Resolution criteria

This market resolves based on Tesla's CLOSINF stock price on NASDAQ:

Tesla hits $400 first: Resolves YES if Tesla CLOSES at or below $400 before hitting $500

Tesla hits $500 first: Resolves YES if Tesla CLOSES at or above $500 before hitting $400

Tesla hits neither $400 nor $500 before EOY 2025: Resolves YES if the market closes on December 31, 2025 without either threshold being reached

Only one answer can resolve YES. Resolution uses trading hours price history. After hours doesn’t count

Background

As of early December 2025, Tesla shares were trading around $430, placing the stock between both price targets. Tesla's 52-week range is between $214.25 and $488.54, meaning the stock has already approached the $500 level this year. Year to date, Tesla is up roughly 6.5% to 11% in 2025.

Analyst sentiment is mixed. Some bullish analysts maintain targets of $475 to $600, while consensus targets cluster around $383-$418, implying downside from current levels. Tesla stock faces pressure from European and China concerns, with a high-profile short seller calling shares "ridiculously overvalued".

Considerations

The market has only ~30 trading days remaining in 2025. Tesla's recent volatility and the wide range of analyst price targets reflect significant uncertainty about near-term catalysts, including full self-driving rollout, robotaxi deployment, and competitive pressures in key markets.

Update 2025-12-23 (PST) (AI summary of creator comment): Market will resolve based on closing price (not intraday prices during trading hours).

Note: The creator has indicated they will compensate certain traders who bet based on intraday prices if Tesla hits $500 intraday without closing above $500.

Update 2025-12-23 (PST) (AI summary of creator comment): Market has been closed early due to confusion. All existing bets will be honored and resolved according to the original criteria.

Update 2025-12-23 (PST) (AI summary of creator comment): The market has been reopened for trading after being temporarily closed due to confusion about resolution criteria.

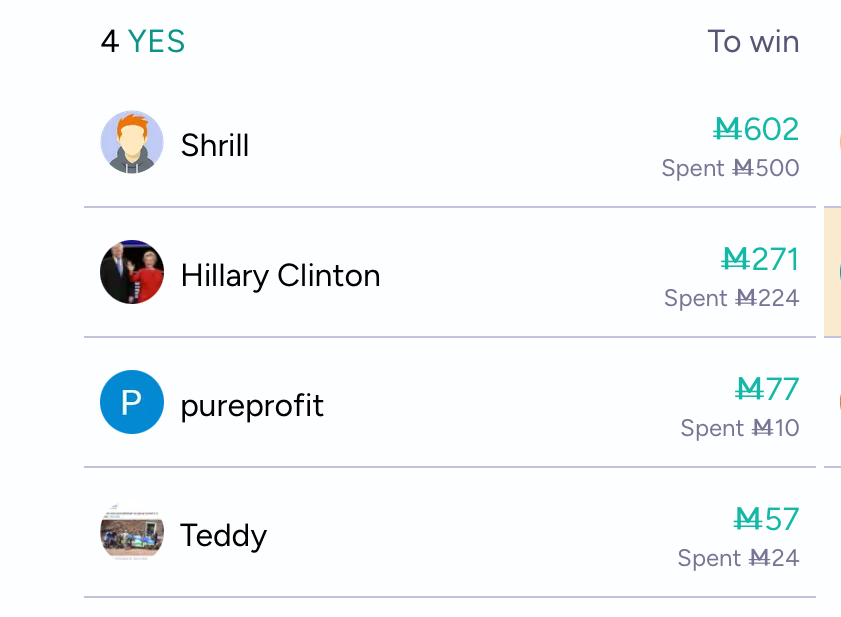

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ377 | |

| 2 | Ṁ216 | |

| 3 | Ṁ36 | |

| 4 | Ṁ12 | |

| 5 | Ṁ8 |

People are also trading

@NzJack0n the resolution criteria in the description seems inconsistent on using both closing basis as well as regular trading hours for the price:

This market resolves based on Tesla's closing stock price on NASDAQ:

Tesla hits $400 first: Resolves YES if Tesla closes at or below $400 before hitting $500

Tesla hits $500 first: Resolves YES if Tesla closes at or above $500 before hitting $400

Tesla hits neither $400 nor $500 before EOY 2025: Resolves YES if the market closes on December 31, 2025 without either threshold being reached

Only one answer can resolve YES. Resolution uses trading hours price history. After hours doesn’t count

I've been betting based on closing prices given that's specifically mentioned in the first line and then again for each case, and only noticed the "uses trading hours... after hours doesn't count" later. Can you confirm it's closing basis, and if so please edit the last line I quoted to reflect this? Thanks!

I’ll resolve based on closing price.

However if It hits 500 and doesn’t close above 500, I’ll pay these 4 what they would have won.

@NzJack0n ok thanks for clarifying but closing it seems unnecessary imo. and the new one also closes early?