This only counts Manifold deciding to take it away from me personally. It does not count Manifold choosing to remove the "Trustworthy. Ish." badge from all traders, or reword the general criteria that badge-holders must meet, nor a bug that makes it not display on my profile, or anything like that.

If I ask Manifold to take away the badge, that also does not count. It must be Manifold's descision.

If I'm banned from the platform, that counts to resolve this to YES.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,233 | |

| 2 | Ṁ1,587 | |

| 3 | Ṁ1,125 | |

| 4 | Ṁ601 | |

| 5 | Ṁ391 |

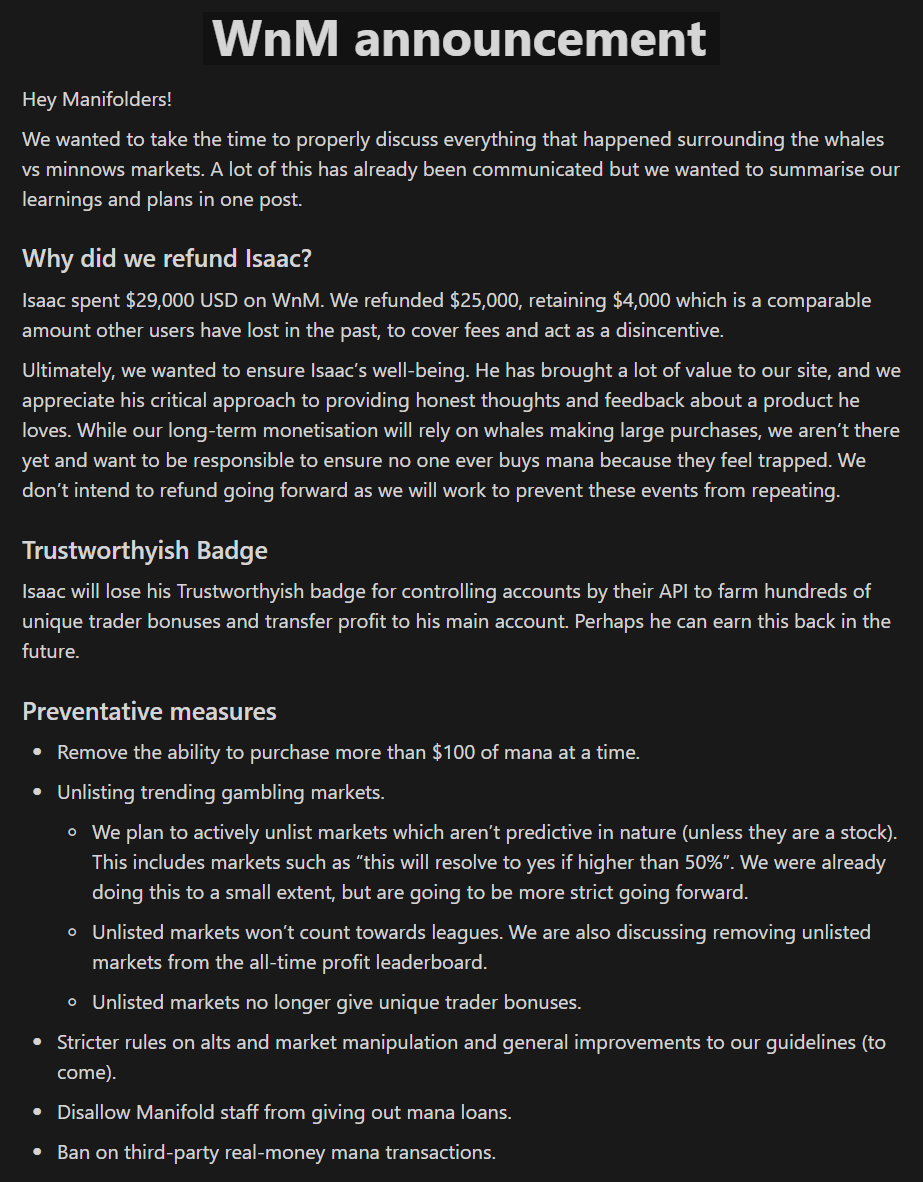

@ahalekelly what about it? It's not a coincidence that he's the only person affected, it's a decision taken by manifold. "This only counts Manifold deciding to take it away from me personally."

