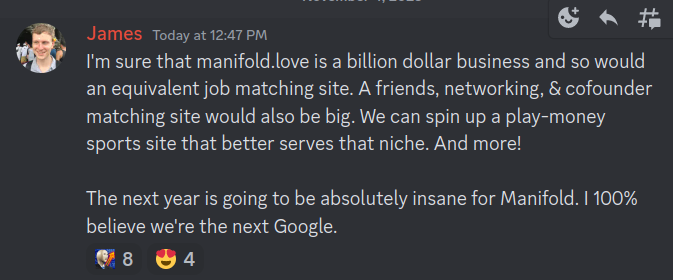

From the discord:

Resolves YES when it happens. Resolves NO when manifold.love is shut

down.

Adjusted for inflation, 2023 dollars.

If there's disagreement over whether it's worth a billion dollars, we'll go by its 409A valuation, or a best estimate of what such a valuation would be if it were to occur.

People are also trading

billion dollar business

409A valuation?

buyout price?

what if there's preferred stock at a higher valuation but with a liquidation preference?

what if they sell $100k of stock to gullible people at ridiculous valuations, like they did with manifold.markets?

@Mira What seems most reasonable?

what if they sell $100k of stock to gullible people at ridiculous valuations, like they did with manifold.markets?

Can you elaborate on this?

What seems most reasonable?

I would use a 409A valuation. And Manifold might even be open enough to reveal it to everyone. It's more common to use the largest price any stock-related security happens to be at, but most companies you'd be in danger of valuing preferred stock like common stock and inflating the apparent valuation, if you rely on announcements of investment rounds.

But if they never reveal it, because some investor doesn't like being open(a real possibility if they raise another round), then you won't be able to resolve unless one of the stockholding employees exercise California's right to see the valuation of stock they own.

Can you elaborate on this?

Some people seem to think that buying a company at high valuations is a good thing, and consider it a successful company.

If you spend $100k of common stock at a valuation of $100k, you bought 100% of the company. If the valuation is $1 million, you bought 10% of the company. If the valuation is $1 billion, you bought 0.01% of the company.

So if nothing about the company changes between these counterfactuals, then all you're doing is getting terrible prices. If someone writes an article calling them a "billion dollar company" citing your purchase at terrible prices, then there's even bragging about getting terrible prices.

They hosted Manifest to dump their stock on people at a $40 million valuation. Some people took it. But that doesn't mean they're a $40 million company, just that they found some real idiots willing to take a bad price. I would value it at most $500k(+ book value of assets on hand), which is mostly the replacement cost. I'm sure they would disagree.

@Mira Also: Since Manifold Love isn't a separate company, you either need the company to be split out and get its own valuation, or for a valuation of Manifold Markets to include a separate estimate of Manifold Love.

Resolves NO when manifold.love is shut

down.

Also resolves NO if they're bought out for a price less than $1 billion, right? Even if the site's still running under new management?