See /Joshua/i-plan-on-putting-m10000-subsidy-in for context.

I've only given out smaller subsidies beore this, as have the other subsidy managers. So I admit this is a weird idea, but I think it's worth trying. This market will stay open for 30 days, and then I'll look back and judge whether I think the subsidy went well.

I'll look at the total volume incrase, trader increase, the change in probability of the question, the number of comments, etc. I don't have a specific metric in mind for determining success, though I'm open to suggestions.

If I think it was overall a success and I don't regret it, this resolves yes. If I do regret it, this resolves no.

This market will not N/A, if I'm talked out of the idea entirely it will resolve to NO. I will not trade on this market.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ158 | |

| 2 | Ṁ59 | |

| 3 | Ṁ27 | |

| 4 | Ṁ22 | |

| 5 | Ṁ7 |

People are also trading

idk at this point - I would ignore the final data point as the week is incomplete, but seems like the other points could just be interpreted as a continuation of an existing trend to me. Even if there is a small effect, I still don't think this was worth 10k mana, that's a lot of mana!

But realistically this market should probably not be priced at 25%.

@DanMan314 Thanks for the data! I'm gonna hold off on judgement right now and look at it in more detail on the weekend.

@Joshua Yea what scares me is there's no provision for resolving to a prob either. I think I would have kept my mana in you might resolve to PROB, but with the criteria you've outlined I think it really could go either way.

@Joshua I'd suggest that your current desire to resolve N/A is likely a (normal) aversion to admitting it was not a good use of mana.

There are many uses for 10k mana subsidies that are/would be clear and very obvious successes; that you have to look into the data on this one to find a narrative in which it was a success indicates at least by a metric of opportunity cost, this was not a good use of the mana (except for maybe as an experiment to see if it would be a success).

@RobertCousineau A fair argument! Resolving to prob does mostly cheat those of you who were betting on "no", which is the more probable of the binary outcomes.

On the other hand, when I was initially looking at this myself I actually was really happy with the results! I only started questioning myself after Dan showed me trend line, and now I don't know how to evaluate it or any of my other subsidized markets >.>

@DanMan314 could I trouble you to check on jack's big multi-choice version of this marke? That would actually be a really good control group, now I think of it.

@Joshua his market is much less old, but doesn't show the same upward trend in general (before or after subsidy).

@DanMan314 hahahaha, much appreciated. I think I've made my decision actually, and am going to go ahead and resolve this market to NO.

I'm not sure how much my subsidy effected the biden market because it was already in a spike, and so purely as a matter of this being an experiment I regret choosing that market. If It could do it again, I'd pick a market which wasn't in a spike so I could be more sure about whether the subsidy worked! I suspect it worked somewhat, but I'm not sure if it was enough to be worth it and I think I should err towards holding myself to a higher standard.

Y'all feel free to buy this to zero, I'll resolve it to NO once you do.

Regardless of the outcome, I think a-priori this was not a good choice for subsidization because

1. There are lots of markets about this already, including real money ones. Compared to the existing attention and volume, the subsidy is not that large.

2. Market participants don't seem to actually disagree that much on this question. At least that's my impression. Maybe I'm wrong on that.

3. It seems implausible people will be able/incentivized to do research that leads to a significant edge (and price correction), especially if the profits are play money. The ideal candidate for a subsidy, imo, would be a question where there is low hanging fruit in terms of research, but where nobody has tried because it's not worth it.

