Inclusive or.

E. g. 2028->2029 +12% or 2032->2033 -16%

People are also trading

@TamarSpoerri But seriously, I suck at economics. Can someone explain or point me to resources that explain what makes volatility more likely?

@TamarSpoerri I'm personally looking at this as a AGI/WW3 market, plus a percent or two for a runaway global warming feedback loop or some other revolutionary technology.

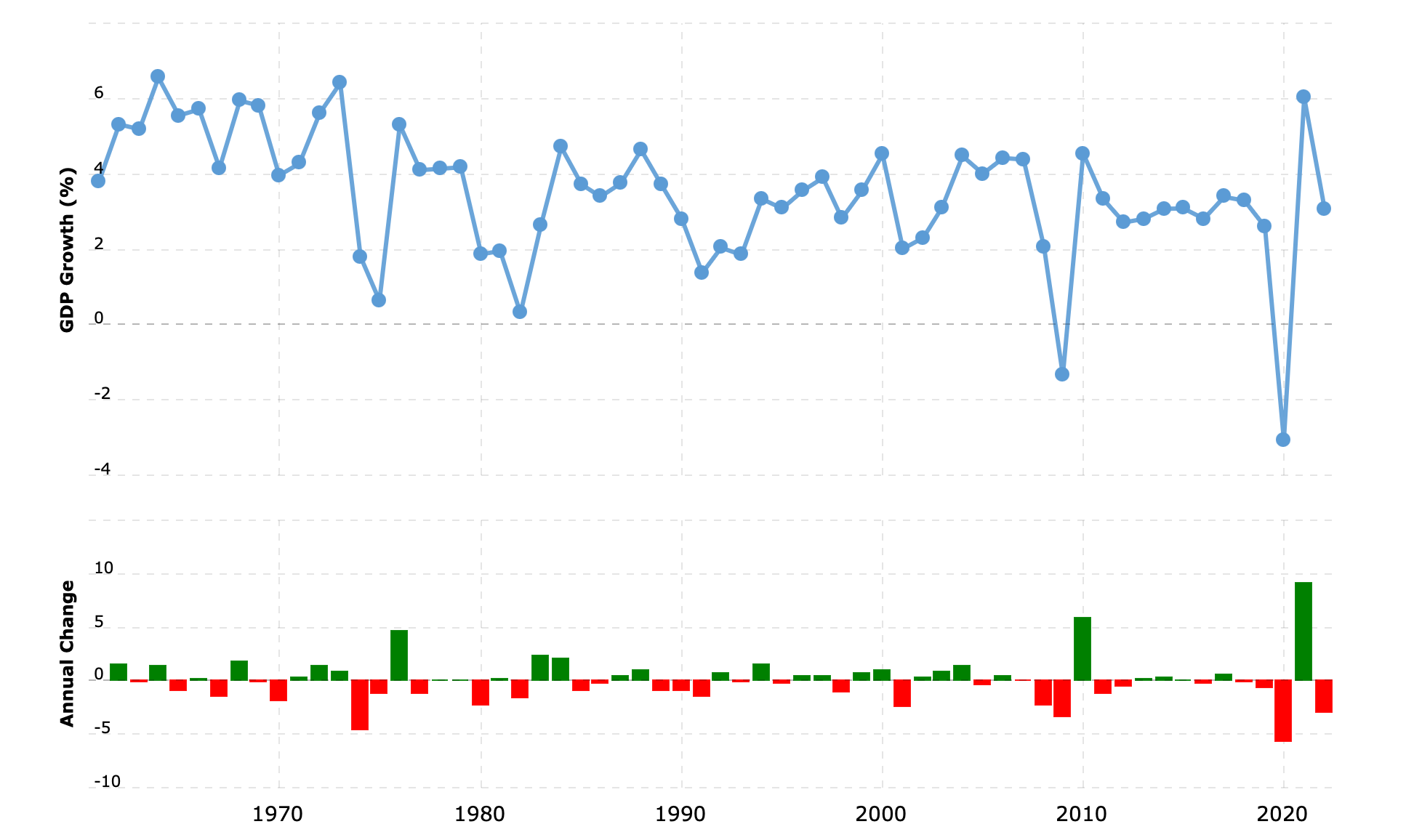

See base rate here. The biggest Δ%s have been the following:

2020->2021 +9.1 Rebound from COVID-19

2009->2010 +5.8 Rebound from the housing market collapse

2019->2020 -5.7 COVID-19 pandemic

1975->1976 +4.7 Rebound from the oil crisis

1973->1974 -4.6 Oil crisis

2008->2009 -3.4 Housing market collapse

@TamarSpoerri Note that my attribution of the 2007-2009 financial crisis to the housing market collapse is an oversimplification and one narrative of many.

@TamarSpoerri Except for COVID these are all relatively far from 10%, no? What’s the argument for YES based on this data?

@NicoDelon True. The argument for YES is extrapolating from this dataset that world GDP volatility will continue to increase.

@Planarian Exactly as the question says, if you think GDP will either rise or fall by at least 10% YoY (in at least one year), thats YES.