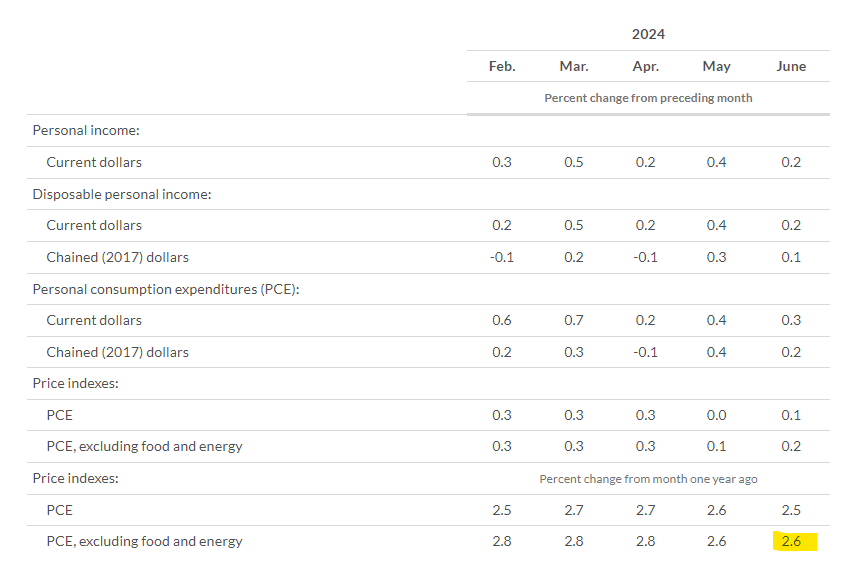

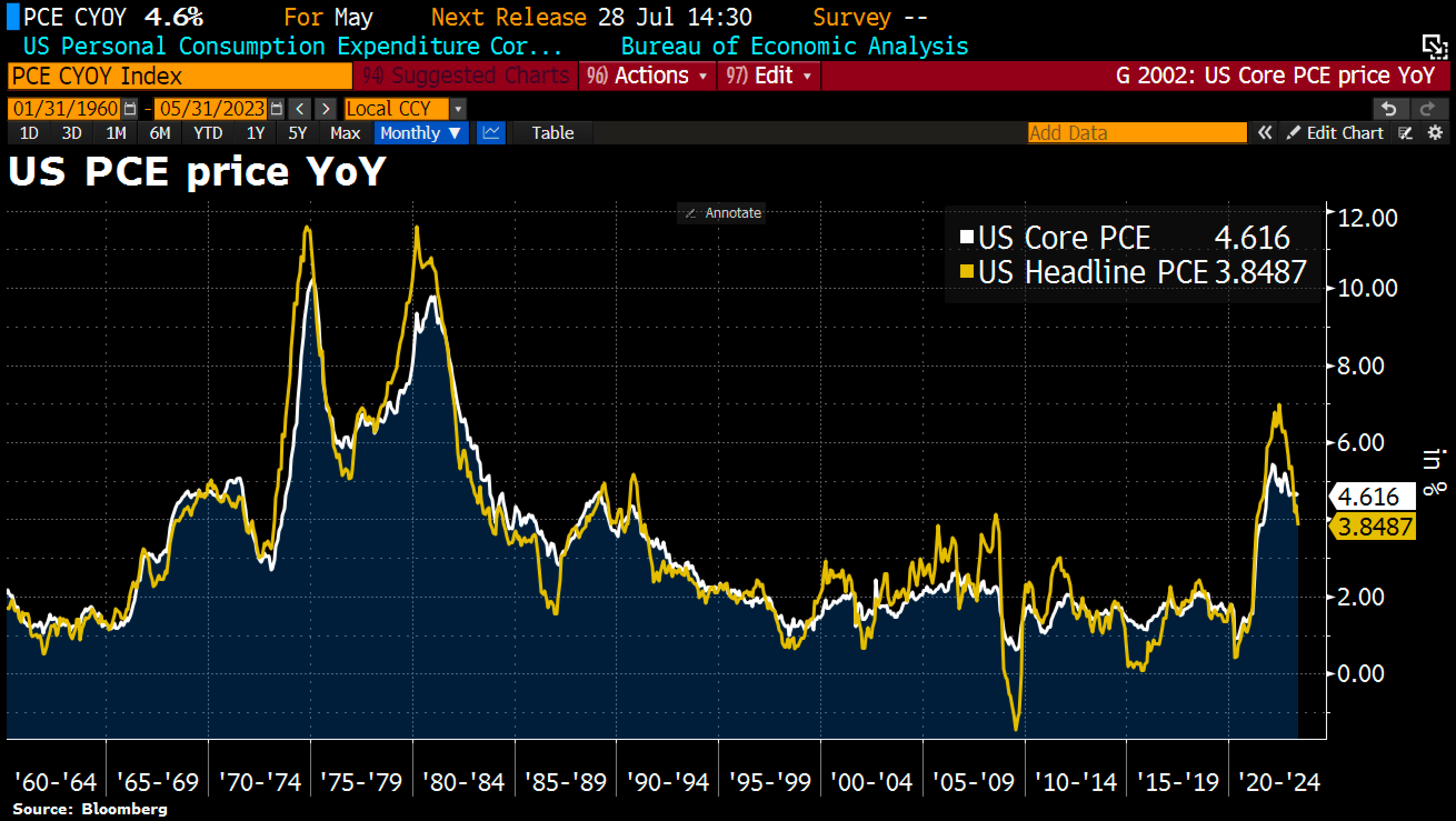

This market will settle to YES if the June 2024 readings of Core PCE Inflation and Unemployment (defined by the BLS) read as the following:

PCE Inflation excluding Food and Energy is below 2% YoY

Unemployment is below 5.5% (2% above the recent low of 3.5%)

This market will also resolve to NO if at any time between Nov 2022 and June 2024 the Unemployment level reads above 5.5%.

Creator policy: I won't bet.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ824 | |

| 2 | Ṁ492 | |

| 3 | Ṁ433 | |

| 4 | Ṁ343 | |

| 5 | Ṁ295 |

