Which quadrant in the tweet below will we end up in? Assume that core inflation is measured by the CPI. Assume that "unemployment" refers to the U-3 unemployment rate published by the BLS.

Fine print:

Note that the inflation condition is based on an annualized rate. The annualized core inflation in 2023-H2 is defined as follows for the purposes of this question: ((Core CPI in Dec 2023)/(Core CPI in June 2023))^2 - 1.

This question will resolve as soon as we first get the relevant unemployment and inflation data for December 2023. If for any reason any relevant data for a prior month is revised before then, I will use the revised version. I will not use any revisions made after that.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ981 | |

| 2 | Ṁ297 | |

| 3 | Ṁ269 | |

| 4 | Ṁ140 | |

| 5 | Ṁ99 |

People are also trading

@IsarBhattacharjee Do you have those numbers? links? Thanks! Creator looks inactive so may need mod resolved.

@SirCryptomind highest unemployment rate was 3.8% https://data.bls.gov/pdq/SurveyOutputServlet

3.2% core inflation (annualised) in H2 https://ycharts.com/indicators/us_core_consumer_price_index_mom

Resolution should be continued overheating

Do you know how best to tag a mod?

@IsarBhattacharjee I don’t think that’s quite valid. I believe it still comes out above 3%, but shouldn’t you be able to compute it by taking the % change in the BLS numbers June-Dec and doubling (to annualize)?

https://fred.stlouisfed.org/series/CPILFESL

June: 308.309

Dec: 313.216

That’s a 1.591% change, doubling gives a 3.182% annualized H2 growth?

Unless I’m making some embarrassing mistakes here.

