Resolution Criteria:

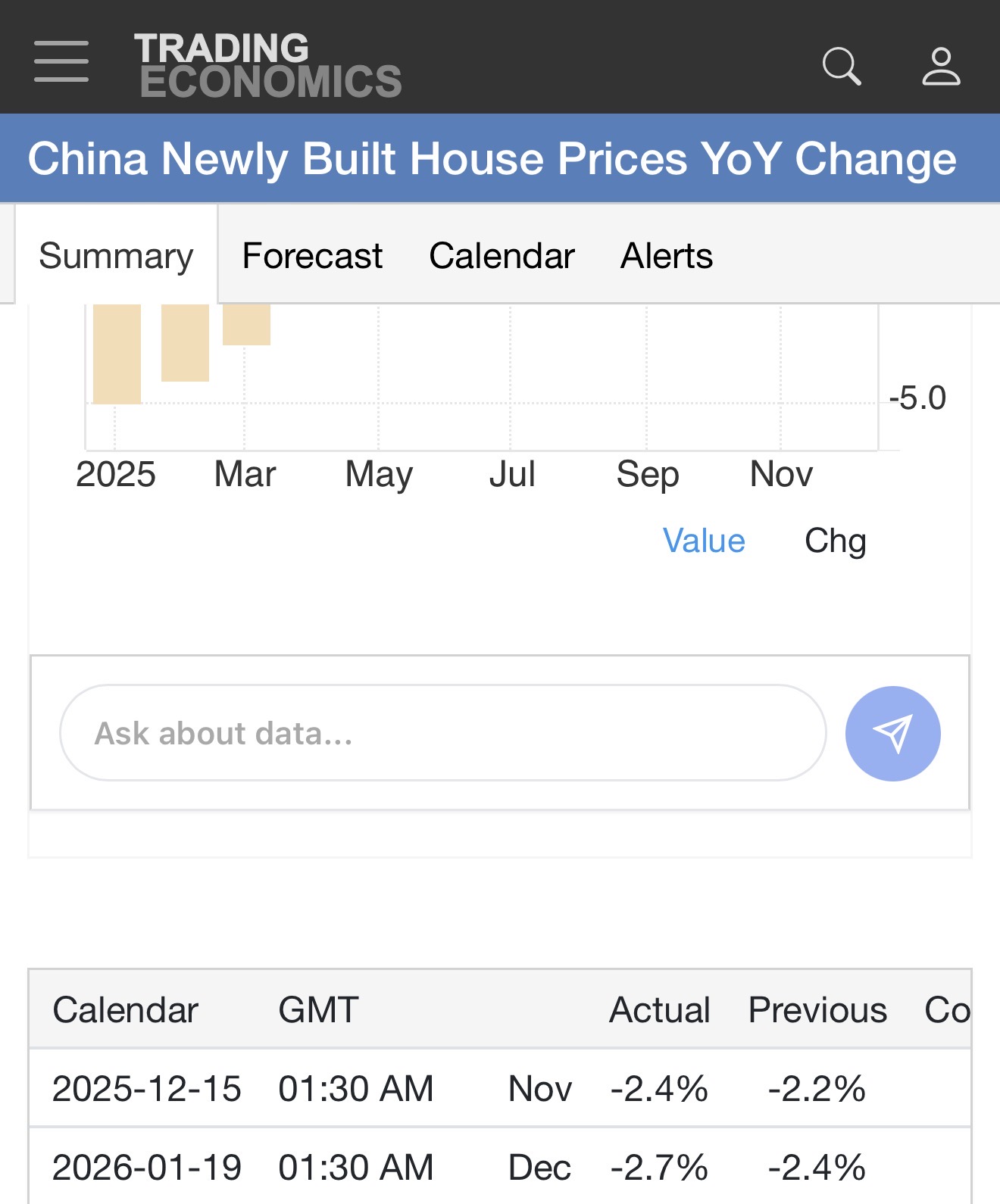

The market resolves YES if the official YoY percentage change for new residential building prices in 70 large and medium-sized cities, as reported by the National Bureau of Statistics of China (NBS), is ≥ -2.0% for December 2025.

The market resolves NO if the change is < -2.0%.

If the data is not released or is ambiguous, the market resolves based on the most recent comparable NBS data or consensus from reputable sources like Reuters or Bloomberg.

Data is typically released mid-month (e.g., around January 15–20, 2026 for December 2025 data).

Resolution Date: January 31, 2026 (to allow time for data release and verification).

Resolution Source: Official NBS press release or data portal (e.g., http://www.stats.gov.cn/english/PressRelease/). Secondary verification from sources like Trading Economics or Reuters if needed.

I'll search for the latest information on China's housing market and the 70-city new home price index to ensure the description is current and accurate.#### Resolution Criteria

The market resolves YES if the year-over-year percentage change for new residential building prices in 70 medium and large-sized cities, as reported by the National Bureau of Statistics of China, is ≥ -2.0% for December 2025. The market resolves NO if the change is < -2.0%.

Data is typically released mid-January (around January 15–20, 2026). Resolution will be verified via the official NBS press release at http://www.stats.gov.cn/english/PressRelease/, with secondary verification from Trading Economics if needed. If data is not released or is ambiguous, the market resolves based on the most recent comparable NBS data or consensus from reputable sources like Reuters or Bloomberg.

Background

The housing index remained at -2.20% in October 2025, following a 2.5% year-on-year drop in August 2025, marking the 26th straight month of decline. A Reuters poll forecasts new-home prices to fall 3.8% in 2025 and a further 0.5% in 2026. Recent government stimulus measures—including mortgage subsidies and reduced transaction costs announced in late November 2025—introduce uncertainty about whether December will show stabilization or continued decline.

Considerations

The threshold of -2.0% is narrow relative to recent readings. Housing prices in China are sensitive to government policy and overall financing conditions, with prices rising when the government relaxes regulatory measures and implementing loose monetary policy, and dropping when policy tightening is in place. The timing of policy implementation and market response in December will be critical to whether the index stabilizes above or falls below the -2.0% threshold.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ5,797 | |

| 2 | Ṁ1,836 | |

| 3 | Ṁ1,121 | |

| 4 | Ṁ683 | |

| 5 | Ṁ122 |

People are also trading

@MikhailTal please resolve, I am constantly in debt and no more interest rate to offset the loan rate 😭