People are also trading

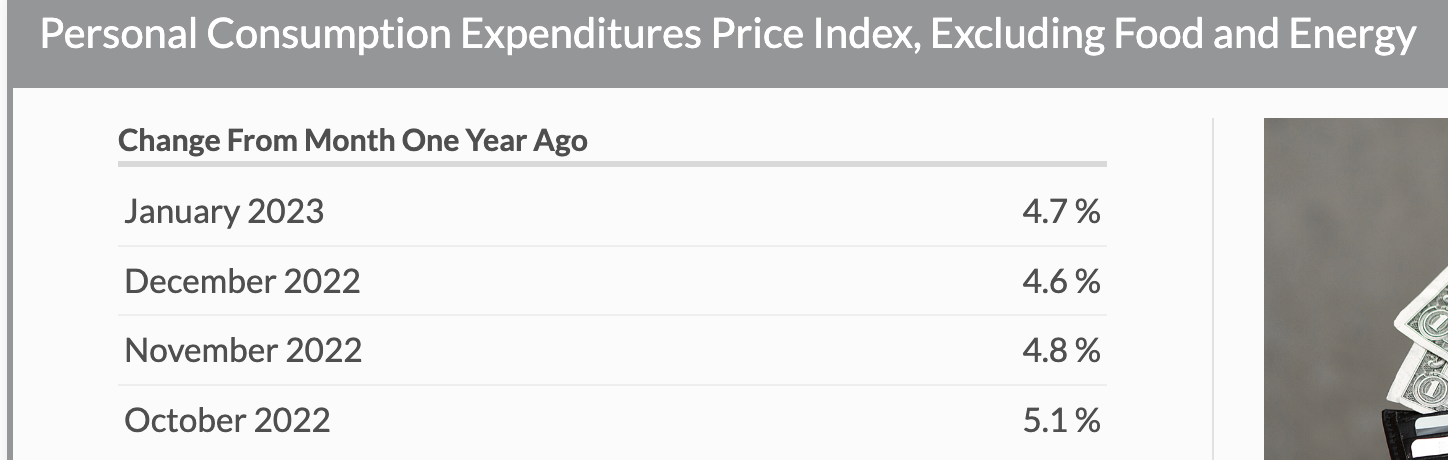

Looking at https://fred.stlouisfed.org/series/PCEPILFE:

June 2023 was 119.189. So the target is 121.572 (maybe 121.512, to round to to 1.9% instead of 2.0%

Feb 2024 was 121.165

121.572/121.165 = 1.0034, so we have 0.34% remaining for 4 months. Seems quite unlikely given current rates.

@MP core PCE below 2% is what gets me. 2% is the target, so if they are on target, there's only a roughly 50% chance it'll be below 2%.

@MP %2 yoy is the sticking point. It's entirely possible the Fed will consider it undesirable to move below the %2 target.