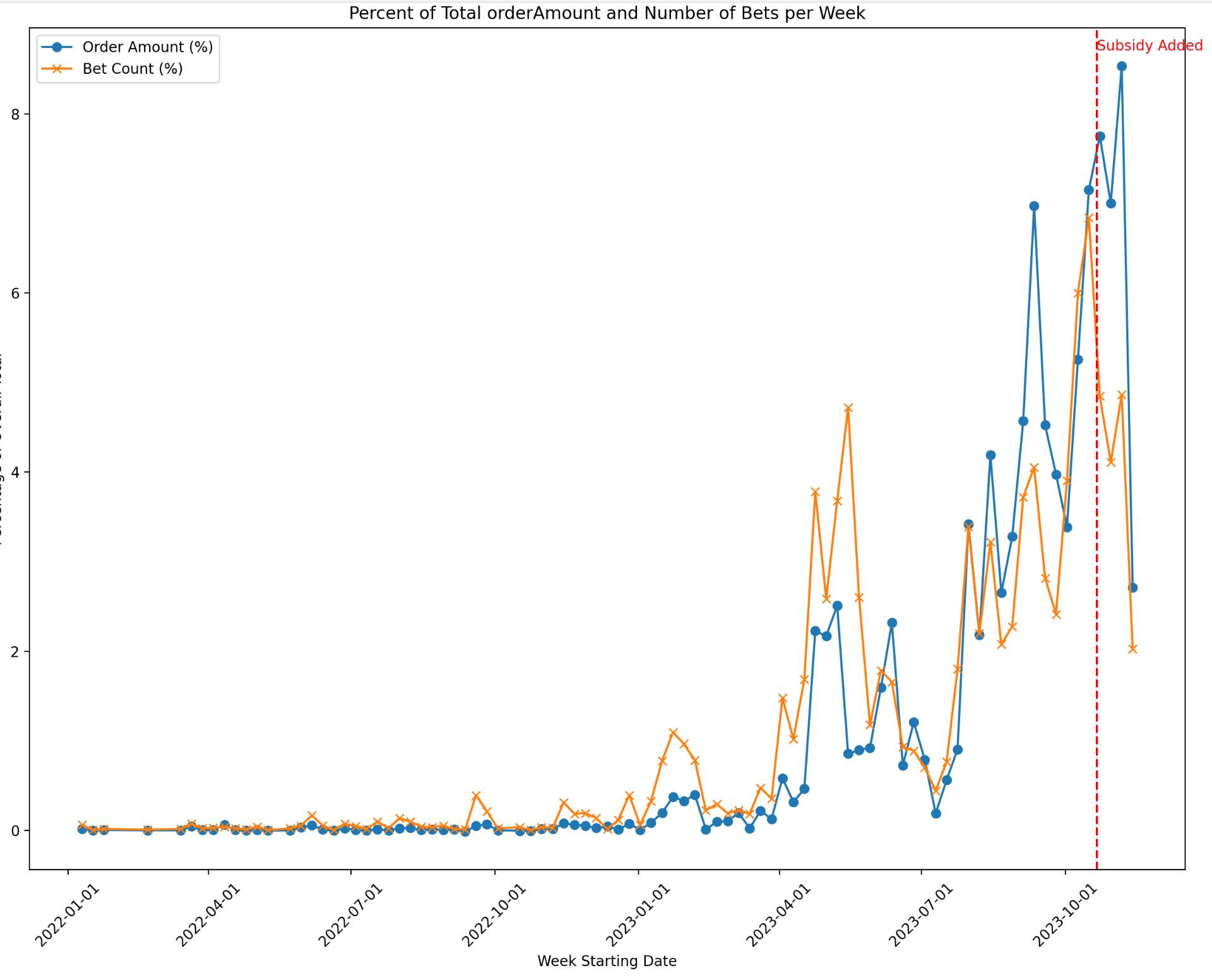

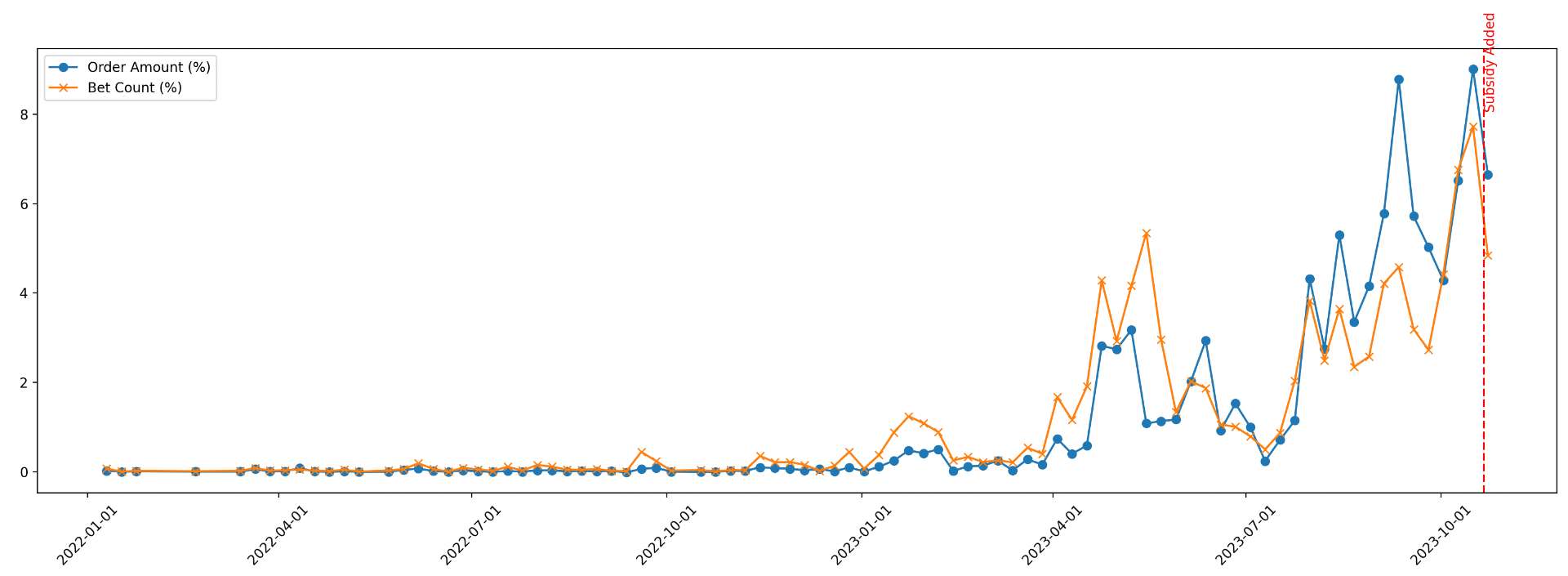

Ok a couple bug fixes (include sells, exclude unfilled limit orders), and changed to be:

Weekly

All time

Expressed as a percent of all time for the market

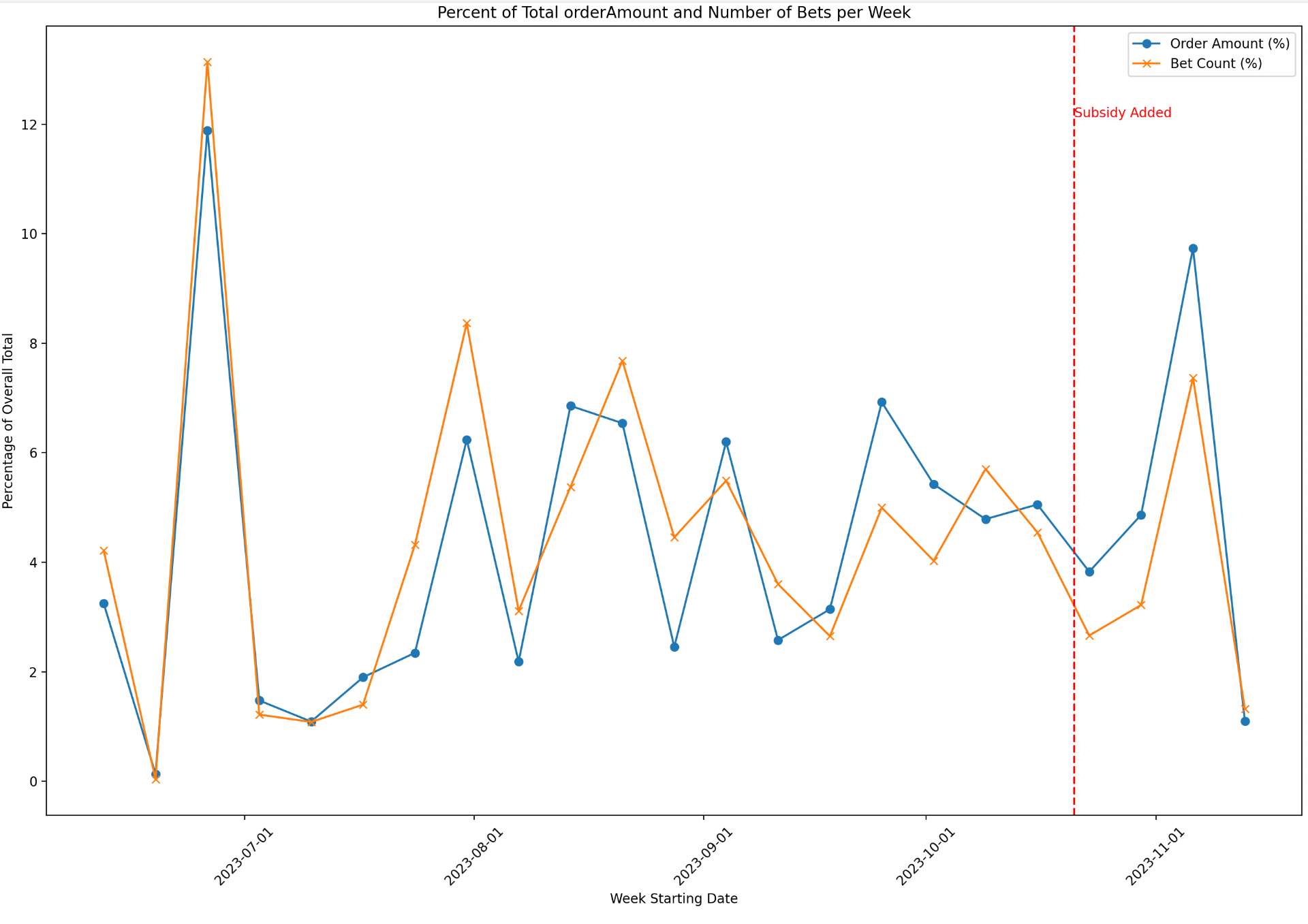

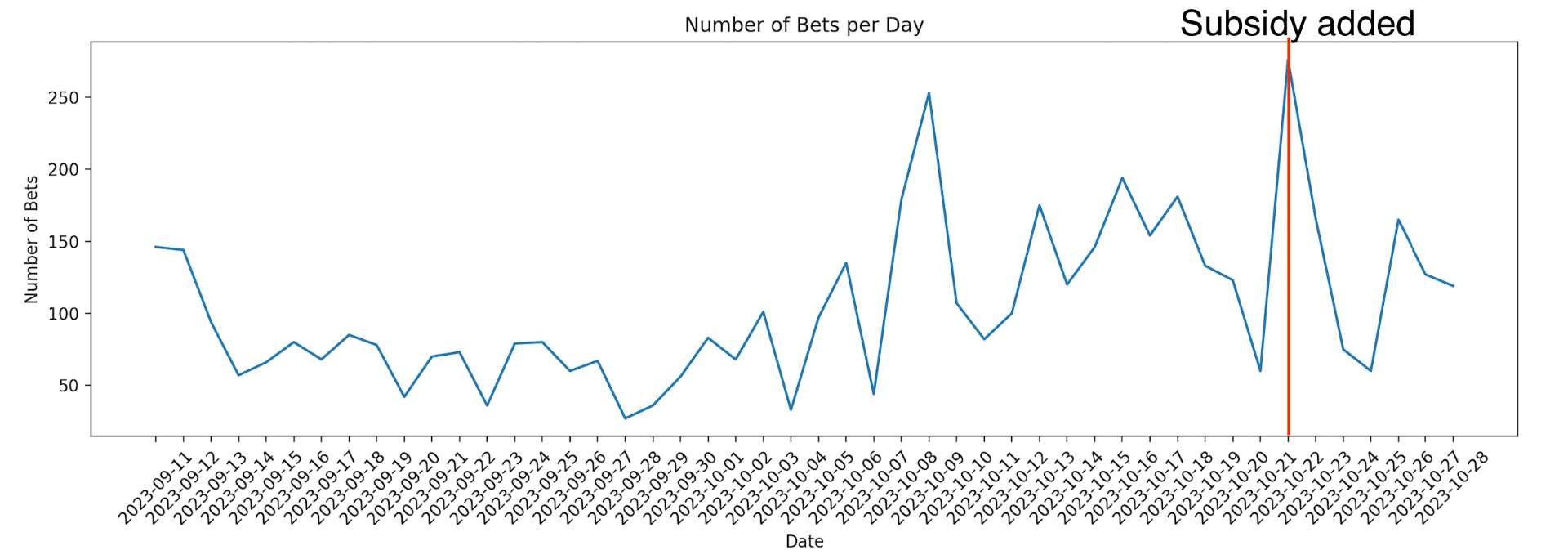

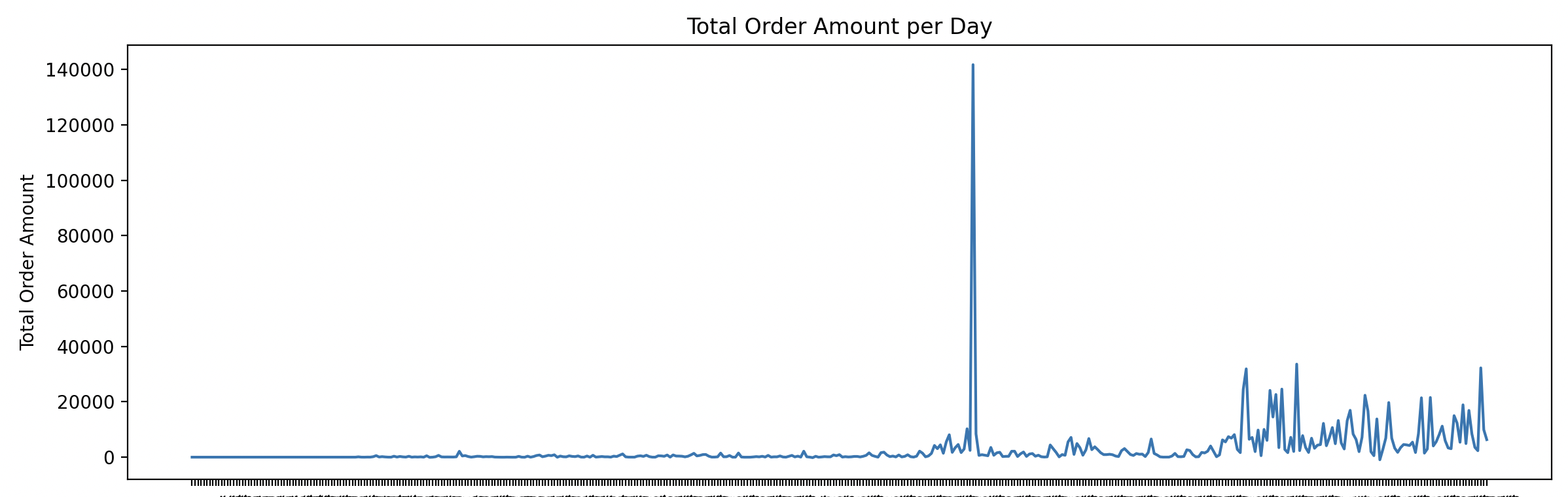

I think this sort of does drive the point home that the market is just getting more popular as election season draws nears (and maybe just because Manifold is a little more popular too)?

But it's also a little early to tell.

Of course, @Joshua is relentlessly optimistic so I realize base rates are not in my favor here.

I really like the idea of this, but I'm leaning NO at this point. 10k is a lot of mana! I think we should have a relatively high bar here, but even with a low bar the early indications are leaning no.

