On January 4th, 2023 Term Sheet, a well-known financial newsletter by Fortune (typically regarding PE/VC) posted a series of predictions regarding the calendar year 2023.

One of these predictions was the following:

“2023 will reveal the world’s first Climate-tech startup ‘dragon’ (a private startup valued at $12B+).” —Brian Walsh, WIND Ventures

I will not attempt to initially define all resolution criteria in this market and will instead attempt to handle any nuances/complications/data feasibility as it arises. If by end of 2023 I think it is not possible to confidently resolve this market in the spirit in which it was intended, I reserve the right to resolve as "n/a".

Any clarifications to the resolution criteria will be listed below, along with the applicable date:

[TBU]

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,113 | |

| 2 | Ṁ136 | |

| 3 | Ṁ105 | |

| 4 | Ṁ100 | |

| 5 | Ṁ56 |

People are also trading

As best I can tell, Northvolt's IPO hasn't gone through yet; as such, I can't count it as exceeding the $12B+ target. I would be inclined to give some credit towards the $11.8B valuation if it happened in 2023, but given that was in 2021, the prediction would have been made being aware of Northvolt. Resolves No, happy to discuss further if helpful.

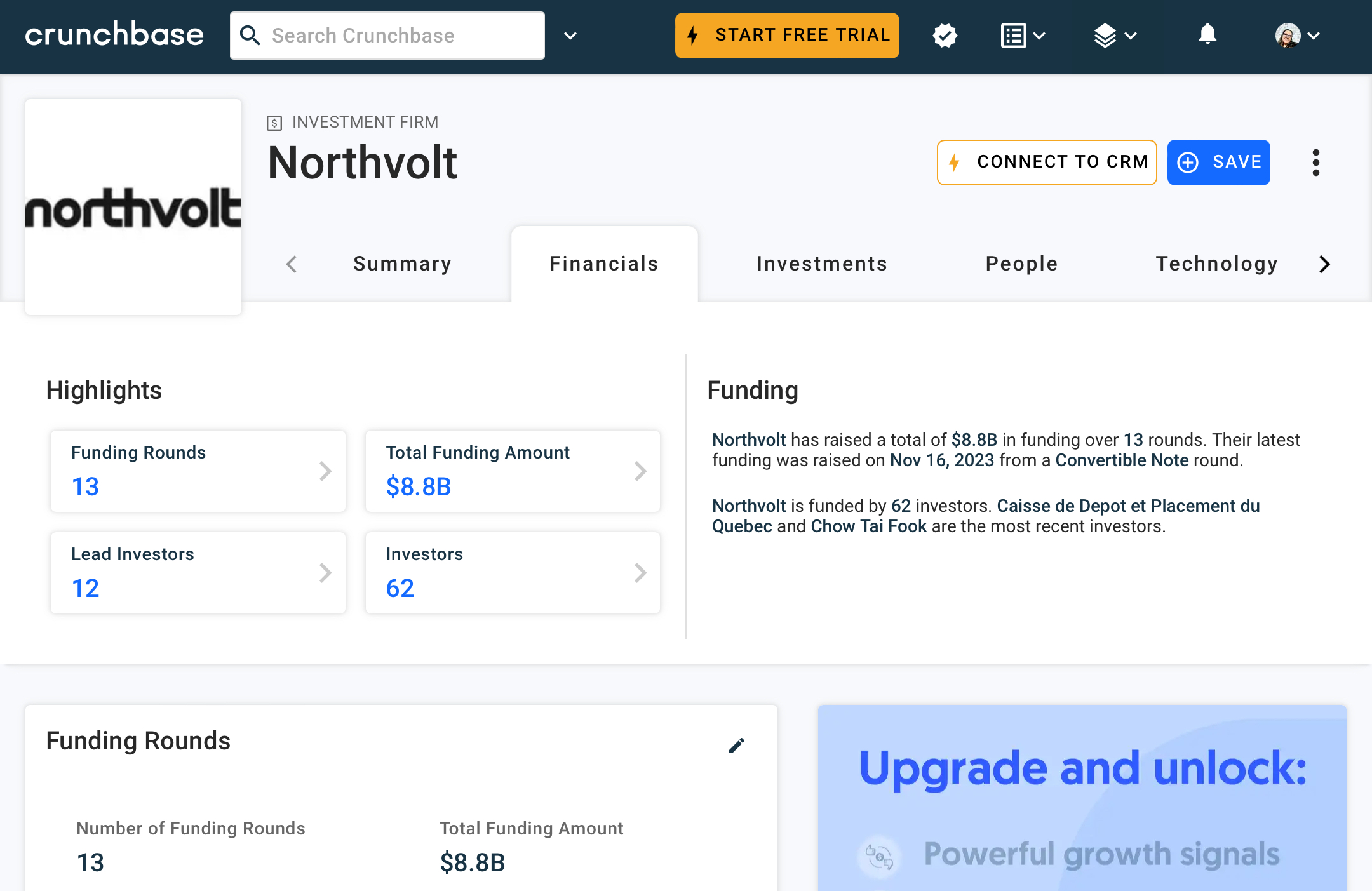

@CarsonGale 11.8 B valuation is based on the last public assessed valuation in 2021. However, they've continued to raise regularly since then in 2022, 2023... and even in 2023 they've raised three times - a total of an additional 1.75 B additional raise over 2023. While not hard evidence, no fund would invest in a company with a decreasing valuation as it would indicate a likelihood they'll lose some portion of their investment - the fact their raising 1.75 B (convertible note) at least indicates each fund must have found an internal valuation higher than the previous valuation. Note the highly financial reputable asset manager, blackrock, was one of those that had invested in the 2023 rounds. Ref: https://www.crunchbase.com/organization/northvolt-ab/investor_financials

In addition, they've settled on a site in 2023 for battery production in North America with the site alone with a value of 7billion. https://www.theglobeandmail.com/amp/business/article-swedens-northvolt-picks-quebec-for-new-multi-billion-dollar-ev-battery/

Last note / summary, company valuations are not fixed, they drift all the time - a historical publicly presented valuations present a single agreed data pont in time. As indicated above, the valuation in 2021 was 11.8B, but all indications point towards a higher valuation at some point in between.