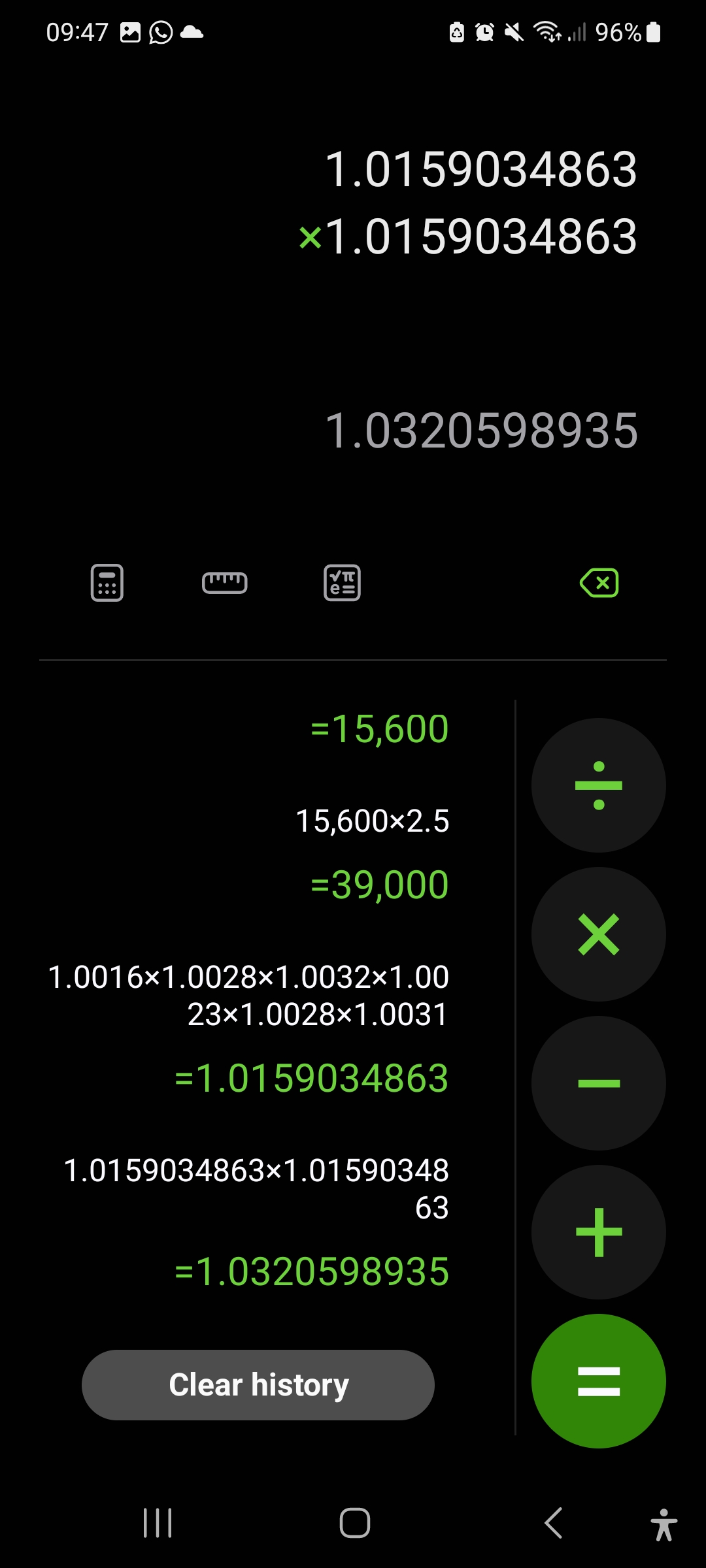

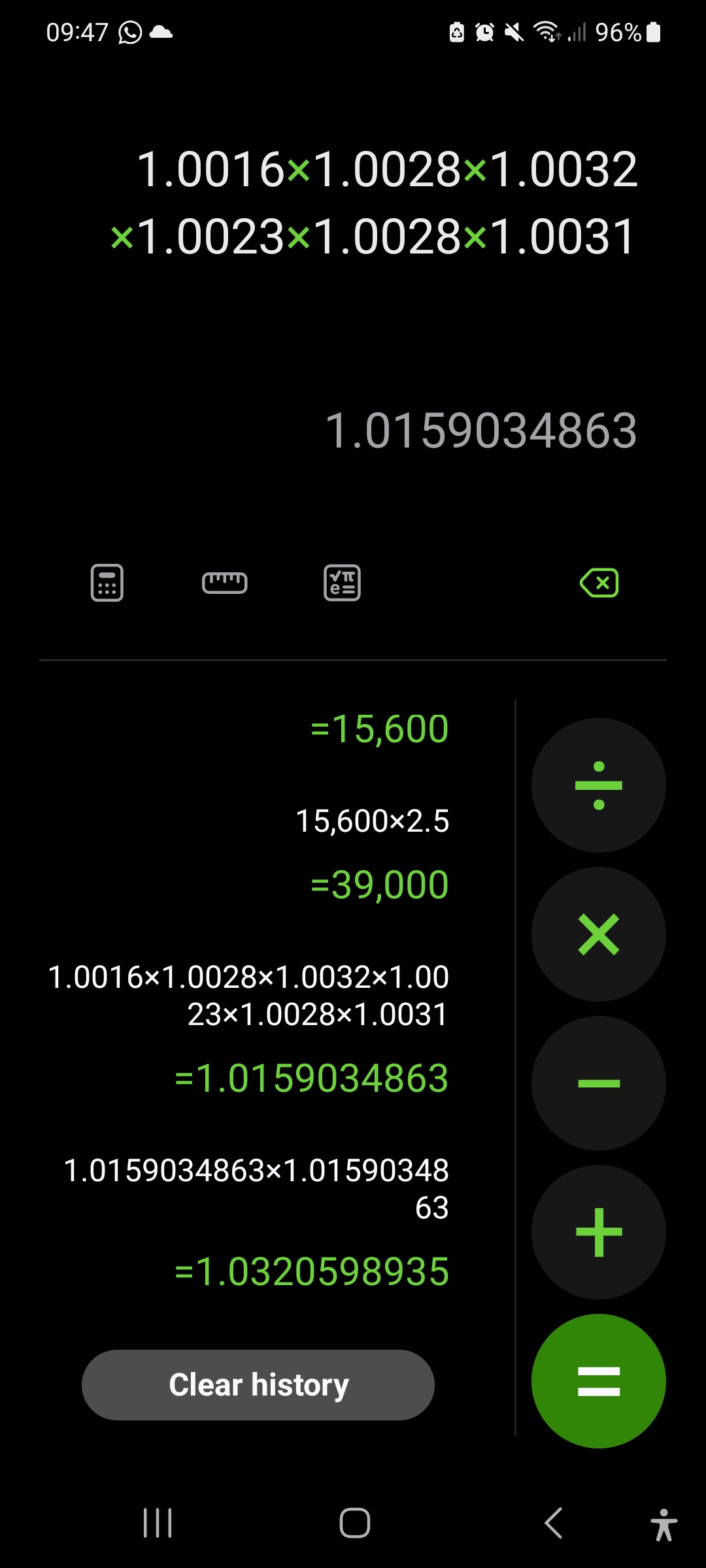

@DanMan314 you can't just double it because the percentages compound

(1+ percentage/100) ^2 -1 will give the annualised rate

I'm not sure why Justin Wolfers said that. It's very uncertain. https://fred.stlouisfed.org/series/CPILFESL

Core CPI in June was 308.309

In November was 312.251 meaning 0 additional inflation would give us 2.57%

But if December comes in at 0.2% m/m it becomes (312.251*1.002/308.309)^2 = 2.98% inflation

December at 0.3% core inflation m/m becomes (312.251*1.003/308.309)^2 = 3.19% annualized for H2.

Currently Cleveland Fed's inflation nowcast is 0.33% for December so if correct, more than 50% it should be continued overheating

https://x.com/JustinWolfers/status/1730296135552471292?s=20

I believe we're headed for soft landing, since the inflation is just for 2023 H2.

Furman thinks this market should be at 98%.