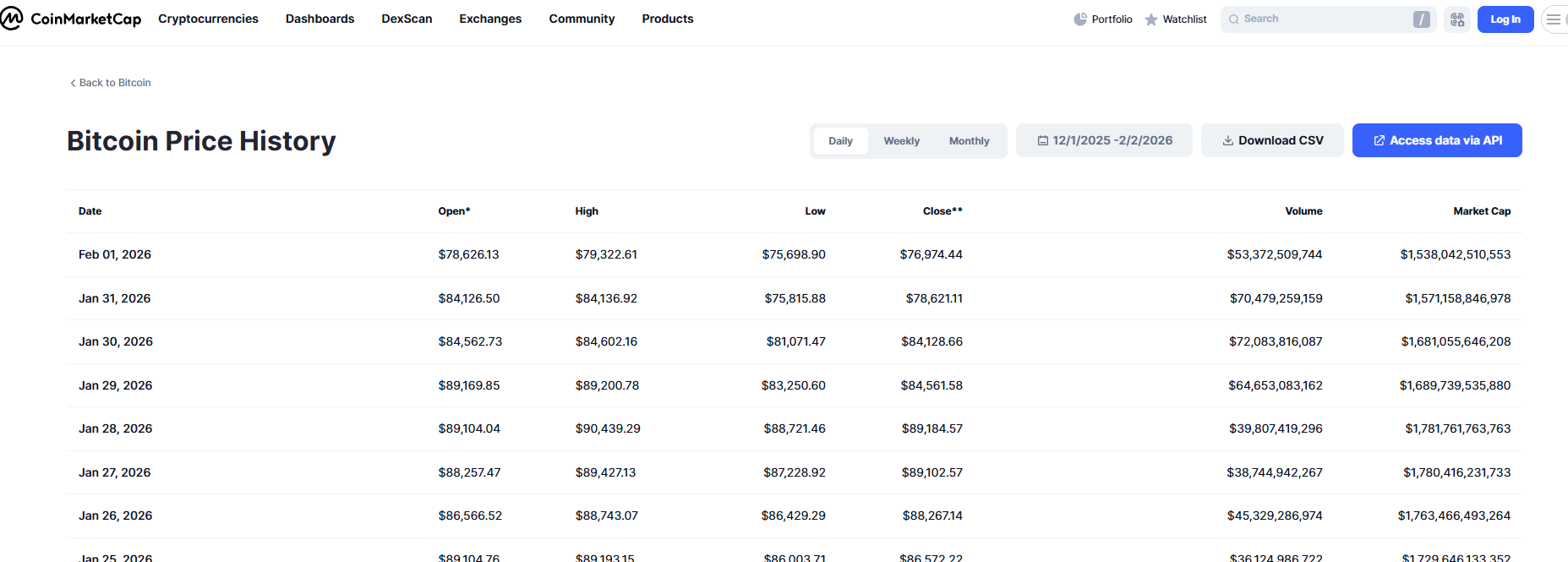

This market will resolve to "Yes" if the price of Bitcoin (BTC) falls below $75,000 USD at any point between October 25, 2025, and April 25, 2026, inclusive. Otherwise, it will resolve to "No." The resolution source will be the daily closing price of BTC/USD as reported on CoinMarketCap.

Background

Bitcoin reached an all-time high price of over $126,270 on October 6, 2025. As of October 25, 2025, Bitcoin's price is trading around $108,000 - $111,000 USD.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ998 | |

| 2 | Ṁ770 | |

| 3 | Ṁ739 | |

| 4 | Ṁ670 | |

| 5 | Ṁ285 |

People are also trading

What do you all mean by closing price?? Isn't bitcoin a continuously traded asset, so the concept of closing price doesn't apply?

if resolution criteria for closing price = 'price at midnight in a specific timezone' then timezone should be clearly defined @PoliticalEconomyPK

@Hakari description is sufficiently defined: “daily closing price of BTC/USD as reported on CoinMarketCap.” all you need is there, including the timezone https://coinmarketcap.com/currencies/bitcoin/historical-data/

@PoliticalEconomyPK Thank you for reopening this market. It might be worthwhile to amend the name to more closely fit the resolution criteria, maybe to "Bitcoin closes below $75,000 before 26th April 2026?".

NO, "The resolution source will be the daily closing price of BTC/USD as reported on CoinMarketCap." The closing price for 1st was $76,974.44. The Bitcoin closing price has not fallen below $75k. That was only the intraday price. @PoliticalEconomyPK could you please reopen this market?

@SacredChicken I'm getting really tired of resolution criteria that don't match the market question.

@Mochi It has not already happened per the resolution criteria which states the determining source of information to be Daily Closing price on CoinMarketCap, not the intraday Low Price.

@robotnik I assumed it was a small technicality as to use the close data to check whether the price ever reached 75k, and the titles intention seems to be just whether the price will reach 75k

@Mochi How can it be a technicality when the precise information that would cover that eventuality is included separately in the same data source?

It is astounding to me.

I've been making tons of mana using bets on pure, informationless, brownian motion. Even setting drift to 0 made mana.

But for some reason, I do not want to bet that it will go down this time.

With a drift of 0 and std dev of .4, there's a 44% chance it goes from 89400 to 75000 by April. compared to the current 28% odds, that's an expected profit of nearly 50% on your investment in just a few months (put in 28 m, expect to win 44 mana). And that's a pretty reasonable std dev, .47 made me tons of mana; .3 is wayyy lower than it has historically been. The .4 comes from comparing a bunch of markets about "BTC hit this number by 2026" and figuring out what standard deviation minimized their disagreements with each other.

But I just don't want to bet yes here any more *shrug. My mental model has changed. I think we're trapped between 80 and 100 until the next big jump, and I don't want to bet that that jump will be downwards :/ Maybe someone else will trust the math more than me and can make more mana than me!

Also... why the heck am I not buying more BTC then? shakes head, stumbles away.

When I try to do the same thing for the current markets I'm tracking:

https://manifold.markets/PoliticalEconomyPK/bitcoin-falls-below-75000-in-next-6?r=ZGVhZ29shttps://manifold.markets/predyx_markets/bitcoin-under-85k-in-januaryhttps://manifold.markets/predyx_markets/bitcoin-below-82k-in-januaryhttps://manifold.markets/predyx_markets/bitcoin-below-80k-in-januaryhttps://manifold.markets/predyx_markets/bitcoin-100k-in-januaryhttps://manifold.markets/strutheo/if-bitcoin-reaches-120k-before-thehttps://manifold.markets/predyx_markets/bitcoin-150k-in-2026https://manifold.markets/DannyqnOht/will-btc-go-below-65k-by-march-1-20https://manifold.markets/predyx_markets/bitcoin-below-52k-by-march-2026

I get that the drift should be like 50% growth per year, and volatility .36. How are people suddenly so much more confident in their predictions (lower volatility) and simultaneously saying it's gonna have a HUGE growth?

Maybe I should just trust the math...

And maybe I should buy more BTC too. Eh, I already have enough if it's gonna go that high.

Still dazed.

I suggest updating the title "next 6 mo" -> "By April 25 2026" so new people can quickly tell how long this really means.

@DannyqnOht also note the description specifically states it's on a closing basis (CMC closes daily at midnight UTC), not intraday. I figure this should lower the odds somewhat.