Given this, I think it would be improper to resolve as a NO. Obviously, I've vested interest and still heavily lean towards YES, but given uncertainty N/A seems also appropriate.

@EricBurns Thanks for your feedback. It is certainly not true that funds wouldn't invest at a decreasing valuation - down rounds have been common in 2023 (see Stripe), including at significant decreases to the sky-high 2020-2021 valuations.

In general, valuations in 2021 were much higher than in 2022-most of 2023, and unless a private company reported a raise at a higher valuation, the default assumption shouldn't be that the valuation increased since 2021.

Please LMK if you disagree - happy to continue the discussion.

@Thomas42 As far as I can tell from many articles the 12 bn number for Northvolt is rounded up, and was valued at 11.8 (this valuation was made well before the article in question). Don’t know if the market creator will round also since they wrote 12 and not 12.0 in the title.

https://www.statista.com/statistics/1409949/climatetech-unicorns-worldwide/

@parhizj part of the difficulty is validation is often a tricky and imprecise definition. That being said, considering northvolt is targeting an ipo north of 20billion early next year would imply that their current valuation at the end of 2023 is between 11.8 and 20billion. Since all expectation is that their valuation is going up, leads me to believe a 12billion valuation is more than fair... But will leave for mods to decide

@EricBurns That 'sounds' reasonable but you have to remember the 'target' is provided by the company it self. The company could just as well be worth less than when the last valuation was made, this I think is something that requires expert judgment (beyond what I think an average person could make).

@parhizj understood - I guess the takeaway is that we may not know the valuation by the end of this month. Though this likely would take someone with inside knowledge /docs to completely verify - not just an expert option - but raising so far indicates a valuation above 11.8B. For ref, while not an expert, I do work in the climate VC space.

@EricBurns I suppose someone could message the guy quoted making his prediction how he rates his own prediction.

@jacksonpolack Are you buying No because the links in the comment section don't refer to a "climate-tech startup" or because you don't believe them? Or just because it moved too far, too fast.

Is this poll essentially resolved? https://www.google.com/amp/s/www.bnnbloomberg.ca/northvolt-founder-says-ipo-needs-less-shaky-market-1.1977687.amp.html