@firstuserhere I don't think there's any confusion here. It's clearly under "If it seems like it was targeted directly towards my past actions, then that will be sufficient to resolve the market to YES."

@firstuserhere I think the alt account policy was crystallized before it was revealed that Isaac had an army of them, actually in response to his concerns about their use in WvM.

@xyz So that "rewording of the general criteria" would not have been targeted directly towards his past actions.

@firstuserhere Surprised they said the quiet part out loud, that their long-term business model "will rely on whales making large purchases...."

@Jason I imagine they mean "Some company wants to buy $100k of advertising on Manifold, or running a prediction market tournament and subsidizing 100 markets with $100 each, or selling an enterprise variant to businesses to run internal prediction markets, or [...]"

Not "People trying to win self-referential whalebait markets".

@Mira In my view, none of those glosses are really consistent with the common connotation of "whale" or the context of the sentence. Few would call, e.g., a corporate advertiser on Twitter, a corporation subsidizing certain website content, or a corporation paying for a custom in-house version of a technology a whale.

Moreover, the context implies that the monetization model is at least somewhat Issac-like, involving people spending large amounts of money to trade on markets. The statement makes little sense if you delete "will rely on whales making large purchases" and replace with "will rely on corporations giving us lots of money for promotions or internal use."

@Gurkenglas If it seems like it was targeted directly towards my past actions, then that will be sufficient to resolve the market to YES.

If it's somehow just a coincidence that I'm the only person affected, then that will not resolve this to YES.

/Courtney/isaacking-and-destiny-together-mani-42332c90e971 arbitrage, and also if you don't trust Isaac you might prefer to bet in that market.

@MartinRandall I don't really trust that creator though. Ideally an impartial third party could make a market on this.

tl;dr: Market manipulation in general is considered ok if the manipulation itself isn't directly harmful. But manipulating profit fraudulently is considered harmful and against the rules. This specific case is pushing the boundaries of what is allowed and probably should not be allowed in the future, in my opinion.

Taking action to cause a market to resolve a certain way (aka market manipulation) has a long record of being considered fair game (obviously assuming that the manipulation isn't directly harmful). Examples:

How much USD will be donated through Manifold for Good before June? - Joel earned a massive profit by donating 5k to charity to cause the market to resolve that way.

Will anyone propose marriage via Manifold by 12/31/25? - Yev made a marriage proposal to earn profit on this market

Will there be an easy way to generate secure, verifiable public randomness for Manifold by end of 2022? - I created the market to propose an idea for someone to implement and provide some incentive to do it, and A wrote the bot and collected profits for it.

There is definitely a spectrum of how much these questions are supposed to be about acting to change the metric vs predicting on the metric without trying to change it. As I said earlier, manipulations that are directly harmful are bad, but even non-harmful manipulations might not be in the spirit of a market if the market was trying to measure a quantity, not change the quantity.

In this specific example, the metric being manipulated was a user's profit. Manipulating profit fraudulently is considered against community norms and against the rules (the admins can and have taken action against such abuses), but what counts as fraudulent might be subject to some debate, and I think this particular case isn't clear-cut. I think it's definitely pushing the boundaries, and I wouldn't do it myself, and I'd also prefer that the community agrees not to do explicit profit manipulation like this again in the future, but I wouldn't necessarily sanction people for doing it this time.

@jack I don't think it's currently against the rules, but I'd be in favor of new rules being added to make such things illegal.

Also, fwiw, I didn't previously think of the fact that manipulating a market on someone's profit might be particularly bad because profit manipulation in general is bad, and I'm guessing the manipulators didn't either, so I don't think their intentions were worse compared to on other market manipulations. Maybe the fact that profit was being manipulated here isn't the most relevant aspect.