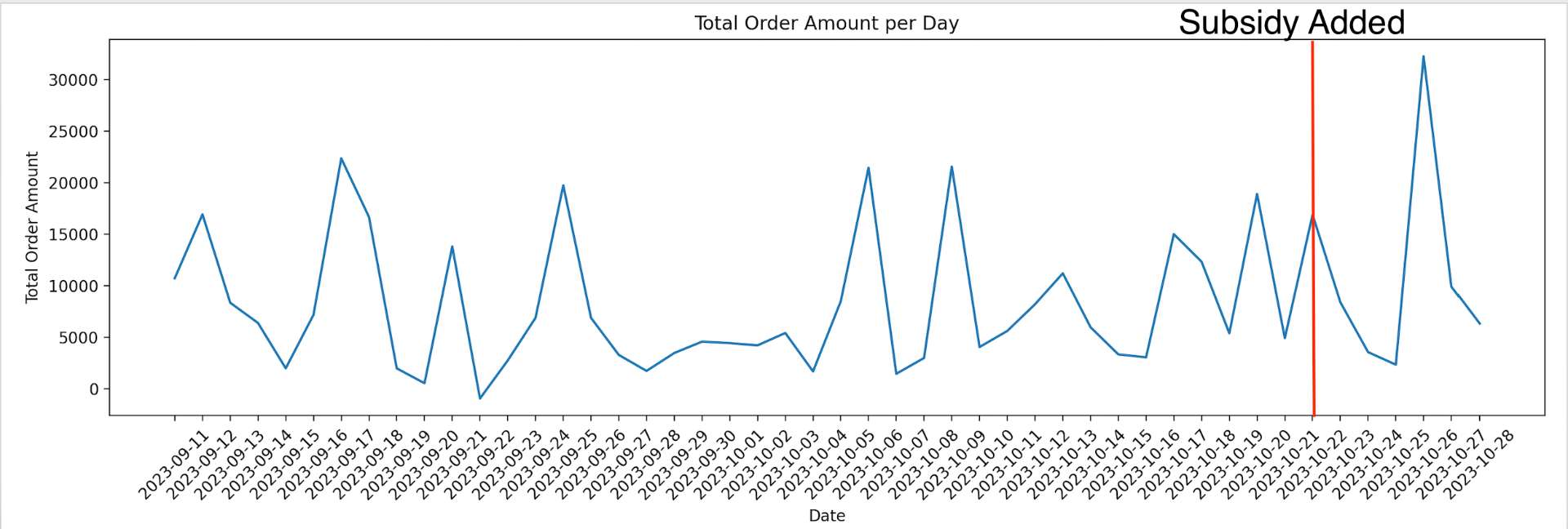

There's definitely a boost in trades around the subsidy being added, and maybe a few days later an increase in volume? But the overall probability has stayed pretty stable, and there's certainly not a drastic change in the volume or number of bets so far.

Things could change from here! Or these little changes could end up mattering a lot over time. But Ṁ10,000 is a lot of mana for a little spike in bets.

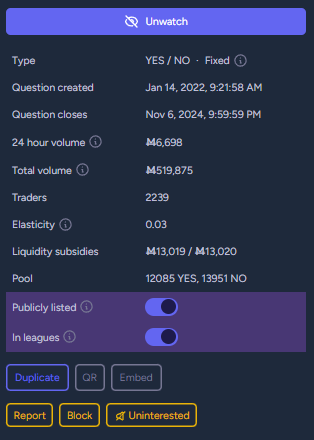

@DanMan314 Also worth noting that if you count the liquidity on the equivalent markets, 10k probably only ~doubles the total liquidity that was already available assuming those markets are correctly arbitraged, which they more or less are.

Oooo I appreciate the analysis! Was just doing some myself today as well. I was just doing a simple before/after comparison of the statblock, take a look:

I had thought that +130 traders (6% of pre-subsidy) and +70k volume (+15% of pres-subsidy) was pretty good for a week!

Those graphs make it seem much less impactful though, hmm. Wish I had done this earlier in the month to see the results for longer.

@Joshua I think behavior might also just be picking up in general with the election getting nearer? Here's the same graphs, but since market creation:

I think in the context of these graphs "6% in a week" seems slightly less impressive because the week before had basically the same volume (and bets), it's just that recent weeks are more active.

@Joshua getting insights on what kind of question is good for subsidies sounds like a successful experiment, whether the question itself actually benefited or not

I am considering the benefit of running the experiment to begin with, but that also needs to be weighed against whether I should have picked a different market to try the experiment on.

I'm still not sure if there was another large market that would have been better for me to try than this one.